Category: Silver

As the broader economy shows signs of foundational weakness, gold and silver (yet again) have proven their inherent value and inflation-hedge properties. Both precious metals have boasted impressive advancements over the last week.

Watch this week’s The Gold Spot to hear Scottsdale Bullion & Coin Founder Eric Sepanek and IRA Liaison Michelle Ellis explain these major price moves, why gold and silver are expected to surge higher, and how investors can take advantage of this situation.

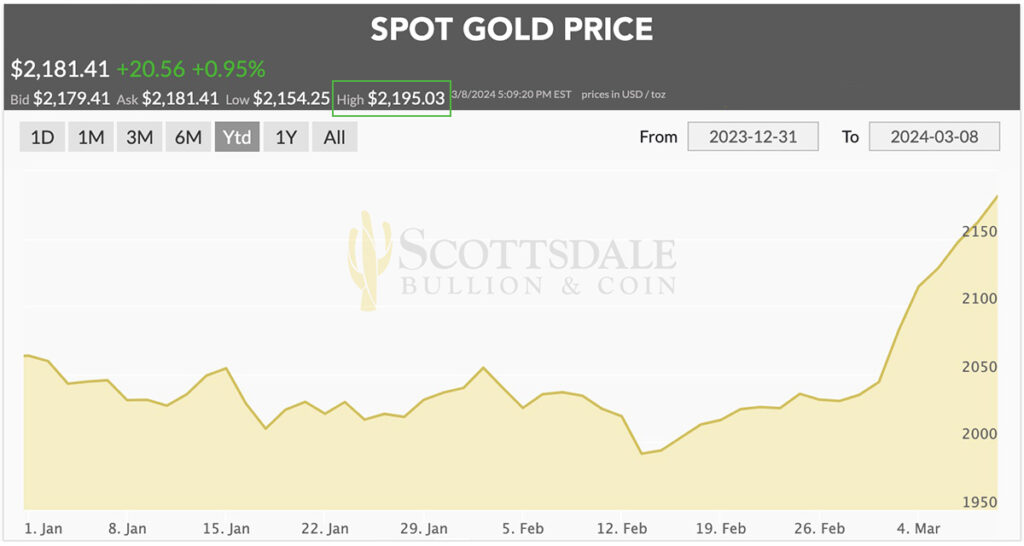

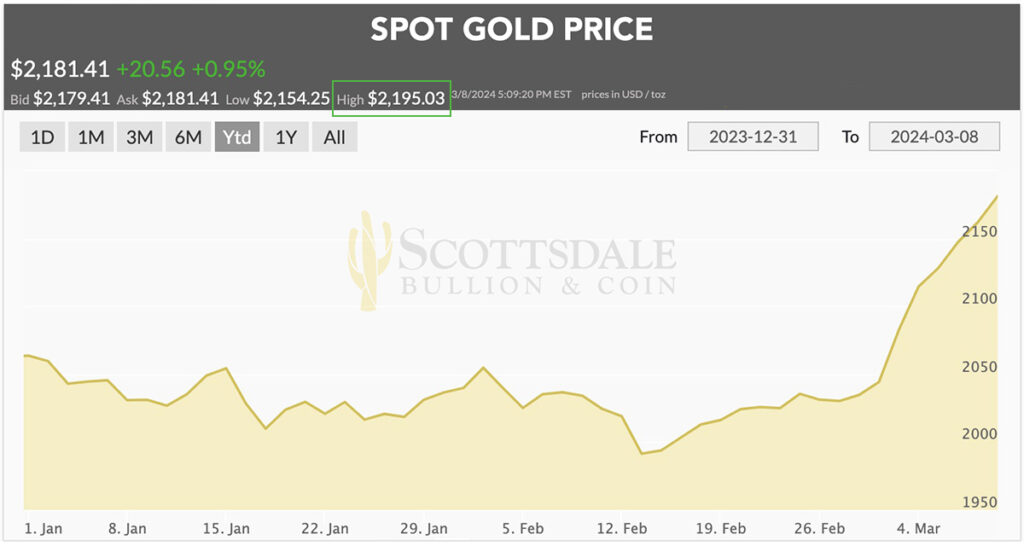

Spot Gold Price Hits All-Time High

This week, spot gold prices took off, notching new highs. On Tuesday, March 5, 2024, the spot price of gold first reached its new high since December 2023 when it hit $2,141.59 an ounce. However, the rally continued as gold brought a new high price each day of the week. As of today, Friday, March 8, 2024, the gold spot price hit a new intra-day all-time high price of $2,195/oz after the release of an overall weaker U.S. jobs report.

