Bob Moriarty: This Time It’s Different

Source: Maurice Jackson for Streetwise Reports 05/18/2020

In this conversation, Bob Moriarty of 321gold and Maurice Jackson of Proven and Probable discuss the coronavirus, the stock market, what lies ahead for gold and silver, and junior mining companies with potential.

Maurice Jackson: Joining us for a conversation is Bob Moriarty, the world-renowned, bestselling author and founder of the websites 321gold and 321energy.com.

Bob Moriarty: Hi, Maurice. It’s good to talk to you.

Maurice Jackson: Always a pleasure, sir. I was revisiting our last interview entitled, “He Nailed It,” where you discuss virtually all that’s come to fruition in the last 60 days. And I have to give credit where credit is due, sir, you absolutely nailed it, which is precisely why we’re delighted to speak to you today.

Bob, let’s begin with a phrase that you’ve cautioned readers about: when a financial guru states, “This time, it’s different.” As we look at the world today, is it different this time?

Bob Moriarty: Absolutely.

Maurice Jackson: Bob, in what regards is it different?

Bob Moriarty: We have the stock market hitting new highs, and we have 30 or 40 million Americans out of work. And if that isn’t different, I don’t know what is.

Maurice Jackson: Beginning with COVID-19, what has your attention regarding the virus that many people may be overlooking and need to really consider?

Bob Moriarty: Everybody’s lying and has an agenda. You’re not being told the truth by anybody, and there are some fairly simple questions that anyone can ask and they can come up with conclusions for themselves. That’s one of the points that I try to make in my books: It was to teach people how to think for themselves. So, I’m going to put it to you. Do you believe the United States are reporting the number of deaths in the United States? Do you believe that’s accurate information? Too high or too low?

Maurice Jackson: I don’t believe it’s accurate information. I believe they may be tying other deaths into that number. So I believe maybe that the numbers probably would be lower.

Bob Moriarty: So let me ask another question that’ll make it a lot clearer. The population of the United States is 4% of the world’s population. If the numbers that are being reported are accurate, is there any way the United States could represent 33% of the cases?

Maurice Jackson: No, that doesn’t seem logical to me.

Bob Moriarty: Absolutely not. Couldn’t possibly happen. Here’s what’s happening. Even Dr. Deborah Birx admitted what’s true. You can die with the coronavirus or you can die of the coronavirus. If you die with the coronavirus and it’s written down as pneumonia, the hospital gets $13,000. If you die of the coronavirus, then obviously we cured your pneumonia, but you just happened to die, it was the virus. The hospital gets $39,000. They have a financial incentive to over-report the numbers. The CDC [Centers for Disease Control and Prevention] came out with some statistics showing the difference between dying of the virus and dying with the virus, and the numbers are overstated by about 500%.

Maurice Jackson: That’s truly a shame that there’s that financial incentive in that regard. When you hear of normalcy, do you foresee us being able to return to a pre-COVID-19 way of life? Or is this the new normal?

Bob Moriarty: No, we will be able to return it, return to a pre-COVID-19.

Maurice Jackson: When do you foresee that coming?

Bob Moriarty: Ten years.

Maurice Jackson: Ten years?

Bob Moriarty: I always try to justify my opinion with facts. The stock market hit a high in September of 1929. I’m sure you’re aware of that. When did it get back to the same number that it was in September of 1929? How long did it take?

Maurice Jackson: The 1960s, or am I completely wrong here?

Bob Moriarty: You’re pretty close. It was 1954.

So there’s two issues you should be talking about. Now you’re addressing the COVID-19 issue or the coronavirus issue. The depression is far more important—the depression that you and I were talking about a year ago, that I said was going to start in October, and we talked about in January (interview here), when I reiterated that we were going to go into a depression. Everybody was going to get hurt. It’s here. If we come out of it inside of 15 years, it will be pretty remarkable.

Maurice Jackson: You and I had a discussion prior to this interview and you inquired about my background on classical education, which I didn’t have any, but to my amazement, based off of our discussion, you referenced someone named Cassandra. Can you fill us in on that?

