Click here to get this article in PDF

Bloomberg/Jeremy Hill and Max Reyes

“Bankruptcy filings are surging due to the economic fallout of Covid-19, and many lenders are coming to the realization that their claims are almost completely worthless. Instead of recouping, say, 40 cents for every dollar owed, as has been the norm for years, unsecured creditors now face the unenviable prospect of walking away with just pennies — if that.”

“Bankruptcy filings are surging due to the economic fallout of Covid-19, and many lenders are coming to the realization that their claims are almost completely worthless. Instead of recouping, say, 40 cents for every dollar owed, as has been the norm for years, unsecured creditors now face the unenviable prospect of walking away with just pennies — if that.”

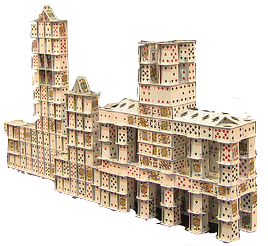

USAGOLD note: In the book The Fourth Turning, Strauss and Howe make repeated reference to what they call a period of “unraveling”. “An initial spark,” they say, “will trigger a chain reaction of unyielding responses and further emergencies.” As I sift through the daily news, I find more and more evidence of this unraveling – so much that it is easy to lose track. Though each particular instance (like corporate bond defaults) need not be fully parsed and understood, it would be advisable to understand the totality of the Great Unravelling as a phenomenon we need to address in our portfolios. A house of cards, no matter how elaborate, is still a house of cards.

Repost from 10-28-2020

The post Bond defaults deliver creditors 2¢ to 3¢ on the dollar first appeared on Today’s top gold news and opinion.