The rush into gold comes amidst a backdrop of weaker economic conditions and spiking gold demand. This is gold’s fifth record high price in the past three months alone, underscoring the yellow metal’s fundamental strength and the shift into safe-haven assets. In early December 2023, spot gold prices hit a then-high of $2,135/oz.

The spot silver price is pulling its weight by setting a two-month record1 around the same time. It’s not uncommon for this shiny precious metal to follow closely behind gold’s upward trajectory.

Premiums Are Still Low…For Now

Don’t make the mistake of assuming that elevated gold and silver prices automatically result in higher dealer premiums. Right now, these add-ons remain at favorable lows as the supply of coins, gold bars, and silver bars is healthy.

“Even though [gold and silver] prices are high, premiums are in a really good spot.” – SBC Founder Eric Sepanek

This hasn’t been the case in previous episodes of significant gold and silver price hikes, so investors should take full advantage of the opportunity while it lasts.

Perfect Timing for Contributions

The strength of gold and silver prices and relatively low premiums come at an opportune time for investors looking to optimize their retirement savings. The clock is ticking on 401k and IRA contributions which investors can make for both the 2023 and 2024 tax years, but only until April 15th. Here are the limits based on age and year:

| 2023 IRA Contribution Limits | 2024 IRA Contribution Limits | |

|---|---|---|

| Under age 50 | $6,500 | $7,000 |

| Age 50+ (catch up contribution) | $7,500 | $8,000 |

You can knock out contributions for two years simultaneously, further diversify your portfolio, and lock in gold and silver prices before they jump higher. It’s also a great time to rollover a 401(k), IRA, or another eligible retirement account to expose your nest egg to physical gold and silver.

A Limited Buying Opportunity

Gold prices might have hit all-time highs, but experts think things are just getting started. The recent price ceiling has been re-established as the floor with gold value remaining steady and strong. Due to a confluence of economic fragility, geopolitical instability, and waning investor confidence, gold and silver prices are expected to continue moving upward.

$2,500 an ounce is the average of 2024 gold price forecasts from a slew of market analysts. It’s only the beginning of March, and gold prices are well on their way to hitting this prediction. Investors can expect a few retractions on the way up, but experts are saying this is a prime time to buy physical gold and silver.

“We’re very bullish, we’re not surprised, and we think it’s going to keep going in that direction.”

Don’t Wait to Buy Gold and Silver. Buy Gold and Silver, and Wait

All signs point to higher gold and silver prices in 2024 and beyond. Right now, investors have a limited opportunity to buy gold and silver while premiums are relatively low and before prices jump higher. Waiting around until the “perfect” time is a failed strategy. As always, investors are much better off buying gold and silver and waiting for their inevitable rise in value.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Gold and real estate are two of the most popular physical assets used for portfolio diversification. When investors are looking for protection from inflation, volatility, and economic uncertainty, these tangible investments commonly spring to mind. Here are some distinctions between gold and real estate that investors could consider before they invest in these assets.

Gold and real estate are two of the most popular physical assets used for portfolio diversification. When investors are looking for protection from inflation, volatility, and economic uncertainty, these tangible investments commonly spring to mind. Here are some distinctions between gold and real estate that investors could consider before they invest in these assets.

Accessibility

When it comes to ease of access, gold is the clear winner. The average home costs over $430,000 and commercial property is orders of magnitude more expensive. These historically high prices, which are ever-increasing, keep the overwhelming majority of investors from considering real estate as part of their portfolio. Conversely, gold’s ease of divisibility results in a broad spectrum of assets representing various price points. Whether you’re purchasing your first piece of gold or topping up your retirement account, you’ll have no trouble finding a gold asset that matches your pricing needs.

