- Gold price fails to hold $1700 as U.S. Treasuries wrap up worst quarter since 2016 Kitco NEWS

- Gold slides almost 2% to near 3-week trough after U.S. yields jump CNBC

- Gold Price Forecast – Gold Markets Continue to Look Very Sick FX Empire

- Gold suffers back-to-back declines on bond yield surge, dollar strength MarketWatch

- Gold Nears Nine-Month Low as Yields Gain on Biden Spending Plan Yahoo Finance

- View Full Coverage on Google News

In Praise of Rurality and Precious Metals

Source: Michael Ballanger for Streetwise Reports 03/29/2021

Sector expert Michael Ballanger sings the praises of rural life and of two of his holdings, Getchell Gold and Norseman Silver.

In early January, I decided that the extra pounds I was carrying around was a definitive mortality check for any sexagenarian lucky enough to be in generally good health, but sufficiently slovenly and undisciplined to allow such to happen. So, with great and good intentions in mind, I decided to try to do something about it and set out on a journey of intermittent fasting and additional exercise, with very interesting results.

The first and most obvious change was the absence of any form of alcohol in January and February, and once the purple alligators and screaming banshees stopped coming out of the walls and ceilings, day-to-day living returned to normal. Thirty-one pounds later, dungarees that refused to fit and belt buckles that would explode into shards of lethal metal are no longer sources of frustration (and danger).

But the one activity that I now cannot do without is my 3-kilometer walk up and down the hills surrounding the lovely Scugog swamp. Some days I take two of these walks and some days (like today) it is in the rain and wind. But whether it is the cows grazing or the crows squawking, there is always something fascinating and invariably thought-provoking.

The picture you see above is a newly renovated barn carried out by two young lads, perhaps in their late twenties, who removed all of the old, dilapidated wood and replaced it within three days. Walking by them this week, I shouted out, “Looking good!” to which they replied with big smiles, “Did you bring this nice weather along with you today?” I turned to my walking partner (who is way better-looking than me, although that it is not difficult) and said, “Look at those hard-working young guys earning an honest living.” Two Millennial males happy to have work, out in the fresh air, zero sense of entitlement, zero expectation of outside “assistance,” and zero reliance on government handouts. Hard to imagine in this day and age.

Another week has gone by and I am thanking the High Heavens that this miserable month of March is almost over. Back in February, the TSX Venture Exchange was ripping along at over 1,100, and just as everyone was beginning to talk about a return to the 2011 highs above 2,400, along came the pre-PDAC “creep,” and then the post-PDAC “sprint,” as investors bolted for the exits with terminal ferocity.

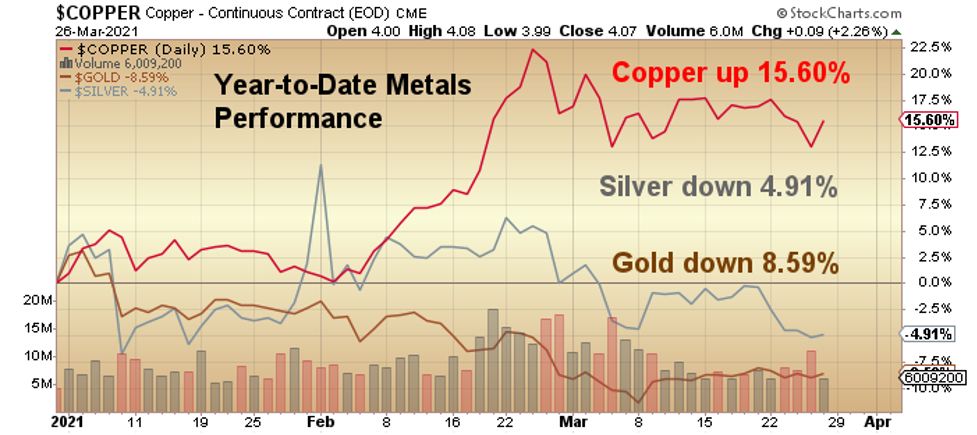

Alas, this too shall pass, but it is with great interest that I note the performance of copper year to date, which is suffering remarkably less pain than both gold and silver. It is also instructive to see just how 2021 is shaping up for gold and silver bulls—of which I am one. But it is one thing to be a gold and silver bull, and quite another to be a gold and silver bug.

