Click here to get this article in PDF

Real Investment Advice/Lance Roberts/1-29-2021

“As we head into 2021, there is a large consensus that the massive monetary interventions in 2020 will lead to an explosion of economic growth, inflation, and higher interest rates. We suspect that the outcome of more debt-driven spending will lead to a disappointment in growth and disinflation instead.”

“As we head into 2021, there is a large consensus that the massive monetary interventions in 2020 will lead to an explosion of economic growth, inflation, and higher interest rates. We suspect that the outcome of more debt-driven spending will lead to a disappointment in growth and disinflation instead.”

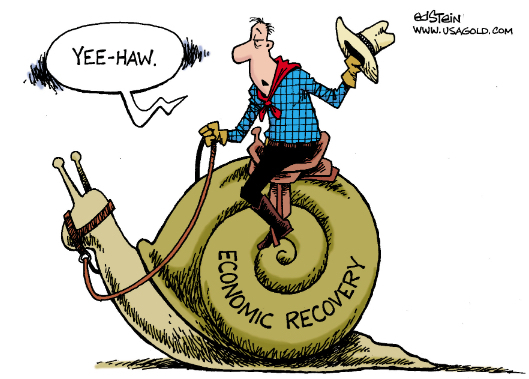

USAGOLD note: When the history is written on this era, the Fed’s inability to spur borrowing and inflation on Main Street likely will be recorded as its greatest failure. It is not enough to print money that goes no further than Wall Street, and its stock and bond markets. The Fed is well aware of this shortcoming, but at a total loss as to what should be done about it. “We fear,” writes Roberts, “the ongoing policies will continue to lead to further social instability and populism. Such has been the result in every other country which has run such programs of unbridled debts and deficits.” In short, the same old same old ……

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.