Gruyere attains commercial production

The U.S. Treasury Department announced Monday that China is no longer on a list of countries deemed to be “currency manipulators.” The timing was awfully convenient, coming just ahead of an expected Phase One trade deal between the two powers.

Nobody actually believes China has stopped manipulating the value of its yuan versus the U.S. dollar.

But the Trump administration is apparently willing to accept a certain degree of currency rigging in exchange for other concessions on trade.

It’s not as if the U.S. government has a stellar record when it comes to heeding principles of free and fair currency markets. It (through the Exchange Stabilization Fund and other vehicles) is constantly trying to manage the value of the dollar versus the currencies of trading partners, too.

It’s not as if equity markets, interest rate markets, and precious metals futures markets are free from manipulation, either. Price rigging schemes of various sorts – ranging from small-scale “spoofing” to large-scale suppression – occur practically around the clock.

Occasionally, there are prosecutions.

Last year, for example, the U.S. Department of Justice criminally charged several JPMorgan traders for fraud and racketeering in a conspiracy to rig precious metals markets.

Yet previous criminal investigations by federal regulators have often gone nowhere, with evidence of manipulation inexplicably disregarded.

Congressman Alex Mooney from West Virginia has asked Attorney General Bill Barr to look into price rigging, particularly within the silver market which is regularly subjected to artificial volatility induced by large institutional traders (i.e., bullion banks) with outsized positions.

The manipulation may be occurring on an even larger scale if the Federal Reserve or the U.S. government or its agents are involved. It is widely suspected but difficult to prove since the Fed operates in secret and the government isn’t keen on investigating itself.

Regardless of what the motivation may be, it is an objective fact that the supply of futures contracts surged last year in both gold and silver markets.

Open interest in gold was up over 70%. Put another way, the supply of paper gold rose by 70% or 33 million new ounces – absorbing much of the growing demand for the metal and preventing prices from rising even more than they did.

Even as vastly more contracts for gold exchanged hands, the amount of physical gold available for delivery in vaults barely budged. Thus, while gold itself is scarce and highly sought after, futures contracts can seemingly be generated in unlimited quantities to divert buyers away from the real thing.

According to Dave Kranzler of Investment Research Dynamics, “Since the introduction of paper gold, the Comex – gold and silver trading – has evolved into what can only be described as a caricature of a ‘market.’ The open interest in gold contracts is nearly 10 times the amount of physical gold reportedly held in Comex vaults. It’s 60 times the amount of ‘registered’ gold, the gold designated as available for delivery.”

Some gold bugs expect an eventual COMEX default – a force majeure, a run on the bank for physical metal that sends prices explosively higher. While such a scenario is possible, it is not necessarily probable.

The powers that be have been adept at playing the paper charade to their advantage for decades. They may be unscrupulous or even evil, but they are not dumb.

The campaign popularized briefly a few years ago of “Buy Silver, Crash JPMorgan” was based on a misunderstanding of the mega banks’ short exposure to silver.

The banks aren’t making an enormous long-term bet that silver will fall and risking everything on it. They are in the markets with complex hedges and trading algorithms that can generate micro-profits on minute-by-minute moves up or down.

Yes, the banks can suppress rallies and trigger sell-offs by going heavily short – even selling more ounces than they could possibly deliver. But the reality is, they will never have to settle their contracts in physical metal.

Financial institutions are playing in a cash market tied to precious metals, not the actual physical market.

The best physical investors can hope for is that the cash/paper markets for gold and silver lose credibility and diverge from real-world pricing for industrial users and wholesale bullion buyers.

Or, alternatively the powers-that-be could avoid such an embarrassment by standing aside while prices reset higher, and then choose a new level at which to try to hold the line.

Ultimately, however, the supply of physical precious metals cannot be manipulated into existence any bank or government. Either it’s real and it’s available or it isn’t.

The key to defeating market riggers – or at least rendering their paper shenanigans irrelevant – is for buyers to avoid derivative markets and insist on obtaining physical metal from physical sources.

Source: Clive Maund for Streetwise Reports 01/13/2020

Technical analyst Clive Maund charts silver’s progress in comparison to gold’s following recent world events.

