Bloomberg/Ranjeetha Pakiam, Misha Savic and Eddie Spence/7-4-2021

“The recovery in global trade is bolstering the current accounts of emerging market nations, giving their central banks the option of buying more gold.”

USAGOLD note: Central banks and private investors buy gold for the same reasons – as a store of value and to diversify their holdings. Though the 1000-tonne projection would be a strong showing it is roughly 15% less than the record-breaking 2018-2019 two-year period. These projections reflect the latest in a trend of central bank buying that began in the wake of the 2008 financial crisis. “If a central bank is looking at diversifying,” says HSBC’s James Steel, “gold is a marvelous way of moving out of the dollar without selecting another currency.”

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

SentimenTrader/Jason Goepfert/7-6-2021

“Right now, we are entering a purportedly favorable time of year for silver. The first major thrust lasts from the end of June through early August, with its seasonal peak occurring in early September. Does this mean that [silver] is guaranteed to race higher in the months ahead? Not at all. Every year is its own roll of the dice. But if we look to put the odds on our side, this seems like a decent place to start.”

USAGOLD note: We do not cater to the trading mentality here at USAGOLD as the vast majority of our clientele is of the buy and hold for the long-term mentality. At the same time, even long-termers like to think of themselves as having purchased their silver at bargain prices – a prospect that crops up seasonally, as Jason Goepfert points out, in July and August. (Gold, we will add, is similarly inclined to present a buying opportunity in the summer months.)

Chart courtesy of GoldChartsRUs • • • Click to enlarge

![]()

The post Today’s top gold news & opinion first appeared on Today’s top gold news and opinion.

Condo and Currency Collapse

On June 24, the Champlain Towers South condominium building fell, killing at least 24 people. The collapse of this building provides a surprising number of insights into the collapse of a currency.

The following discussion is based on information that is emerging about the incident. Some of the particular details we cite may later prove to be wrong. Our focus is not to try to prescribe remedies for the construction or maintenance industries, but to shed light on problems in our monetary system.

The first take-away from this disaster is that problems can fester for a long time. Years, or even decades, can go by.

During this time, the parties responsible are surely telling themselves that “it works”. By “work” they mean they are getting away with it.

It doesn’t really work, but the consequences are postponed for a long time.

Two, the politicization of decision-making is an important factor. Especially where there is a long-term capital investment, and something like a fiduciary duty of care.

The condo Board is not just a social club, deciding how to decorate the Clubhouse for the Fourth of July. They have a duty to hire engineering firms to assess the health of their building, and to hire contractors to perform the maintenance recommended by the engineers.

Unfortunately, some people think that if the consequences are off in the future, they can squander time and money. They fail to realize that it’s much easier to pay for maintenance, via a small charge every month, than it is to wait until there is a crisis and then assess a large amount. Maintenance deferred becomes more expensive.

Three, there is an element of dishonesty. No matter how nice the Board members may have been, wishing everyone “good day” at the pool, they were dishonest in a sense.

By their actions, and their inactions, by their words, and by the words they did not say, they led the residents to think that the building was safe. All during the time when it was gradually decaying. And up until the moment when it fell. The Board was getting away with it, while knowing that it cannot be gotten away with forever.

Four, it seems likely there was a corrupt element. Cronyism.

We are not casting aspersions on the Board of this particular building, but instead speaking in general to all situations of long-term neglect of maintenance required for safety.

From voting not to increase the assessment, out of deference to some residents who may have wanted to sell soon or who were old enough that they expected that any disaster would be after they were gone, to the choice of engineering firms and those contractors they hired, there is often a perverse incentive at work.

Board members will not gain any popularity, if they vote for big assessments to spend on things that most people don’t see. Conversely, those who say there’s no need to spend now will win over most of the residents who vote for their reelection.

Five, this is a clear example of consumption of capital. While their building decayed, leading inexorably towards its collapse, the residents were spending more on Bimmers, boats, and benders to Vegas than they could really afford.

If, that is, they were paying for the necessary work to keep their tower standing.

