Click here to get this article in PDF

The Mises Institute/Ryan McMaken/8-2-2022

“In spite of the fact that real wages are going down, the cost of living is soaring, and new jobless claims are heading up at a rapid pace, and the savings rate has collapsed, what really matters to the White House, it seems, is the “technical definition” of recession. Never mind the fact that the US economy has contracted for the past two quarters, according to the federal government’s own numbers.”

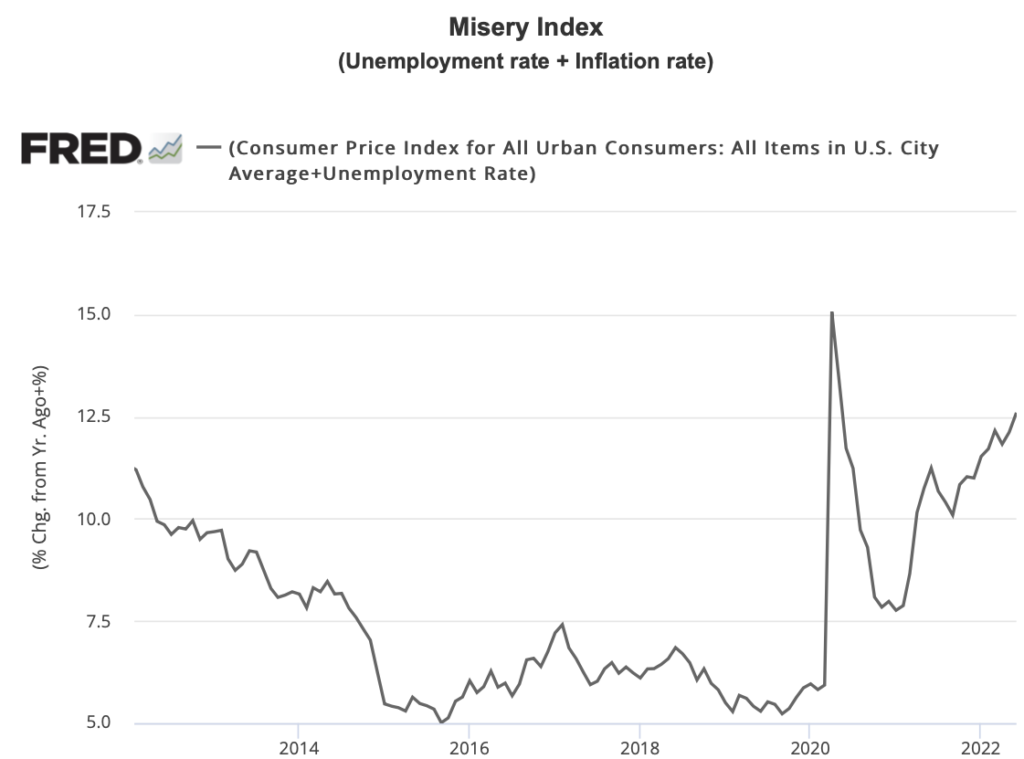

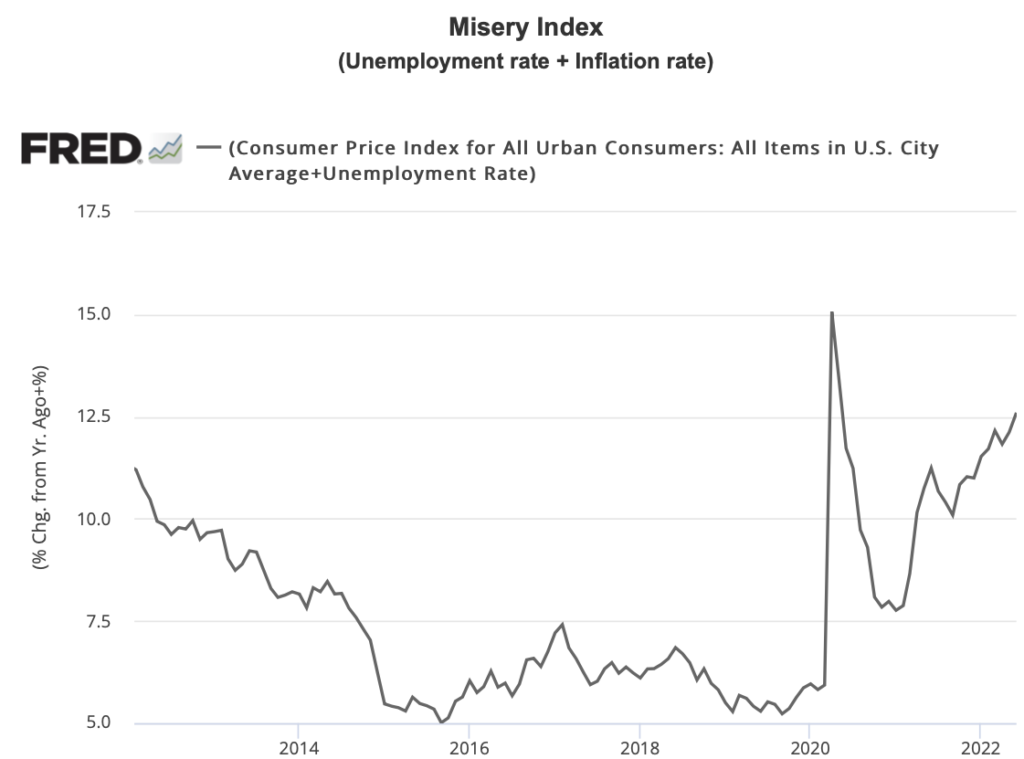

USAGOLD note: What should be noted in the investment community is that inflation, not unemployment, drove the Misery Index in the 1970s, and it is driving it now. It would be a good thing if economists and the financial press began including a modifier to the word recession as a matter of routine – stagflationary, as in stagflationary recession to differentiate it from the traditional kind driven by unemployment, bankruptcies, systemic risks, et al. It would give investors and consumers are more defined sense of what we are up against. We add a reminder that gold and silver did very well during the stagflationary 1970s when the Misery Index went to roughly 22. (It is 12.5 now, and from the perspective of the 1970s, looks to be just getting started.)

Sources: St. Louis Federal Reserve [FRED], US Bureau of Labor Statistics

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.