The title of my service was changed from “Gold and Gold Miners Advisory” to “GGM Advisory” because I did not want to give people the impression that I am a gold bug, because I am most definitely not. There are times (such as last August) when I exit positions taken during sharp selloffs (such as the COVID crash of March 2020), because when the “crazies” are out, you have to step aside. In fact, one item pounced upon by the “bugs” was Warren Buffett buying Barrick Gold Corp., but that was anything but bullish because I must have seen that news release tweeted out 500,000 times in five days, which told me that if a gold hater like Buffett is a buyer of GOLD:US, then sentiment must have been “frothy,” to say the least.

Another major difference between the philosophies of the gold bug versus the gold bull is the recent “#SilverSqueeze Movement,” which went viral back in February. Not to be outdone by the lunacy of trying to grapple with the bullion bank bullies as happened last month, what has surfaced is the latest “conspiracy theory,” which the #Silversqueeze Community is now launching into the Twitterverse and Instagram and Facebook (and everywhere they think someone has a stock account). It all revolves around the “Perth Mint,” where (it is alleged) that “allocated gold” has disappeared or been comingled with “unallocated gold,” leaving Perth Mint customers high and dry in being able to access their private gold stashes.

I am continually left aghast at how this is anything new in the zoo, when the world knows full well that the central bank gold holdings have been hypothecated many times over, and yet they continue to hold it on the books at par value and in quantities that have never been audited nor verified. As a gold bull, I learned years and years ago to discount these kinds of rumors—not necessarily that they are untrue, but that relative to the U.S. dollar-denominated price of gold (which governs the prices of gold and silver equities), they are meaningless.

As the infamous J.P. Morgan once said, “Gold is money—everything else is credit.” And it is credit (and the destruction thereof) that is going to determine how many ounces of gold and silver it will take to buy a home in Ajax, Ontario. Incidentally, the average price for a detached home in working-class Ajax is over CA$900,000, which, at today’s ridiculous prices, is 458.92 ounces of gold or 31,620 ounces of silver. (In normal times, it would take less than 100 ounces of gold and less than 6,000 ounces of silver.) The way a gold bull views his holdings is not how many Canadian dollars it is worth, but rather how many houses in Ajax it will buy, and at what point he should trade his gold for a home in Ajax.

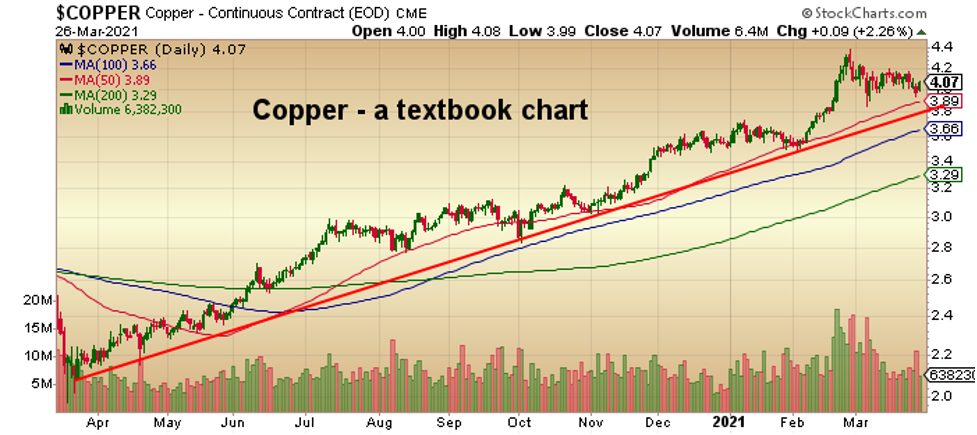

In a similar fashion, I am a copper bull, but certainly nothing resembling a copper bug, because copper represents a commodity linked to global demand and supply. While current conditions suggest that prices (especially in U.S. dollar terms) are headed higher, I will let the charts determine whether or not I want to own it. As it stands, the price of copper is currently in a textbook uptrend, with a letter-perfect 30o angle of ascent, with all moving averages perfectly aligned within the uptrend.

Now, I have a great many friends around the globe who are gold bugs, and while I tease them and flick ashes on their carpets from time to time, they know what I believe the ultimate outcome will be when the Day of Fiscal and Monetary Reckoning arrives (and it will not revolve around crypto or “Modern Monetary Theory”). They know that J.P. Morgan was correct and that is precisely why he made that statement. Bankers are bankers, and when you look back upon the history of financial folly, you need to look no further Baron von Rothschild, who said: “Let me control a nation’s currency and I care not who makes the laws.”

