Category: Silver

There’s a lot to consider when leaving a job, including what to do with an old 401(k). Whether you’ve recently rediscovered a forgotten employer-sponsored retirement plan or you’re just now cutting ties with an employer, knowing all your options can put you and your nest egg in the best position for long-term success.

There’s a lot to consider when leaving a job, including what to do with an old 401(k). Whether you’ve recently rediscovered a forgotten employer-sponsored retirement plan or you’re just now cutting ties with an employer, knowing all your options can put you and your nest egg in the best position for long-term success.

What to Do With an Old 401k

You effectively have four different choices when figuring out what to do with an old 401k:

- Leave it with your former employer

- Withdraw the funds

- Transfer it to a new employer’s plan

- Rollover into an IRA

Let’s take a look at the advantages and considerations of each option to help you determine the best given your circumstances and investment goals.

1. Keeping it with an old employer.

Contrary to popular belief, ex-employees are often entitled to maintain their 401(k)s with their former employers. Of course, policies vary between businesses which are further influenced by the funds managing those accounts. Often, account holders who don’t meet a minimum investment amount are required to remove their funds from previous employers. This minimum threshold is typically around $5,000.

Advantages

You maintain current investments.

Not every 401k has the same investment options. If you’re a fan of what you’re currently holding in your old retirement plan, you might think twice about moving it. Maybe your prior employer offered unique investment packages which might have even influenced your decision to work there initially. Additionally, you may wish to preserve the favorable cost basis of a specific asset in your current plan.

The fees are reasonable.

Some investors might decide to leave an old 401k in place because of low fees. Sometimes, companies offer financial incentives in the form of locked-in account expenses to keep employees in their plans. In comparison, the fees of a new account could act as a deterrent to doing anything with the account.

You’re in between jobs.

If you’re actively searching for a new job and wondering what to do with an old 401k, it could be strategic to leave it until you secure a new position. In this case, keeping it with a former employer gives your investments a chance to appreciate throughout the job search. Plus, you don’t have the hassle of completing the paperwork associated with transferring accounts while looking for a new position.

Considerations

“We don’t recommend you ever leave your [401k plan] behind with your former employer or roll it into the new company’s 401k plan.” – Sr. Precious Metals Advisor Steve Rand

You’re betting on the success of the company.

There are legal protections ensuring individuals with employer-backed retirement plans aren’t financially harmed if the company goes under. However, leaving an old 401(k) with a prior employer certainly presents potential challenges when it comes to the oversight and management of the account. In the event of a bankruptcy filing or sale, a company could inadvertently make it harder for ex-employees to recover their accounts.

You’re relinquishing control.

Another downside to leaving an old 401(k) with a former employer is a significant lack of control. When you’re no longer at a company, you may not have as much oversight or information regarding the plan’s management, investment options, or administrative policies. This can lead to a situation where you are less aware of how your retirement funds are being handled which is never a good sign.

The account could become lost.

There are plenty of ways an ex-employee can lose track of an old 401(k), especially when changing jobs. Employer-sponsored retirement plans can be “lost” due to mergers and acquisitions, poor communication, or mere forgetfulness. Leaving your retirement account with a former employer increases the likelihood of these scenarios which could be stressful or equivalent to leaving money on the table.

2. Cashing Out of an Old 401(k)

Many investors might feel as though clearing out their retirement plan from a former employee is a natural extension of the transition. While wiping the slate clean might feel right, that doesn’t necessarily make it the most fiscally responsible decision.

Advantages

You get cash in hand.

There’s something gratifying about taking ownership of the gains you’ve realized from years or even decades of diligent investing. Liquidating your old 401k will undoubtedly add a boost to your cash holdings.

There’s a 60-day grace period.

When you take a “full distribution” from an old employer-sponsored retirement plan, the IRS gives you 60 days to move it into another plan before you incur any penalties. However, if you plan to move the funds into another retirement account, it’s much safer to simply make a rollover.

Considerations

There are tax implications.

Every time someone cashes out of an old 401k, Uncle Sam hears a cash register ring. The process elicits a fair number of tax implications. The amount you take out will likely get tacked onto your taxable income for the year since 401ks are tax-advantaged. You’ll also be slapped with an early distribution fee to the tune of 10% if you’re not 55 yet. That penalty jumps to 25% when associated with a SIMPLE IRA or SEP account.

You suffer unrealized gains.

The minute you pull an old 401k out of the market, you lose an opportunity for growth. Even if you were to jump right back into the market, you might have a much higher cost basis for every investment.

3. Transfer to a new employer’s 401k

Many companies allow new employees to transfer old 401ks held into their plans. If you have a new job lined up, you should clarify the terms of your new business’s retirement benefits before deciding what to do with an old 401k.

Advantages

The account is fully managed.

One of the main benefits of transferring an old 401(k) to a new employer is having a fully managed retirement plan. This means that administrative tasks such as performance monitoring and investment management are managed on your behalf. That’s a significant time and stress relief for many employees.

You might have matching contributions.