Silver’s recent rally looks diminutive and stunted compared to gold’s, but that’s normal at this early stage of a new bull market, when silver typically underperforms gold due to investors being risk-averse and silver being perceived as more risky and volatile than gold.

Nevertheless, as we can see on its latest 6-month chart, silver did manage to break out of its reactive downtrend in force from early September. Last week, at the time Iran lobbed missiles at U.S. bases in Iraq, it had a go at breaking above its late September highs. But it was not up to the task and fell back, putting in a reversal candle on big volume, which suggests that it probably has further to fall short term—perhaps back to the upper boundary of the downtrend channel shown. But with the overall tenor of this chart positive, it should then turn higher again.

Wheeling out the 10-year chart once more, which gives us the big picture, we see that, although so far looking much more restrained than gold, silver appears to be ascending away from the second low of a giant double-bottom pattern. The advance out of the lows of last summer was on good volume, which has driven both volume indicators quite strongly higher. This is bullish and marks a breakout drive out of the base pattern, with a completed breakout being signaled by silver breaking above the resistance, approaching and at $22/ounce. A break above this level will usher in a period of much more dynamic advance.

The latest COT chart shows that Commercial short and Large Spec long positions are still at fairly extreme levels, which makes more corrective action over the near term likely.

Conclusion

Although last week’s reversal candle and the current rather extreme COT readings make short-term weakness likely, perhaps to the upper boundary of the fall downtrend, the overall picture for silver is favorable, with it readying to break out of a giant, 5-year plus base pattern to follow gold higher. Marked acceleration is likely to follow a breakout above the $22 level.

Article originally published on CliveMaund.com on Sunday, Jan. 12, 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

Source: Clive Maund for Streetwise Reports 01/13/2020

Technical analyst Clive Maund examines the effects of recent geopolitical events on the precious metals markets.

It has been a week of surprises since the last updates were posted. First, I had not expected Iran to retaliate following the murder of its top general by a U.S. drone—but it did, despite the risks, as it was politically necessary to assuage the extreme anger of its population who demanded revenge.

The next surprise was that Israel and the U.S. did not use this retaliation as an excuse to bomb Iran back to the Stone Age, which is what they really want to do. As we know, the long-term goal of Israel and the U.S. is to subjugate Iran, and they will not stop until they attain this goal.

And so it goes on. It appears that there was a bit of theater involved in Iran’s retaliation, as it clandestinely signaled its intentions which allowed U.S. forces to get out of harm’s way. Perhaps U.S. forces did not then launch a blitzkrieg out of consideration for this courtesy.

Regardless of the muddled and unpredictable fundamental situation, which included the accidental downing of a passenger plane by Iranian defensive missile batteries, the charts allowed us to make a reasonably accurate prediction regarding what was likely to happen to the gold price. The call for a near-term top in the precious metals (PM) sector made on the site on Monday looked incorrect the following evening, when gold suddenly surged about $35 on news of the retaliatory Iranian missile strike. But when it later became apparent that there were, strangely, no U.S. troop casualties and no further action against Iran, gold and silver reversed dramatically and dropped quite hard, as the tension then looked set to ease, at least over the short-term.

Technically what happened is that gold pushed quite deep into heavy overhead resistance, becoming very overbought at a time when COTs were showing extreme readings, and was thus vulnerable to a sudden reversal. The action around this time illustrates an important point, which is that when gold rises due to sudden geopolitical developments, the gains tend not to stick.

What really matters, and is the big driver for gold at this time, is the insane monetary expansion that is going on, which is being undertaken in a desperate attempt to postpone the systemic implosion that is baked in for as long as possible. As we have already observed in these updates in recent weeks, gold is already in a raging bull market against a wide variety of currencies, and it won’t be all that long before it’s in a raging bull market against the dollar too, as the Fed sets the stage for hyperinflation.

There are two big and compelling reasons for the U.S. government to tank the dollar. One is that it makes U.S. exporters more competitive, and the other is that it can use the mechanism of inflation to wipe clean its colossal debts by paying them off in devalued coin, printing vast amounts of money to pay them off, and in the process legally swindling the foolish creditors out of their dues.