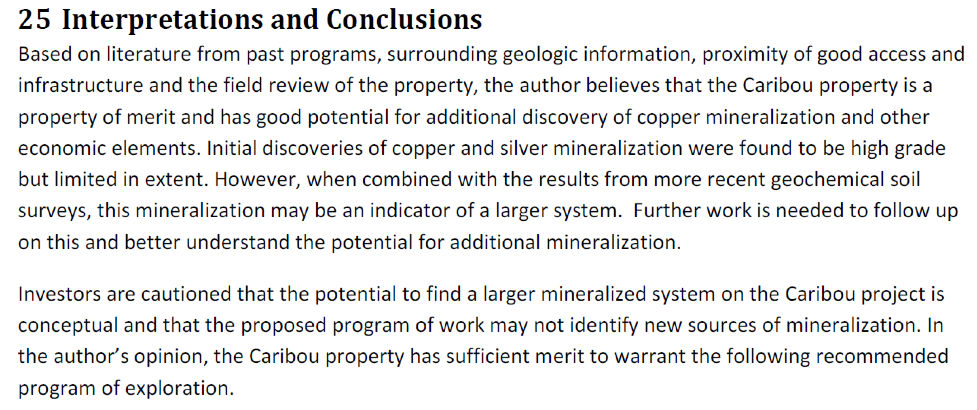

However, when it comes to the near-term need to generate income, flexibility reigns paramount in the implementation of wealth preservation, which is why I bring to your attention these tiny little micro-cap jewels like Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) and Norseman Silver Ltd. (NOC:TSX.V). Norseman is a silver deal that delivered as a “qualifying transaction” a property called Cariboo in late 2020. As I am wont to do, I dug deep on Cariboo and downloaded their technical report on sedar.com, and discovered that it is situated deep in the heart of British Columbia “porphyry country,” where porphyry copper-gold-silver deposits run rampant. Here is a snippet from that report:

“Initial discoveries of copper and silver mineralization were found to be high grade” was sufficient for me to call the property vendor and ask him a few probative questions, to which he offered complimentary responses and added excitement. To me, it is apparent that the Cariboo project might just be a copper-silver porphyry deposit, which would fit nicely into my bullish perspective on the red metal.

Both Getchell Gold Corp. and Norseman Silver Inc. comprise major allocations in the GGMA 2021 Portfolio and have since the late summer of 2020. Like Norseman, Getchell also has exposure to copper through its Star Point/Star South projects, which are going to be drilled later this year. This grants me optionality and flexibility in the event that the electric metal story gathers momentum.

Of course, the risks to owning any industrial metal lie in the return of global growth and robust trade, which have been anemic since the lockdowns. Since the wizards in government are slowly discovering that pestilence is not a preferable fate to starvation, it looks increasingly evident that economies will be allowed to function normally, allowing the human immune system to function as it has so successfully down through the ages. However, that old expression of “a penny late and a dollar short” immediately springs to mind.

There is no such word as “rurality” in the dictionary, but please trust me when I tell you that there is, indeed, such a word in my heart. I grew up in a small town called Malton, as in the international airport in Toronto (formerly “Malton Airport”). That was a wonderful place to grow up and get into all kinds of trouble, but where the cops raised their families with zero police presence because the mothers were the only police that were required. In the 1950s, Malton was a rural setting, with farmer’s fields surrounding the town and the Canadian National rail line cutting through it only to service the aircraft factories like AVRO and De Havilland. The main drinking place was the Malton Legion, which also served as the bingo hall and the after-work pub for all the workers in the factories. There were tons of fistfights and tons of arguments, but never were there shootings and never were there knife fights, because the arguments and the fistfights were just one more excuse to got to the Malton Legion to “sort things out”—which always happened without fail, thanks to the mothers that absolutely ruled the town. “Rurality” rules.

Originally published March 26, 2021.

Follow Michael Ballanger on Twitter @MiningJunkie. He is the Editor and Publisher of The GGM Advisory Service and can be contacted at miningjunkie216@outlook.com for subscription information.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Getchell Gold, Norseman Silver. My company has a financial relationship with the following companies referred to in this article: Getchell Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Getchell Gold. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold and Norseman Silver, companies mentioned in this article.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Charts and graphics provided by the author.

