Source: Matt Badiali for Streetwise Reports 03/30/2021

Independent financial analyst Matt Badiali delves into Bunker Hill Mining’s most recent drill results.

On March 22, 2021, Bunker Hill Mining Corp. (BNKR:CSE; BHLL:OTCMKTS) showed us how much metal remains at the old Bunker Hill mining complex. It’s an exciting rejuvenation of one of the most storied mines in U.S. history.

The Bunker Hill Mine went into production in 1885 and ran until 1991. It produced 42.8 million tons of ore that ran 8.4% lead, 4.5% zinc and 3.5 ounces of silver per ton. It produced around 42% of all the lead, 41% of the zinc and 15% of the silver produced in the iconic Coeur d’Alene Mining District in Idaho. The mine spent the last two decades in various stages of clean up and maintenance.

In 2020, a new management and board came in to study the opportunities around the historic workings. The new team, mostly former executives from Barrick Gold Corp., have the knowledge and experience to execute on their plan to restart the mine at low cost.

They are already setting new standards for exploration. The company analyzed 261 drill holes and nearly six miles’ worth of core. They compiled 5,720 lead, zinc and silver assays. And they incorporated thousands of historical samples from the old mine data. That information was enough to convert 77% of the resource to the indicated category. The result was a massive updated resource estimate.

It’s impressive, to say the least:

- Zinc Indicated and Inferred Resources: 1.1 billion pounds

- Lead Indicated and Inferred Resources: 536 million pounds

- Silver Indicated and Inferred Resources: 11.3 million ounces

That’s just the easily found resources, which will underpin the preliminary economic assessment (PEA). We should see that document by the end of June, if not sooner.

However, the share price of Bunker Hill isn’t responding as if the company holds over a billion pounds of zinc and 11.3 million ounces of silver. As you can see in the chart below, its shares bottomed out recently around C$0.32:

This looks like a huge opportunity for investors looking to add a new silver name to their portfolio. Because Bunker Hill isn’t just upgrading their existing resources; they have new tools to find more of the high-grade material that made the mine famous in the past.

The exploration group digitized all the historical workings and developed a 3D model of the rocks. The historic workings showed that the silver production came from specific galena-quartz veins that formed in the Revett Formation. Large faults cut the veins and moved the ore bodies around.

Historically, the miners thought these faults controlled the ore placement. When they hit a fault, they figured the metal was gone. It wasn’t until the 1960s that the geologists recognized that wasn’t true. The ore hadn’t ended, it had moved. The question was, how far.

That’s where the modern digital modeling comes in. The new team believes that there is a lot more of those veins left untouched. According to their latest press release:

The Cate Fault was the limit of most early mining in the upper parts of Bunker Hill, and it wasn’t until the 1960’s that it was recognized as having post-mineral offset. A few of the first core holes ever drilled in Bunker Hill in 1898 from the 5 Level were directed past the Cate and Buckeye Faults, with impressive results including 12′ @ 42.7% Pb and 18.6 opt Ag in DH-4, but mining largely shifted to below the 9 level after the Kellogg Tunnel was completed, and these holes were never followed up on.

That’s critical, because it means there is high grade potential in the undrilled regions around the mine. The company has drill rigs on these targets right now. The exciting part is that the material in these holes will be:

“…an entirely new vein system for Bunker Hill, not defined, named, mined or incorporated in any prior mine plans or resource estimates.”

This drill program already hit incredibly high-grade material in hole 7056: 1.2 meters of 1,195 grams per ton silver. That works out to 37 ounces of silver per ton of rock.

The new material is within the area of the PEA study. That means the PEA will include the results. Investors are eagerly awaiting more news from this drilling program.

