The federal government is spending and redistributing newly created cash so rapidly, it’s becoming difficult to keep track of which trillions are going where.

This week, President Joe Biden will pitch a $3 trillion “green” infrastructure package. That’s on top of the $1.9 trillion economic “relief” bill he recently signed into law.

Next month, Biden is expected to roll out plans for additional trillions to be spent on healthcare, education, housing, and more.

Republicans in Congress may object to some of the proposed spending. But they have a lousy track record – even during times when they were the majority – when it comes to actually reining in federal outlays.

Infrastructure spending is likely to garner some bipartisan support.

Politicians of both parties are eager to “bring home the bacon” to their districts. Many of them are blighted by deteriorating roads, crumbling bridges, and functionally obsolete facilities.

Implementing the “Build Back Better” agenda will require concrete, steel, copper, and other commodities – lots of them.

The green energy components in particular could result in massive demand increase for metals including silver.

The Biden administration is ordering all federal government agencies to transition their vehicle fleets to electric motors. It is also expanding subsidies and incentives for electric vehicles sold to consumers, with the stated goal of ultimately banning the sale of gasoline-powered cars.

Electrification has a silver lining – literally.

Silver is a superior conductor of electricity. It is critical in all stages of electrification infrastructure – from solar panels, to charging stations, to battery connections, to just about every electronic system that consumes power.

Silver, gold, and other hard assets also stand to benefit from the broader rise in inflationary pressures likely to accompany Washington’s spending spree. It’s all being facilitated by debt issuance and the Federal Reserve’s printing press, which it uses to buy the government bonds that no one else will.

At the moment, the central bank actually wants to see inflation run hotter. It has virtually abandoned all concern over budget deficits and other aspects of fiscal responsibility on the part of Congress.

But Democrats still want to raise additional revenues the conventional way – through tax increases:

- Former Fed chair and current Treasury Secretary Janet Yellen is pushing for tax hikes on corporations and high earners.

- Transportation Secretary Pete Buttigieg wants to impose a mileage tax on motorists.

- Senate Budget Committee Chairman Bernie Sanders recently introduced legislation to dramatically raise the estate tax.

- Massachusetts Senator Elizabeth Warren, Rep. Alexandria Ocasio-Cortez, and their allies are threatening to impose a wealth tax.

A bevy of new taxes could be just the thing to spook Wall Street and bring the bull market in equities to an unceremonious end.

When investors perceiving rising threats to paper wealth, they are more likely to hunker down financially. And among the safe havens they may find attractive for sheltering wealth are physical precious metals.

Paper liquidations of precious metals traded on futures exchanges are possible during periods of distress in financial markets.

But these types of selloffs, like the one experienced last year amid the COVID panic, are usually fast-unfolding technical events. They aren’t indicative of fundamentally driven trends.

Although the paper selling in March 2020 was quite extreme, strong physical buying in response helped lift the gold market to a record high by late summer – and pushed the silver market to a multi-year high.

Given the extreme nature of the inflationary policies now being pursued in Washington, investors shouldn’t expect the 2020 highs in gold and silver to be any kind of ceiling.

The more rapidly that officials depreciate the currency in the months ahead, the greater the upside potential for precious metals.

Inflation Pressures Building

There has been considerable discussion in recent weeks about the prospect and threat of rising inflation. This inflationary scare comes at a time when the government is unleashing massive stimulus measures to bailout states, businesses, and consumers – all in the name of combatting the pandemic.

We’ve already seen a $1.9 trillion helicopter money drop this year, and the Biden administration appears just to be getting started.

The latest reading of government’s CPI (Consumer Price Index) continues to suggest that inflation so far remains low. Even if we do experience inflation, government officials continue to assure, it will be transitory. Despite these weak guarantees, financial establishment luminaries are starting to sound the alarm and Americans are becoming increasingly concerned about soaring inflation.