( Companies Mentioned: GTCH:CSE; GGLDF:OTCQB,

NOC:TSX.V,

)

Source: Maurice Jackson for Streetwise Reports 03/29/2021

Bob Moriarty of 321gold speaks to Maurice Jackson of Proven and Probable about his book chronicling Novo Resources’ adventures in Australia, and he also discusses a handful of junior miners on his radar screen.

Maurice Jackson: Joining us for our conversation is Bob Moriarty, the founder of 321gold and 321energy.com.

Sir, in my hands, I have the Inside Story on the Greatest Gold Discovery in History, which happens to be your literary masterpiece entitled “What Became of the Crow?,” which I believe may be the single most important piece of literature for anyone participating in any capacity in the natural resource space. Bob, would you please introduce us to your magnum opus, “What Became of the Crow?”

Bob Moriarty: Maurice, as you are well aware, I spent 20 years visiting two or three or four projects a month. I used to travel up to 150,000 miles a year and visited probably 500 projects. It got to the point where I was going to the same project 10 years later owned by a different company. In 2008 at the height of the Great Financial Crisis, I met Quinton Hennigh of Novo Resources, who is the main character in the book. He and I drove to the Rattlesnake Project together. And during that drive, Quinton shared his theory about how gold got into the Witwatersrand. And I thought that’s interesting. Little did I know that conversation would change my life and have a profound impact on the mining space. And I got to participate in Novo Resources from a theory stage into actual production. And as much reading as I do, I’ve never really read a good book that tells the story about what goes on with the mining project.

Quinton Hennigh (Left) with Jayant Bhandari (Right) at Beatons Creek in 2014.

And what I wanted to do was tell as honest a story as I could. And I’ll be real candid here, in the beginning of the book, I say I’m going to tell you most of the truth. If investors knew what went on behind the scenes, they would have a fit. It’s a difficult, difficult business and to go from theory to production is very difficult to do. The process takes more than capital and years to come to fruition, and you must have some really good people. And I got to write the story because I was part of it right from the beginning.

Maurice Jackson: And speaking of writing the story, we all have our gifts, but you seem to have mastered many in your life as you have a unique way of conveying a story. And allow me to highlight the brilliance of your work. You’ve written a book that is a book within a book within a book. And here’s what I mean. At first glance, one might assume that this is a book just for a geologist. And then as you read on, you discover, wait a minute, this is a must-read for any speculator buying stocks in the resource space. But then as you continue to read further, you realize this is a book for any business person, specifically—and I want to foot stomp this—for any entrepreneur. Now, I want to ask you, was this by design and how were you able to write in a way that touches each of the aforementioned?

Bob Moriarty: It was not by design. I will tell you something that everybody who’s an artist or writer knows intuitively. Your brain kind of takes over, I mean, all I do is sit down at the computer, put my fingers on the keyboard and my fingers start writing. I don’t know what’s going to come out. It’s whatever fits it with time. It used to drive my wife Barbara crazy because she would see me typing 30, 40 words per minute. And then she would read what I wrote and realized it doesn’t take very much editing. And it drove her crazy because it shouldn’t be that easy, but it is easy for me and I can’t explain it. And there is no overall design in mind, I just wanted to write a good book. And I think I came up with a pretty good book.

Maurice Jackson: In reading What Became of the Crow?, you also get an insight into one of the most interesting people in the world, and that is Bob Moriarty. And I have to give credit where credit is due. I’m honored to say that over the years you’ve mentored me, and many times, I have to admit it, you’ve taken me apart and sometimes put me back together again. And I say that with the most profound respect for you, as one of the things that you’ve instilled in me is the importance of being a good steward to the space and the obligations that we have to our subscribers, to be honest, and never break their trust. And I say that because I’m often asked what’s it like to speak with Bob offline? And I have to share that in reading this book, this is what it’s like because you’ve taken through an exploration project with one of the most successful minds in history.

You provide a behind-the-scenes look into the industry that many speculators overlook. And as you’ve pointed out many times, it’s not just the size and the grade of a deposit, it’s the intangibles that many speculators overlook. Allow me to share some of the intangibles that readers will discover while reading your book that touched me. Vision, belief, team, passion, adversity, triumph, greed, backstabbing, loyalty, wealth, willingness to make mistakes and overcome those mistakes and challenging paradigms. This is so critical to understand about the industry is that it’s not just numbers. Now, before we move on to companies, where can we purchase What Became of the Crow? And also if you would, what are some of the readers saying about your book?

