- Silver Price Forecast – Silver Continues to See Volatility FX Empire

- Silver price forecast update 06-12-2024 Economies.com

- Silver price today: broadly unchanged on December 6 FXStreet

- Silver Price Rebounds Off $30, Heads to $32 As USD Retreats After Weak US Data FX Leaders

- Silver Price Forecast – Silver Continues to See Pressures FX Empire

- Silver Price Forecast: XAG/USD experiences V-shape recovery from $30.50 after US ADP job data FXStreet

- Silver Price Forecast: XAG/USD loses traction below $31.50 as Fed officials signal cautious path for rate cuts FXStreet

- Silver Price Forecast – Silver Pulls Back in Consolidation FX Empire

- Silver Weekly Price Outlook – Silver Continues to Threaten The Same Level FX Empire

Category: Silver

A famed financial author recognized for accurately predicting the 2008 housing market bubble has recently called gold the “real play” in de-dollarization. Nassim Nicholas Taleb, a once-staunch Bitcoin supporter, has thrown his weight behind the yellow metal amidst a global shift away from the dollar. His advice reflects a growing consensus of economists, banks, and other experts pointing to gold’s strength and the dollar’s relative weakness.

Who is Nassim Taleb?

Taleb is well-known for calling the 2007-2008 financial crisis and developing the Black Swan theory — a model highlighting the financial impact of unpredictable events. Accurate economic forecasts and astute observations have made Taleb a trusted voice in financial markets.

What did he say about gold?

In a recent X post, Taleb points out that “de-dollarization [is] in progress”, referring to the global pattern of countries reducing their reliance on the US dollar. The author highlights that “central banks (particularly BRICS) have been…putting their reserves in gold.” Although many international transactions are denominated in USD, Taleb highlights that the true underlying value lies in gold, as it’s where fiat currency ultimately converges.