Former Treasury Secretary Lawrence Summers along with former IMF Chief Economist Olivier Blanchard recently voiced concerns over President Joe Biden’s $1.9 trillion stimulus plan, suggesting that so much new largess on top of all last year’s large stimulus packages could cause the economy to “overheat.”

Inflation is a tax on savers, wage earners, and those without sound money or hard assets, so while the exact definition of “overheat” remains under debate, it seems clear that a sudden rise in price pressures could cause the Fed to lift rates rapidly, potentially causing job losses and other issues as the economy slows.

Such a scenario could lead to a period of higher inflation, or even 1970s-style stagflation.

Considering more than 25% of all U.S. Dollars ever printed have been printed in the last year, would anyone be surprised?

The ongoing threat of inflation could lead to more buying of gold and other hard assets. Fed chief Jerome Powell has suggested time and again that the central bank would be comfortable allowing inflation to run hot for a while before taking any action to calm price pressures.

This means that the central bankers will not hike interest rates or roll back bond purchases to slow things down. And when government-reported inflation rises well above 2% while interest rates remain at lower levels, the resulting negative real interest rates will underpin gold prices and could potentially lead to substantially more gold buying and higher prices.

The Win/Win Scenario

The gold market may very well have entered a win/win scenario.

The market has been buoyed by ultra-low interest rates, quantitative easing, and the threat of rising price pressures. Such conditions put the dollar under pressure, and gold’s proven record as a historical inflation hedge continues to create a tailwind for the metal’s market.

And even if the Fed ultimately hikes rates, if history is any guide, these monetary alchemists who believe they can create wealth by printing it will be behind the curve – and gold will still benefit from real interest rates that continue to be in negative territory.

The gold market may, therefore, be headed for a further ascent regardless of what the Fed does or does not do in the years ahead.

Price action in the yellow metal has been to the downside since the all-time high achieved last August, although that downtrend may have now run its course.

In recent days, bargain hunters and long-term investors have stepped into the market, and gold may soon reverse decisively and make a new run at its all-time high of $2,060 an ounce.

Source: Maurice Jackson for Streetwise Reports 03/26/2021

Michael Rowley, CEO of Group Ten Metals, talks with Maurice Jackson of Proven and Probable to discuss the flagship Stillwater West Project located in Montana and why it has the potential to become one of the largest sulphide nickel and platinum group metals projects in the world.

Maurice Jackson: Joining us for a conversation is Michael Rowley, the CEO of Group Ten Metals Inc. (PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE).

Glad to have you back to get us up to date on the latest, exciting developments on the high-grade, polymetallic Stillwater West Project located in Montana. Before we begin, Mr. Rowley, please introduce us to Group Ten Metals and the opportunity before us.