Another significant benefit is the possibility of matching contributions from your new employer. Of the companies offering 401(k)s, a whopping 98% mirror employee contributions in one way or another. If a new employer offers this perk, it could be an effective way to grow your retirement savings quicker, especially if you’re planning to max out your contributions.

Considerations

There can be limited investment options

401k plans are highly restricted in the type of investments they permit. Investors are pretty much stuck with stocks and bonds which are great asset classes when part of a diverse portfolio. However, these limited investment options leave people vulnerable to bouts of inflation and broad market volatility.

You’re “locked in” until retirement.

When switching jobs, there’s a short window of opportunity to take full control of your retirement plan. However, that chance is gone when you finalize the 401k rollover to your next employer. Since you’re working hard to build your investments and will rely on them for your future, it’s crucial to maintain maximal control over your retirement funds.

The company’s performance is a risk factor.

Having an employer set up and match contributions to a 401k feels great, but this ties the performance of your retirement fund to a company. If your employer were to go bankrupt or merge with another company, you have less control over what happens to your account. As mentioned before, frozen retirement accounts aren’t unheard of.

There’s one more account to track.

Transferring an old 401k to a new employer doesn’t work to simplify your retirement portfolio. Even if you’re not handling the active investing, it’s still an extra retirement plan you have to keep tabs on. While portfolio diversification is important when it comes to the variety of assets, there’s no inherent advantage to having a range of retirement accounts.

4. Individual Retirement Account (IRA)

If you’re looking for maximum control over your retirement plan and true diversification for your portfolio, you should consider rolling over an old 401k into an IRA. This retirement account grants you access to a range of physical assets and greater flexibility when making withdrawals. With the help of an experienced investment advisor, rolling over a 401k to an IRA can be pretty quick and easy.

Advantages

You’ll have true diversity.

Every investor understands the importance of portfolio diversity. The more varied your investments, the less exposure you have. This is especially important when approaching retirement as you have a shorter window in which to invest. In retirement, it’s imperative as you’re living off investments and savings. IRAs tend to permit a broader array of assets than employer-sponsored accounts which are restricted by legal allowances and company interests.

The fees are transparent.

It’s easy for investors to lose track of 401k fees which can add up over time, eating a chunk of their retirement growth. On the other hand, IRAs have upfront and transparent fees attached which are lower overall than their 401k counterparts. That means more money in your pocket for retirement. Plus, investors have more options to choose from when searching for an IRA with reasonable fees.

You can consolidate retirement plans.

An IRA makes it possible to consolidate various retirement accounts into a single plan. For instance, if you have a string of old 401ks from different employers, you can roll all of them into a single IRA. That’s not possible the other way around.

Considerations

You’ll need to pay attention.

Although an IRA grants you greater control over your retirement plan, it also brings with it added responsibility. You’ll need to take a more active approach to your investing when compared to a standard employer-sponsored 401k.

There are no matching contributions.

Another consideration when transferring an old 401k to an IRA is the lack of matching contributions. Since an IRA isn’t hosted by a company, investors don’t receive any employer benefits. IRA contributions are completely self-funded. Also, annual contribution limits for 401ks can be higher than for IRAs.

Bonus Option: Rollover to Precious Metals IRA

All of the above options have their advantages and considerations, but some investors might be looking for the heightened protection, price stability, and growth potential that only comes with physical metals. A precious metals IRA is a special kind of self-directed IRA permitting investors to put tax-advantaged dollars toward physical precious metals assets. If you’re considering what to do with an old 401k, don’t act until you explore some benefits of this unique type of account.

Advantages

You have access to physical precious metals.

Traditional retirement accounts such as 401ks and traditional and Roth IRAs restrict investors to paper gold assets which are subject to the same risks as standard investments. The real protection, security, and stability of precious metals are found in their physical form. A precious metals IRA is the only retirement plan that makes it possible to hold these tangible metals.

Your retirement becomes an inflation hedge

Gold, silver, and other metals are proven reliable hedges against inflation unlike stocks, bonds, and other USD-backed assets. With a physical precious metals IRA, you’re gaining protection from market volatility and the ability to protect and leverage inflation.

Considerations

Less Familiarity

Most investors are less familiar with self-directed IRAs than with more conventional retirement accounts which can make the process a little confusing. Working with a reputable precious metals advisor can simplify the setup since these professionals help you pick a worthwhile custodian, suggest ideal precious metals for your goals, and support you in the buying process.

👉 Suggested Reading: How Much Money Do You Need to Start a Gold IRA?

Interested in learning more about how a precious metals IRA can help you protect your nest egg from inflation, dollar devaluation, and other economic pressures? Check out our in-depth FAQs about precious metals IRA for clear answers to the most common questions.

With spot gold prices sitting near all-time highs following a confident surge, many investors wonder if now is the time to sell their holdings. Watch this week’s The Gold Spot to hear Scottsdale Bullion & Coin Sr. Precious Metals Advisor Steve Rand and Precious Metals Advisor John Karow explain why now is the time precious metals investors should BUY instead of sell, what the economic forecast looks like, and why gold is still an effective hedge against market shocks.

