Key Points:

- Market strategist forecasts $25/oz Silver Prices by Thanksgiving.

- Billionaire investor predicts GOLD’S NEXT RUN will be EXPLOSIVE!

- 5-Year PLATINUM chart shows BIG UPSIDE POTENTIAL.

Trade disputes boil in every corner of the world: the U.S. vs. China; the U.S. vs. the EU; India vs. Pakistan; and Japan vs. South Korea.

Manufacturing constricts in the four largest economies—the U.S., China, Japan, and Germany—and the yield curve inverts to the worst level since 2007.[1]

Investor optimism disappears from Wall Street after an August rife with intense stock market volatility. In its place? FEAR.

Investors are finally feeling the impact of the protracted trade war with China and onset of the long overdue market correction and downturn where it hurts the most: their portfolios. And they’re scared. From Wall Street to Main Street, investors are rushing to the safety of precious metals, setting off what’s expected to be an UNPRECEDENTED BULL MARKET.

Learn How to Avoid Costly Rookie Mistakes & Invest in Gold Like a Pro!

Get Free Gold Investor Guide

Prices for gold, silver, platinum, palladium, and rhodium have only one direction to go: UP! Will you seize the opportunity to buy before they do?

Precious Metals Prices Surge on Safe-Haven Buying

“‘People are looking basically for resources that they know are going to have a value 20 years from now, or 30 years from now, as they age. That is clearly a fundamental force that is driving’ market moves.” — Former Federal Reserve Chairman Alan Greenspan in an interview on September 4, 2019

Prices for gold and silver surge. Rhodium roars higher. Palladium keeps climbing. Platinum market conditions are ripe for a rally.

How high are precious metals prices? Even more importantly, where are they headed?

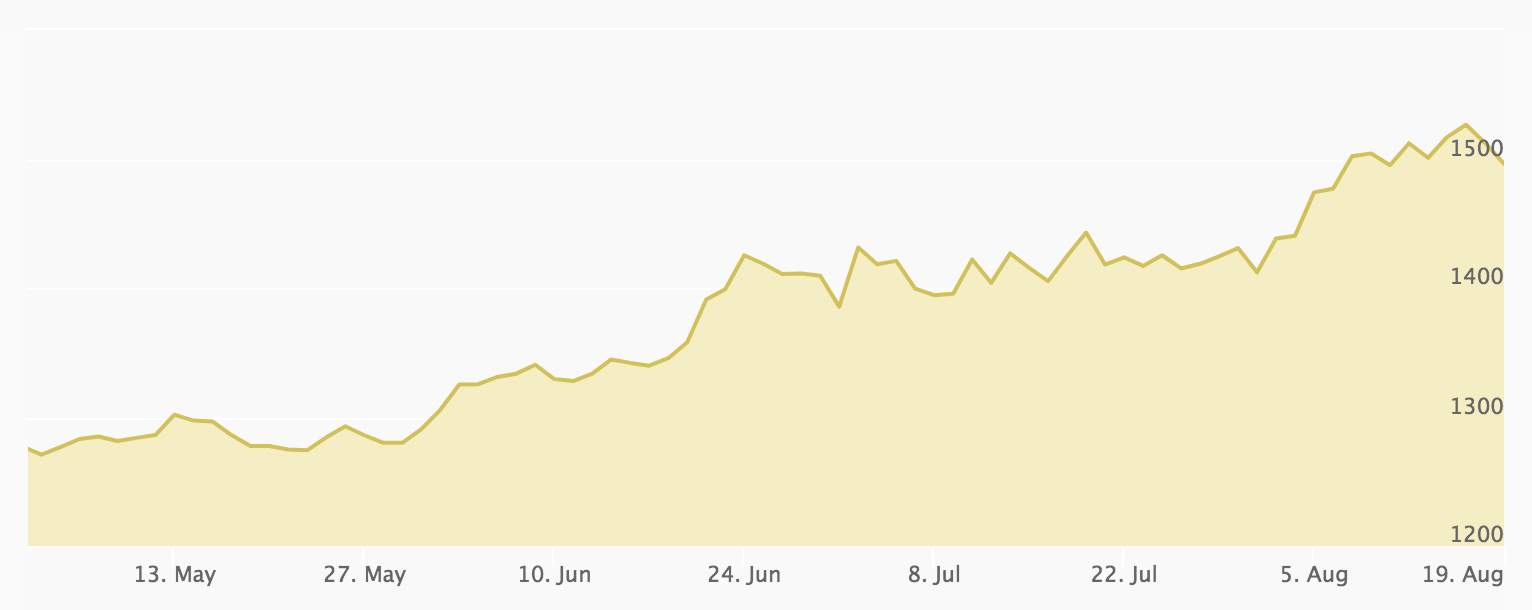

Gold Prices Skyrocketing

I think we’re in the third and final phase of the gold market that’s started in 2001, and this will be the most explosive phase for gold.–Frank Giustra, chairman of Leagold Mining

Gold Prices 2019-2020

| January Gold Price Open | $1,287.20/oz |

| September Gold Price Open | $1,523.35/oz |

| Percentage Gain | 18.35% |

| Record High Hit in 2019 | 6-Year High |

| Gold Price Forecast End of 2019 | $1,600/oz |

| Gold Price Forecast End of 2020 | $2,000/oz |

[2][3][4][5]

Why is Giustra so bullish on gold? Because we’re finally seeing the fallout from central banks’ drastic measures to rescue markets after the last financial crisis. That the Fed has no exit strategy for quantitative easing, except more QE—FOREVER.