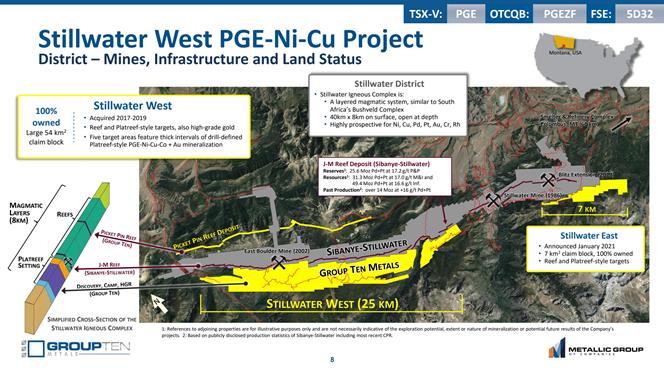

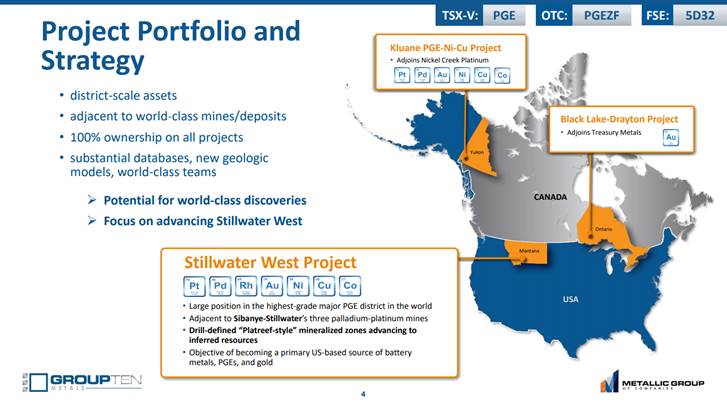

Michael Rowley: Group Ten is advancing our Stillwater West project in Montana, which we expect will emerge as one of the largest sulphide nickel and platinum group metals project in the world, based on the analogs that we are applying from South African mines such as Anglo American’s Mogalakwena and Ivanhoe’s Platreef. We will be publishing an initial resource estimate this summer that will begin to demonstrate how the mineralization holds together in our most advanced three targets, and we are also planning our largest drill program to date in order to expand those resources into adjacent untested targets. And as a side note, our recent drill results, some of the very best nickel and PGE intercepts in the past year, speak to the ability of our team to target and drill new mineralized zones in this iconic district.

Stillwater West hosts nickel, palladium, platinum, copper, gold and cobalt—all metals that are in high demand particularly now with global moves toward greener energy and sustainability. Nickel sulphide systems of size are very rare, and to have significant co-product values of platinum group elements is even more rare. The list of exploration or development stage peers in our space is a very short, and we feel we stack up extremely well in comparison, especially when you consider that we are in some of the best rocks in the world for our target commodities, and it happens to be in a U.S. mining district that hosts three mines and smelter.

We think this project is ultimately something that one of the global mining titans is going to have to have in their portfolio. It’s our job to add as much value for our shareholders as possible until such time as those conversations mature, and for right now that means drilling and proving out billions of pounds of base metals and millions of ounces of precious metals in one of the globe’s most iconic mining districts.

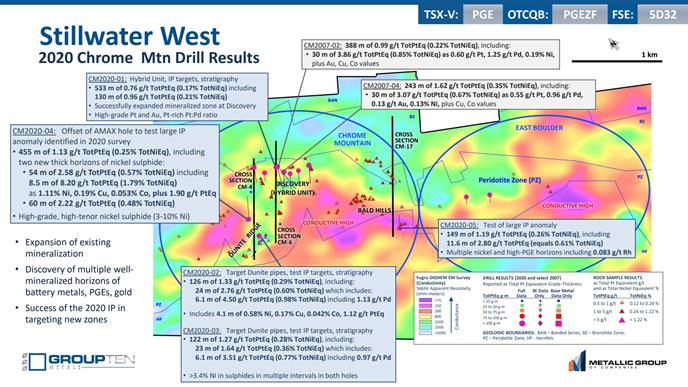

Maurice Jackson: Group Ten Metals has delivered impressive results consistently at Stillwater, starting from the existing database in 2017, and then your own drill programs in 2019 and 2020. Those 2020 drill results have just been released and they returned exceptional nickel, platinum, palladium and even rhodium drill results from Stillwater West. Mr. Rowley, can you take us through the results?

Michael Rowley: The Stillwater district is well known for its metal riches—it hosts the highest-grade palladium-platinum deposit in the world with 100 Moz at more than 17 g/t grade, plus lesser amounts of nickel and copper sulphide, and other commodities. There was a lot of metal in the pulses of magma that created the district! We are drilling new areas of the same system for a new deposit model—this bulk minable Platreef model that we can touch on in a minute.

