Click here to get this article in PDF

Zero Hedge/Tyler Durden/5-22-2021

“How did [the late 1960s] end? Unhappily, as the value bull of 1968 (comparable to the first half of 2021) was followed by the volatile bear of 1969… which then was followed by the 1970s – the decade when the US almost succumbed to hyperinflation and only 20% interest rates courtesy of Paul Volcker prevented the premature collapse of the American empire.

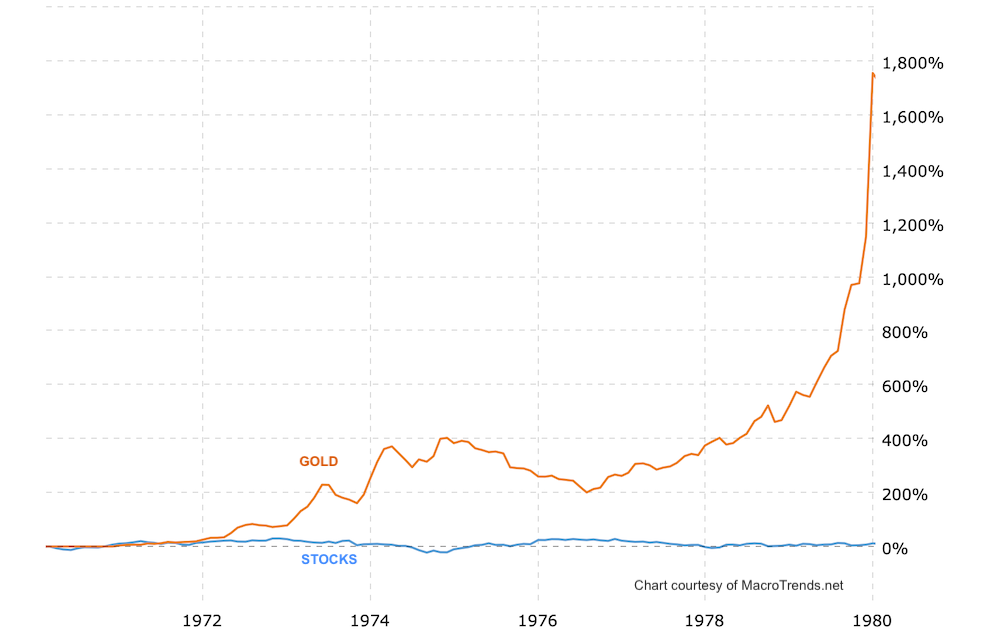

USAGOLD note: If the 1970s were the inflationary main event, the late 1960s were the warm-up act – an indication of, and laying the groundwork for, things to come. We sometimes overlook the fact that stocks peaked right about then. Twenty years of sideways to down action followed. As we pointed out in the past, stocks started and ended the 1970s at 1000 while inflation, as Durden points out, raged.

Gold vs Dow Jones Industrial Average

(1970-1979, in percent)

Chart courtesy of MacroTrends.net • • • Click to enlarge

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.