This is precisely what the Weimar Republic in Germany did in 1923 to eliminate the unfair reparations imposed by the Treaty of Versailles, which were unfair also because Germany didn’t start the First World War—it was tricked into it by the Allies, because the British Empire was scared of Germany’s rising industrial and military might and wanted to destroy it. . .100-plus years of propaganda lies about Germany being responsible for the First World War notwithstanding.

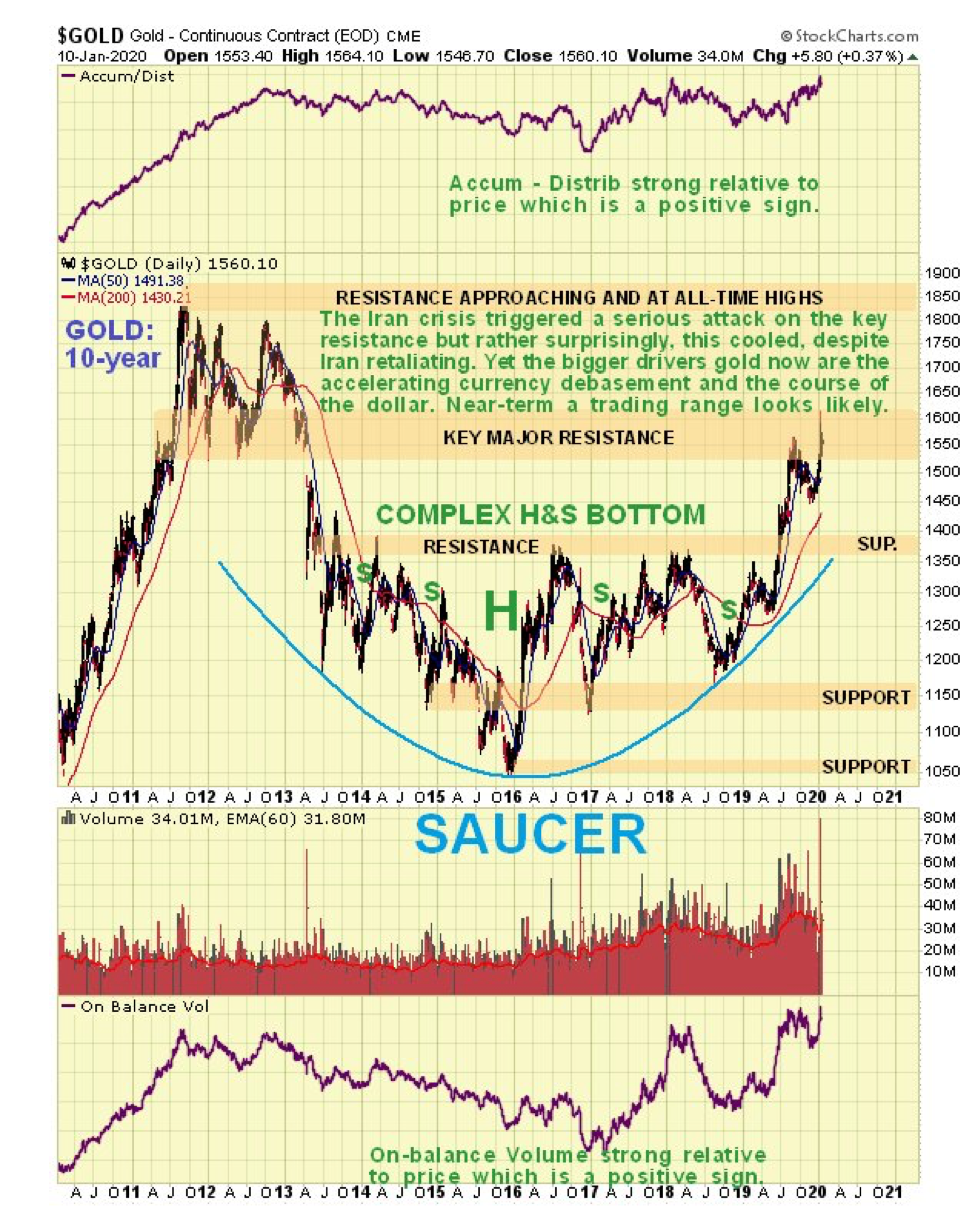

We’ll look at the dollar a little later. First we will review gold’s charts, starting with the 10-year chart.