On March 29, 2021, the company reported high-grade results from a channel sampling. This is a surface program used to follow up on the results from the 3D digitization program. The latest press release confirms the silver potential of an area called the Deadwood vein in a part of the historic underground mine workings. Chip samples across the exposed part of the vein hit bonanza grade silver and lead:

|

Selected Results from Channel Samples of Deadwood Vein |

||||

|

Channel |

Width |

Silver Grade |

Lead Grade |

Zinc Grade |

|

1 |

0.9 meters |

56.8 g/6 |

8.2% |

0% |

|

2 |

1.2 meters |

497 g/t |

20.9% |

0% |

|

3 |

0.6 meters |

312 g/t |

22.5% |

0% |

|

3 |

0.6 meters |

940 g/t |

21.5% |

0% |

|

4 |

1.2 meters |

336 g/t |

19.6% |

0% |

|

5 |

0.9 meters |

549 g/t |

20.6% |

0% |

|

6 |

0.9 meters |

581 g/t |

20.5% |

0% |

|

6 |

0.9 meters |

377 g/t |

21.4% |

0.1% |

|

7 |

1.2 meters |

206 g/t |

16.8% |

0% |

|

7 |

0.9 meters |

288 g/t |

19.4% |

0% |

|

8 |

0.9 meters |

343 g/t |

20.0% |

0% |

|

9 |

0.6 meters |

1,100 g/t |

60.3% |

0% |

|

Data from Bunker Hill press release |

||||

Today, Bunker Hill is a C$54.4 million company. That means we can buy its current resources for 3¢ per pound of lead and zinc…and get the silver for free. This can’t last. As we get closer to the PEA, shares will continue to creep upward. Particularly if they put out more positive drill results over the next three months.

The company plans a webinar on Wednesday March 31 at 8:00 am Pacific Time to discuss the results:

Link: https://6ix.com/event/high-grade-silver-mineralization-results-what-does-this-mean-and-whats-next/

This little silver company is worth a whole lot more than its current price. It looks like a fantastic speculation for folks looking to play the junior silver space.

–Matt Badiali

Reach Matt Badiali at www.mattbadiali.net.

Matt Badiali is a geologist and independent financial analyst. He spent fifteen years researching and writing about great investments inside the natural resources sectors. He can be reached at www.mattbadiali.net.

Read what other experts are saying about:

- Bunker Hill Mining Corp.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Streetwise Reports Disclosure:

1) Matt Badiali: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: Bunker Hill Mining. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: BNKR:CSE; BHLL:OTCMKTS,

)

$100 Silver Ahead

Source: Peter Krauth for Streetwise Reports 03/30/2021

Peter Krauth, editor of Silver Stock Investor, discusses the macroeconomic environment for silver and why he is embracing the metal’s volatility.

Being a silver investor over the last few weeks has become more psychologically challenging.

That’s true even for us die-hard silver enthusiasts.

After all silver had a standout 2020, having gained about 47% in its best year since 2010. That easily outpaced gold’s own impressive 25% return.

But the reality is that so far in 2021, silver is down 9%. And meanwhile, nearly all the fundamental market drivers have remained intact. It seems the pressures on silver prices are likely from two angles. The first is after such an impressive 2020, it was due to correct. That’s what bull markets do.

The second pressure point is a rising U.S. dollar index, likely thanks to rising long-term bond yields. However, it’s important to consider that this trend will also run its course and exhaust itself. That could happen naturally, or the Fed could intervene by imposing Yield Curve Control.

But higher yields are a sign of soaring inflation expectations and burgeoning economic activity. And a stronger U.S. dollar, which favors imports over exports, is probably not a favored outcome for central planners.

So patience is the best approach at this point. In my view, the end of this silver correction is nigh.

Embrace Silver Volatility

In a recent report, Bank of America’s commodity analysts indicated they expect to see silver prices averaging $29.28 this year. That’s based on their expectation for a modest supply deficit of 281 Moz. They also point out, “While we expect a rebound in supply this year, output should remain below the peak levels seen a short while back, also because the project pipeline is relatively empty.”

The push for green energy combined with massive infrastructure spending, and stalwart investment demand, should keep a bid under the silver price and help it rise again this year.

