Click here to get this article in PDF

Financial Times/Robin Wigglesworth/3-29-2021

“It is still unclear exactly where Archegos Capital fits into the annals of spectacular hedge fund blow-ups. But the early signs are that it will probably prove the biggest since Long-Term Capital Management’s collapse in 1998.”

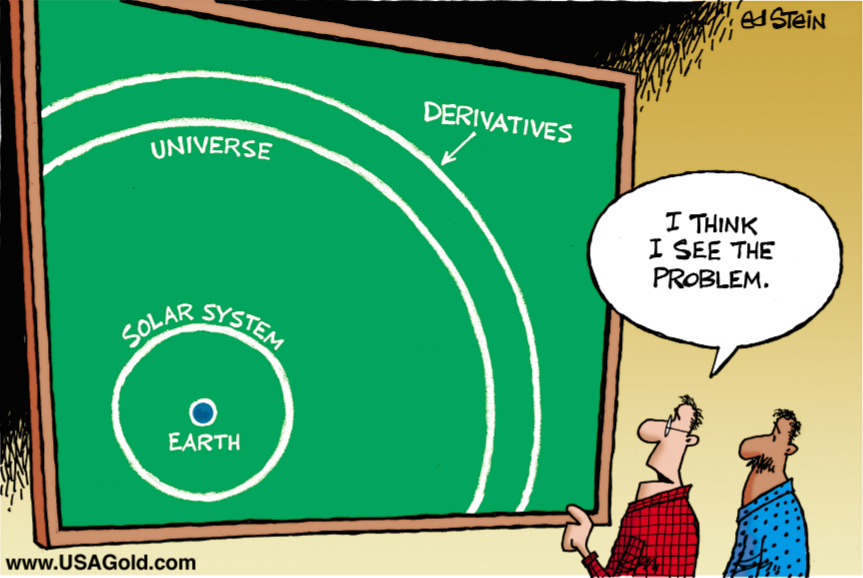

USAGOLD note: This is a case where Wall Street ‘s right didn’t know what the left hand was doing. The exposure of each bank was not known to other banks and the magnitude spectacular collapse that was about to occur remained hidden until the ultimate event. What will haunt financial markets for months to come is the prospect of other hedge funds with similar exposure posing the specter of similar meltdowns, or something even bigger and more pervasive. Warren Buffett’s “financial weapons of mass destruction” comes to mind. Wigglesworth warns that the Archegos blow-up “could become a snowball that triggers a broader hedge fund deleveraging. For now, markets are taking the debacle in their stride, but that could still change.” That deleveraging, of course, could trigger mass liquidations of stocks and from there a slew of unintended consequences.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.