On the 10-year chart we see that gold is now a bull market, even against the dollar, and is currently challenging the heavy resistance arising from the 2011–2013 top area. The second attack on this resistance in the space of few months got further because of the Iran crisis. If this cools any more short term, it will probably lead to gold settling into a trading range before it mounts a more successful attack on this resistance.

A point to note here is that while the resistance up to the 2011 highs, in the $1,800 area, looks like a major obstacle, it’s not such a big deal as many think, given the rate at which the dollar is now being debased.

This week it’s worth also taking a quick look at a 3-year chart for added perspective. This chart shows us that since the bull market started in midsummer, we have seen three sharp run-ups punctuated by two bull flags. While the second of these flags targets the $1,800 area, we have to factor in that gold now has much more overhanging supply to contend with than on the first run-up. This, coupled with quite extreme COT readings, inclines to the view that this will need to be worked off. Hence, the interpretation that it will probably need to consolidate for a while before it makes significant further progress—although it obviously won’t if the U.S. starts a serious bombing campaign against Iran. The Fed’s increasingly manic money printing will eventually drive it higher, of course.

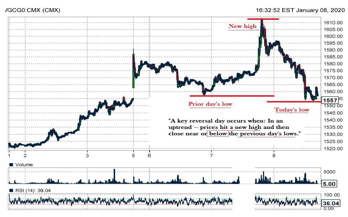

On the 6-month chart we can see the interesting price action around the Iran crisis over the past week or so. A bearish “shooting star” appeared on the chart last Monday, which we took as a sign that gold was forming a short-term top. But then, overnight on Jan. 7–8, it surged briefly above $1,610—when Iran lobbed missiles at U.S. bases in Iraq—which had many concluding, not unnaturally that this would trigger a major Israel–US bombing campaign.

When it became apparent that there were no casualties from the Iranian attack and no U.S. counter-strike, tensions quickly cooled, and gold lost ground fast the next day, putting in a big high-volume reversal candle, approximating to another shooting star. Normally such action is followed by a retreat, at least for a while, and some stocks, like silver stock Coeur Mining Inc. (CDE:NYSE), which we ditched a while ago, got clobbered. This is why gold is expected to settle down into a trading range for a while, before mounting another attack on the resistance.

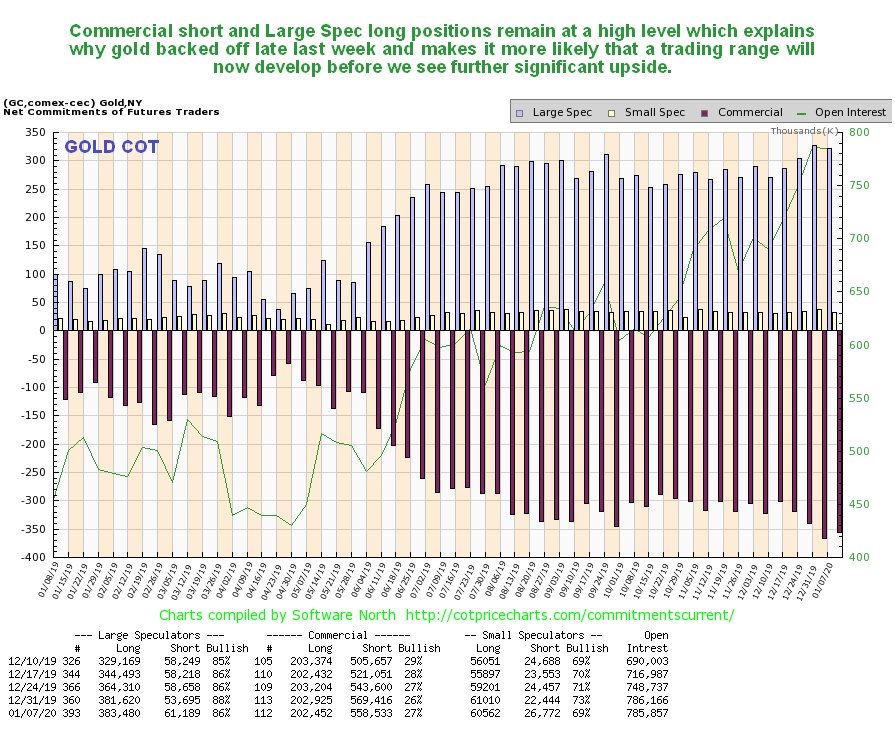

Another factor suggesting that gold will consolidate/react back for a while is the latest COT, which shows still very high Commercial short and Large Spec long positions.