Bob Moriarty: One has to go back to the Iliad and the Odyssey, Greek mythology. Cassandra was the daughter of King Priam. She was gifted with the ability to predict the future. However, she was cursed in that nobody believed her. And strange enough—and you and I were talking about this—I make a lot of predictions that people think I’m crazy, and a lot more of them come true than people want to admit. But I’m looking at a consensus, and when everybody says the stock market’s going to go up, I know that it’s going to go down. And when everybody says gold is going to go down, I know that it’s going to go up. I pay great attention to natures of psychology and consensus. And if you do that, you’ll be right a lot of the time.

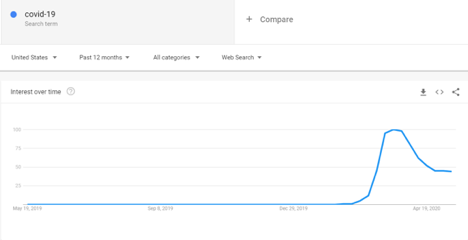

Maurice Jackson: Speaking of psychology, I have a chart before us from Google Trends that my son, Brayden, and I were reviewing. And we noticed that when we put it in the search term COVID-19, it spiked to 100 in March and it has fallen off dramatically. Now, although he’s nine, he drew a conclusion that people were getting relaxed and there was a greater potential in his view for more infections. Now, I hope we’re incorrect. Sir, you’re a big advocate of using Google Trends. What does this chart indicate to Bob Moriarty?

Bob Moriarty: People are bored.

Maurice Jackson: And if they’re bored, what kind of situation does that really create for us?

Bob Moriarty: Well, we don’t really know. And your son is absolutely correct that having a recurrence of the virus is certainly a possibility.

But there are three issues that we need to think about, one issue being how dangerous is the virus? The secondary issue [is] how dangerous is the depression that we’re in? And the third issue that, quite bluntly I absolutely missed, is being quarantined for a period of time, you eventually get to a point you start going stir crazy and you can absolutely see it. There has been a lot of social unrest in the last month and quite bluntly it’s because everybody is bored silly being at home. They want to do something else.

So it’s certainly possible that there’s a recurrence in the virus. My big problem with the virus is, it’s been going on for five months. We still don’t know how deadly it is. We don’t know what the cures are for it. They’ve got all these agendas. You have any idea what the average age of the people in Italy who died was?

Maurice Jackson: I’m going to assume, not knowing that number, in the 60s?

Bob Moriarty: Seventy-nine and a half.

Maurice Jackson: Well that’s—I mean, you’re close to your expiration date and I hate to say it in that regard, but I mean, there’s a number of factors that go into that number of mortality.

Bob Moriarty: When you’re 79.5 years old, don’t go to the store and buy green bananas.

Maurice Jackson: Might be a good way to put it. Well, let’s discuss the stock market. And again, it fits into the narrative of the depression. The Dow hit an air pocket in March and it descended fast, and last month it’s been trying to climb again. Is this the right time for investors to get back into general equities?

Bob Moriarty: Anybody who invests in the general stock market in the next 15 years is begging to give their money away. There’s only one safe haven.

Maurice Jackson: And we’ll get to that here shortly. So let me ask you this, coincidentally. If general equities are not the place to be, how about the contrarian sector of the stock market—resource stocks and, in particular, junior mining companies. Is this a place where someone should have some exposure?

Bob Moriarty: Yes.

Maurice Jackson: Speaking of the junior mining companies, are there any that have your attention at the moment, and why?

Bob Moriarty: A whole bunch of them. First of all, commodities in general are at the lowest price they’ve been in 55 years relative to the stock market. So commodities—all of them, soy beans, wheat, corn, copper, lead, zinc, gold, silver, platinum, palladium—everything is cheap in relative terms. And even in the depression, you still need commodities.

But the real key is, for the mining stocks, it is such a small door that when people try to fit through it, it’s going to get very crowded. So overall, I like the market. You had mentioned some stocks, tell me which one you’d like me to cover.

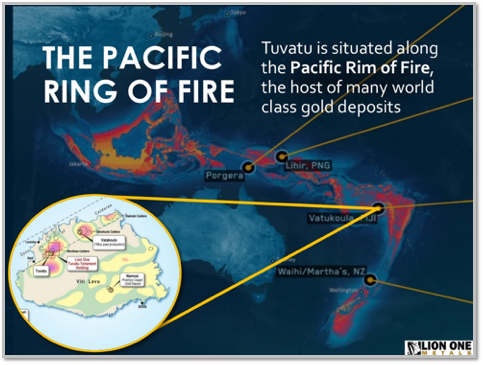

Maurice Jackson: Let’s begin with Lion One Metals Ltd. (LIO:TSX.V; LOMLF:OTCQX).

