Category: Silver

Peter Spina

Sun, 11/19/2023 – 14:37

Ed Steer

Sat, 11/18/2023 – 07:09

Peter Spina

Sat, 11/18/2023 – 05:07

At first glance, the most recent Consumer Price Index (CPI) and Producer Price Index (PPI) reports look promising. Stocks and gold responded positively, and the dollar dropped in value. However, Americans aren’t actually seeing any lower prices at the grocery store or the gas pump. What’s the deal?

In this week’s The Gold Spot Scottsdale Bullion & Coin Precious Metals Advisor Todd Graf and Sr. Precious Metals Advisor Damian White explain this paradox, the cold hard truth behind inflation, why this economy is eerily reminiscent of the 1970s, and how investors can best protect their wealth.

Inflation vs Rate of Inflation

Accurately assessing the economy’s health requires a deeper look into the CPI and PPI numbers. There’s a crucial distinction between inflation and the rate of inflation. While inflation tracks the increase in the prices of goods and services, the rate of inflation measures the speed at which those changes occur over a specific period.

These economic metrics are NOT showing a reduction in inflation. Instead, they’re showing a decrease in the rate of inflation. In other words, the cost of things is going up at a slower rate than before, but prices are still going up.

Inflation has NOT come down. The rate of inflation has slowed down.–

That’s equivalent to being on a ship sinking at a slower pace. The main issue of dwindling purchasing power and surging prices has yet to be addressed. The cost of living remains exceptionally high, and it may get worse.

A Blast From the Past

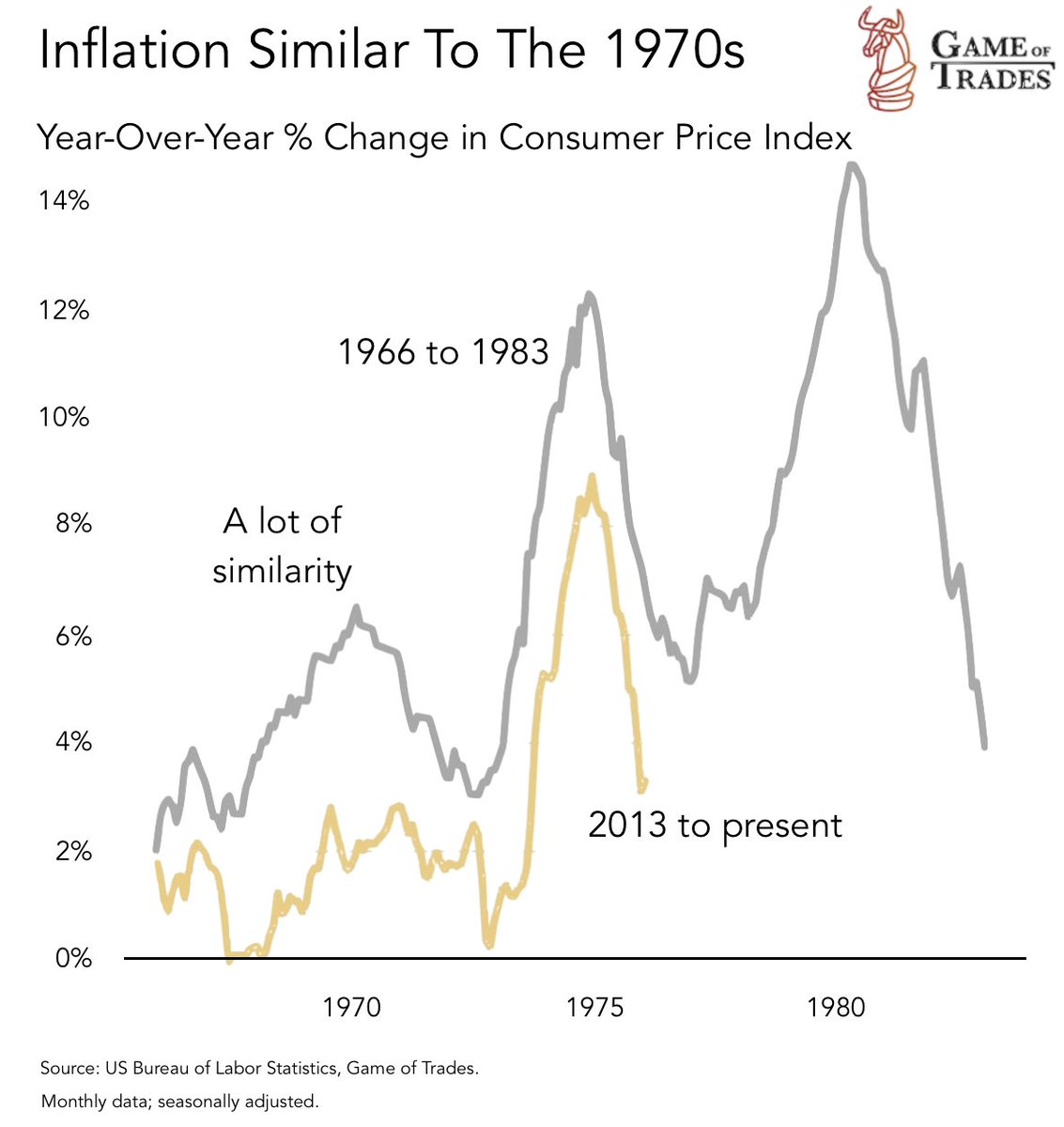

The current economic trajectory is concerningly similar to the stagflationary period of the 1970s. Extreme inflation rates from irresponsible spending and geopolitical turmoil wreaked havoc on living expenses. It’s noteworthy that inflation came in waves rather than a consistent upward surge during this time.

A significant surge in inflation would be followed by a brief drop in the inflation rate. Everyone assumed inflation was over before another massive inflationary spike hit. The US economy suffered these bouts for about 15 years with disastrous consequences. This most recent drop in the inflation rate is lulling many investors into a similarly false sense of security.

Don’t Wait to Buy Gold, Buy Gold and Wait

Gold prices have a long history of rising as inflation sinks the value of the traditional markets. In fact, gold saw one of its quickest periods of growth in the 1970s while the US economy was grappling with stagflation. These reminiscent economic conditions could send gold prices on a similar upward trajectory.

If [inflation] increases, the…purchasing power of our dollar is going down. Gold and silver [are] going to be the best place to have your money.–

Investors who are eager to protect their wealth from inflationary pressures and economic uncertainty should take this opportunity to buy gold before things get worse. If you already have a stockpile of gold, now is an excellent opportunity to dollar cost average.

There’s a reason central banks are buying gold at record rates. The economy faces worsening conditions, and gold prices will only increase in response. As always, trying to time the market is a waste of time and energy. Simply buy gold and wait to protect yourself and your wealth from incoming inflationary waves. Don’t let misleading inflation numbers make you complacent.

Central Banks like Fed are buying gold. Does this mean fiat money is safe? Hell no! Central Bankers are saving themselves from their own incompetence, that’s why they buy gold. Their job is to protect the banks not you. Get smart. Protect yourself from Central Bankers: Save…

— Robert Kiyosaki (@theRealKiyosaki) November 11, 2023

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

CommentCOT Silver Report – November 17, 2023

Silver COT Report

Fri, 11/17/2023 – 15:24

Questions or Comments?

We do not sell your information.