Click here to get this article in PDF

Bloomberg/John Authers/3-3-2021

“Let’s make a big assumption. We really are in the process of not only a great shift toward reflation, but toward a new inflationary regime. What is this like, how can we tell, and what does the future hold?”

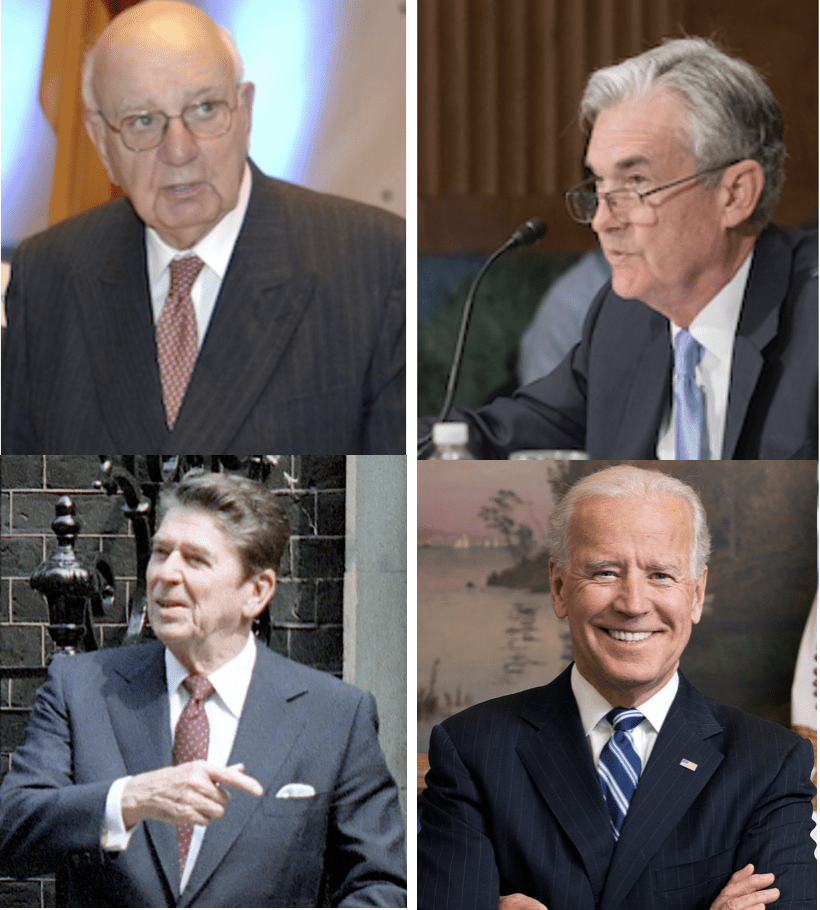

USAGOLD note: We have noted previously that as the current government/central bank policy mix is fully deployed, it might turn out that what the Reagan-Volcker team were to disinflation the Biden-Powell team might be to inflation. Authers explores that possibility in this essay. In the process, he offers a few deep insights like this one from Alex Lennard of Ruffer LLP. “Volcker said he was going to tame inflation, unemployment be damned. Now it’s the other way around. I don’t think people have quite realized that you’ve had this huge change in the mandate of policymakers.” Although gold does not come up in this piece, Authers has mentioned it in previous writings. He does not come off in any way as an ardent gold advocate, but he does, it is clear, understand its uses in the contemporary portfolio.

USAGOLD note: We have noted previously that as the current government/central bank policy mix is fully deployed, it might turn out that what the Reagan-Volcker team were to disinflation the Biden-Powell team might be to inflation. Authers explores that possibility in this essay. In the process, he offers a few deep insights like this one from Alex Lennard of Ruffer LLP. “Volcker said he was going to tame inflation, unemployment be damned. Now it’s the other way around. I don’t think people have quite realized that you’ve had this huge change in the mandate of policymakers.” Although gold does not come up in this piece, Authers has mentioned it in previous writings. He does not come off in any way as an ardent gold advocate, but he does, it is clear, understand its uses in the contemporary portfolio.

“Inflation has no date of beginning. Inflation is the cancer of modern civilization, the leukemia of planning and hope; as with all cancers, no one can say when it begins or how fast it may spread. It is a disease of money, and when money goes, order goes with it. Inflation comes when a government has made too many promises it cannot keep and papers over the shortfall with currency which, ultimately, becomes confetti — and faith is lost.” – Theodore H. White, historian-political journalist, “America in Search of Itself” (1982) As quoted by Authers at the link above.

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.