Bob Moriarty: Lion One is a junior that has 100% ownership of the only alkaline deposit in the entire world owned by a junior, the Tuvatu Gold Project (3D Vrify). It’s on the Ring of Fire in Fiji. The Tuvatu is approximately 20 kilometers away from a mine that has produced 7 million ounces of gold. LIO is currently drilling, and assay results should be coming in from Australia soon. Lion One Metals has a number of holes that are in for assaying.

This stock has all the potential of being a home run, and they currently undervalued in my opinion. I think people will do very, very well owning Lion One. If gold and silver do what Lawrence Lepard says I agree: The production stories and pre-production stories are going to be the best investments you could make. Now, I’ve talked in the past about stocks that have tenfold potential. Lepard and I both believe that gold and silver, they go into hyper-inflation, so there are a lot of stocks that you could be buying mow that have hundred-fold potential.

Maurice Jackson: How about Hannan Metals Ltd. (HAN:TSX.V; HANNF:OTCPK)?

Bob Moriarty: Hannan Metals is down in Peru, and they have an unusual form of silver-copper sedimentary deposit. I think it’s going to be a giant district—I mean literally hundreds of kilometers—and Hannan is very cheap. I think they’re $0.20 a share. They have a CA$14 million market cap. Quinton Hennigh, who is my best friend, is an advisor to the company. I own shares. I think it’s a great company. I think it will do very well.

Maurice Jackson: Speaking of Dr. Hennigh, he’s also affiliated with Lion One Metals, the aforementioned company, and speaking of his companies, how about Novo Resources Corp. (NVO:TSX.V; NSRPF:OTCQX) and Irving Resources Inc. (IRV:CSE; IRVRF:OTCBB)?

Bob Moriarty: They’re moving right along. Quinton has been very quiet about Novo Resources. We know that he’s trying to do a deal on the Millennium Mill. Millennium was very poorly run, very poorly managed. I wrote about that years ago and said so. They went into bankruptcy. Their main creditor has taken control of the mill. It costs them $30,000 a day to keep the electricity turned on. So I think there’s a lot of incentive for the creditor to do a deal with Novo, and it would turn Novo into a producer, literally immediately.

Irving Resources is drilling. They are drilling at the Omu Project and have sent the core off for assaying, which is now en route to Canada. Akiko Levinson is doing a remarkable job there. And I think it’s going to be another home run.

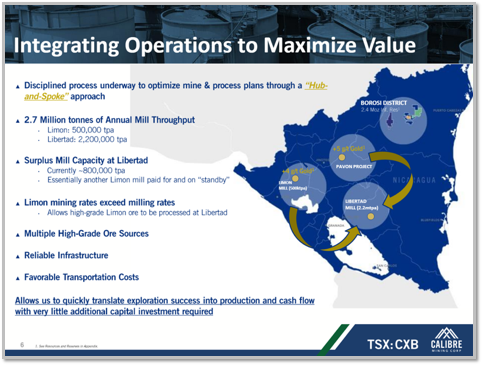

Maurice Jackson: We were just in Peru. Let’s go to Nicaragua. How about Calibre Mining Corp. (CXB:TSX.V; CXBMF:OTC.MKTS)?

Bob Moriarty: Calibre is in production. They’ve picked up two mines from B2Gold Corp. (BTG:NYSE; BTO:TSX; B2G:NSX), which was a fantastic acquisition. They have really good management. B2 Gold released the two newly acquired project to Calibre as they were expanding their portfolio and efforts in the Far East and Africa, so they didn’t need their Nicaragua assets. Calibre’s in production, and they’re absolutely going to get enormous benefit from the price of oil going down by two-thirds.

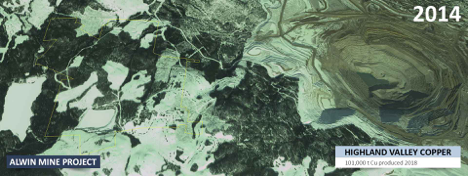

Maurice Jackson: One more. How about GSP Resource Corp. (GSPR:TSX.V)?

