Click here to get this article in PDF

“Today’s problems all go back to the huge mistake in 1971 of taking the dollar off the gold standard. The move to a complete fiat currency allowed the government to print as much money as they wanted, devaluing each dollar so much that compared to 1971 they are worth almost nothing. Under this mountain of debt, interest rates cannot go up without destroying the world economy. Therefore, the Fed will have to allow inflation to run a bit wild on the short end of the market with the 10-year note rising, but cap long-term interest rates on the 30-year bond. The Fed appears to have lost control of short-term interest rates at this point. If the market forces interest rates up, that will put increasing pressure on the Fed and decrease their control, leaving it with the option of capping long-term rates. If that happens, it will be negative for the US dollar and governments around the world may be forced to start tapering interest rates. A rise in interest rates will also lead to defaults around the world. All of these factors increase the focus on gold. More investors see gold as real money and that will only increase as fiat currencies lose more and more value.” – Equity Management Academy, Seeking Alpha, 5/30/2021

“Today’s problems all go back to the huge mistake in 1971 of taking the dollar off the gold standard. The move to a complete fiat currency allowed the government to print as much money as they wanted, devaluing each dollar so much that compared to 1971 they are worth almost nothing. Under this mountain of debt, interest rates cannot go up without destroying the world economy. Therefore, the Fed will have to allow inflation to run a bit wild on the short end of the market with the 10-year note rising, but cap long-term interest rates on the 30-year bond. The Fed appears to have lost control of short-term interest rates at this point. If the market forces interest rates up, that will put increasing pressure on the Fed and decrease their control, leaving it with the option of capping long-term rates. If that happens, it will be negative for the US dollar and governments around the world may be forced to start tapering interest rates. A rise in interest rates will also lead to defaults around the world. All of these factors increase the focus on gold. More investors see gold as real money and that will only increase as fiat currencies lose more and more value.” – Equity Management Academy, Seeking Alpha, 5/30/2021

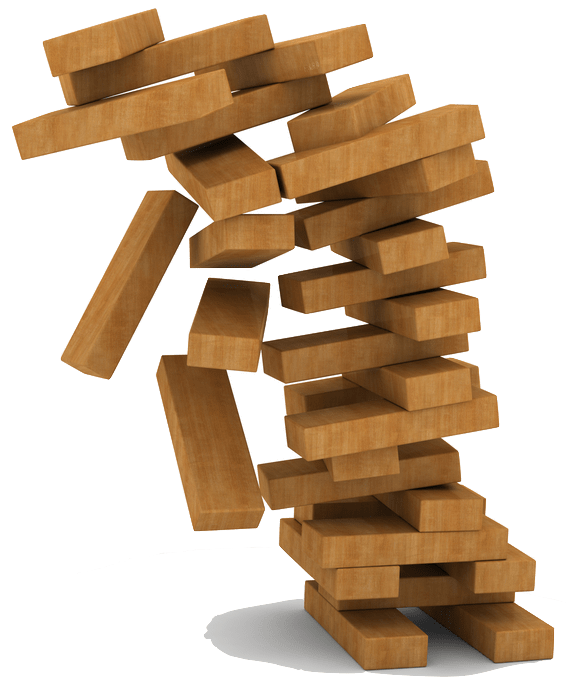

USAGOLD note: The situation in a nutshell……“It’s market jenga,” says Morning Porridge’s Bill Blain, “At some point… its going to come crashing down…”

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.