Central Banks Dump the Dollar, Gobble Up Gold

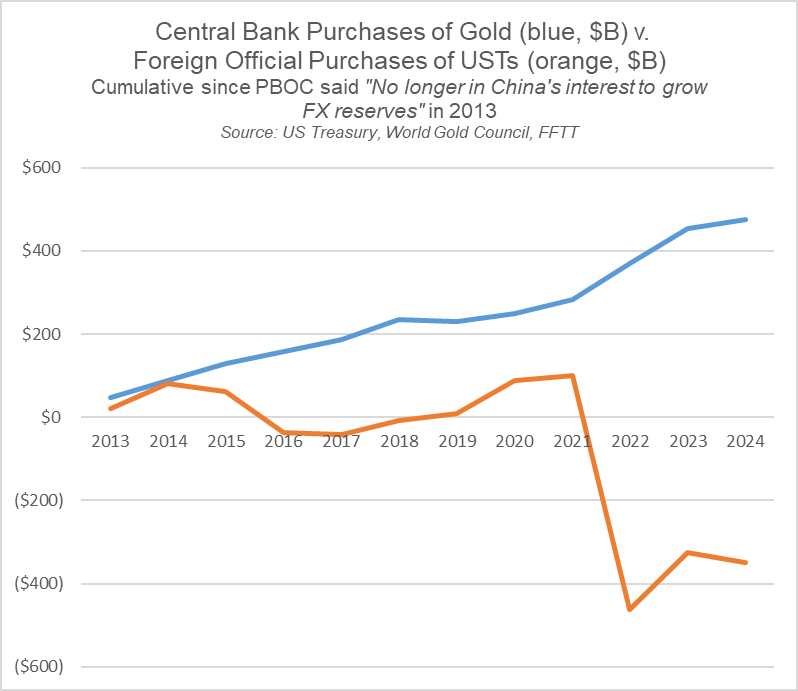

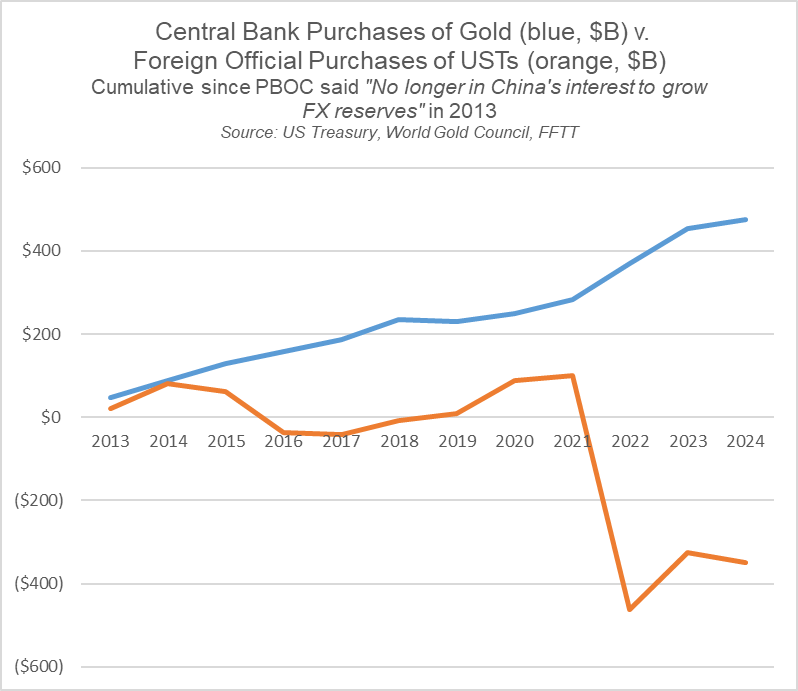

In response to Taleb’s gold-praising post, the founder of Forest for the Trees Luke Gromen, provided the following graph, illustrating the decade-long shift away from the dollar to gold.

Source: Kitco

The economic analyst explains that “[De-dollarization has] quietly been underway for 10 years; got much louder post-2022 sanctioning of Russian FX reserves.” As the graph shows, 2014 saw a clear divergence between central bank holdings of US Treasuries and gold. That inverse trend spiked following a gauntlet of Western sanctions against Russia.

BRICS Lead the Charge

Taleb’s brief mention of the BRICS block is a crucial piece of the de-dollarization puzzle. Originally composed of Brazil, Russia, India, China, and South Africa, this rapidly expanding group of emerging economies is dealing the biggest blow against the greenback. The collective group is at the helm of gold demand and dollar shedding. Their collective effort in both endeavors is building considerable momentum that was absent in the past, threatening to supplant the dollar altogether.

Bitcoin Criticisms

Taleb’s praise of gold is significant because the financial author used to be an unapologetic Bitcoin supporter. His eventual disillusionment with the cryptocurrency reflects a growing trend as broad swathes of investors see Bitcoin falling short of their high expectations. People tend to focus on the promise of exceptionally quick and high returns while ignoring the flip side of equally volatile drops. Now, Taleb calls Bitcoin a “malignant tumor” of the economy due to its explosive popularity yet disastrous consequences.

Gold Still Preferred

The world economy might have severed ties with the gold standard decades ago, but gold is still the clear preference among nations. Bitcoin is only officially held by a handful of countries with El Salvador being the strongest proponent. (Unfortunately, the crypto experiment seems to have been a failure.) On the flip side, gold is held by every single nation plus recognized territories.

De-Dollarization Hits Home

As central banks abandon the dollar, American investors stand to suffer the brunt. USD underpins the majority of investments people have in their portfolios, savings accounts, and retirement plans. Taleb calls gold the “real play” during this process of de-dollarization due to its tendency to keep pace with inflation. Historically, physical gold has increased in value as the US dollar has fallen. That’s precisely what’s playing out now as the yellow metal hits all-time highs and the greenback buckles following aggressive rate cuts.

Follow Central Banks

Experts across the financial spectrum aren’t pointing to central bank behavior for nothing. They understand that these market heavyweights have an unrivaled impact on economic activity. The near-universal rush into gold and exodus from the dollar is mirrored in the yellow metal’s record-setting rally and the greenback’s weakness. Taleb joins major banks such as Goldman Sachs and Bank of America in advising investors to follow the lead of central banks.