Bob Moriarty: GSP Resources is a really interesting stock. I own some. I participated in a placement, and their advertisers. When I looked at it, I couldn’t quite believe the numbers. The Alwin Project is next to the Highland Valley copper mine in central British Columbia, and Highland Valley is drilling toward the Alwin Project, and they have very similar geochemical signatures. I believe that Highland Valley will eventually do a deal with them. GSP Resources has only have 12 million shares outstanding, with a market cap of $2 million. And in Vancouver, if you’ve got a secretary and a three-line phone, you should be worth $5 million.

Maurice Jackson: All right, sticking with investment opportunities, let’s discuss the physical precious metals. Are you surprised at the precious metals price response in the last 60 days?

Bob Moriarty: No. I’ve been saying that same thing for years. Why would I be surprised? This is what I said was going to happen.

Maurice Jackson: Well, I think what a lot of investors were looking at, with all the printing and devaluation of the currency, the immediate response was silver should jump, gold should jump. And gold has actually made a little move, but silver has kind of remained stagnant. Which metals have your attention, at least, and why right now?

Bob Moriarty: In 5,000 years, the highest the gold-silver ratio ever got to was 101 ounces of silver to buy one ounce of gold. In the middle of March, it went up to 131:1.

Silver is the easiest call for an investment that I have ever seen. Period. I don’t care that gold’s at the top. I don’t care if gold stays sideways and I don’t give a care if gold goes down. Silver is going to gain value substantially against gold. It literally is the best time in 5,000 years to be buying silver. And I am not a silver bug. Silver bugs are nuts. I mean, they’re bat crazy. They worship silver. Gold and silver are not something to be worshiped. They represent real value, and I believe that we will go back to a gold and silver standard, but there’s nothing you need to worship about it. But as an investment, silver is a good deal.

Maurice Jackson: There’s another metal that you and I like, and that is platinum. What are your thoughts on platinum right now?

Bob Moriarty: Same thing with platinum, but it’s not as extreme. Platinum’s in the same position today that rhodium was in three or four years ago. Everybody hates it. Nobody wants it. I’m going to eat a worm.

Maurice Jackson: Just for some giggles here, rhodium, as you referenced, three years ago was $600 an ounce. And as of March, rhodium reached up to $13,000. Readers can view our call on rhodium (here).

Bob Moriarty: Yes.

Maurice Jackson: Look at those numbers. And again, I don’t know of any of my online peers, then and or now, referencing the move that rhodium has made. It’s just remarkable. This is that classical education Cassandra call.

And as a reminder, I am licensed to buy and sell physical precious metals through Miles Franklin Precious Metals Investments. I would be honored to have an opportunity to earn your business. The contact details are available below.

Sir, what keeps you up at night that we don’t know about?

Bob Moriarty: Strange enough, what kept me up last night was the power went out and I couldn’t sleep without some lights on.

Maurice Jackson: Well, you would think you’d want it dark. OK, but you needed some lights. Everyone’s different. OK.

Bob Moriarty: When the lights go out in this little town, it is really, really dark.

Maurice Jackson: I can imagine. All right, last question, and that is, what did I forget to ask?

Bob Moriarty: I think you pretty much covered it.

Maurice Jackson: Awesome. Well, great to hear that. Bob, for someone listening that wants to get more information about your books and your work, please share the website addresses.

Bob Moriarty: 321gold and/or 321energy. Readers can find my work on Amazon and put in Robert Moriarty; I published a number of books. I’m working on another one right now. And one of them, Basic Investing in Resource Stocks, is perfectly timed. If you do not own some resource stocks right now, you understand neither economics nor history. And I stole that line.

Maurice Jackson: Well, before you make your next bullion purchase, make sure you call me. I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, and precious metal IRAs. Call me directly at (855) 505-1900 or you may e-mail maurice@milesfranklin.com.

Finally, please subscribe to www.provenandprobable.com. We provide mining insights and bullion sales. Subscription is free.

Bob Moriarty of 321gold and 321energy, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Read what other experts are saying about:

- Lion One Metals Ltd.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Lion One Metals, Calibre Mining, Hannan Metals, Novo Resources and Irving Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Lion One Metals, Calibre Mining, Hannan Metals, Novo Resources and Irving Resources are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

2) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Lion One Metals, Calibre Mining, Hannan Metals, GSP, Novo Resources and Irving Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Lion One Metals, Calibre Mining, Hannan Metals, Novo Resources, GSP and Irving Resources are sponsors of Proven and Probable. Proven and Probable disclosures are listed below.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Lion One Metals. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Irving Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: HAN:TSX.V; HANNF:OTCPK,

IRV:CSE; IRVRF:OTCBB,

LIO:TSX.V; LOMLF:OTCQX,

NVO:TSX.V; NSRPF:OTCQX,

)

Source: Adrian Day for Streetwise Reports 05/18/2020

Money manager Adrian Day looks at three large gold royalty companies that have reported Q1 earnings.