Bob Moriarty: Okay, there are three different versions available. There is the hardback from Lulu, which is about 50 bucks and that’s full color. There’s a paperback from Lulu. There’s black and white, that’s available on both Amazon and Lulu. And there’s the Kindle version, which is available on Amazon. Now, if anybody is even thinking they might be interested in this, they owe it to themselves to go to Amazon, or go to Lulu, put in What Became to the Crow?, and read the reviews. Now I buy up to 200 books a year. I got nothing better to do so I read two or three or four books a week.

It’s the highest-rated book that I’ve ever seen and the reader comments are brilliant. And I’ll be candid, if I went and saw so many incredible reviews of a book, I would buy the book. If you buy the book, you’re going to be happy. And strange enough, the hardback is a high-quality book. It’s something I was proud of. I was just so impressed with the quality of the book from Lulu and I think readers will be too. It’s a book you’re going to want to buy and keep and read 20 years from now. I think it’s going to be the classic in mining history. It’s that good.

Maurice Jackson: I share the same opinion. And I’m not going to wait 20 years, I shared with you before the interview, I plan on rereading the book this weekend, What Became of the Crow? Now, moving on to resource stocks that have your attention, let’s begin with Novo Resources. What can you share with us?

Bob Moriarty: Now, there are two things that I want to share, and you are the first or the best person because you’re the most qualified. When your children were born, how much sleep did you get the first 90 days?

Maurice Jackson: Zero.

Bob Moriarty: That’s exactly how much sleep Quinton is getting right now. Second of all, you were in the military and you’re quite familiar with people marching, etc. If you went out on the street and paid 50 people to come work with you, and you wanted to get them to march in formation for, say a quarter of a mile, how long would it take to train them?

Maurice Jackson: It would take weeks.

Bob Moriarty: You just made two really important points that investors simply don’t understand and Quinton didn’t understand. That’s funny. I’ve talked to Quinton and he said, “Oh my God, I’m pulling my hair off.” Now that was a crisis, you know Quinton, right?

Maurice Jackson: Yes, sir.

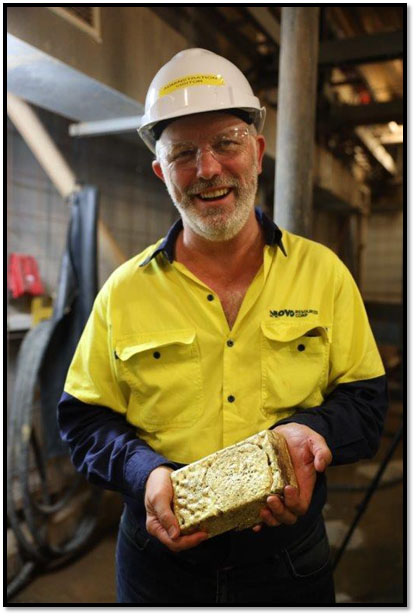

Rob Humphryson, the CEO of Novo Resources, holding Novo’s inaugural gold bar from the Beatons Creek Gold Project.

Bob Moriarty: He hasn’t got any hair. So when he started pulling his hair out, he’s got a real problem. It’s all gone. But if you’re going to go into production, it’s just like having a baby, forget sleeping for the next 90 days. And if you’re going to get people to march in formation for a quarter of a mile, and you take 40 or 50 people together, it’s going to take months to do so. Quinton and I had many conversations since the first gold poured about six weeks ago. And every time we speak he shares his frustrations with me stating: “This happened, this happened, this happened, and this happened.” And he truly was concerned and I said, “Quinton, give it up. They’re supposed to screw up. That’s what happens. You got to get everybody marching in the same direction and it’s like a brand new baby. You’re not going to get any sleep for the first 90 days.” And what I’ll say is, and I’m kind of amazed by this, he was exceptionally concerned in the first week or two after the pour because little tiny things were blowing up.

And I said, “Quinton, that’s how it’s supposed to work. If you called me up and said, everything’s perfect and everything’s going smoothly and nothing’s going wrong and everybody’s doing their job exactly right”—

Maurice Jackson: Then something’s wrong.

Bob Moriarty: Novo has put together an incredible team. Things are working out very well and there’s going to be some real pleasant surprises. One thing that Quinton has never discussed publicly, there are two kinds of gold processing in the mill. They’ve got a gravity circuit and they’ve got a cyanide circuit. Now the gravity circuit, it’s on the front end. So if you’ve got nuggety gold, and they are not big nuggets, they are small nuggets. If you have small nuggety gold flakes and you can take them out of the material, it means your cyanide process is going to be a lot more efficient.

