Click here to get this article in PDF

Seeking Alpha/Austrolib/3-15-2021

“In order to embark on yield curve control in the first place, the Fed will first have to allow primary dealer banks in the US Treasury market to continue to expand their balance sheets. It has until March 31 to get this done, or there could be serious trouble in the Treasury markets. Both JPMorgan (JPM) and the Securities Industry and Financial Markets Association – SIFMA – have made it very clear that without regulatory relief by the end of the month, primary dealers in US Treasuries may not be able to continue serving as market makers in the world’s benchmark interest rate market.”

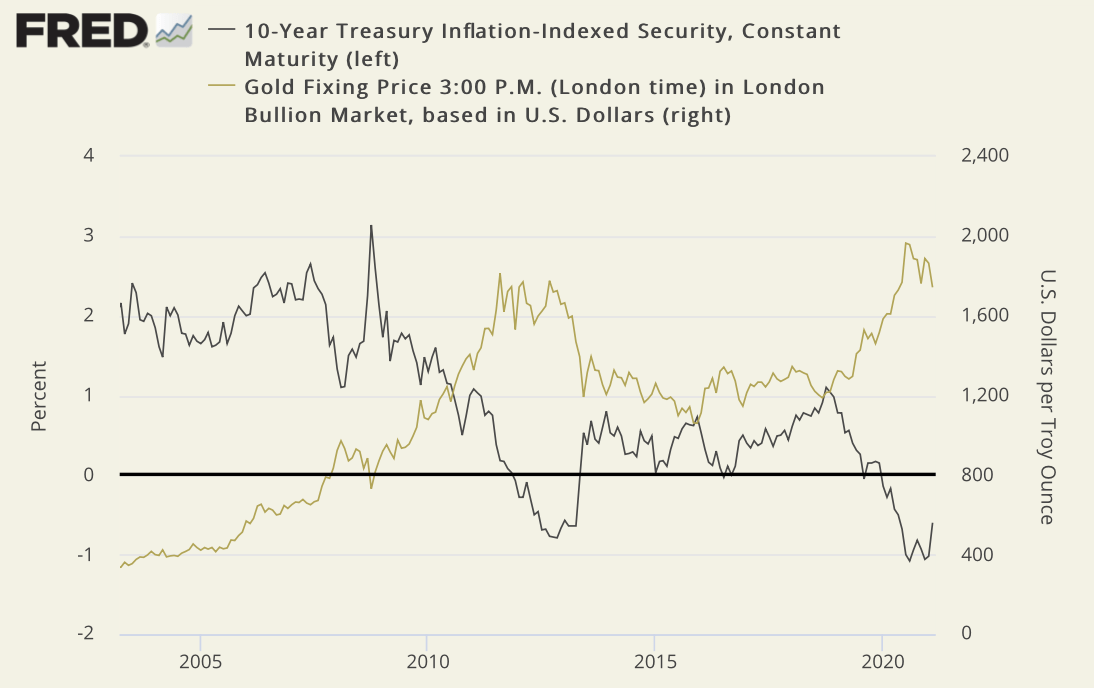

USAGOLD note: This article is for the market watchers looking for a deeper understanding of what’s going on with major Wall Street players in the bond and gold markets. The long-term association between the real rate of return on Treasuries and the gold price is shown in the chart below. Gold rises as the real rates fall and falls when real rates rise. At present, as Austrolib points out, the Fed appears poised to control yields as signs of inflation begin to show up in the economy.

Sources: St. Louis Federal Reserve, Federal Reserve Board of Governors, ICE Benchmark Administration

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.