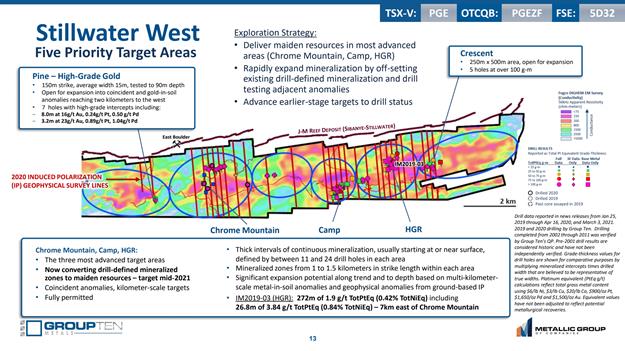

Last year, like in our 2019 drill program, we hit in every hole. And we delivered some of the very best nickel hits of the past year and—separately—some of the very best PGE hits of the past year, and absolutely the best combined Ni-PGE mineralization in drill results when you take those together.

We drilled several new magmatic horizons that show good to high-grade nickel and 50–100% of additional value in co-product values of Pd, Pt, Rh, Cu, Co, Au.

In hole 4, for example, we returned 8.5m of 1.1% Ni with precious and base metals that carry that to 1.79% TotNiEq grade (or 8.2 g/t TotPtEq), and that’s within a broader 54m intercept of 2.58 g/t TotPtEq, which in turn is within 455 meters at 1.13 g/t TotPtEq, being the entire length of the hole. This is a truly impressive amount of mineralization, and we are able to look at multiple possible mining scenarios based on grade.

In another hole, hole 5, about a kilometer away, we again discovered multiple new well-mineralized horizons including 11.6 meters of 2.80 g/t TotPtEq with rhodium at grades comparable to some mines in South Africa.

Rhodium is interesting because it is one of the more rare platinum group elements, and it’s currently worth more than USD 25,000/oz. It is used in catalytic converters in cars, and other uses, and there is very little mine supply in North America. So it’s pretty compelling to have robust co-product rhodium grades in the U.S.

So, two takeaways: One, there is a lot of mineralization in the system, and we are successfully targeting new high-grade zones and quickly building our maiden resources. And these 2020 results are a full 7 kilometers away from similar results in our 2019 program, within a claim block that we own 100% that spans 31 kilometers.

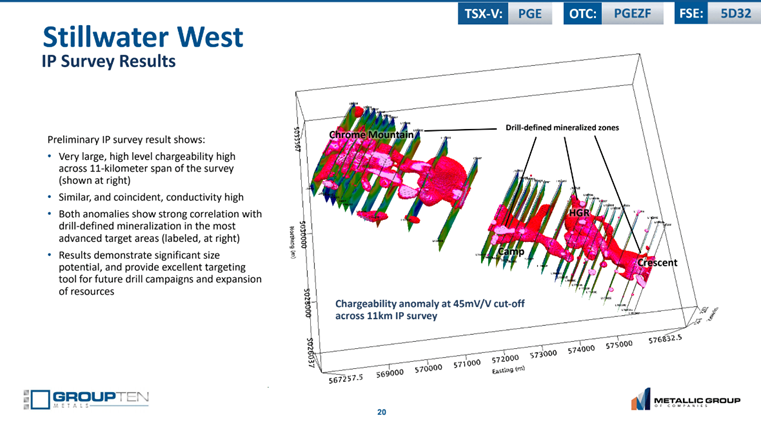

And the size of the claim block and the mineralized system ties into the second takeaway: the geophysical survey we completed in 2020 had a lot to do with our success with holes drilled that year. That survey covered 11km of strike, and we have only begun to test the targets it revealed. We’re looking forward to coming back with a bigger drill program this year to test more of those targets.

Maurice Jackson: The size of the system here is truly remarkable. As I recall, size is part of the Platreef deposit model that you have now confirmed in Montana. Can you tell us more about that model, and why it is significant?