Franco-Nevada Corp. (FNV:TSX; FNV:NYSE, US$143.88) reported first-quarter earnings slightly better than expected, with Gold Equivalent Ounces (GEOs) up over 10% compared with a year ago. It has withdrawn its full year guidance due to the covid-related shutdown of some of its mines; about 30% of its production has been affected, primarily at Cobre Panama and Antamina. The timing of the restart in Panama is uncertain, though work is ongoing towards a restart. Another 11 assets had announced stoppages, though five of those have since resumed activities. Franco has also been hurt by the low oil price and consequent reduced production, and the company took some write-downs on its oil assets. G&A costs were less than 3% of revenues in first quarter.

Looking ahead with confidence

In two signs of confidence however, Franco paid off its remaining $80 million in debt; the company has always been debt averse. And it increased its quarterly dividend by a penny to 0.26, for its 13th consecutive annual dividend increase. Both these moves contrast with most mining companies that have drawn down on the credit facilities and cut their dividends.

The pipeline is “healthy,” with Franco looking at a wide range of assets including opportunities in base metals and bulk materials. A particular opportunity is with base metals producers, hurt by lower prices, looking to monetize precious metals by-product. Various government restrictions make on-the-ground due diligence difficult, and in the near term, we would expect smaller transactions to close first.

Debt free again, with cash available

Franco now has $200 million in cash with $1 billion undrawn on its revolver, and it has increased to $300 million the amount authorized under its “ATM,” the ability to issue small amounts of shares “at the market,” more than sufficient for any near-term transactions.

As previously announced, Pierre Lassonde has now became chairman emeritus, David Harquail chairman, and Paul Brink CEO. We have discussed this previously.

The stock fell to under $90 in March, so it has had a very strong recovery, moving to all-time highs. Trading at 5.6x book, a price-to-cash flow of 40x, well above even Franco’s historically rich valuations. Historical norms, Franco is not cheap. But it belongs in every gold investor’s portfolio.

Debt cut as one third of production affected by shutdowns

Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE, US$43.38) reported in line with expectations, with operating cash flow up 50% on last year. It also reduced its debt, by $159 million, ending the quarter with $127 million in cash and $716 million outstanding on its revolver. It also has a $300 million ATM to raise equity. It did not update its full-year guidance, but 35% of its production has been affected by covid-shutdowns, including at Peñasquito.

The stock, at $24 in mid-March, has also experienced a strong recovery. Now trading at 3.7x book, and a price-to-cash flow of 35x, it also is not cheap.

Taking different approach, with growth ahead

Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX, US$136.43) reported earnings, up 24% on year ago, slightly above expectations. It generated cash flow of $100 million, ending the quarter with $94 million in cash and $105 million in debt. After quarter end, it drew down $200 million on its revolving credit facility “as a precautionary measure.” In line with the other major royalty/streaming companies, about 30% of its production has been affected by mine shutdowns. Mt Milligan and Rainy River are returning to normal production levels, with only Peñasquito of its major assets still shut. Alone of the three, it has not withdrawn its 2020 guidance but had no update.

Construction work at Khoeomacau in Botswana, the company’s next major asset, continues, though at a reduced scale because of local restrictions. Royal has made its third construction contribution, and production is still scheduled for mid-2021. Like the others, it did not update its full year guidance.

From under $70 in March, the stock has also had a very strong move, now trading at 4x book, and 28x cash flow. Though not cheap, it is comparatively better value.

All three large royalty and streamers reported strong earnings. All have strong management, solid balance sheets, available cash, diversity of revenue, and deep pipelines. But all three stocks are expensive. As mentioned above, as the gold price moves higher, more and more investors, particularly generalists, will turn to the royalty companies that have strong records of delivering. So while this may be a good time to trim if one wants to be a trader, a year or two from now, the stocks will, I believe, be higher. Franco is, in my mind, the best company, while Royal is the least overvalued.

