Silvercorp Met…

Fri, 11/10/2023 – 10:36

Category: Silver

Kootenay Silver Inc.

Fri, 11/10/2023 – 04:05

Kootenay Silver Inc.

Fri, 11/10/2023 – 04:05

Silvercorp Met…

Fri, 11/10/2023 – 03:55

In a strong economy, investing is relatively simple. Following traditional investment wisdom generally yields decent returns. However, most investors get tripped up when the economy hits rough patches. Mainstream advice presumes a strong dollar and low inflation which is really just a small fraction of market cycles. Knowing what investments to seek out during periods of economic downturn can put your portfolio in the best position for optimized protection and maximal growth.

The Relationship Between a Weak Dollar & High Inflation

A devalued dollar and high inflation are two sides of the same coin. Inflation is defined as the consistent increase in the general price of certain goods and services within the economy over an extended period. The direct result of this phenomenon is a decrease in purchasing power. In other words, the higher the inflation rate, the less valuable your dollar. The American people have seen this relationship play out over the past few years as inflation hit record highs and the dollar, along with dollar-backed assets, lost value.

We keep hearing news about how well the dollar is doing but when you go to the grocery store, it just doesn’t feel that way.– Information Consultant Sebastian Gonzales

What causes a weak dollar?

In today’s globalized, fiat money system, there are several factors influencing the value of the dollar. Any one of these factors or some combination of them can weigh on the greenback’s price.

Fed Policies

Central banks have significant leverage over the dollar’s value primarily through two means of intervention: interest rates and money supply. When the Fed wants to stimulate a stagnant economy, it might consider lowering interest rates and injecting more money into the economy. These policies often have the side effect of hampering the dollar by scaring investors away from devalued US assets and saturating the money supply.

“The Federal Reserve is starting to become concerned. They realize that they’re well behind the curve.”– Precious Metals Advisor Damian White

Foreign Central Banks

Although the Fed controls domestic fiscal policies, the actions of foreign governments can have detrimental effects on the dollar too. At times, governments engage in currency intervention by purposefully offloading their own currencies in exchange for US dollars. This can lead to a rapid increase in available USD on global markets, depreciating its value in comparison to other currencies. These economic measures are often taken by governments to increase the value of exports or improve currency stability.

Learn How to Avoid Costly Rookie Mistakes & Invest in Gold Like a Pro!

Get Free Gold Investor Guide

De-Dollarization

The US dollar has been the world reserve currency for nearly five decades with the majority of foreign reserves being denominated in USD. However, a number of domestic fiscal blunders and geopolitical schemes have ramped up de-dollarization as countries actively decouple from the US dollar. Since much of the dollar’s value is shored up by these dollar reserves, the global shift away from the dollar severely impacts its value. With countries progressively growing bolder in their shifts away from the status quo, some experts warn of a dollar collapse.

Oil Prices

The near-universal demand for oil gives this commodity an outsized impact on the greenback’s value. In fact, ever since the gold standard was abandoned, the US dollar has been directly linked to oil through the petrodollar system – deepening the ties between oil and dollar markets. Typically, when oil prices dip due to demand slumps, oversupply, production booms, or technological advancements, the US dollar decreases in value. Of course, there are times when exceptional and unforeseen hikes in oil prices can result in a temporarily weak dollar.

Market Sentiments

The real x-factor influencing the value of the dollar is how people feel about the market. Studies have shown that humans often make irrational investment decisions based on emotions instead of carefully analyzed information. When market sentiment is cautious and pessimistic, investors usually pull out of traditional markets in favor of safe-haven investments . This immeasurable and largely unpredictable variable can lead to dollar devaluation regardless of market indicators.

Who benefits from a weak dollar?

The US dollar is the foundation of the global economic system which means most assets are linked to the greenback. As a result, a dip in the value of USD tends to sink the majority of investments. However, there are some countervailing assets that benefit from a weak dollar.

Foreign Governments

When the dollar experiences bouts of weakness, foreign currencies often see a surge in value. This imbalance puts foreign governments in an advantageous position to buy US goods and services at a discount, purchase Fed bonds at decent rates, and speed up domestic economic growth.

US Exporters

While a weak dollar is bad news for most domestic companies, it can act as a boon to large US exporters. As the dollar declines in value compared to other currencies, US products become considerably more affordable in foreign markets. This generates more sales and profits for foreign-focused companies.

Emerging Markets

Emerging markets tend to perform well during periods of dollar devaluation. This is especially true for the largest among these middle markets including China and Russia. In fact, the entire BRICS group, which is comprised of rapidly growing middle markets, has strategically placed itself in a position to capitalize on every dollar weakness.

