Click here to get this article in PDF

The Felder Report/Jesse Felder/3-25-2021

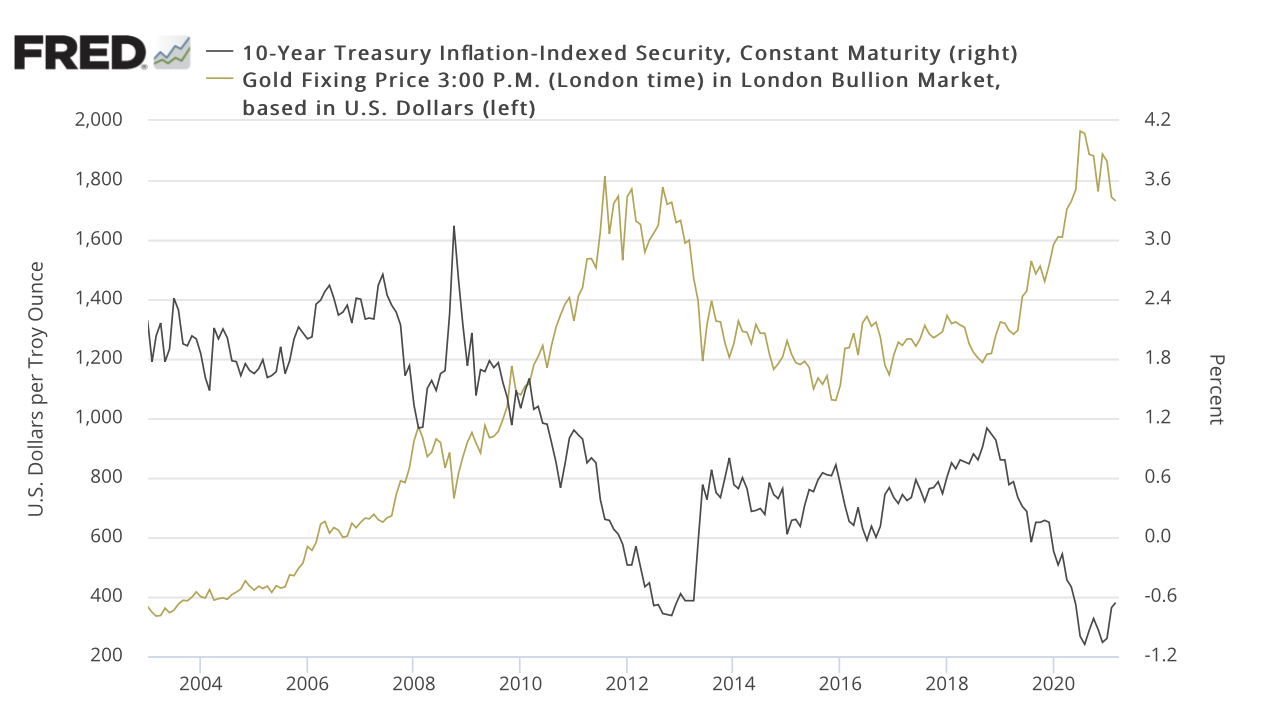

“Recently, nominal interest rates have been rising faster than inflation creating a headwind for the gold price. However, there is good reason to believe that this trend could soon shift and become a strong tailwind for the gold price again. The rise in rates has already been dramatic and there is reason to believe it may be nearer to its end than its beginning. At the same time, inflation appears to be on the verge of picking up once again. If so, real rates will fall and gold will likely resume its uptrend.”

USAGOLD note: This insightful short analysis from Jesse Felder is the perfect accompaniment to the post immediately below. Even if bond yields rise, a rising inflation rate could drive considerable safe-haven demand in gold’s direction. It is difficult to believe, it requires saying, that the items pictured above are going to go out of style any time soon – not as long as the federal government is running deficits to the moon and the Federal Reserve is printing money to cover them. The chart below comparing the real rate of return on the 10-year Treasury to the price of gold since 2000 clearly shows the relationship Felder discusses in his analysis. As you can see, the turn higher over the last few months in real rates is a small blip when compared to the dominant trend.

Sources: St. Louis Federal Reserve, Federal Reserve Board of Governors,ICE Benchmark Administration

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.