Although silver is down 9% in 2021, and has retreated 19% since its August peak near $30, that’s certainly well within historical bull market corrections.

The point is silver corrections come with the territory. Investors need to embrace them, and use them to their advantage.

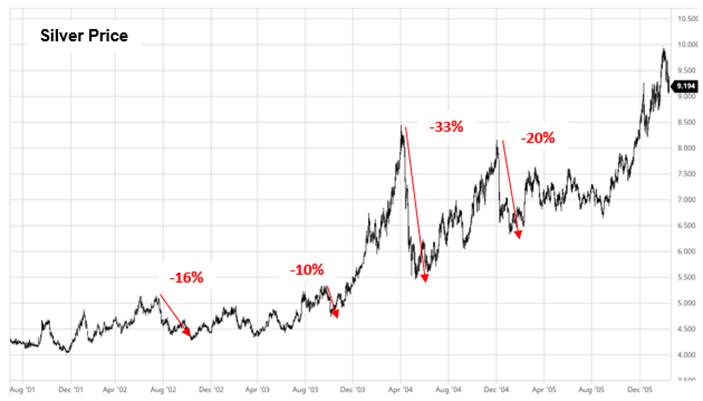

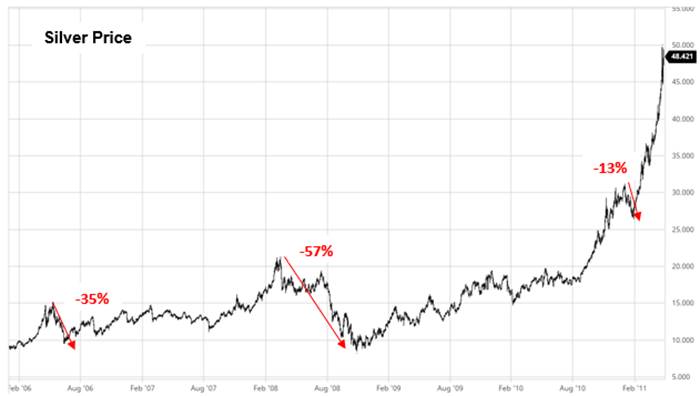

Between 2002 and 2006, silver dropped 10% or more four separate times.

Then, between 2006 and 2011, more short but sometimes deep corrections came, with silver dropping 13% or more three separate times.

The point is to look at what silver did after those corrections. In nearly every case, it went on to establish new bull market highs.

Now let’s look at what silver has done in multiple currencies.

20 Years of Worldwide Silver Gains

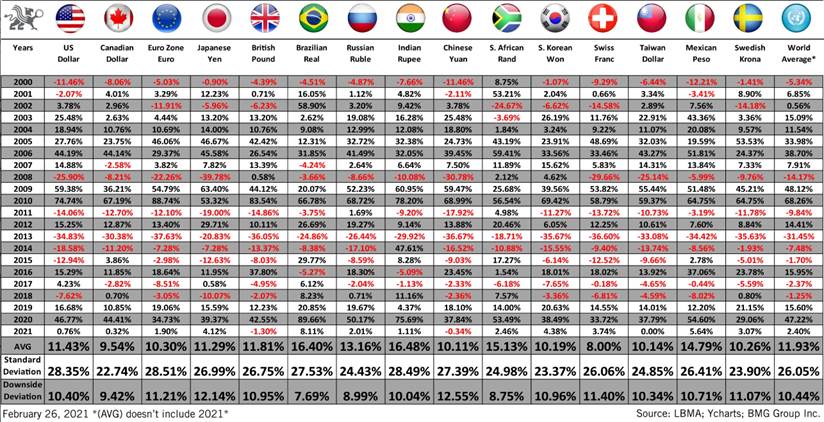

As you can see from the following chart, over the past 21 years silver has produced an average annual return between 8% (Swiss franc) and 16.48% (Chinese yuan). In USD, silver averaged 11.43% per year.