👉 Suggested Reading: A BRICS Currency? The BRICS nations have even discussed the potential of a gold-backed BRICS currency to rival the dollar on the international stage.

Physical Asset Holders

Investors in hard assets are one of the biggest benefactors of a dollar decline. When the greenback shows signs of weakness, retail and institutional investors alike shift from paper-backed to physical assets. This is precisely why central bank gold demand has been skyrocketing. Unlike paper assets which are anchored to the US dollar, physical assets maintain strength due to their inherent value.

How to Invest With a Weak Dollar & High Inflation

Understanding who benefits from a weak dollar is worthwhile, but the fundamental question is what to own if the dollar collapses. There’s a reason retail investors, institutions, and governments have been turning to precious metals for centuries. These physical assets offer unrivaled protection against inflation and other economic pressures to preserve and even expand wealth. Gold and silver prices tend to have an inverse relationship with dollar prices, increasing when currency devalues.

If you’re interested in learning more about diversifying your portfolio with gold and silver, claim a FREE copy of our Precious Metals Investment Guide.

Money Versus Metal

Ted Butler

Thu, 11/09/2023 – 16:05

Money Versus Metal

Ted Butler

Thu, 11/09/2023 – 16:05

The combination of out-of-control spending, ceaseless printing, and astronomical debt has many investors wondering what happens if the US defaults on its debt. The question was virtually unthinkable just a few decades ago when the nation’s deficit was a fraction of where it stands today. With the US debt nearing $34 trillion and political gridlock reaching new heights, a complete debt default is looking more possible every day.

The Impact of De-Dollarization on US Debt

There’s a reason the US has been able to accumulate a deficit far surpassing that of other countries. Namely, the US dollar’s position as the world reserve currency has made it possible to borrow massive sums with limited consequences. Central banks around the globe place a large portion of their reserves in the greenback for economic stability and security. The high demand for the US dollar in conjunction with its abundant presence in the global economy leads to low interest rates for US borrowing.

The dollar’s privileged position has enabled the Fed’s experimental and disastrous fiscal policies under the banner of Modern Monetary Theory (MMT). These failed economic decisions have wreaked economic havoc across the globe which is why countries are pursuing a process of de-dollarization. This global shift away from the dollar essentially removes the only backstop preventing the complete collapse of the greenback, making debt default that much more likely.

👉 Suggested Reading: De-Dollarization 101: What to Know About the Global Shift Away From the Dollar

What happens if the US defaults On its debt?

Government functions could fail.

One of the most immediate effects of a US debt default would be a severe restriction on government operations. Americans get a glimpse of this every time the government can’t increase the debt ceiling and low-stakes government operations such as the National Park Service are restricted for a few days or weeks. A full-blown debt default would be significantly worse. According to the White House, it would affect even the most basic and crucial functions of the government such as national defense and public health care.

Learn How to Avoid Costly Rookie Mistakes & Invest in Gold Like a Pro!

Get Free Gold Investor Guide

The dollar would lose significant value.

The dollar’s value has been artificially propped up by its prestige as the world reserve currency. A US debt default would cause irrevocable damage to the dollar’s reputation in the global economy, further eroding confidence in its stability and security. The government’s inability to repay debts when they come due transforms the dollar from an economic boon to an unnecessary risk for foreign countries. The resulting drop in demand for USD could cause a rapid dollar devaluation.

Financial markets would tank.

Traditional financial assets including stocks, ETFs, mutual funds, and even bonds are directly linked to the performance of the dollar. As the greenback’s value falters in the wake of a US debt default, standard investment instruments wouldn’t be far behind. Furthermore, as the attractiveness of US assets wanes, central banks and international investors would pull out their investments in droves. With foreign countries holding 40% of domestic corporate equity, the ramifications of a global retreat from the US market could be catastrophic.

“When you get to these levels of debt and default, you start to lose confidence around the world in the dollar. A lack of confidence is what starts major currency collapses.”– Precious Metals Sr. Advisor Damian White

Dollar alternatives might take hold.

The dollar’s once-firm grip on power within the world economy has been slipping for years. The US debt default could easily be the final domino to fall in the gradual decline of the dollar’s dominance. The ensuing battle for supremacy among dollar alternatives could yield any number of emerging currencies. For instance, China has been actively pursuing the petroyuan system as a foundation for its Renminbi currency. Even the BRICS nations have recently considered a gold-backed BRICS currency. The prevailing currency could dictate the direction of world economics and geopolitics for decades to come.