“The bigger central banks…and nations…are buying a ton of gold. Take a page out of their book.”– Eric Sepanek, founder of Scottsdale Bullion & Coin

Gold Outshines Stocks in the 21st Century

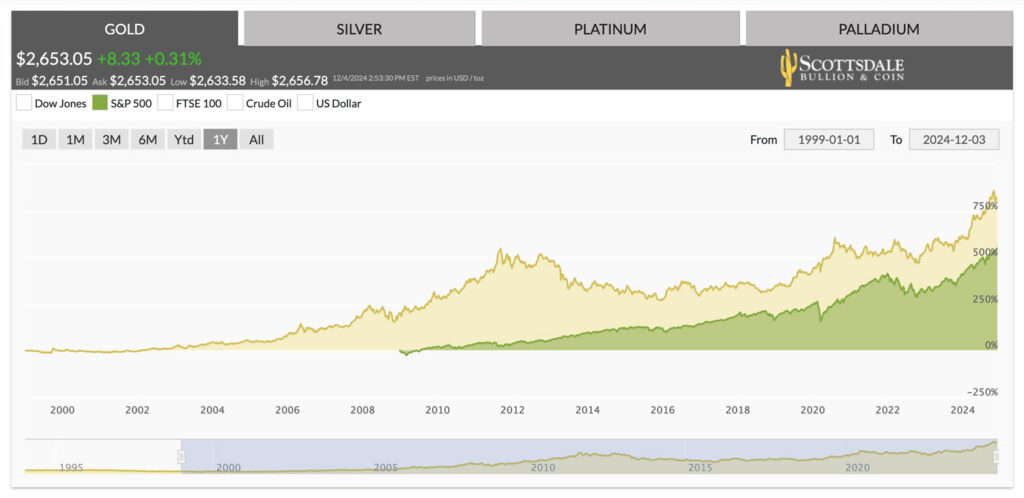

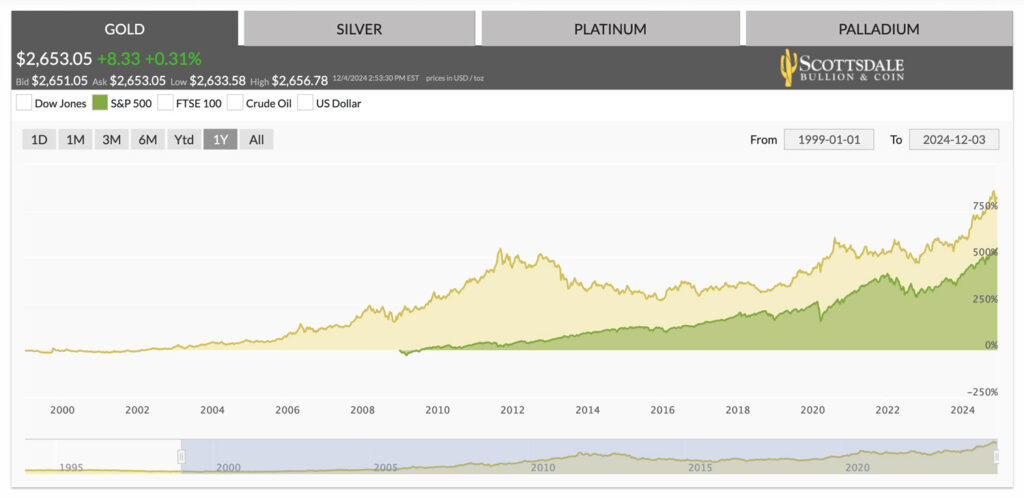

Gold made headlines for outshining the broader stock market throughout 2024, but this performance is part of a larger trend, extending throughout the past three decades. In the 21st century, gold has provided a higher average return than the S&P 500, the most popular vehicle for growth among American investors.

Gold Prices vs S&P 500

In various metrics, gold has outperformed the stock market over the last 25 years. Since the start of 1999, gold has skyrocketed by 866.67%, climbing from $288.25 to a 2024 high of $2,756.76. By comparison, the S&P 500 has risen from 1,228.10 to 6,001.35 points—a gain of 388.67%. In simpler terms, a portfolio invested solely in gold would have more than doubled the returns of one invested exclusively in stocks during this period.

