Click here to get this article in PDF

MarketWatch/William Watts/6-21-2021

“Dalio, speaking in a conversation with economist and former Treasury Secretary Lawrence Summers at the Qatar Economic Forum, warned that it will be difficult to avoid an overheating of ‘monetary inflation’ due to a flood of bond issuance.”

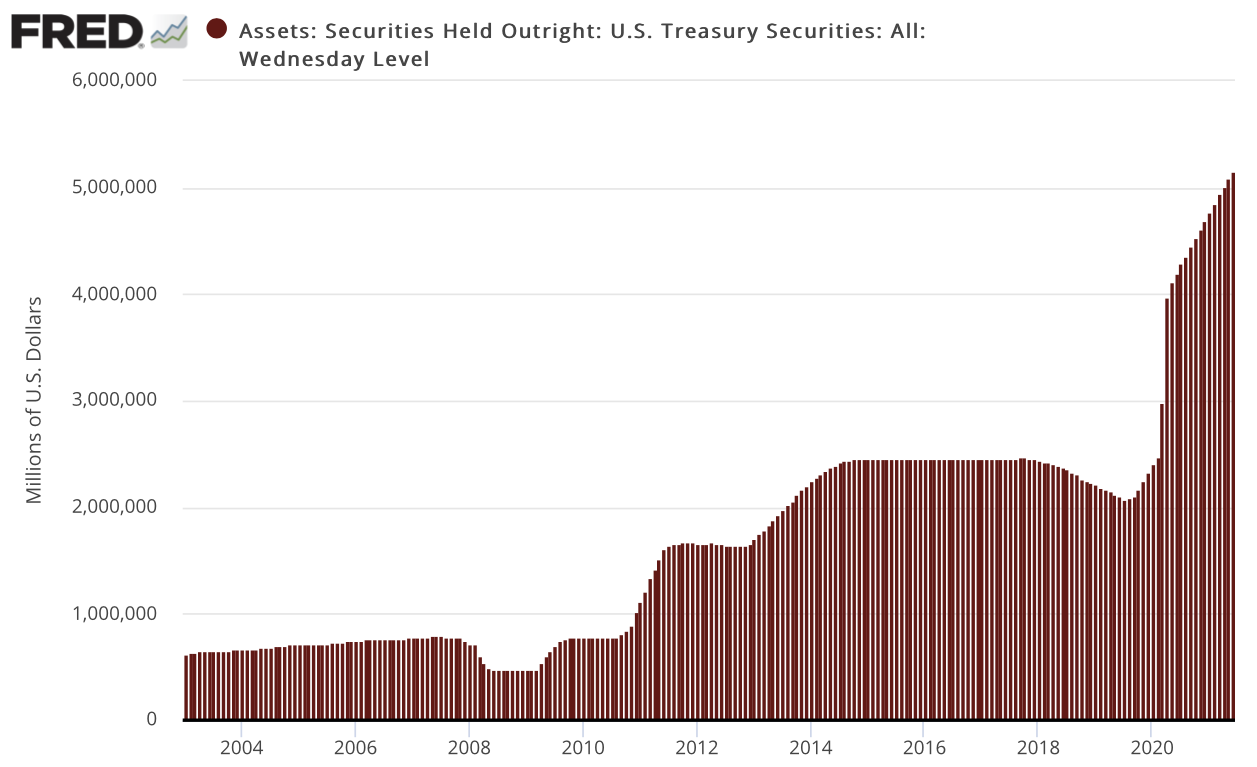

USAGOLD note: The Fed is behind the proverbial rock and hard place with more jawboning probably its best option. For its part, the Biden administration looks to have situated itself to the left of the Carter administration when it comes to fiscal policy. To say the Washington mix is volatile might be to understate the situation. The chart below shows in the aggregate the amount of federal debt monetized by the Federal Reserve. It stands at a little over $5 trillion and a level not even remotely associated with anything assumed previously. Capital, Dalio suggests, might flow in the direction of China and other markets.

Sources: St. Louis Federal Reserve [FRED], Board of Governors of the Federal Reserve System

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.