What about precious metals stocks? The latest 10-year chart for GDX shows that we still have most everything to look forward to. Despite the rally from the middle of last year, it still hasn’t broken out of the giant complex head-and-shoulders bottom that has formed since way back early in 2013. A breakout above the nearby resistance should lead to a rapid ascent to the next resistance level at the underside of a large top pattern, and thereafter it will have to work its way through continuing resistance up to its highs. The strength of the volume indicators in the recent past are a sign that it “means business.”

Now we turn our attention to the dollar, which is looking increasingly frail, as we can see on the latest 6-year chart for the dollar index. It is rolling over beneath resistance and appears to be breaking down from the 16-month gentle uptrend shown.

This is, of course, the main reason that gold, shown at the top of this chart, has been breaking higher again. If it fails to hold up here it could be targeting the lower boundary of the bullhorn pattern, which would involve a heavy drop from the current level that would “light a fire” under the precious metals, and many other commodities, notably copper.

A chart that really gives the game away and calls time on the dollar is the 6-year chart for dollar proxy UUP. As we can see, unlike the dollar index itself, this has risen up to the upper boundary of its giant bullhorn pattern, and appears to be on the point of breaking down. Its accumulation line has been very weak. This chart suggests that the dollar could be in for a very rough ride before long, which is hardly surprising considering the lengths to which the Federal Reserve is going to destroy it. While other countries and trading blocs, most notably the European Union (EU), are making a valiant attempt to destroy their own currencies, they will be hard put to keep up with the Fed.

And now, for the benefit of anyone who still doubts that gold is in a bull market, I have pleasure in presenting the following 6-year chart for gold against the Japanese yen.

Still think gold might be in bear market? No—didn’t think you would.

It’s always good to end on a positive note, and we’ll do so by looking at a stock with a supremely bullish setup, which we happened to buy right before it broke out about a week ago. It may well have been our buying that triggered the breakout.

Although you can never be 100% sure of anything with these smaller issues, I am sure that you will agree with me that this chart is not suggestive of a sector that is going anywhere but up.

Conclusion

Although last week’s reversal candle and the current rather extreme COT structure mean that gold may react back more near term, the overall picture is strongly bullish, which is hardly surprising as the fiat money system is fast approaching its nemesis, with the line of least resistance leading to hyperinflation. Our general approach, therefore, is not to sell PM sector investments, except on a case-by-case basis where they become critically overbought, but instead to buy or add to positions on dips.

Article originally published on CliveMaund.com on Sunday, Jan. 12, 2020.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Metallic Minerals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Metallic Minerals. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Metallic Minerals and Coeur Mining, companies mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

( Companies Mentioned: MMG:TSX.V; MMNGF:OTCMKTS,

)

Visionary Vicissitude

Source: Michael Ballanger for Streetwise Reports 01/13/2020

Sector expert Michael Ballanger offers his insights into the precious metals markets as 2020 begins.

It was one of those days that all sexagenarians loathe; you have to go to the doctor, and whether it’s the GP (general practitioner) or the dentist or the proctologist, nothing reminds you more rapidly of your advancing age than going to the optometrist.

Now, many of you would say that your annual prostate exam or a root canal or bloodwork would be the dreaded of all medical dreads, but for me, it is having the 50-something eye lady remind me that two years ago (when I last mustered up the courage to see her), my long vision was great and my reading vision required only 150-magnification “cheaters.” Smiling at me as if I just ran the New York Marathon, she then proceeds to tell me that I now require “progressive lenses” and 325-mag reading glasses.