Low Precious Metals Premiums = Buying Opportunity

Although gold prices recently hit a record high, premiums on precious metals are still advantageously low. These add-on costs, which cover the overhead accrued by precious metals dealers, are reliable indicators of buying opportunities.

“Premiums are low, they’re tighter than they have been in quite a while. That’s a signal to buy, not to sell.”

On top of that, several broader market indicators point to further growth for gold and silver prices.

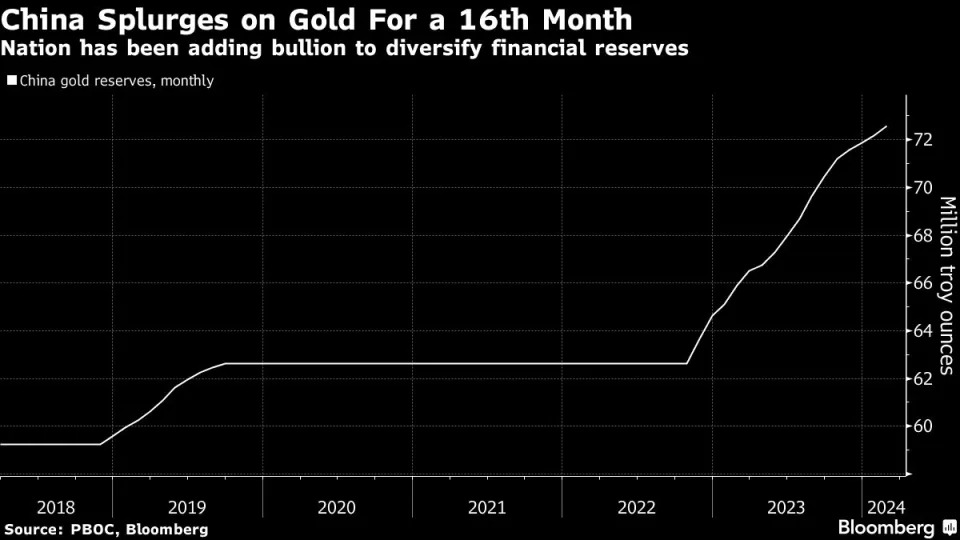

Central Bank’s Surge Gold

This strategy advice is supported by the actions of governments as central banks buy record amounts of gold. China continues to lead the pack, marking its 16th consecutive month of gold bingeing, with 12 tonnes added last month. Overall, central banks have been buying gold at a record rate of over 1,000 tonnes per year, underscoring the global shift into physical precious metals.

Geopolitical Tensions Mount

The deteriorating geopolitical climate is further encouraging this transition to gold. Wars rage in Eastern Europe and the Middle East, China flexes its military might in the South China Sea, and the BRICS nations threaten to destabilize the dollar with a BRICS currency. Gold prices have already responded to these developments by hitting record highs, but worsening conditions indicate prices aren’t stopping at these levels.

Interest Rate Cuts Incoming

The Federal Reserve predicted three rate cuts throughout 2024, early in the year. Those odds have only improved since that initial forecast. These interest rate reversals are bullish for gold prices, adding more fuel to the yellow metal’s upward momentum.

Gold Prices Too High?

It’s perfectly rational for investors to consider selling after an asset breaks through into uncharted territory. However, when the fundamentals undergirding the asset’s value remain strong, there’s good reason to believe spot prices will continue moving upward. This is precisely what’s happening with spot gold prices.

After notching record numbers, gold prices maintain their stability, signaling the potential for more upward movement. This is reminiscent of the 1980s when gold skyrocketed to $850 amid soaring domestic inflation and geopolitical turmoil spurred by the Iranian hostage crisis and the Russian invasion of Afghanistan.

The economic and geopolitical landscapes share many of the same features. A recent study found that gold prices would have to reach $3,000/oz today after adjusting for inflation to match the high of the 1980s. That represents a roughly 38% jump from current evaluations. The combination of market volatility and global uncertainty means there’s still plenty of runway for gold prices to move even following recent highs.

Don’t Wait to Buy Gold & Silver, Buy Gold & Silver and Wait

Everything suggests that NOW is a prime time to buy physical gold and silver. Premiums are surprisingly low given high demand; central banks, institutional money, and retail investors are diving into gold; geopolitical uncertainty is peaking; and economic instability is rampant. Gold price forecasts for 2024 indicate prices are likely to go higher.

Whether exposing yourself to gold and silver for the first time or adding to your stockpiles, now is a great time to buy. You’re always better off buying and waiting rather than waiting to buy. Pressure is building, and it’s only a matter of time before prices continue to move higher. Selling now would only put you at a disadvantage.

Understand which precious metals meet your needs by requesting our FREE Precious Metals Investment Guide.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment Silvercorp Met…

Fri, 03/15/2024 – 05:11

COT Silver Report – March 15, 2024

Silver COT Report

Fri, 03/15/2024 – 15:24

Silvercorp Met…

Fri, 03/15/2024 – 05:11

Questions or Comments?

We do not sell your information.