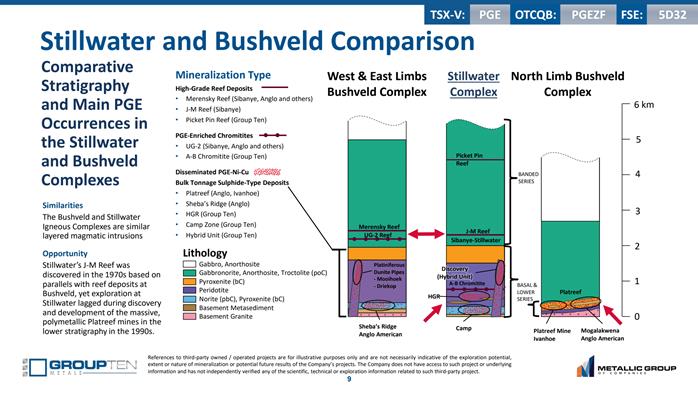

Michael Rowley: When we say Platreef we are referring to the Platreef district, in South Africa. These are some of the very largest and most profitable nickel-copper-PGE mines the world. They are desirable because they offer thick mineralized widths that are amenable to bulk mining methods, and also because they have a rare commodity mix that includes both nickel and Platinum Group Elements in economic quantities.

The magmatic system that hosts the Platreef—the Bushveld igneous complex—is a layered system that is very similar to the Stillwater igneous complex, halfway around the world in Montana. They are so similar that the deposit beside us at Stillwater was discovered by extrapolating from similar deposits in the Bushveld back to Montana. And they found it in the 1970s when America wanted a domestic source of platinum for catalytic converters in cars, in the exact same place within the layers, a little over 2km up the magmatic sequence.

From there, South Africa kept moving and developed Anglo America’s giant Mogalakwena mines, on the Platreef, below the existing mines in the layers. More recently Ivanhoe’s Platreef Mine and Platinum Group Metals’ Waterberg have joined Anglo, and so the district now totals over 400 Moz of PGEs and gold, and tens of billions of pounds of nickel and copper, in sulphide deposits that are tens, even hundreds of meters thick.

We are essentially bringing Platreef to Montana. We are in the correct location, and our work in the past few years has confirmed it, and now we are on our way to our first resources at the three most advanced areas. Those are expected this summer, and should re-value the company nicely and allow to get on to bigger and bigger exploration programs, and the kinds of returns that investors look to junior companies to deliver.

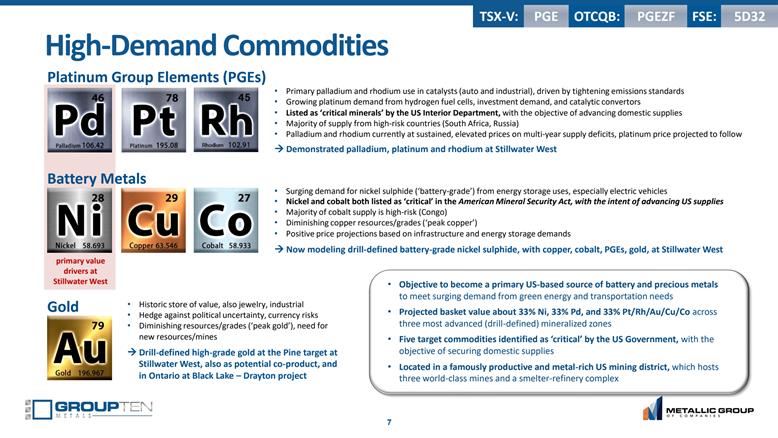

Maurice Jackson: The global demand for clean air is on the rise and with that an obvious explosion in demand for electric vehicles, battery storage, fuel cells…so much so that the U.S. government has been prompted to add a number of your commodities to a critical metals list. In other words, “mineral commodities that are vital to the nation’s security and economic prosperity.” Stillwater West is a polymetallic project and a potential source for several of these metals. Beginning with nickel, what can you share with us?

Michael Rowley: Our nickel is nickel sulphide, so it is indeed the battery-grade nickel that Telsa and others are looking for. There are very few projects with potential for grade and scale in the nickel-PGE space. Group Ten shares one of the largest and best geological formations in the world—the Stillwater Igneous Complex—with a producing major—Sibanye. They operate three mines right beside us and a smelter-refinery complex in the district.