Staring at her with slack-jawed miasma, I tell her that I can “manage just fine” and that since I am constantly losing my Dollar Store reading glasses, I really don’t feel an overwhelming desire to walk around with $900 glasses that will make me feel “like a new and younger man!” I won’t feel very young if I find them in a snowbank after running over them with the Toro Supercharger that does zero-to-thirty in less than sixty seconds and blows snow fifty feet in the air.

Then off I went to the dentist for the afternoon ordeal, only to have this millennial mouth-breather dental technician constantly scold me for “not flossing enough” as she takes her Black & Decker plaque remover to my gums.

Then the Generation X Chinese dentist looks into my mouth with his forehead lamp blinding me and tells me that an “old filling” (from the 1900s, he is sure) has come loose and he will need to clean it up. So, driving home to the site of lovely Lake Scugog, I was astonished that a policeman (who shaves once a month) didn’t pull me over and yank my license for the “unsafe operation of a vehicle” because I can’t read the bottom line of the eye chart or because my root canal from 1937 is failing.

All in all, this was just “one of those days.”

However, this week has played out exactly as I predicted, instructed and rued, as the precious metals succumbed to the weight brought to bear by three events:

· A rampaging stock market

· Severely overbought conditions in gold and silver, and

· 90% bullish consensus for the metals

Now, I was fearful, albeit briefly, that the assassination of Iranian General Qasem Soleimani by a U.S. drone strike might have kicked the precious metals into the same short squeeze moonshot—as we had back in June where we stayed overbought for most of the month. But alas, as I said on Monday, geopolitical events always get faded (sold), and just as stocks failed to follow through to the downside after the Sunday evening massacre, gold reacted identically and closed the week out about $66 off the wee-hours peak of US$1,613/ounce from last Monday morning.

I raised 30% cash in the portfolio at or near the highs seen Friday and Monday, and have advised all subscribers to refrain from buying any of the names in the GGMA portfolio until things settle down, probably next week, but surely by month-end.

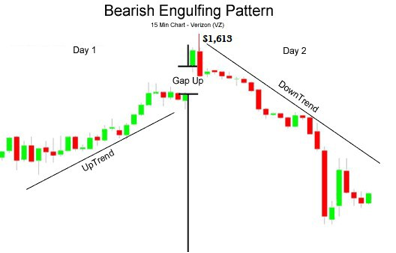

The daily gold chart for the past month shows a really ugly “bearish engulfing” candle that surely, albeit in retrospect, serves as the apex for the latest advance. While it is certainly a formidable short-term top, it by no means has changed my 2020 forecast for substantially higher prices for gold and silver.

The key to outperformance, for me at least, seems to lie in “fading blind optimism” and “buying despair” and, of course, looking under my desk to see if Fido is content. If, God forbid, he is to be found under the tool shed or off his food, then surely a bullion bank takedown is either pending or upon us.

Needless to say, Fido is not a happy puppy as he appears to be getting totally intolerant of the constant shenanigans in our precious metals markets, and also of the absurdity of this constant Twitter “cheerleading” by “the Donald.”

The moves I made to raise cash in the two miner exchange-traded funds, GDX and GDXJ, in addition to taking off all the leveraged positions (futures, options, ETFs) allows me to begin to target a re-entry point for those same positions. The danger lies in trying to get “too cute” trading these things, because in a true bull market such as this one, you make one false move and suddenly they are 3% higher and you are unable to get back on board. I cannot tell you all how many times that has happened to me, so to avoid this, I scale in and I scale out, taking 25–50% initial positions and then adding as they go the right way.

On Friday morning Jan. 10, we are getting a nice precious metal rebound off the lows thanks to a disappointing non-farm-payroll report (the “unemployment” report), where the weak number plus negative revisions were shrugged off by the rampaging equities bull.

The chart of the NASDAQ shown above is a screaming “sell” with RSI (relative strength index) in the high 70s and at a level where it has topped out numerous times in the last three years. However, we are in an election year and I am so cynical of the collusion and intervention and manipulation that I just cannot find the courage to short this massively overvalued market. It is like the Ontario housing market; people keep leveraging up to own million-dollar houses on 90-foot lots with 1,500 square feet of living space that went for $200,000 ten years ago. It’s just another bank-created bubble, and part of this enormous global wave of credit that benefits only the financial crowd and those who have learned to game the system.

