Click here to get this article in PDF

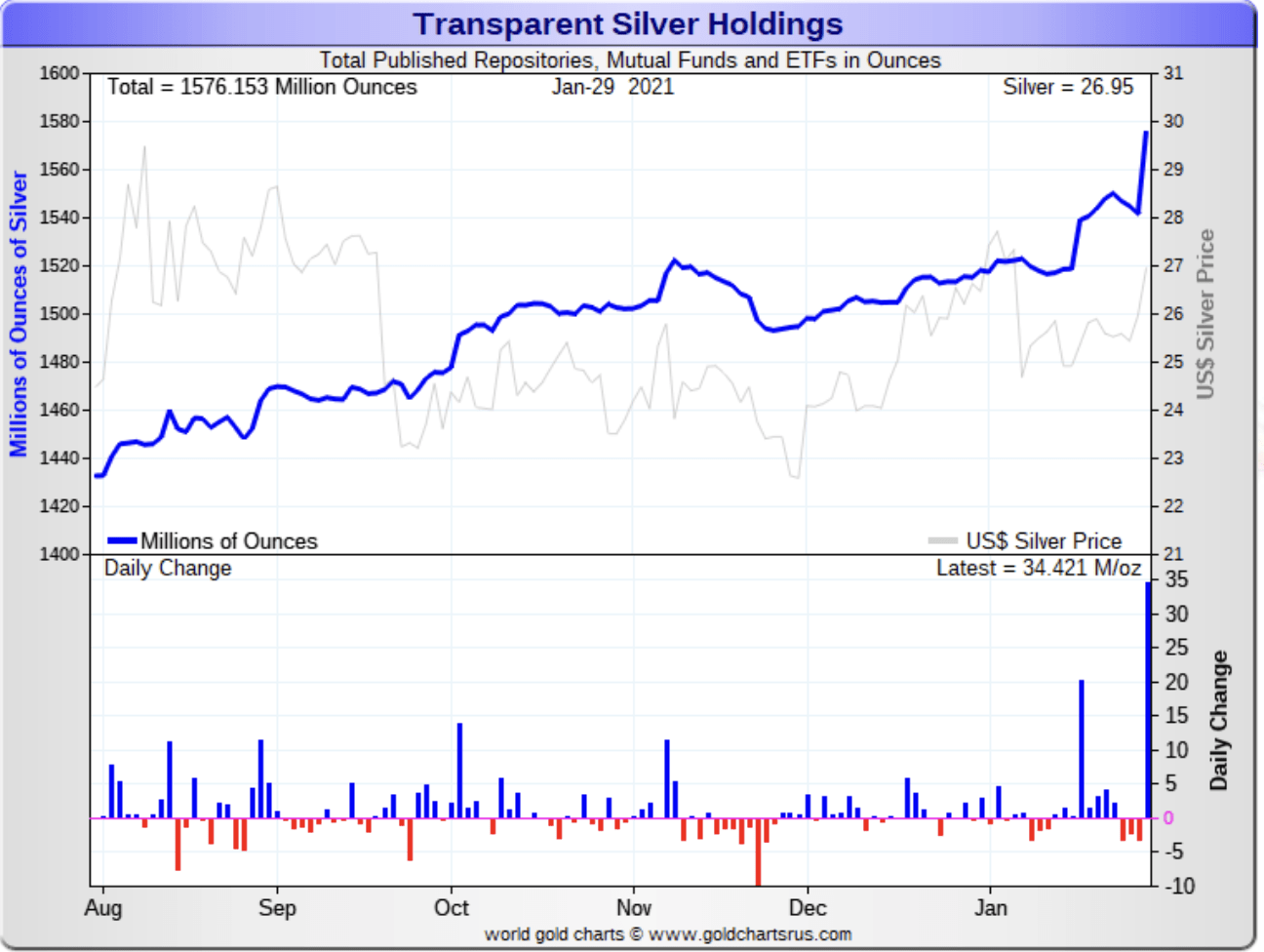

Friday’s silver ETF stockpile gains are an attention grabber.

TheStreet/David Dierking/1-29-2021

“It’s still early message board chatter and there hasn’t been a commitment from the Reddit crowd yet, but silver prices are rising, volumes are increasing and there’s a strong macro argument to be made. Don’t be surprised if this group experiences a wild ride next week.”