By not paying to upkeep the capital in the form of the building, they could consume more. It’s a false economy, that seems to be working for decades.

Six, and this may be the most counterintuitive point about the monetary system. We hope that seeing it in this analogous situation with a collapsed building, it becomes clearer.

The decay in value—and certainly market price—is not linear. We assume that the selling price of a condo in this building held steady up until 23 June. Zillow shows one unit sold for $700k as late as 17 June. On 24 June, the price went to zero.

This is because it’s not a problem of quantity, dilution, hidden tax, or a transfer of purchasing power. It is a problem of soundness. That is, the building slowly became unsound as the structure rotted. Then it failed, catastrophically. Such failures tend to be that way.

Finally, there are horrific consequences.

These are suffered by guilty and innocent alike. Whether one voted for or against spending to repair the building, one can be killed in the collapse. And the same is true about monetary collapse. Indeed, in a catastrophic failure, one may be lucky to get out alive.

In certain things, there are perverse incentives. Those in charge seek to cheat, neglect the capital, and conceal the consequences. So consumptions of the edifice on which everyone depends continues.

This dynamic is especially dangerous when the people are aggressively indifferent, when they eagerly look away because they feel it expedient to do so. On the surface, everything seems to be working, which is to say they’re temporarily getting away with it.

But the structure that holds it up is degrading. This process can go for a long time, perhaps many decades.

Until it cannot.

The Silver Bull Is Not Transitory

Source: Peter Krauth for Streetwise Reports 07/06/2021

Peter Krauth of Silver Stock Investor delves into the silver market and discusses why it “looks primed to rally strongly on the back of multiple drivers.”

Transitory. That’s something we’ve been hearing a lot lately.

At its latest FOMC meeting the Fed naturally decided to keep the fed funds rate target at 0.25%.

It also decided not to mess with the $120 billion monthly bond buying program to help “support the flow of credit to households and businesses.” Par for the course.

Meanwhile inflation numbers of the previous four months have been anything but typical. The Fed’s favored Personal Consumption Expenditures Price Index has soared: in February it was 1.6%, March 2.4%, April 3.6% and in May 3.9%.

But headline CPI recently came in at 5%, reaching a 10-year high.

These recent months of elevated and increasing prices may have been exacerbated by price plunges due to the COVID-19 pandemic. But those were for a few months, and their effects should already have dissipated. And yet, they haven’t.

In fact core inflation, which excludes volatile energy and food prices, recently touched 3.8%, its highest in 30 years.

The Fed is looking increasingly wrong in its assessment that the inflation numbers we’ve been seeing are transitory. That means investors would do well to seek shelter from inflation-protection assets. And as I’ll show, for multiple reasons, chief among them is silver.

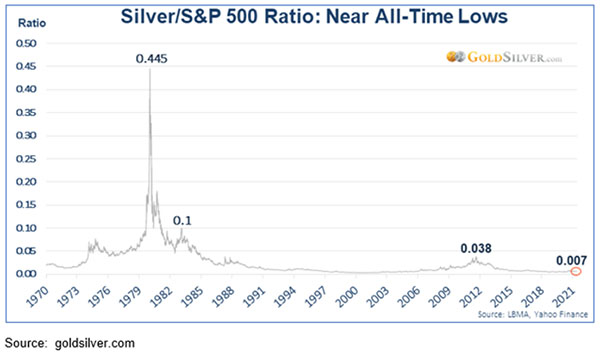

Silver is Cheap Vs. Stocks

It’s always informative, and sometimes eye-opening, to look at asset prices in relation to other assets. It usually provides good perspective on relative pricing. In that vein, there’s little more surprising than to see just how cheap silver remains relative to the S&P 500 ratio.

The following chart shows the long-term ratio of silver to the S&P 500.

It’s currently sitting near its 50-year lows. For what it’s worth, silver would have to rise by a factor of 63 times just to match its level at its $50 peak in 1980. While this might sound sensational, my point is these conditions have existed in the past. This alone suggests explosive potential upside as the stock market matures and likely corrects, while silver continues to climb.