Originally posted on May 10, 2020.

Adrian Day, London-born and a graduate of the London School of Economics, heads the money management firm Adrian Day Asset Management, where he manages discretionary accounts in both global and resource areas. Day is also sub-adviser to the EuroPacific Gold Fund (EPGFX). His latest book is “Investing in Resources: How to Profit from the Outsized Potential and Avoid the Risks.”

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Adrian Day: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Franco-Nevada and Royal Gold. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Adrian Day Asset Management hold shares of the following companies mentioned in this article: All. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Franco-Nevada and Royal Gold, companies mentioned in this article.

Adrian Day’s Global Analyst disclosures: Staff may have positions in securities discussed herein. Adrian Day is also President of Global Strategic Management (GSM), a registered investment advisor, and a separate company from this service. In his capacity as GSM president, Adrian Day may be buying or selling for clients securities recommended herein concurrently, before or after recommendations herein, and may be acting for clients in a manner contrary to recommendations herein. This is not a solicitation for GSM. Views herein are the editor’s opinion and not fact. All information is believed to be correct, but its accuracy cannot be guaranteed. The owner and editor are not responsible for errors and omissions. © 2020.

( Companies Mentioned: FNV:TSX; FNV:NYSE,

RGLD:NASDAQ; RGL:TSX,

WPM:TSX; WPM:NYSE,

)

Taiga Gold Corp. Will Be Bought Out

Source: Bob Moriarty for Streetwise Reports 05/18/2020

Bob Moriarty of 321gold discusses why he believes the spin-off company will be bought out.

Gold and silver have had a good run lately but the DSI (Daily Sentiment Index) is suggesting a pause may be in the works. Gold hit a reading of 91 on Friday May 15th while silver showed 88. While I am convinced the actions of the Fed in unleashing a flood of dollars will result in hyperinflation in the metals and deflation in real terms for all of the bubbles, corrections are part of investing. There are so many wonderful stories out there right now that have not caught fire that I think correction or not, juniors are the only game in town.

And for new subscribers to the DSI Jake has a sale on right now for up to 50% off until June 1st. I find the DSI the most useful took in investing. Other than my articles, that is.

Eagle Plains is a project generator company. They hold a number of projects of various kinds in western Canada and do deals with other juniors for cash and shares. If one of their deals does well they do well and haven’t had to pay their way.

Since investors are as incapable as I am of keeping track of a dozen or more projects usually investors will pay X for the biggest and most important project. They will pay ½ X for the 2nd most important and potential and maybe 1/10th X for the rest of the stable. It’s frustrating to project generator companies to know that they are not getting full value for each of their properties.

So in 2006 Eagle Plains spun out a great copper project located near the Galore Creek project of Novagold into a company they named Copper Canyon. Because it had a lot of copper. There literally was a creek running bright blue from the copper.

It took another five years for someone to get interested. Novagold bought Copper Canyon in 2011.

There wasn’t a giant premium paid to the shareholders of Copper Canyon but Eagle Plains owned a lot of shares and generated substantial value for something that investors weren’t giving them anything for.

So in April of 2018 Tim Termuende made a similar deal spinning off various projects to a new company to be known as Taiga Gold Corp. (TGC:CSE; TGGDF:OTCBB). Taiga Gold shares the same management as that of Eagle Plains. And Eagle Plains retained 12 million shares of TGC as part of the deal.

Taiga’s lead property is the Fisher gold project adjacent to the Seabee/Santoy Gold mines owned by SSRM (Formerly Silver Standard [and I liked the name Silver Standard a lot better]). SSRM did a deal on the Fisher gold property that calls for them to get a 60% interest for spending $4 million on exploration and paying Taiga $400,000 in cash with a $100,000 yearly advance royalty on production. So far SSRM has spent over $10 million and done 79 holes of over 35,000 meters. They can increase their ownership of Fisher by paying Taiga $1 million.

SSRM believes the Santoy Shear extends 20 km on the Fisher project. That’s the ore host for the Seabee/Santoy deposits. Santoy is a low cost producer for SSRM having produced over 112,000 ounces of gold in 2019 at a grade of 9.56 g/t and a cost of $464 an ounce in US pesos.

On the 14th of May Taiga announced results for 23 of the 31 drill holes completed in the 2020 winter program at Fisher. Some 14 of the 23 holes reported meaningful gold results with visible gold in 5 of the holes. An additional 8 holes are in the process of being assayed.