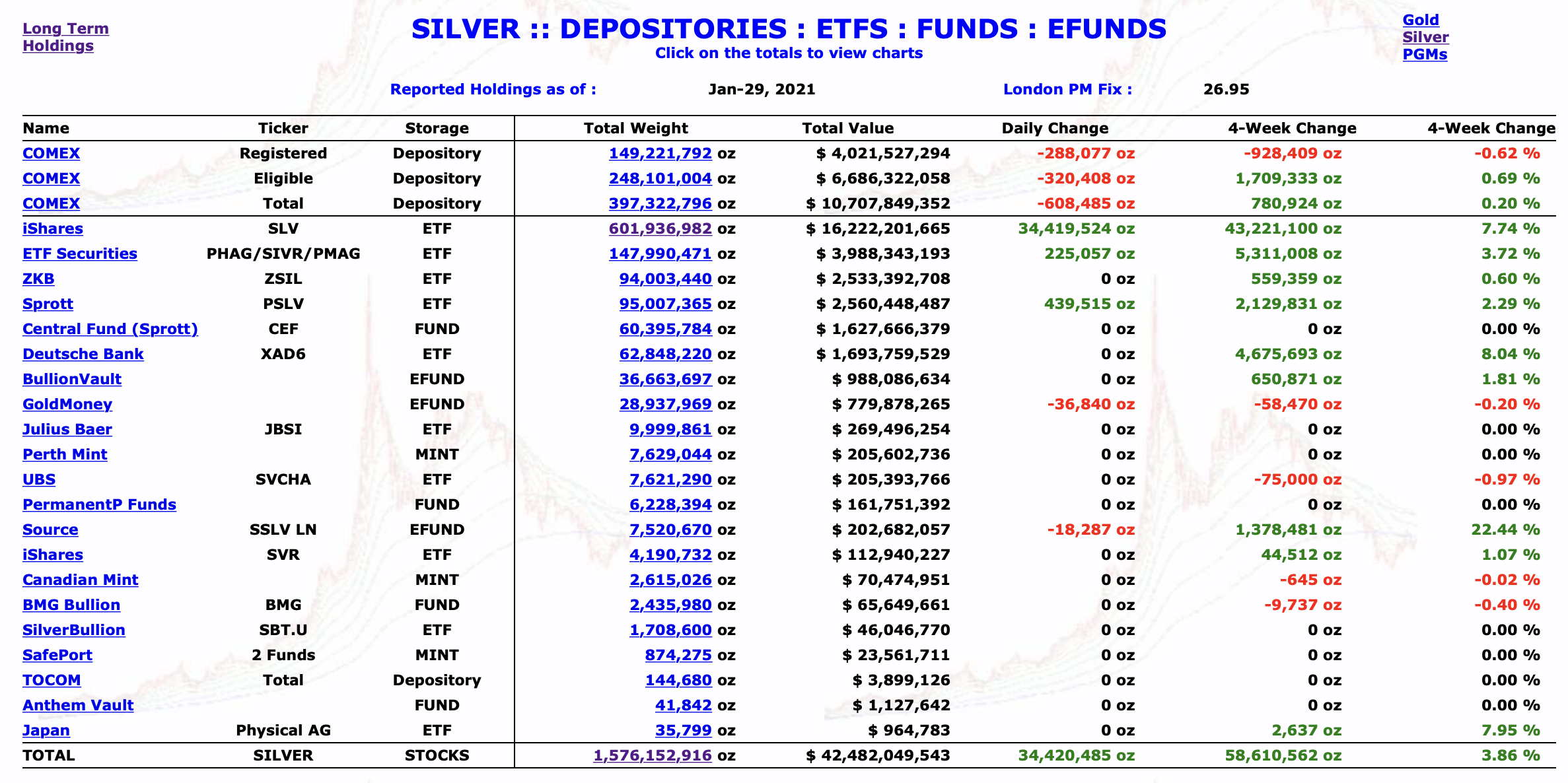

USAGOLD note: This positive assessment was published before Friday’s numbers came out on ETF stockpile additions. GoldChartsRUs reports strong buying from silver ETFs to close out the week including a 34.4 million troy ounce stockpile gain for the IShares ETF (SLV) – the group’s most prominent member. As you can see in the chart below (which includes all repositories, mutual funds, and ETFs, including SLV), Friday’s addition is the largest by far over the past year for a single day (and by the way the largest since 2013). We’ve included a table from GCRU that shows a concentration of Friday’s volume in the IShares ETF (SLV). Above and beyond the intentions of the Reddit crowd, Dierking makes the point that silver could be headed for a big year anyway based on the fundamentals. That said, Friday’s stockpile growth is an attention grabber.

Chart and table courtesy of GoldChartsRUs • • • Click to enlarge

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.