We can’t talk about nickel without talking about metallurgy and processing. Nickel sulphide is ideal for generating the kind of nickel they need for batteries—nickel sulphate—in the cleanest, lowest carbon manner possible. These are much cleaner than the other primary source of nickel in the world, which is from nickel laterites. Laterites are oxide minerals that are mined in Indonesia, Philippines, New Caledonia. A lot of the mining for this type of nickel is environmentally bad, and it takes a much higher carbon footprint and additional processing to produce a clean nickel sulphate that is suitable for batteries.

The challenge with nickel sulphide ores can be recoveries, and thankfully Stillwater has given very good indications of positive metallurgy, and high-tenor—meaning basically high-strength—nickel sulphides, which is very desirable.

In addition to nickel, the U.S. has listed PGEs such as Pd, Pt, Rh and also Co as critical, with a view to securing domestic supplies and reducing dependency on Africa and Russia for supply. We are in some of the very best rocks in the world for our target commodities as there is a 100 Moz deposit of palladium, platinum and lesser PGEs adjacent to us along about 31 kilometers, so we know there was a lot of metal in the magma that made the complex.

Palladium and rhodium are breaking new highs all the time due to persistent supply deficits, and that doesn’t appear like it will slow any time soon. In fact the giant Russian Norilsk mines have lowered their production guidance for the year for palladium following recent mine problems, so we may even see greater shortfalls, especially as consumer spending returns and car sales move up, as 80% of palladium and rhodium are used in catalytic converters for cars.

Platinum is getting very interesting. It is now entering its third year of supply deficit following many years of surplus, and the price has moved up nicely as a result. Aside from investment demand, and use in catalytic convertors, we are also seeing increasing use of hydrogen fuel cells in trains, and large machinery including haul trucks at mines.

Maurice Jackson: I’ve enjoyed being part of this project from an early stage, and have to say it just keeps looking better. What is your ultimate exit strategy, and have you talked to major miners, including your neighbor, Sibanye?

Michael Rowley: The most likely exit strategy for us would be a sale or partnership with a major who would go on to build a mine. That can work very well for all parties involved as the juniors are good at delivering spectacular returns de-risking a project and proving up the potential. And then both parties can get a further bump in value when a major with deep pockets and experience builds a mine. Given the right backers I wouldn’t rule out building a mine, but it wouldn’t be our first choice. The first step in the either direction is debut our maiden resource in the coming months and get onto expanding them and add the other studies around them.

We have spoken to everyone who is relevant to the space, including the majors, in some capacity whether it be at a trade show or core shack display, along with some that we have under confidentiality agreement, which are looking to conduct a deeper dive into the data. It’s interesting that Sibanye has stated that they are looking for more acquisitions in the U.S., and in particular for battery metals acquisitions. And those nickel sulphide intercepts that I just referenced are only a kilometer from where they are mining, so that is potentially relevant. Readers should note that Sibanye operates a smelter in the district as well, which in broad terms would be a good fit with Stillwater West. Robert Friedland of Ivanhoe Mines has also stated that they are looking for battery metal projects in the U.S., and that is music to our ears.

Maurice Jackson: I would be remiss if I didn’t ask a two-part question, sir, when can shareholders expect a maiden resource to be published and where do you think it will put you in relation to your peers?

Michael Rowley: The modeling work is proceeding nicely on the three most advanced zones—Chrome Mountain, Camp, HGR—and we are targeting release middle of this year. And we are excited for that—it’s a major graduation point for a junior exploration company, and one that adds a lot of value and credibility.

In terms of peers, it’s hard to find a direct fit and of course we do not have published numbers to talk about yet. In broad terms, looking at our current peers, we offer the PGEs that, say, Generation Mining, but we have Ni that they do not have. We also own our asset 100% as opposed to their current 80%. Another peer might be Canada Nickel, but again it’s not a direct comparison as they have limited PGEs. If you could blend those two in terms of geology, then you’re getting somewhere closer to that Platreef model of an Ivanhoe.