While total returns provide an impressive snapshot, annualized returns offer a clearer measure of an asset’s performance over longer time frames. When looking at inflation-adjusted returns, gold boasts a 6.8% annual yield. On the other hand, the S&P 500 provided an average real return of 4.9%. Put another way, investors have gained 27.94% less from the stock market than gold in the past 25 years.

While total returns provide an impressive snapshot, annualized returns offer a clearer measure of an asset’s performance over longer time frames. When looking at inflation-adjusted returns, gold boasts a 6.8% annual yield. On the other hand, the S&P 500 provided an average real return of 4.9%. Put another way, investors have gained 27.94% less from the stock market than gold in the past 25 years.

Why Gold Outperformed Stocks

Low Bond Yields

Low bond yields have been a hidden driver of gold’s meteoric rise over the past quarter-century. US Treasury Inflation-Protected Securities (TIPS) have experienced a prolonged period of low inflation-adjusted returns, also known as real yields. Investors often flock to other safe-haven assets away from bonds in a low-yield climate. Gold has been the primary beneficiary of this shift as the opportunity cost of owning the yellow metal has been relatively low.

Stock Market Crashes

The stock market’s returns over the past 25 years have been bogged down by three cataclysmic financial crashes: the Dot-Com Crash, the Global Financial Crisis, and the COVID-19 Crash. These Black Swan events slashed the S&P 500 by 49%, 51.9%, and 34%, respectively. In response, gold has emerged as a favorite shield against inflationary pressures. Even record-setting recoveries weren’t enough to protect against the eroding public trust in fiat-based monetary systems.

Central Bank Demand

In the wake of geopolitical turmoil, particularly following Russia’s invasion of Ukraine, central banks have ramped up their gold purchases. This sustained demand has bolstered prices and reinforced gold’s reputation as an inflation hedge. Central bank gold binging set records in 2022, 2023, and the first three-quarters of 2024, with emerging markets pulling more than their weight. Experts expect this diversification trend to continue as the central bank’s shield against growing market uncertainty.

Future Gold vs Stock Market Performance

Looking at the historical gold vs stock market performance can offer insights into the potential future trajectory of these inversely related assets. Periods marked by uncertainty, volatility, and rapid change often see alternative, physical assets perform better than traditional instruments. Even after a record-shattering rally with dozens of new highs, experts are still raising their gold price predictions.

On the other hand, many warn of an overheated and inflated stock market with many companies extending into overvalued territory. Furthermore, the staggering $36 trillion debt puts additional pressure on the stock market which tends to struggle when the dollar weakens.

The Internal Revenue Service (IRS) is increasing retirement contribution limits for 2025, giving investors more breathing room in their nest eggs. Every year, the government’s collection arm reviews contribution caps and tax thresholds in light of ever-changing economic conditions.

The Internal Revenue Service (IRS) is increasing retirement contribution limits for 2025, giving investors more breathing room in their nest eggs. Every year, the government’s collection arm reviews contribution caps and tax thresholds in light of ever-changing economic conditions.

$500 Contribution Boost

The IRS is elevating contribution limits for 401(k), 403(b), most 457 plans, and the Thrift Saving Plan by $500. In 2025, taxpayers will be eligible to add $23,500 (up from $23,000) to these retirement plans. SIMPLE plan owners can also contribute $500 more but only for a total of $16,500. Remember that the SECURE 2.0 Act sets some SIMPLE plan contribution limits to $17,600.

Beginning in 2025, a supercharged catch-up contribution is available for those 60 to 63 for the following plans:

- 401(k) plans – $11,250 (up from $7,500)

- SIMPLE plans – $5,250 (up from $3,500)

Higher Phase-Out Ranges

The IRS stopped short of raising the contribution ceiling for IRAs, which will remain at $7,000 for 2025. Catch-up contributions for those 50 and older also stay unchanged at $1,000. However, more high-income earners qualify for these contributions through higher phase-out ranges – income caps the IRS places on tax perks.