Physical Silver Demand Remains Elevated

Of course, protection from inflation and uncertainty are great reasons to buy and own silver. And as I described above, inflation appears to be coming back with a vengeance. In any case, many investors are hedging against the risk that it becomes entrenched.

In the past 15 months, prices for physical silver are higher than normal. That’s because demand for physical products has remained elevated, leading to sustained high premiums over the spot price. And that’s if you can even get your hands on them. Many of the most popular coins and bars have been persistently out of stock. Premiums are typically 40% or higher, which is nearly triple normal levels.

What’s more, in its recent World Silver Survey 2021, the Silver Institute is forecasting continued strength this year. It expects physical demand to climb by 26% after a very strong 2020. In fact, it foresees overall demand, from all sectors, to be up by 15%, nearly doubling supply growth of 8%.

One area of note is demand from flexible electronics. The Silver Institute indicates demand for silver in printed and flexible electronics is about 48 million ounces annually. It forecasts demand will rise to about 74 million ounces in 2030, absorbing 615 million ounces of silver in this decade alone.

As technology becomes increasingly commonplace in our daily lives the world over, printed and flexible electronics are likely to play a bigger role. Consider that wearable electronics like smartwatches, appliances, medical devices and a host of internet-connected devices are exploding in use. Sensors for light, motion, temperature, moisture and motion all make use of printed and flexible electronics.

So, it’s natural that the electronics subsector promises to be the fastest growing demand for industrial silver usage.

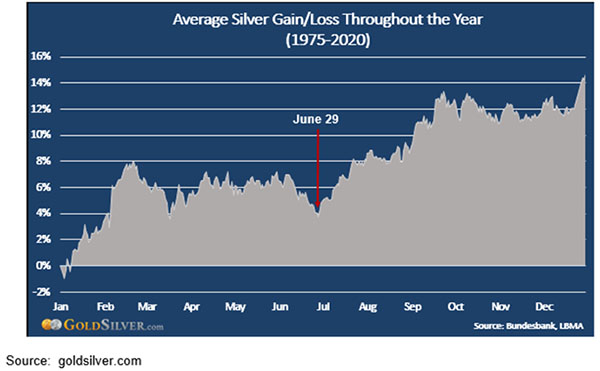

Silver’s Seasonal Outlook is Bullish

Another indicator that now may be a great time to be bullish on silver is its seasonal trend.

The following is a 45-year chart, from 1975 to 2020, which averages the annual silver price tendency.

From this, it’s quite clear that silver tends to mark a mid-year low right at the end of June. And from that point on, on average, the silver price enjoys a strong third quarter.

How to Play Silver Now

In my view a basket of silver stocks is a great way to approach the high potential of this sector right now. One of my favorite options to accomplish this is the ETFMG Prime Junior Silver Miners ETF (NYSE:SILJ). With over 1 billion in assets and average daily volume over 1.5 million shares, SILJ offer plenty of liquidity to enter and exit at will.

Its top ten holdings represent over 63% of overall assets. And these include Hecla Mining (NYSE:HL), Pan American Silver (TSX:PAAS; Nasdaq:PAAS), First Majestic Silver (TSX:FR; NYSE:AG), MAG Silver (TSX:MAG; NYSE:MAG), Yamana Gold (TSX:YRI; NYSE:AUY), Hochschild Mining (LSE:HOC), SSR Mining (TSX:SSRM; Nasdaq: SSRM), SilverCrest Metals (TSX:SIL; NYSE:SILV), Turquoise Hill (TSX:TRQ; NYSE:TRQ) and Endeavour Silver (TSX:EXK; NYSE:EXK).

In the end, the Fed is all about managing expectations, not about tell us what we should really expect. Therefore, actively hedging for inflation with a silver miners ETF such as SILJ looks like a great option with a lot of potential upside.

One thing is certain; silver is in the early days of a massive bull market. That’s why in the Silver Stock Investor newsletter I provide my outlook on which silver stocks have the best prospects as this bull market progresses. One stock in the portfolio is up 50%, and several more are up over 30% since the start of 2021 alone. Many offer 5x to 10x return potential in just the next few years, especially as silver heats up.