Gold prices could jump higher.

Ever since the US abandoned the gold standard, gold and the dollar have had an inverse relationship. Generally, gold prices rise as the dollar loses value. This makes a US debt default a potential tailwind for gold prices. Governments tend to increase gold holdings when economic uncertainty and instability are dominant. Recently, central bank gold purchases have been breaking records as countries seek shelter. The US defaulting on its debt could feasibly spark even higher gold demand, inevitably sending prices skyward.

“Gold is the opposite of debt.”– Precious Metals Advisor Todd Graph

Will the US ever default on its debt?

Investors tuned into the political process understand that the debt default is used as a political football every year. Both parties use the threat of a default as leverage to pursue their agendas. Despite all the finger-pointing, name-calling, and tantrum-throwing, the government “surprisingly” pulls through in the 11th hour with a budget deal.

Like always, the American people end up suffering the brunt of the damage. With global confidence in the US dollar waning rapidly, this political theater can only remain a show for so long. It’s starting to have real-life implications as our increasingly partisan and petty political class flirts with an actual default.

During the last debt ceiling fiasco, JP Morgan analysts placed the odds of a US debt default at 25%. That’s not a reassuring number given the dire consequences of what happens if the US defaults on its debt. Unless the government makes a 180-degree turn away from failed policies and towards fiscal responsibility, these catastrophic events remain ever-increasing possibilities.

How to Invest in a Debt Crisis

Investors should NOT wait for a debt default to start making moves to protect their wealth. The dollar collapse won’t be a gradual process. It will happen instantly. As a result, smart money is already making investment moves to protect against the effects of a potential US debt default. Savvy investors have been stealing a page out of the playbook of central banks by scooping up more gold in anticipation of worsening economic conditions. Precious metals have a proven track record of hedging against inflation and preserving value no matter what happens on the international stage.

If you’re interested in learning more about diversifying with gold and silver, claim a copy of our FREE Precious Metals Investment Guide. You can also contact one of Scottsdale Bullion & Coin’s dedicated precious metals experts by calling 1-888-812-9892 or using our live chat function. Our advisors would be happy to help you determine an investment strategy that matches your goals and budget.

We’re taking a step back from the normal market commentary to recognize the brave men and women who serve in all branches of our military. In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Precious Metals Advisor John Karow discuss a special offer for military personnel and two amazing charities who serve our veterans and that we’re proud to support.

Limited-Time Veterans Day Bullion & Coin Specials

The Scottsdale Bullion & Coin team would like to extend a heartfelt thank you to all the veterans and active-duty service members who have sacrificed to preserve our safety and way of life. In light of Veterans Day and our commitment to giving military men and women the credit they deserve; SBC is proud to offer a special upcoming promotion.

On Friday, November 10th, from 8:30 a.m. to 4:30 p.m. (MST), we’ll be offering exclusive bullion and coin specials for veterans and active-duty members.* You must call or text your advisor to receive these limited-time specials. If you don’t have an advisor, simply call 1-888-812-9892, and we’ll be happy to pair you with a dedicated expert to get you the details on the Veterans Day specials.

Two Veteran Charities We Proudly Support

Scottsdale Bullion & Coin is committed to supporting charities that offer meaningful and impactful services to those they serve. Here are two veteran-focused organizations we’re proud to sponsor, and we would encourage you to check them out too.

American Service Animal Society

The American Service Animal Society (Dogs4Vets) is a local nonprofit organization dedicated to improving the lives of veterans with disabilities through the use of service animals. Many returning military members require assistance moving forward, and service animals can offer the extra support needed to regain a sense of freedom and autonomy in their lives. The ASAS also plays a crucial role in advocating for the rights and welfare of service animals and their handlers, striving to ensure that these partnerships are supported and protected.

To learn more about the ASAS or to donate, visit: https://dogs4vets.org/

Angels of America’s Fallen

The Angels of America’s Fallen is a unique organization focused on providing support and mentorship to children of fallen military members and first responders. They fund extracurricular and developmental activities to help bridge the gap for Gold Star children who have lost a parent. These activities are designed to offer positive mentorship, foster personal development, and promote strong social skills. While most nonprofits focus on college-age individuals, AOAF caters directly to kids aged 1 to 18, which means every penny donated has a massive impact.

To learn more about the AOAF or to donate, visit: https://aoafallen.org/

*Valid proof of military service is required to receive specials.

