Kitco News

(Kitco News) – U.S. Mint gold coin sales saw a strong recovery in January after the weakest year on record in 2019.

![]()

The post U.S. Mint gold coin sales see a sharp jump after worst year on record appeared first on WorldSilverNews.

Kitco News

(Kitco News) – U.S. Mint gold coin sales saw a strong recovery in January after the weakest year on record in 2019.

![]()

The post U.S. Mint gold coin sales see a sharp jump after worst year on record appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Skeena Resources (TSX.V:SKE) is currently focused on the exploration and development of the past-producing Eskay Creek mine and Snip mine.

![]()

The post Newcrest buys property in the Golden Triangle appeared first on WorldSilverNews.

Reports by the Wall Street Journal show that the Federal Reserve has continued to inject billions of dollars into what is called the “repo market” and have even begun adding something called a “reverse repo” into the mix. Reuters has noted that these operations have no clear ending in the immediate future. Learn more in this episode of USMR Market Insights with Patrick Brunson.

Patrick Brunson: 00:01

According to the Wall Street Journal, the Federal Reserve has continued with a program that places billions of dollars into the hands of banks and other major financial institutions. This program started with a single operation on September 16th, 2019. On this day, the New York Fed bought $53 billion worth of treasury bonds with an agreement to repurchase the bonds back. Since then, the Fed has repeatedly made these multibillion dollar repurchase agreements over and over. The question on many people’s minds when they hear about this is: why is the Fed doing this? Essentially, they’re trying to ensure there is sufficient liquidity in the financial system. As reported by the Wall Street Journal, institutions who hold treasury bonds typically sell them in order to have cash flows for other activities. When they sell these treasuries, they do so with an agreement to repurchase the treasury bonds back with interest. These agreements are known as repos.

Patrick Brunson: 00:56

When buyers of the treasuries began to refuse doing so, the Fed stepped in and began buying these treasuries to keep cash flowing throughout the financial system. In the month since, it has been reported that there have been multiple repo operations by the Fed. Reuters has reported that the Fed was planning to have the operations last until the end of January. But until a permanent solution is reached, the operations will likely continue beyond that. They also reported that some staff members believe these operations will probably continue until at least April. Recent operations have taken an interesting twist, however. It was reported that on Wednesday, January 22nd, in addition to spending 49.8 billion in overnight repos, there was also 15.6 billion spent on reverse repos. These reverse repos are basically the opposite of a regular repo operation, with the Fed now temporarily loaning treasuries for $15.6 billion in cash. Additionally, the Wall Street Journal reports that there were $74.2 billion in repo operations and another $12.9 billion in reverse repo operations on January 23rd alone.

Patrick Brunson: 02:05

This was followed by 55.3 billion in repo operations for the following weekend, with no reported reverse repos at all. Whether these new reverse repos will become a regular part of the Fed operations, or how long these Fed operations will last, well, that remains to be seen. For more information about major stimulus policies, such as these, please call the number on your screen for more information about U.S. Money Reserve’s special report: The Big Easing: Are Global Stimulus Policies Burning Out? This free report delves into the facts about the signs of the slowing global economy. So click the link below for a free download and please give us your thoughts in the comments below and share this video. Make sure to subscribe to our YouTube channel so that you don’t miss a single episode of Market Insights. I’m U.S. Money Reserve’s Patrick Brunson, and thank you for watching.

The post When Will the Fed’s Repo Operations End? appeared first on U.S. Money Reserve.

Faster than a speeding bullet. More powerful than a locomotive. Able to leap tall buildings in a single bound … It’s Superman!

Such preternatural powers were historically assigned to the queens, kings, and emperors whose visages graced the world’s earliest coins. It’s only fitting in modern times that a figure of fictitious yet equal greatness shares the same honor by having his shield—symbol of hope, truth, and justice—sculpted in silver.

Get Free Gold Investor Guide

For nearly 80 years, Superman has stirred young imaginations, inspired hope, and reinforced sacred values of truth and justice across the globe. What better way to celebrate the “Man of Steel” than by featuring his iconic S-Shield in the world’s other favorite white metal—silver? Thanks to the Royal Canadian Mint, this archetypal superhero’s legacy will shine on for generations to come.

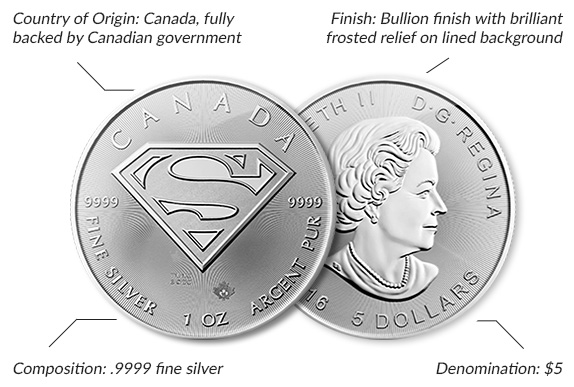

Superman’s S-Shield is brilliantly depicted on the reverse of the coin: the radial line patterns behind the shield and the premium frosting on it combine to make this iconic symbol appear to pop out from the coin—as if Superman himself is thrusting the shield forward with his chest. A micro engraved textured maple leaf below the shield provides added security and peace of mind. Inscriptions of “CANADA,” “9999,” “FINE SILVER,” “1 OZ,” and “ARGENT PUR” encircle this empowering image.

The obverse of the Silver Superman coin features famous Canadian portrait artist Susanna Blunt’s profile of Queen Elizabeth II, similar to the Silver Maple Leafs. This classic depiction of the queen with her hair neatly coiffed and donning a string of pearls around her neck has graced Canadian coinage and currency since 2003. Engravings of “ELIZABETH II,” “D.G. REGINA,” “2016,” and “5 DOLLARS” surround her profile.

| Denomination: | $5 |

| Composition: | 99.99% fine silver |

| Finish: | Bullion finish with brilliant frosted relief on lined background |

| Country of Origin: | Canada, fully backed by Canadian government |

Add some superhero shine to your collection with this stunning 2016 1 OZ Canadian Superman shield coin. Call Scottsdale Bullion & Coin for prices & availability: 1-888-812-9892.

Kitco News

(Kitco News) – Continental Gold (TSX:CNL) announced yesterday a new high-grade vein discovery in an underground development at Buriticá, including drill results of 60.9 g/t gold along 50 meters.

![]()

The post Continental Gold discovers bonanza-grade gold appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Australian-based Paladin Energy announced today that Ian Purdy is the company’s new CEO.

![]()

The post Paladin Energy appoints new CEO appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Australia-focused Ora Banda Mining (ASX:OBM) said today its Waihi Mineral resource, indicated and inferred, increased by 190% to 2.46 Mt at 2.6 g/t Au for 206,000 oz Au.

![]()

The post Ora Banda Mining increases mineral resource by 190% to 206,000 oz of gold appeared first on WorldSilverNews.

Kitco News

(Kitco News) – Excelsior Mining said today its first copper production at its in-situ copper mine in Arizona is being pushed out to Q2 2020.

![]()

The post Excelsior Mining pushes out copper production appeared first on WorldSilverNews.

Kitco News

(Kitco News) – The yellow metal remains this year’s likely top performer based on a weaker China’s economy and declining bond yields, Bloomberg Intelligence said in its February commodities update.

![]()

The post Gold to kick-off a bull market this year, $1,700 is resistance target – Bloomberg Intelligence appeared first on WorldSilverNews.