These income phase-out ranges impact traditional and Roth IRAs differently. In short, a deduction phase-out for traditional plans affects contribution tax deductions, and income phase-outs for Roth plans determine if contributions can be made. Here’s how the IRS changes breakdown:

Related Reading: Strategies to De-Risk Your Nest Egg

Traditional IRA Deduction Phase-Out

The deduction phase-out range for individuals covered by a workplace retirement plan is $79,000 to $89,000 (up from $77,000 to $87,000). For married couples filing jointly, where the spouse making the IRA contribution is covered by a workplace plan, the range is between $126,000 and $146,000 (up from $123,000 to $143,000)

Roth IRA Income Phase-Out

Single filers and heads of household have an income phase-out range between $150,000 and $165,000 (up from $146,000 to $161,000). This jumps to a range of $236,000 to $246,000 (up from $230,000 to $240,000) for married couples filing jointly.

Lower Thresholds for Saver’s Credit

The Saver’s Credit is also getting a facelift heading into 2025. Officially dubbed the Retirement Savings Contributions Credit, this tax credit is designed to help low to middle-income earners pad their nest eggs. Eligible taxpayers get the dual advantage of reducing their taxable income while topping up their retirement plans.

The Saver’s Credit can apply to a traditional IRA, Roth IRA, 401(k), 403(b), governmental 457(b), SARSEP, SIMPLE plan, and Thrift Savings Plan, 501(c)(18)(D) plan. The IRS reduced the income thresholds to ensure more American households qualify:

Income Eligibility Thresholds

- $39,500 for individuals (up from $38,250)

- $59,250 for heads of household (up from $57,375)

- $79,000 for married couples filing jointly (up from $76,500)

Stubborn Inflation

These retirement plan adjustments come on the heels of persistent inflation. The Fed’s launch of an aggressive rate cut policy earlier this year was supposed to signal a victory in the fight against inflation. However, the battle continues with this key economic metric ticking up to 2.6% in October – 30% higher than the Fed’s target range. The IRS cited higher costs of living and inflation concerns as causes for their adjustments, tacitly acknowledging that the government is struggling to improve the economic situation.

As Donald Trump’s transition team starts laying the foundations for a second term, markets are paying close attention. Nearly every asset class has reacted to the expectations of a disruptive administration. The key question is how markets will perform over the next four years as Trump implements bold economic and geopolitical policies.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Precious Metals Advisors Todd Graf and Tim Murphy discuss gold’s historical performance under Trump’s first presidency, the fundamentals behind the metal’s rally, and what’s unlikely to change over the next few years.