Remember, silver’s been rising on balance for the last couple of years, and looks primed to rally strongly on the back of multiple drivers.

The key takeaway is that silver’s bull market is anything but transitory.

–Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Peter Krauth: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: ETFMG Prime Junior Silver Miners ETF, Pan American, First Majestic, MAG Silver, Yamana, SSR Mining, SilverCrest and Endeavour Silver. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: MAG Silver. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pan American Silver, a company mentioned in this article.

Source: Streetwise Reports 07/06/2021

This gold exploration company in the “best jurisdiction in the world,” according to the Fraser Institute, is turning heads with the drill bit.

The Streetwise Live! broadcast on July 6, 2021, focused on gold as an investment and gold exploration company Riley Gold Corp. (RLYG:TSX.V; RLYGF:OTCQB). The broadcast featured guests Gwen Preston, editor of the Resource Maven newsletter, and Todd Hilditch, Riley Gold’s CEO.

Cyndi Edwards began the broadcast by asking Gwen Preston, the Resource Maven, why some investors aren’t even aware of gold as an investment option. That phenomenon, Preston said, most likely is due to gold’s ebb and flow, going in and out of phases of “incredible value.”

“When we get a gold bull market, it is incredibly profitable for investors who are positioned for that, and you can be positioned in low risk gold miners all the way through to high risk gold explorers,” she said. “It really works when the market’s hot, and all the macroeconomic forces are lined up for the market to work right now.”

Looking forward, Preston purports that by fall, gold’s strongest season, the precious metal will be heating up. In the meantime, for the next month or two, though, the gold price will stay about the same while the market determines how much inflation we’ll see and for how long, and what, if anything, the Federal Reserve intends to do regarding interest rates. She pointed out that inflation is good for gold, saying that high inflation makes gold prices rise because gold is a hedge against a devaluing dollar.

“I really think gold has support almost no matter what happens, from a macroeconomic perspective, as a hedge against uncertainty and simply because gold at $1,800 means gold miners are printing money,” Preston added. “So gold just makes a lot of sense as a dividend paying, low risk stock.”

Edwards noted that Riley Gold Corp. is an exploration company looking for gold in Nevada’s Great Basin. She asked its CEO, Todd Hilditch, whether the state still has gold to be found. He responded that yes, it does.

“The state of Nevada is sixth largest [gold] producer as a region in the world,” he added. “The gold endowment in this state is unbelievable, and we believe there’s lots more to be found.”

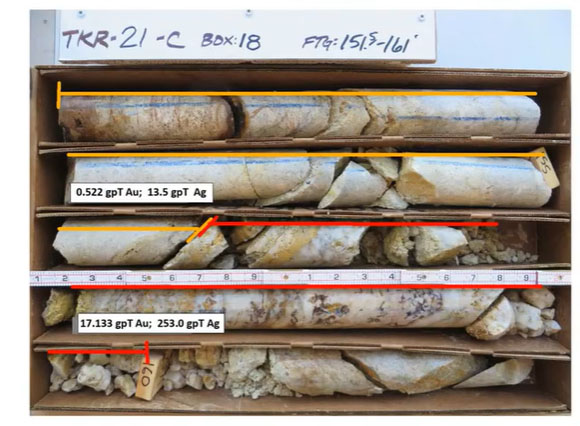

Hilditch then described Riley Gold’s two projects. One is Tokop, located in the Walker Lane Trend and on a 20-plus kilometer land package. The project was last explored by another operator 10 years ago. Since Riley Gold brought it online in 2020, the company has conducted a sampling program of 200 samples, which showed reasonably good widths and 0.5 ounce material at surface. Based on those results, Riley Gold planned and began a 20-hole drill program. The three holes drilled to date at Tokop returned up to 17 grams per ton (17 g/t) gold.

“We’re fortunate that our truth serum in the drill rig was able to show that we do have high grade subsurface,” Hilditch said.

The explorer intends to keep drilling at Tokop throughout the summer, as well as mapping, sampling and doing additional geophysics.