So about half the gold they’re recovering, they’re recovering on the gravity side. And that’s key, which means they can put a lot more materials than they ever suspected. So it’s going to take another month or two or three to get everything sorted out. There are going to be tiny issues, and they’re going to sort them out. But when investors figure out how much the throughput is and how much gold they’re producing, everybody’s going to be very happy. I think it’s a giant success story. I’m pleased to be associated with Quinton, with Rob, with the entire team. They’re just great people and they’ve done a brilliant job.

Maurice Jackson: Let’s stick with Dr. Hennigh and get your thoughts on some of the companies in which he serves as an advisor, beginning with Irving Resources.

Bob Moriarty: Irving stumbled because of Japan. I think that a lot of countries have overreacted and Japan shut the drillers out. It’s taken longer to get organized than it should have, but it’s COVID. It’s the same deal with the assets. Assays are now taking months and months and months; they used to take a week. But Irving has the goods, they’re going to succeed and they’ve got a lot of gold. Irving, I think it’s my second biggest holding right now. I love Irving.

Maurice Jackson: Well, if one person can get the job done, it is Akiko Levinson, the CEO of Irving Resources.

Bob Moriarty: I’m glad you said that because you’re correct. I was afraid for a minute you’re going to say, Quinton. Quinton does his job there, which is to assist Akiko, but Akiko is magic. And you and I know her, you and I have been over there. And the last time I was over there, I walked into where they had all the samples and Akiko was sweeping the floor. Now, that is management.

Maurice Jackson: Indeed. She’s a class act by the way. Let’s go to Fiji and visit Walter Berukoff in Lion One Metals.

Bob Moriarty: Interestingly enough, again, because of COVID, Lion One sort of stumbled. They ordered some drills, I think they’ve got $65 million in cash. Wally did a brilliant job of raising money when he could. He and I had several conversations. I said, “Look Wally, the biggest danger right now is the banking system. You need to spend that money as fast as you can on things that you’re going to need for the future.” Lion is drilling right now and they’ve got an assay lab on site. So there will be results coming out. That stock is down 15% since August. And there’s nothing wrong with the stock; it’s certainly cheap.

Maurice Jackson: It’s a great buying opportunity, a great value proposition and it’s an alkaline deposit. Let’s foot stomp that, an alkaline deposit. Let’s go to Nevada and let’s visit Peter Ball and NV Gold.

Bob Moriarty: Interestingly enough, and it’s not necessarily Nevada, Peter has been very aggressively picking up other projects. And there’s no particular news yet, but they got money and they’re going to do a lot of drilling next year. And there are a lot of projects, any one of which could be company making.

Maurice Jackson: Moving on to The Metallic Group of Companies, spearheaded by Greg Johnson, another prominent name in the natural resource space.

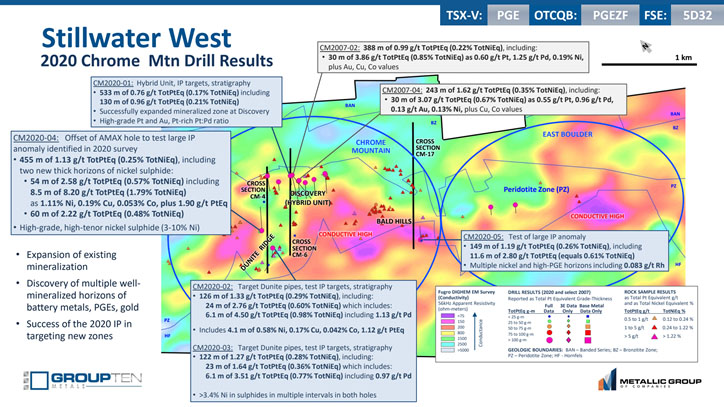

Bob Moriarty: All three companies share management. I’ve known Greg for 20 years now. He was the number two guy at NovaGold 20 years ago. He’s brilliant. And the drill results from Group Ten Metals on the platinum-palladium Stillwater West project are exceptional. And for some reason, the market hasn’t picked up on it yet. Equally interesting, the Metallic Group of Companies has a great copper project in Granite Creek Copper and a compelling silver project in Metallic Minerals. Copper and silver both look like they’re going to be the most important commodities in the next segment of the bull market. So any of the Metallic Group companies I think are cheap and are going to go up a lot.