This is one of those zero brainer type investments. SSRM didn’t spend $10 million on drilling unless they had a real good idea of what they will find. At some point they will write a check to Taiga for $1 million and own 80% of the project. The only issue for investors would becoming up with a value for the remaining 20% of the project. Seebee has been mined out and Santoy has a 1.5 million ounce 43-101 resource.

It’s a low cost producer, surely SSRM will have a back of the envelope calculation for how much gold they believe they can find on the Fisher project. SSRM will buy out Taiga at some point.

Since I happen to believe we are going to see far higher prices for gold than resource investors can imagine today, will the takeover be early or later? I’d rather see it later because with a $14 million market cap today Taiga is absurdly cheap.

Taiga is an advertiser. I have bought shares in the open market and been in the last private placement. Do your own due diligence

Taiga Gold Corp.

TGC-C $0.18 (May 15, 2020)

TGGDF – OTCBB 79.4 million shares

Taiga Gold Corp. website

Bob Moriarty

President: 321gold

Archives

321gold

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Read what other experts are saying about:

- Defense Metals Corp.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Taiga Gold. Taiga Gold is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: TGC:CSE; TGGDF:OTCBB,

)

Source: Michael Ballanger for Streetwise Reports 05/18/2020

Sector expert Michael Ballanger anticipates the come-from-behind winning run of silver.

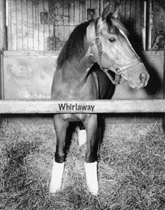

In the late 1930s, a young stallion was born in Lexington, Ky., at the legendary Calumet Farm, that went on to win seventeen major races from 1940–1942, including the Triple Crown (Kentucky Derby, Preakness and Belmont Stakes) in 1941. Named after his brood-mare mother, Dustwhirl, this record-breaking stallion went by the moniker of “Whirlaway,” and was famous not only for his speed and power but also for his “quirkiness.”

Whirlaway had a bad habit of “drifting out” to the middle of the track, taking him out of contention in races that were clearly his to win. This behavior was so troublesome that trainer Ben A. Jones fitted the colt with a special full-cup blinder over his right eye while preparing for the Kentucky Derby, and after cutting a tiny hole in it to allow a limited field of vision, Whirlaway stayed on course and blew the field away with a record-breaking eight-length victory.

Another trait of this magnificent horse was his preference for lagging the field, and one of the trademark phrases used countless times as the horses rounded the Clubhouse Turn was “and here comes Whirlaway!” The crowds would roar as he turned on the afterburners, passing the field in a blaze of acceleration and focus.

What, pray tell, does this have to do with the metals markets or COVID-19 or the inflation-deflation debate? Nothing. Nothing at all. But what it does perfectly describe is the behavior of the one precious metal that we love to hate and that we hate to love—silver.

Which of the metals, packed with superlative fundamentals and above average technicals, tends to “drift out” into the middle of the track, aimlessly lagging its precious metals brethren, gold and the gold mining equities? Silver. Since this golden bull market exploded out the starting gate in May 2019, there have been countless times that I have wanted to fit a full-cup blinder over silver’s right eye to keep it on course.

During the summer of 2019, as I was contemplating the launch of GGM Advisory, gold broke out of a multiyear ceiling at US$1,375/ounce and rocketed to the $1,565/ounce. I watched in abject horror as the GSR (gold-to-silver ratio) flew to 95, leaving behind a trail of heartbroken silver bugs, aghast at the underperformance and outraged at the blatant interventions that capped it.

Whether it is silver’s Whirlaway-like “quirkiness,” or the odious machinations of the bullion banks, the metal has had a habit recently of exhibiting aberrant behavior, which has cost me and many other investors not only a lot of money but also a loss of willpower, where our bullish conviction is wrung out of us by the absurdity of silver’s tape action.

However, you will recall what I said about Whirlaway’s preference of “lagging the field?” There isn’t a day that goes by when I don’t look at the silver quote and see that mighty stallion, lollygagging at the back of the precious metals field, totally ambivalent to the thundering hooves of GLD, GDX, GDXJ and a myriad of junior miners. To describe it as “maddening” is understatement of the highest order. To call it “bizarre” is testimonial to the criminality of the exchange upon which it resides. Whatever the case, it has been agony.