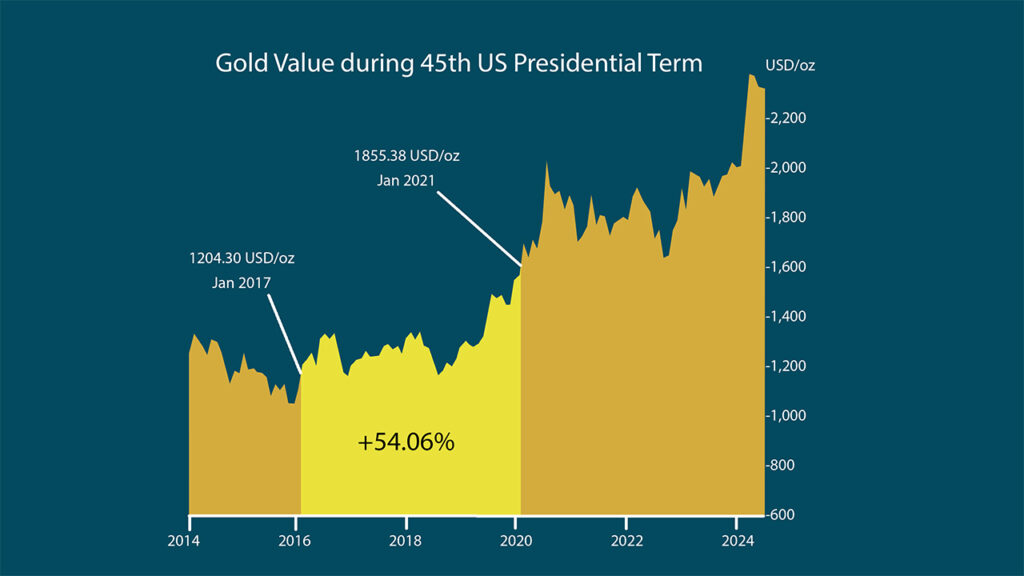

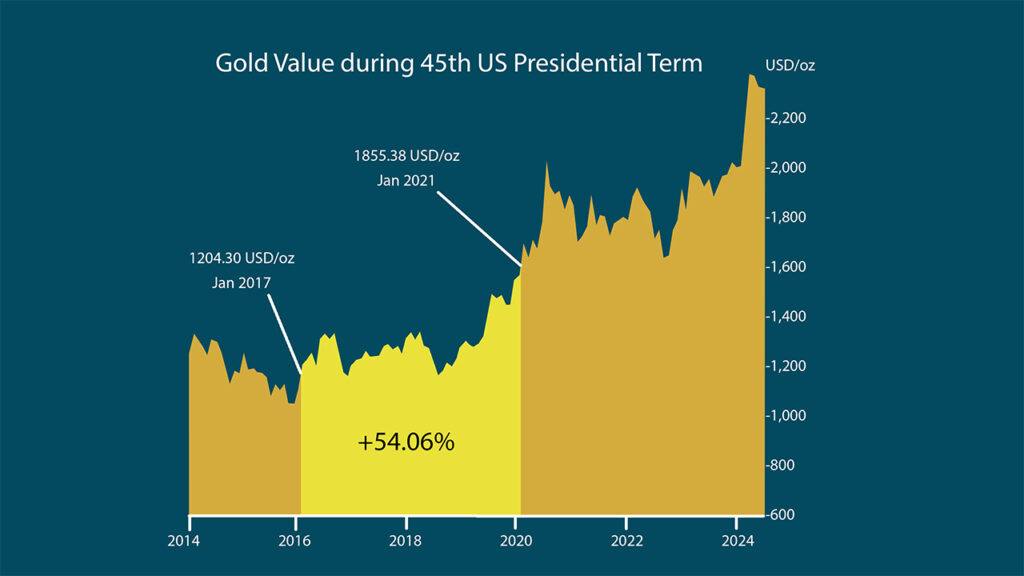

Gold’s Performance During Trump’s First Term

Gold price gains during Trump’s first presidency.

Investors aren’t completely blind to projecting gold’s performance under the Trump administration. Looking at the precious metal’s trajectory throughout the first term can shed some light on what can be expected moving forward. Right after the heated 2016 election, gold prices fell between 9% and 11%. This dip quickly reversed into a sustained rally throughout Trump’s tenure. At the end of those four years, gold prices had risen an astounding 54%, nearly keeping pace with the stock market’s record-setting gain of 67.8%.

Many experts are drawing parallels between this historical trend and gold’s current movements. In the frenzy of the post-election market, gold has retreated more than 8% from an all-time high of $2,786.44 an ounce. However, the metal has already regained most of those losses on the back of deteriorating geopolitical stability and rising economic uncertainty. Additionally, experts are maintaining their already higher gold price predictions for 2025 and beyond.

Reasons to Own Physical Gold

The spot price charts aren’t the only indicator suggesting tailwinds for gold. Short-term movements might be influenced by characteristic post-election volatility, but the broader story is still dictated by more foundational economic and geopolitical issues.

Recently, the US national debt pierced $36 trillion! At the same time, interest payments on the national debt have surged to over $1 trillion per year, making it harder for the country to manage its excessive borrowing. This has triggered a global de-dollarization push as countries seek to limit their reliance on the debt-burdened greenback.

“The reasons to own physical gold right now are more serious than ever. The problems with our debt and the dollar aren’t going away.”

Fiscal Changes NOT Incoming

Some of Trump’s cabinet picks have generated harsh opposition from both sides of the aisle. One of the most troubling from an economic standpoint is Scott Bessent who has been tapped as Treasury Secretary. Unlike many of the next admins’ picks, Bessent seems to represent the old guard of fiscal policies that have led the country to exploding debt and irresponsible spending. For example, he was the Chief Investment Officer for the Soros Fund Management.

That’s not the only bump in the road to much-needed economic healing investors have suffered. Earlier this month, Trump floated the idea of ousting Federal Reserve Chair Jerome Powell–the architect behind the government’s years-high interest rates–who claimed such an action was “not permitted under the law.” This collision comes as inflation numbers creep higher, indicating tough economic headwinds.