Maurice Jackson: Switching gears, Group Ten has a portfolio of projects, any of which could be a flagship for an explorer. Can you update us on your Black Lake-Drayton project in Ontario, Canada?

Michael Rowley: The Black Lake Drayton Project is a getting a lot attention lately. We have parties under confidentiality agreements. It’s a project that adjoins Treasury Metals, which has consolidated the other two projects in the district. Treasury Metals has 3 million ounces and a permit to build a mill. They are also have good infrastructure. Group Ten owns 100% the remaining part of the district. We are of the impression that it is a matter of time before someone consolidates the entire district and takes it into production. The sale of the Black Lake Drayton Project would provide us with some value that is not recognized on our balance at the present, it’s an impressive asset. And in the Yukon we have another district scale asset the Kluane Project, which also receiving attention as a merger and acquisition candidate.

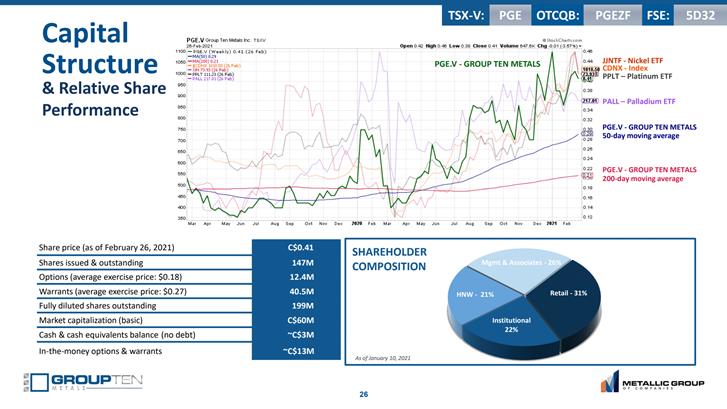

Maurice Jackson: Let’s take a look at the capital structure for Group Ten Metals:

Maurice Jackson: Last question, what did I forget to ask?

Michael Rowley: I think that one thing that gets lost on the Stillwater West is the enormous scale. We have kilometer scale targets. Therefore, strategy becomes important. And that’s why we are focused on the three most advanced areas and even the additional two less advanced, which rounds that out to five targets. We have to focus on tabling the resources on the advanced three, and get to work to expand them. The IP survey is indicating that we are on track and have a lot potential upside. Therefore, we need to focus on what we know and advance the early stage targets in meantime, but remained committed to staying focused on the prize.

Maurice Jackson: Mr. Rowley, for someone listening who wants to get more information on Group Ten Metals, please share the contact details.

Michael Rowley: www.grouptenmetals.com.

Maurice Jackson: Mr. Rowley, it’s been a delight to speak with you today, and wish you and Group Ten Metals the absolute best, sir.

And as a reminder, I am licensed representative to buy and sell precious metals through Miles Franklin Precious Metals Investments, where have several options to expand your precious metals portfolio, from physical delivery of gold, silver, platinum, palladium and rhodium, to offshore depositories and precious metals IRAs. Give me a call at 855.505.1900 or you may email: Maurice@MilesFranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide Mining Insights and Bullion Sales, subscription is free.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Group Ten Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Group Ten Metals is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Group Ten Metals and Generation Mining. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Group Ten Metals, a company mentioned in this article.

Disclosures for Proven and Probable: Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: PGE:TSX.V; PGEZF:OTCQB; 5D32:FSE,

)

The Russian Finance Ministry has given the green light for the Russian National Wealth fund to diversify and invest in gold and other precious metals. According to a report by RT, this is part of a broader move to de-dollarize the wealth fund. The National Wealth Fund falls under the direction of the Russian Finance Ministry. […]

The post Blog first appeared on SchiffGold.

Jerome Powell and Janet Yellen testified jointly before the US Senate last week. Inflation was a big topic of conversation. The Fed chair continued to insist that the central can fight inflation if necessary, but that it really isn’t a problem we need to worry about right now. In his podcast, Peter Schiff said the […]

The post Blog first appeared on SchiffGold.