We’re seeing it right now with the latest interest rate cut. Once markets realize historically low interest rates are here to stay, GOLD PRICES WILL KEEP GOING UP. And they won’t stop!

Learn more about global market vulnerabilities in “Why the Next Financial Crisis Could Be Worse than 2008.”

Silver Prices Predicted to Outperform Gold

You would expect silver to outperform gold given the fact that it has double the volatility of gold.—Bart Melek, head of global strategy at TD Securities.[6]

Silver Prices 2019-2020

| January Silver Price Open | $15.44/oz |

| September Silver Price Open | $18.35/oz |

| Percentage Gain | 18.85% |

| Record High Hit in 2019 | 2-Year High |

| Silver Price Forecast 2019 | $25/oz |

| Silver Price Forecast 2020 and Beyond | $130/oz |

[7][8][9][10]

Melek explained that silver is catching up to gold. With U.S. dollar drops, lower interest rates, and stock market volatility, he expects the white metal to hit $19 to $20 quickly.

Read our “Silver Price Forecast 2019” for an in-depth look at the market movers for silver this year.

Platinum Group Metals Prices Rising

All of the precious metals have been moving higher over the past months as the sector has outperformed almost all other asset classes. Even platinum has joined the bullish party.—Andrew Hecht, commodity and futures trader and analyst and author of the Hecht Commodity Report

Platinum Prices Set to Breakout

The view that these investors are taking is that there will ultimately be more demand from the automotive sector and supply looks to shrink. For a lot of investors it just looks like everything is pointing in the right direction for platinum.—Trevor Raymond, director of research for the World Platinum Investment Council (WPIC)[11]

Platinum Prices 2019-2020

| January Platinum Price Open | $794/oz |

| September Platinum Price Open | $936/oz |

| Percentage Gain | 18% |

| Record High Hit in 2019 | 1.5 Year |

| Platinum Price Forecast 2019 | $1,100/oz |

| Platinum Price Forecast 2019 | $1,500/oz |

[12][13][14][15]

The WPIC reported “unprecedented investment demand” in the platinum market during the first half of 2019. The 145,000-ounce jump in investment demand offset declines in automotive and retail platinum consumption.

The organization predicts investment purchases to rise to 900,000 ounces for the year, as many investors are anticipating a switch to platinum from palladium in the automotive sector due to its lower price-point.[16]

Platinum Investment Demand 2019

5-Year Platinum Chart Shows Big Upside Potential

| Platinum Price 5-Year Low | $767/oz |

| Platinum Price 5-year High | $1,394/oz |

| Current Price of Platinum | $957/oz |

| Upside Potential: | 46% |

Platinum is way undervalued based on its benchmarks. Because of its strong correlation to gold I think we can still see higher prices.—Bart Melek, head of commodity strategy at TD Securities.[17]

Palladium Prices Keep Climbing

The precious metals market is about to resume a rally, in our view, on the back of a surge in the palladium price. For the first time in five years, the Bloomberg Precious Metals Spot Subindex is poking above its 72-month average. It may be a better bullish broad-market indication if the recent visit above $1,500 an ounce in palladium marks a peak.—Mike McGlone, senior commodity strategist at Bloomberg Intelligence.[18]

Palladium Prices 2019-2020

| January Palladium Price Open | $1,263/oz |

| September Palladium Price Open | $1,535/oz |

| Percentage Gain | 22% |

| Record High Hit in 2019 | All-Time High $1,620.53 (March 2019) |

| Palladium Price Forecast 2019 | $1,350/oz Average |

| Palladium Price Forecast 2020 | $1,275/oz Average |

Analysts expect palladium prices to pullback a bit this year and next as industry and investors take advantage of bargain platinum prices. However, the forecast 2019 average price of $1,350 for palladium is the highest ever on record, so demand and prices should remain relatively robust.[19]

Runaway Rhodium Prices

They are putting rhodium in everything. Because of higher environment standards, they are throwing more and more rhodium in converters. I don’t see the big automakers stopping this trend anytime soon and the supplies they need are just not there.—Matt Watson, president at Precious Metals Commodity Management[20]

Rhodium Prices 2019-2020

| January Rhodium Price Open | $2,300/oz |

| September Rhodium Price Open | $4,700/oz |

| Year-to-Date Gain | 104% |

| Record High Hit in 2019 | 11-Year High |

| Rhodium Price Forecast 2019 | $10,000/oz |

| Rhodium Price Forecast 2020 | $10,000/oz |

[21][22][23]

Rhodium has seen strong demand from the automotive sector this year because, unlike palladium and platinum, it can be used in both diesel and gasoline engines. However, with no primary rhodium deposits in the world, supplies of the byproduct of nickel and platinum mines remains small and non-respondent to price swings.[24]

Given this supply and demand equation, some analysts foresee rhodium prices reaching or surpassing their all-time high of approximately $10,000, which was reached in 2008.[25]

Smart Investors Safeguarding Their Wealth with Precious Metals

Safe-haven assets rule when investor fears turn into market realities—RIGHT NOW.

But, with $17 trillion in government debt globally yielding less than zero percent and analysts proclaiming Bitcoin is “no longer a safe-haven asset,” only precious metals are shining.[26][27]

Gold Prices vs. 10-Year Treasury Bond Yields

And they’ve caught investors’ attention: prices for gold, silver, and the platinum group metals are surging due to sudden and rampant demand.

What does this mean for those who’ve yet seek the safety of precious metals? Their window for affordable portfolio protection is closing—and fast!