Maintenance

Real estate doesn’t just require a bigger buy-in than gold. It also demands considerable ongoing investments. Generally, owners should expect to spend up to 2% of the property’s value every year on general upkeep including maintenance and repairs. That means real estate investors should expect to put over $8,000 annually into this asset, based on the average price of a home. On the other hand, investing in physical gold doesn’t incur any routine costs. In proper storage conditions, gold assets don’t face any risks of deterioration. The only exception would be for investors who open a precious metals IRA which only costs a few hundred dollars annually.

👉 Suggested Reading: How Much Money Do You Need to Start a Gold IRA?

Liquidity

Ideally, a physical investment offers wealth protection while being easily convertible into cash when necessary. Unfortunately, this isn’t the case for real estate which has a strong reputation as an illiquid asset. The average timeline for selling a home stands at nearly two months, while historically a short period of time, severely restricts an investor’s flexibility when they are ready to sell. The liquidation process is even longer for commercial properties. Alternatively, gold is considered a highly liquid asset because of its incredibly high demand and worldwide recognition. Selling gold is a much more straightforward process that often only takes a few days. This allows investors to convert their investments at will to take advantage of market trends or to address financial needs.

Inflation Hedge

One of the defining characteristics of a worthwhile physical asset is its ability to hedge against inflation. Investors purposefully seek out these investments to preserve their wealth as inflation ravages paper markets. Gold has always demonstrated a strong inverse relationship to the rest of the economy. In other words, gold prices tend to rise as inflationary pressures sink the value of traditional assets. For example, when the US economy was being decimated by stagflation throughout the 1970s, gold prices surged over 1,700% from around $36 to well over $650 within the decade. In the same period, the average home prices climbed only 9.9%. It’s also important to note that all the costs involved with maintaining real estate increase with inflation, eating into any potential gains.

Risk

Physical assets are typically perceived as carrying less risk than their paper counterparts. However, the complexity of real estate transactions and the sheer number of people involved opens up investors to considerable counterparty risk. Just recently, the National Association of Realtors – the largest consortium of brokers in the country – was found guilty of artificially inflating brokerage fees by fixing industry-wide rates. This robbed investors of several percentages of their property’s value. Institutional investors have been found guilty of manipulating gold prices too, but the impact is much less severe than in the real estate market. Plus, these schemes impact paper gold much more than physical gold which maintains its inherent value regardless of market manipulation.

Debt

Real estate’s higher barrier of entry inevitably forces people into debt. A staggering 78% of home purchases in the United States require financing which is reflected in the national mortgage debt of $19 trillion. This debt accumulation puts investors at risk of overleveraging and defaulting. Although some precious metals investors take out loans to increase their gold holdings, debt is not a prerequisite for investing in gold like it is for real estate. There’s a rich variety of gold assets spanning a range of price points, making it easy for investors to find products that suit their needs. Gold’s lower price point also lends itself to the investment strategy of dollar-cost averaging.

Volatility

The real estate market is heavily influenced by the rest of the economy which makes it a more volatile asset than gold. Everything from interest rate hikes and currency devaluation to inventory changes and market sentiment can throw real estate prices out of whack. Plus, there’s the constant issue of debt. The relatively recent 2008 Global Financial Crisis was sparked by a massive housing bubble resulting from bad loaning practices, and the foundation of the real estate market is still based on debt. Centuries of recognition and worldwide use as a hedge against economic pressures have made gold an incredibly stable asset. Its inherent value isn’t impacted by flare-ups in the economy which keeps prices relatively calm.

Gold vs Real Estate: Shifts in Perception

Common investing wisdom might suggest that real estate is the ideal physical asset for protection against economic uncertainty and instability. However, recent numbers demonstrate gold’s strength in virtually all categories. A recent Gallup survey revealed that the number of Americans choosing real estate as the best long-term investment dropped by 11%. Conversely, gold’s selection as the leading investment nearly doubled from 15% to 26%.

If you’re interested in learning more about investing in gold, grab a FREE copy of our Precious Metals Investment Guide. It’ll equip you with everything you need to know to get started investing in precious metals to diversify your portfolio, protect your wealth, and hedge against inflation.

Questions or Comments?

We do not sell your information.