Of course, that came with considerable volatility as well as a number of down years. But the world average is 11.93% gains annually over the last two decades. So the overall trend is undeniably up: we’re in a silver bull market.

Now let’s zoom out for a longer-term perspective.

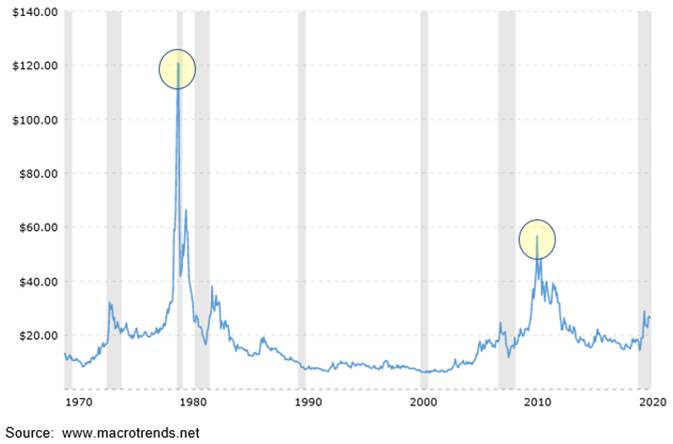

If we account for inflation, and that’s massively understated “official inflation,” then silver prices peaked at $120 in 1980 and around $57 in 2011. Today’s price near $24 is still well below those levels, suggesting a lot of upside remains ahead.

In fact at $24 today versus the inflation-adjusted $120 in 1980, silver is currently about 80% below that peak. And yet, current economic fundamentals like debt, deficits, spending, interest rates and supply/demand outlook are so much more bullish that the 1980 $120 level is likely to be easily surpassed.

Looking at silver from a technical perspective, in my view we are either at or near a final bottom for this correction.

The $23 and $24 levels acted as support multiple times between late September and mid-December. I think any further weakness is likely to be limited near $23.

If you hold or you’ve been buying silver and/or silver stocks over the past several months, two approaches make the most sense to me right now. Either sit tight if you feel you have sufficient exposure to this sector, or gradually add to some of your positions if you feel they’ve simply gotten too cheap.

Investors should emphasize how to be properly positioned in this market, with balanced exposure to physical silver, silver producers and royalty/streamers, as well as silver developers and even high-octane junior silver explorers.

In the Silver Stock Investor newsletter, I provide my outlook on which silver stocks offer the best prospects as this bull market progresses. I recently added a junior explorer that’s up 40% in just eight weeks despite current weakness, with scores of others ripe for buying now.

It’s time to be a silver contrarian. History has rewarded us repeatedly.

$100 silver is well within reach.

–Peter Krauth

Peter Krauth is a former portfolio adviser and a 20-year veteran of the resource market, with special expertise in precious metals, mining and energy stocks. He is editor of two newsletters to help investors profit from metal market opportunities: Silver Stock Investor, www.silverstockinvestor.com and Gold Resource Investor, www.goldresourceinvestor.com. In those letters Peter writes about what he is buying and selling; he takes no pay from companies for coverage. Peter has contributed numerous articles to Kitco.com, BNN Bloomberg, the Financial Post, Seeking Alpha, Streetwise Reports, Investing.com, TalkMarkets and Barchart, and he holds a Master of Business Administration from McGill University.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

US money supply growth hit another all-time high in February as the Federal Reserve continues to churn out dollars and inject them into the economy. As measured by the True Money Supply Measure (TMS), the money supply grew by 39.1% year-on-year. That was up slightly from January’s record growth of 38.7%. To put the growth […]

The post Blog first appeared on SchiffGold.

Recently, a piece of collage art entitled “Everydays: The First 5000 Days,” by an artist known as Beeple, sold at a Christie’s auction for $69 million. The Wall Street Journal noted that the price was higher than any that has ever been paid for works of Frida Kahlo, Paul Gaugin, or Salvador Dali. But, before the auction, few outside […]

The post Blog first appeared on SchiffGold.