If you’ve heard of Project Hamilton, you stumbled upon the latest development in the quickly unraveling saga of a US central bank digital currency (CBDC). The specter of a digital dollar looms large over American investors concerned about the future of privacy, security, and financial freedom. While the government insists a digitized currency would only have beneficial repercussions such as reducing crime, speeding up transactions, and expanding economic access, the American people see a powerful instrument of potential government overreach. Keeping an eye on the government’s dabblings in the CBDC space is the most effective way to protect yourself and your wealth in the new world of digital currencies.

If you’ve heard of Project Hamilton, you stumbled upon the latest development in the quickly unraveling saga of a US central bank digital currency (CBDC). The specter of a digital dollar looms large over American investors concerned about the future of privacy, security, and financial freedom. While the government insists a digitized currency would only have beneficial repercussions such as reducing crime, speeding up transactions, and expanding economic access, the American people see a powerful instrument of potential government overreach. Keeping an eye on the government’s dabblings in the CBDC space is the most effective way to protect yourself and your wealth in the new world of digital currencies.

👉 Related Reading: The CBDC Future: Unmasking Key Risks Investors Should Prepare For

What is Project Hamilton?

Project Hamilton is a collaboration between the Federal Reserve Bank of Boston and the Massachusetts Institute of Technology’s Digital Currency Initiative (MIT DCI) to develop a hypothetical CBDC. Although most discussions surrounding a digital dollar have been theoretical in nature, Project Hamilton sought to uncover the technical possibilities and limitations of a potential CBDC. In essence, the project explored the feasibility of creating a fully digital currency system to handle the transactional, security, and peer-to-peer demands of a national currency infrastructure. The two-part research effort launched in early 2020 and preliminary findings were released in 2022.

Phases 1

The first phase of Project Hamilton focused on developing a transaction processing system for a CBDC. The primary goal was to create a system capable of rapid transactions, impressive capacity, and robust operation. In the end, an open-source processing infrastructure OpenCBDC was released, allowing other governments or institutions to improve and/or use the software.

Phase 2

The latter half of Project Hamilton centered on testing the CBDC platform developed in Phase 1. More specifically, the Boston Fed and MIT DCI explored how the system handled integration with other systems, secure operation, and the maintenance of accurate transactional records.

Bracing for CBDC: Unmasking Key Risks Investors Should Prepare For.

Get Report – It’s Free!

Ongoing Research

Despite initially being relegated to two phases, it seems Project Hamilton will receive more funding and research. The project’s spokesperson said that Boston Fed would continue to support research that seeks to increase the government’s “understanding of the technology that could support the issuance of a CBDC.”

Project Hamilton Findings

Centralization is the ideal structure.

For many investors, the most attractive feature of Bitcoin and other cryptocurrencies was the promise of decentralization. With the results of Project Hamilton, the Federal Reserve has effectively rerouted the future flow of digital currencies toward centralization. The project tested a CBDC on distributed ledger technology – a secure, transparent, and decentralized platform – and unsurprisingly concluded that a more centralized model was more effective. This unequivocally squashes any hope of a truly decentralized digital dollar.

A CBDC outperforms the dollar.

Many investors understandably view the physical dollar as the last haven of privacy and anonymity within the confines of the increasingly digital financial infrastructure. Unfortunately – and all too predictably – Project Hamilton drove the government to the realization that a CBDC can feasibly replace the dollar entirely. In their own words, the Federal Reserve concluded “a CBDC can provide functionality that is not currently possible with either cash or bank accounts.” This essentially renders the US dollar useless in the purview of the government.

Digital currencies can track everything.

Inadvertently, Project Hamilton served to solidify concerns that a CBDC could be used as the ultimate form of government surveillance. The research indicated that a digital dollar infrastructure can easily record, organize, and store every single transaction. Fed officials are padding these findings with plenty of reassurance and promises, but their performance over the past few years hasn’t instilled much trust in the American public.

What are the implications of Project Hamilton?

It’s easy to let the technical jargon and genuinely impressive developments distract from the real news of Project Hamilton: the US government is actively pursuing the creation of a CBDC.

The journey to a digital dollar officially kicked off with the signing of Executive Order 14067 which ambiguously referred to the “exploration” of a CBDC. Despite the government’s incessant attempts to persuade the public otherwise, the revelations of Project Hamilton have vindicated skeptics.

This little-spoken-about project has accomplished much more than mere experimentation. It has laid the groundwork for a CBDC by providing the government with the technology needed to make it a reality. Careful descriptors of a CBDC as merely “theoretical” or “hypothetical” now ring hollow as the government possesses functional systems for implementing a centralized digital dollar.

“[C]entralization [is] what people should be worried about. The fact that a very small group of people can control everybody’s…access to the monetary system.”–Sr. Precious Metals Advisor Steve Rand

Nine members of Congress already addressed a letter to the Boston Fed President outlining their concerns about Project Hamilton’s interaction with private sector entities and the privacy issues inherent with the development of a CBDC. The Boston Fed has yet to respond to the Congressional challenge.

Stay Informed to Protect Your Wealth

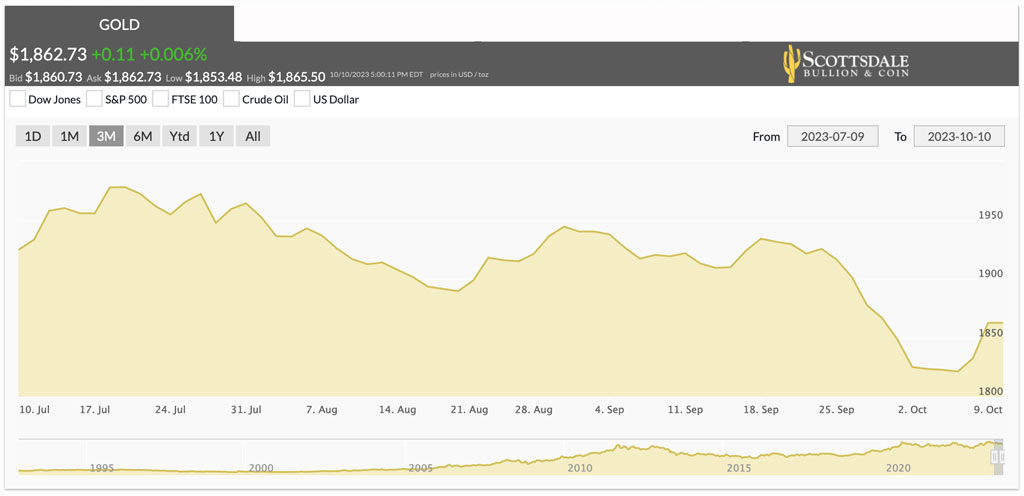

Project Hamilton underscores the government’s dedication to the rapid development of a CBDC. Smart money is already taking action by protecting their wealth and optimizing their privacy through increased gold holdings. This precious metal has proven to be a reliable hedge against inflation and a robust shield against government overreach. As the reality of a digital dollar becomes inches closer, it’s imperative for investors to stay informed on the latest developments.

Request your FREE COPY of our free CBDC report to never miss a crucial step in the not-so-long path to a digital dollar.