Trust me when I tell you that it will not end well, but also keep in mind that these cretins have kept the charade intact for infinitely longer than I (or Ray Dalio or Stanley Druckenmiller or Jeffrey Gundlach) might ever have dreamed. I hate to use this well-worn phrase but it is certainly true that “markets can remain irrational much longer than you or I can remain solvent.” This is the reason I use stop-losses and cut-losses quickly, no matter whether my reasoning is sound or not. Rigged markets do that to you, so never forget it.

Here are a few charts to give you an idea of where my head is at in terms of buying back or initiating positions in the various names in the Forecast Issue. (Not all but a few. . .)

My inbox is now chock-full o’ queries as to whether last week’s rally constitutes a bottom for the Gold Miner ETF’s and the answer is categorically “NO!” When you get an outside reversal day like we had on Monday, you don’t usually have a tradeable bottom until at least a couple of weeks later. You can see from the chart shown below how it unfolded.

Here is the textbook definition of what grabbed gold by the throat on Monday. It is a powerful technical signal and while of course there is no certainty that we are entering a prolonged downtrend, I include it here as a way of accentuating the need for patience.

Since many of you are new subscribers, I want you to accumulate the GGMA portfolio (should that be your intention) at optimum prices and hopefully into oversold (as opposed to overbought) conditions, with RSI sub-30.

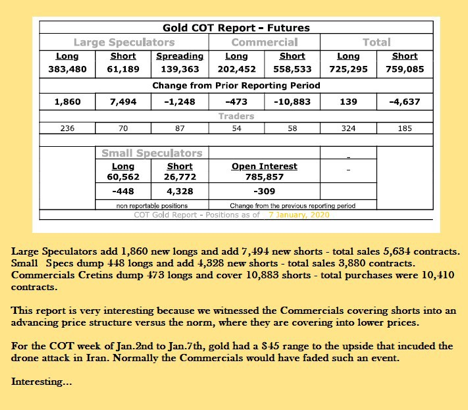

COT Report

The COT, or Commitment of Traders, report covers activity on the Crimex futures exchange and the interplay between “Commercials” (large bullion banks acting for miners and metal fabricators, as well as their own prop accounts), “Large Speculators” (large commodity funds run by CTAs [commodity trading advisors], hedge funds, and locals), and “Small Speculators” (small retail investors usually on the wrong end of most major trends). It covers a Tuesday-to-Tuesday reporting period and is released on Friday afternoons at around 3:30 p.m. It is far more predictive during bear market periods, as liquidity is sparse and the big banks can move the market wherever they wish.

The Commercials are the arm of the U.S. Treasury and the major central banks, and for this reason, you must be very attentive to their positioning. However, the period of June to September had the Commercials heavily short during the entire rise of US$250 per ounce. Selling or getting short metals and miners alongside the Commercials proved a faulty strategy for more than a few investors. (Even I lightened up on the leveraged ETFs prematurely.)

The COT report for the week ended Jan. 7 means very little, but suffice it to say that, at an aggregate short position of 356,081 contracts held by Commercial traders, it coincides with major tops in past years. It is one reason why I am “cautious,” not “bearish,” on the metals and miners going into this first few weeks of the New Year. Another week of sideways to down action and I will probably begin to accumulate.

So now I’m going to put some eyedrops in my eyes and some oil of cloves on my loose filling, guzzle some Metamucil, pop a few anti-arthritis pills and try to make it to Monday when I’m sure some poor defenseless fool will remind me of just how really ancient I have become.

Billy clubs and hobnail boots are great, ain’t they?

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver. My company has a financial relationship with the following companies referred to in this article: Aftermath Silver. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aftermath Silver. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Aftermath.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver, a company mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: AAG:TSX.V,

)

US Foreign Policy, Oil and the Dollar

The war drums have quieted for the time being. But while the threat of a hot war seems to have diminished, economic warfare continues. President Trump announced another round of economic sanctions on Iran. We have written extensively how about how the US weaponizes the dollar and uses it as a foreign policy tool. This […]

The post US Foreign Policy, Oil and the Dollar appeared first on SchiffGold.com.