Maurice Jackson: Let’s go back to Montana. You talked about exceptional grades; the other important thing is they hit on every single target. That’s impressive. That shows the proof of concept. And I’m speaking of Group Ten Metals in Montana, and that is Michael Rowley. And by the way, we just released an interview with Mr. Rowley yesterday (click here). Then the copper play in the Yukon is Granite Creek copper. And we just released an interview (click here) with Tim Johnson and that was about two weeks ago and we were looking forward to speaking with Greg Johnson on the silver play, which is Metallic Minerals, soon.

Bob Moriarty: You missed the most important thing in your last press release for Group Ten Metals (click here). In the press release they came out with, on the 3rd of March, they had 455 meters of over 1.5 gram material. That’s incredible in itself. When the market picks up on it, and I don’t understand why the market hasn’t picked up on it. But Group Ten Metals has found rhodium on the Stillwater West. Rhodium’s like $25,000 an ounce. Remember us talking about it when it was $600?

Maurice Jackson: I do. And by the way, it went up recently to $29,000. So you’re correct that all three companies respectively are great opportunities for someone that’s looking for bargain prices with exceptional management, with a proven pedigree of success.

All right, let’s move on to another company that you and I like very much, and that is Dolly Varden Silver, led by Shawn Khunkhun.

Bob Moriarty: Again, Dolly Varden is right in the heart of silver country in northern BC. Dolly Varden has a lot of silver, it has great management, it has a tight share structure. And it’s just about one of the very few, almost pure plays on silver.

Maurice Jackson: Please check out our interview with CEO Shawn Khunkhun (click here).

Let’s go to the Yellowknife District and visit Judson Culter of Rover Metals. They produced the 11th best drill hole in Canada last year on the Cabin Lake Gold Project.

Bob Moriarty: That’s another funny one. It was not a big drill program. I think it was 2,000 meters.

Maurice Jackson: Yeah, 2,000, 2,500 no more than that.

Bob Moriarty: Yeah, exactly. And you know, if you hit anything, you look like a hero. But they came up with extraordinary results. How do you achieve the number 11 intercept in Canada with a 2,000 meter drill program? I did a piece recently on Amex and we should talk about them. They’ve got a 300,000-meter drill program going on. They have completed 150,000 meters. They have one home run after another, after another, after another, after another and the market doesn’t get it because there’s too much information. Rover had a great hole and the market kind of ignored it. There’s something here going on and I don’t quite understand. Check out our interview with CEO Judson Culter (click here).

Maurice Jackson: Well, so speaking of Amex Exploration, just give us a brief overview. Where are they located, sir?

Bob Moriarty: They’re in Quebec. They’re right on the border with Ontario. Good management, they are absolutely in the New Found Gold, Great Bear, Walbridge camp of extraordinary results. I think their only problem is the market doesn’t understand them. And I talked to management, I spent an hour on the phone with them last weekend and said, “You guys just need to broaden your reach.” The danger with Amex is them being bought out too cheap. They are going to get bought out. They are going to have a 5 to 10 million ounce deposit and somebody’s going to want to own them.

Maurice Jackson: Well, my eyebrows went up there. All right, moving on to physical precious metals, which metals are you buying? And why?

Bob Moriarty: Silver. Because somebody called me and could sell me 2,000 ounces at $27. And I think that that’s cheap given the situation and I was happy to do it. It is fairly difficult right now to be buying precious metals because people are waking up to the fact that the Federal Reserve, it was on the verge of destroying the dollar.

Maurice Jackson: Well, let me ask you this as well. I didn’t conduct any interviews regarding it, but when we had the Robinhood situation unfold a couple of months ago, a lot of clients were somewhat hitting the panic button. And I had a more of pragmatic view point. I believe the fundamentals are there for silver to move organically. Not because of some third party trying to go in there and create havoc in the market. And just want to get your thoughts on that because it reminds me of the Madness of the Crowds.

Bob Moriarty: Well, that’s exactly what it is. Anytime you see a mob taking any action, you want to do exactly the opposite. There is no situation where being part of a mob is a good idea. So when a bunch of 20 something year olds go out and say, “Okay, we’re going to run silver.” First of all, it’s bovine feces. Silver is a market like any other market. And they drove up the premiums on a temporary basis, but they’re not about to corner silver. You should never buy silver because the mob says so, you should buy silver or gold or platinum, or even rhodium because they’re cheap, but you should buy them when they’re cheap. And you and I had three or four discussions about rhodium when it was $600 or $700 an ounce. And I’m sure you thought I was out of my mind.