The gold market is off to a poor start as the trading week gets underway. On Tuesday afternoon, spot gold is down by over $10 per ounce in mid-afternoon action. Some weaker-than-expected data out of China this morning put the yellow metal as well as silver on the defensive, with gold down by over $20 per ounce earlier in the session. As the world’s second-largest economy, China has the power to strongly influence global financial markets. Poor data from China without question has the ability to move global markets as it did today.

Fed’s Interest Rate Decisions and Inflation Pondered by Financial World

In addition to any fresh developments out of China, the financial world remains focused on the two wars going on as well as inflation and interest rates. The Federal Reserve recently held interest rates steady, but seemingly left the door open to another hike before the end of the year. The idea of “higher for longer” has begun to resonate, and the Fed may decide to keep rates at current levels for much longer than many had expected. Inflation has come down in the previous few months, although price pressures remain stubbornly higher than the Fed’s preferred level of 2% annualized. The gold market may get a sense of all being clear once the Fed signals that no more rate hikes will be implemented. Until that time, however, the gold bulls may move with a sense of caution that may prevent any significant, sustainable upside in the market.

Learn everything you should know about investing in precious metals.

Request the Free Guide

Ongoing Conflicts in Ukraine and Israel Heighten Global Uncertainty

The wars in Ukraine and Israel continue to rage on. There have been few, if any, fresh developments in the Russian/Ukrainian war in recent weeks. The potential threat of a nuclear war breaking out remains a source of concern for global markets. With so much uncertainty surrounding the health of Russian leader Vladimir Putin, it is unclear when this war may conclude. Russia does appear to be on the losing end of the conflict thus far.

The war between Israel and Hamas is another story. Israeli defense forces have penetrated into Gaza in recent days as the conflict takes a turn for the worse. With many civilians and non-combatants in the area, the potential for a high rate of civilian casualties is enormous. It is unclear whether this will alter Israeli plans in the region or not, but Israel does seem to be aware of the risks. This conflict is only a few weeks in age at this point, and could drag on for some time to come. The biggest potential risk for this conflict is the addition of other players. If Iran were to become involved, for example, it would almost certainly invite a response from the United States. This could, in turn, lead to the Third World War. The potential threat of this escalating into a much larger conflict may keep buyers looking to gold in the weeks and months ahead.

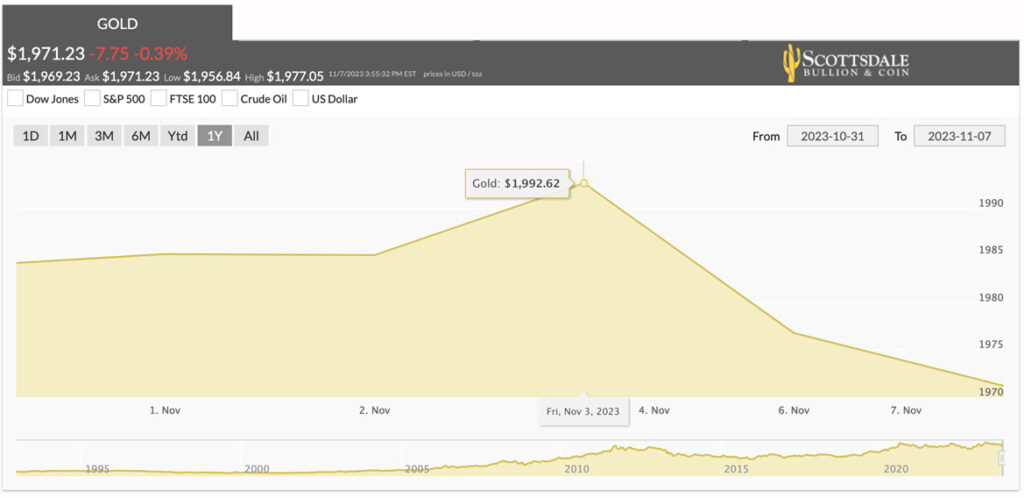

Gold Bulls Eye $2,000 Level as Key Indicator for Market Direction

The gold bulls have done some significant work in recent weeks. That work is unfinished, however, as the bulls have yet to produce a solid rally and closing above the $2,000 level. This area may hold the keys to gold in the months ahead. If the bulls can produce a close or series of closes above $2,000, the market may attract a fresh round of buyers. If the bulls fail to do so, then the bears may look to take control of the market again.

To follow the action in precious metals prices, check out our spot gold and silver price charts. They offer daily, weekly and yearly charts, plus the option to overlay crude oil and US dollar for reference.