Riley Gold’s other project, Hilditch said, is Pipeline West/Clipper, in the Battle Mountain-Eureka Trend and adjacent to Nevada Gold Mines’ Gold Acres open pit. Riley Gold plans to start work at Pipeline West/Clipper this fall.

Edwards noted that Riley Gold is getting analysts and others’ attention. For example, she said, Gerardo Del Real of Resource Stock Digest says the Vancouver-based explorer’s numbers so far are great. They show up to 17 g/t gold and 253 g/t silver at Tokop.

Preston, the expert behind The Maven Letter newsletter, also considers Riley Gold a good investment for those looking for a high risk-high reward play, she said, as it meets her requirements in four areas: people, structure, project and plans. The Riley Gold team is experienced with proven success. The company structure is ideal. The project is mostly unexplored, is in a great location, has high grade gold and has potential for low grade bulk gold. Also, the company has plans to create value for shareholders, and its first drill results are good.

Hilditch touched on Riley Gold’s structure, noting management has been intentional about limiting the number of shares it has issued and outstanding, which is 25 million. Management also purposefully opted to start with a project at the beginning of the life cycle versus buying and trying to develop ounces in the ground, thereby increasing the potential rewards for investors.

As for Riley Gold’s team, Hilditch said it includes exploration manager Charlie Sulfrian, who has 40 years of production-to-development geological experience, 22 of those years with Barrick, and chairman William Lamb, whose experience includes finding golf ball-sized diamonds in Botswana as the CEO of Lucara Diamond Corp.. The rest of the Riley Gold team together advanced four companies in the last decade to the point of getting taken over, doing a takeover or merging with another entity.

The broadcast ended with Hilditch describing a photo depicting core from Tokop. He said the core in the bottom of the photo returned 17 g/t gold and that in the top demonstrated 0.522 g/t gold.

Click on the link below to view the broadcast:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Riley Gold. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Riley Gold, a company mentioned in this article.

Disclosures:

- This broadcast does not constitute investment advice. Each viewer is encouraged to consult with his or her individual financial professional and any action a viewer takes as a result of information presented here is his or her own responsibility. This broadcast is not a solicitation for investment. Streetwise Live! does not render general or specific investment advice and the information should not be considered a recommendation to buy or sell any security. Streetwise Live! does not endorse or recommend the business, products, services or securities of any company mentioned here.

- Statements and opinions expressed are the opinions of the presenters and not of Streetwise Live! or its officers. The presenters are wholly responsible for the validity of the statements. The presenter was not paid by Streetwise Live! for this broadcast. Streetwise Live! requires presenters to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Live! relies upon the authors to accurately provide this information and Streetwise Live! has no means of verifying its accuracy.

- The following companies discussed in this broadcast have paid a $10,000 fee to participate: Riley Gold Corp.

- From time to time, Streetwise Live! and its directors, officers, employees or members of their families, as well as persons interviewed for broadcasts and interviews on the site, may have a long or short position in securities mentioned. As of the date of this broadcast, officers and/or employees of Streetwise Live! (including members of their household) own securities of the following companies discussed in this broadcast: Riley Gold Corp. Riley Gold Corp. has a consulting relationship with an affiliate of Streetwise Live! (description available at https://www.streetwisereports.com/disclaimer/html#consulting). Riley Gold Corp. is not a billboard sponsor of Streetwise Reports, an affiliate of Streetwise Live! (description available at https://www.streetwisereports.com/disclaimer/).

- Todd Hilditch – CEO, Director owns securities of the company.

- Disclosures for: Gwen Preston – The Resource Maven. I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: Riley Gold Corp. I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None. My company has a financial relationship with the following companies discussed in the broadcast: None.

- Disclosures for: Cyndi Edwards, Host. I, or members of my immediate household or family, own securities of the following companies discussed in the broadcast: None. I personally am, or members of my immediate household or family are, paid by the following companies discussed in the broadcast: None. My company has a financial relationship with the following companies discussed in the broadcast: None.

( Companies Mentioned: RLYG:TSX.V; RLYGF:OTCQB,

)