Maurice Jackson: No, I didn’t. I acted.

Bob Moriarty: What kind of metal goes up 40-fold?

Maurice Jackson: Yeah. Those are those unique opportunities that you only find right here on Proven & Probable. Let me ask you this as well; my favorite metal’s platinum. Are you buying platinum?

Bob Moriarty: I’m not buying platinum because I’ve got a lot of it. Platinum’s gone up, when it was $700 or $800 an ounce it absolutely was a steal. It’s $1,100 and change now, went up to $1,300. You’ve known me long enough and there’s no BS about this, I buy things because they’re cheap, for no other reason than they are cheap. And if you buy things when they’re cheap, you’ll make money. If you insist on buying things after they’ve gone up and they hit a new high, you’re not going to make any money.

Maurice Jackson: Bob, before we close, what keeps you up at night that we don’t know about?

Bob Moriarty: I don’t think anything. I think that the correction is near and end; I own some great stocks. I do worry about the warmongering from Biden and the idiots that he surrounded himself with. The U.S. is making an absolutely gigantic error in trying to mess with both the Chinese and the Russians. And it could get quite expensive.

Maurice Jackson: Last question. What did I forget to ask?

Bob Moriarty: I don’t think you forgot anything. I think we’ve covered a lot of stuff.

Maurice Jackson: For someone who wants to find out more about your work, please share the website address.

Bob Moriarty: 321gold.com and 321energy.com. And if you want to buy the hardback, buy it directly from Lulu. Amazon plays games. If you go to Amazon and try to order the hardback, it’s actually the Lulu book. And they’re saying that it’s out of stock and it will be a month and it’s total nonsense. Go to Lulu and buy it direct from Lulu. It’s a great book.

Maurice Jackson: And just for the record, I have the Kindle version, I have the paperback and the hardback is coming. And I do not benefit in any capacity financially from you purchasing your book. I’m just a big believer in great work. And this great work has repeatedly rewarded me financially by me applying the rules, the axioms that this gentleman today has shared with us.

Mr. Moriarty, it’s been an absolute pleasure speaking with you today. Wishing you the best, sir.

Bob Moriarty: Good deal. It’s good talking to you, Maurice. Have a good weekend. And you realize of course, when you read the book for the second time, you’ve got to send me some more money.

Maurice Jackson: I like that. You’re a true businessman.

Bob Moriarty: Yeah.

Maurice Jackson: Will do.

Bob Moriarty: Okay. Thanks, Maurice. Have a good weekend.

Maurice Jackson: And as a reminder, I am a licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium, and rhodium, to offshore depositories, and precious metals IRAs. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide: Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

- Dolly Varden Silver Corp.

- Irving Resources Inc.

- Lion One Metals Ltd.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources, Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden and Rover. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Novo Resources, Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden and Rover are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

2) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Novo Resources, Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden, Rover and Amex Exploration. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Novo Resources, Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden, Rover and Amex Exploration are sponsors of 321gold.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals, Granite Creek Copper, Dolly Varden. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Irving Resources, Lion One Metals, Group Ten Metals, Metallic Metals and Granite Creek Copper, companies mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: AMX:TSX.V; AMXEF:OTCQX; MX0:FRA,

DV:TSX.V; DOLLF:OTCMKTS,

GCX:TSX.V; GCXXF:OTC,

PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE,

IRV:CSE; IRVRF:OTCQX,

LIO:TSX.V; LOMLF:OTCQX,

MMG:TSX.V; MMNGF:OTCMKTS,

NVO:TSX.V; NSRPF:OTCQX,

ROVR:TSX.V; ROVMF:OTCQB,

)

We have been saying that given the extraordinary level of money printing the Fed has done since the beginning of the pandemic, a wave of price inflation is coming down the pike – perhaps even hyperinflation. But many will be quick to remind us that we raised the warning flag about inflation when the Fed […]

The post Blog first appeared on SchiffGold.

Since the beginning of the pandemic, government debt and money printing are off the chart. This is creating inflationary pressure. Prices are on the rise. And this is by design. In fact, the Fed has been promising more inflation for years. As Peter Schiff explains, it looks like this is one promise the Fed is […]

The post Blog first appeared on SchiffGold.