A lot of the same characters that got us into this situation are still going to be in charge of everything.–

The Golden Lining

With a decades-long debt crisis and an unchanging financial elite, the country’s economic challenges are unlikely to disappear over the next four years. One of the sole benefits of this trajectory is a positive outlook for gold prices. Following a steep and sustained climb throughout most of 2024, the yellow metal entered a slight correction which some experts are calling just a blip before the next rally.

If you’re able to add to your holdings, this current slump could be an opportunity to buy the dip as many big-name banks are telling investors. Investors not in a position to scoop up more gold should consider holding the line to avoid the risk of selling before a reversal to the upside. Have any questions about the current market or investing in precious metals? The Precious Metals Advisors at Scottsdale Bullion & Coin would be happy to help. Give us a call toll-free at 1-888-812-9892 or using our live chat function.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

According to major financial institutions, gold is set to surge during President-elect Donald Trump’s second term. JP Morgan and ANZ–New Zealand’s largest bank–are predicting higher gold prices under the next administration, despite the yellow metal’s current pullback. Both banking giants expect investors to continue choosing gold as a protective measure against anticipated inflationary hurdles brought on by economic and geopolitical upheaval.

According to major financial institutions, gold is set to surge during President-elect Donald Trump’s second term. JP Morgan and ANZ–New Zealand’s largest bank–are predicting higher gold prices under the next administration, despite the yellow metal’s current pullback. Both banking giants expect investors to continue choosing gold as a protective measure against anticipated inflationary hurdles brought on by economic and geopolitical upheaval.

Gold’s Routine Post-Election Pullback

Following the presidential election, gold prices fell from $2,743.98 to a relative low of $2,562.10. The yellow metal has clawed back most of that 7% drop, and prices are now holding steady above $2,660. This isn’t uncharacteristic behavior as gold has entered similar slumps after the last six out of nine elections. In the wake of Trump’s first victory, prices dropped by more than 11%. ANZ analysts explain: “While a post-election selloff was expected as investors de-hedged their positions following the results, the intensity of the fall was sharper than expected.”

Why Trump is Gold for Gold

A promise to obliterate the status quo has been a cornerstone of Trump’s campaign, and the Republicans’ trifecta of power in the presidency and both houses of Congress seems likely the admin’s transformative policies will be implemented. JP Morgan and ANZ analysts warn of potentially inflationary and debt-laden consequences:

Inflation & Stagnation

Many experts anticipate Trump’s more aggressive fiscal policies to exacerbate inflation which has ticked back up following victory cries of a soft-landing. The National Retail Federation (NRF) projected the President elect’s across-the-board tariff scheme to cut the country’s gross domestic product (GDP) by $50 billion annually. “Trump’s plans…will likely deteriorate the US fiscal situation, and this could pave the way for macroeconomic policy adjustments that would support gold,” warn ANZ analysts.

Geopolitical Tensions

Trump 2.0 is set to inherit a turbulent and uncertain geopolitical landscape. The war in Eastern Europe is reaching alarming levels of confrontation with Ukraine launching US missiles deep inside Russia and Putin lowering the country’s requirement for nuclear launches. As JP Morgan notes, “ Gold…has historically been one of the best-performing tactical hedges against geopolitical risk.”

Debt Burden

Adding to the national debt seems to be the only bipartisan policy, and Trump’s first term was no exception. His administration threw $8.4 trillion ($3.6 trillion related to COVID relief) onto the already heavy debt burden. A report from the Committee for a Responsible Federal Budget (CRFB) estimates Trump’s proposed policies would raise the debt by another $7.75 trillion. Even the soon-to-be-established “Department of Government Efficiency” claims to be able to slash the federal budget by $2 trillion–a small dent in a systemic problem.

Gold Forecasts Remain Elevated

Gold’s recent slump has done nothing to reverse gold’s shining outlook. Experts have had to raise their price predictions several times throughout 2024 in the face of relentless upward momentum. In fact, many have been eyeing the $3,000 milestone. The consensus seems to view this dip as a cool-off rather than a reversal. JP Morgan has described it as a “stumble, not a sea change”, reinforcing a bullish stance on gold.

Questions or Comments?

We do not sell your information.