However, just as I have watched the horse come from last to first in a mere quarter-mile of pulsating excitement, I have always known that my little silver “Whirlaway” was going to make his move, exactly as happened in 1941, when he captured the Triple Crown. Sure enough, it was only eight days ago that I issued Email Alert (EA) 2020-80 and wrote: “I am finally confident enough to assume that the GSR (gold-silver ratio), currently at 111, is heading back to 80 over the balance of 2020.” I then proceeded to “damn the torpedoes” and doubled down on SLV (IShares Silver Trust), while adding another huge swath of the July $17 calls.

Call it whatever you wish—luck, clairvoyance, acumen (or dementia)—Friday May 15 had gold sporting a 0.67% gain and silver up a huge 4.33% (!), taking the GSR to its lowest post-crash reading at 103.65.

To put this into perspective, shortly after gold bottomed in late 2015, the GSR rose to around 83 by February of the following year, with silver “lagging the field,” just like the last two months. Then, as if injected with amphetamines, silver vaulted forward, taking the GSR from 83 to 66 in three months.

Understanding silver’s “quirkiness” is many times difficult, and trading around its idiosyncratic nuances can be very costly, but once you know that it has finally taken the bit in its teeth, silver gives one a ride fifty times as exciting as any amusement park “coaster” or Elon Musk stock promotion.

Writing about silver conjures up memories of superstitions of days gone by. Forecasting a sharply higher price is like being in the dressing room between second and third periods, up 3–0, and saying out loud the word “shutout.” It is like Bill Murphy’s LeMetropole Cafe website, where we beg him to not show a rocket blasting off with the word “silver” on it. No dearth of leprechauns, rabbits feet, four-leaf clovers or Amazonian virility symbols are enough to ward off the silver demons, because we have endured the silver jinx all too many times.

The point of this missive is this: False breakouts notwithstanding, when silver finally catches a bid, as happened in late 1979, early 2016 and August 2019, the moves are breathtaking. At the very least, a test of the September 2019 highs at US$19.75/ounce appears to be the most likely target.

The period of seasonal weakness referred to in earlier missives is mainly for gold; silver is not as suspect because it responds to different stimuli not related to seasonality. In the 2020-80 EA, I spoke of a flat gold price and a GSR of 80. If that holds, with gold at US$1,750, silver will print US$21.875, a 44.3% advance from the May 8 entry at US$15.15.

Another important consideration is this: Silver’s underperformance was one of my causes for concern for the Senior and Junior Gold Miner exchange-traded funds (ETFs; GDX:US & GDXJ:US), and now that silver has assumed a leadership role, the odds of a meaningful correction in gold (and the miners) are diminished. While I have elected to stand aside on the GDX/GDXJ combo, the massive July call position in SLV will compensate in spades if we get the Whirlaway charge.

Let us not forget that our second largest portfolio position remains Aftermath Silver Ltd. (AAG:TSX.V) (CA$0.28 / US$0.208 per share); behind the mighty Getchell Gold Corp. (GTCH:CSE), so we have enormous leverage to both rising gold and galloping silver prices. As the post-lockdown period unfolds and you are trying to figure out what silver is going to do, remember the immortal words of Derby announcer Dave Johnson in 1941:

“. . .and h-e-r-e c-o-m-e-s Whirlaway!”

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Aftermath Silver, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Aftermath Silver, Getchell Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Aftermath Silver. Please click here for more information. Within the last six months, an affiliate of Streetwise Reports has disseminated information about the private placement of the following companies mentioned in this article: Aftermath.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver, Getchell Gold, companies mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

( Companies Mentioned: AAG:TSX.V,

GTCH:CSE,

)

What Is the Best Way to Buy Gold? (Video)

Silver Joins Gold at the Party

The script continues to play out perfectly and people still actually fall for it… by Josh Sigurdson of World Alternative Media Josh Sigurdson reports on the recent news of an […]

The post MORE “Second Wave” Propaganda Goes VIRAL As China Locks Down 100 MILLION People! appeared first on Silver Doctors.

Historically, a “buy” signal like this is typically followed by gains of hundreds of percent! by Stewart Thomson of Graceland Updates May 19, 2020 1. Gold is consolidating after reaching substantial […]

The post Massive ‘Buy’ Signal On Gold’s Long-Term Charts appeared first on Silver Doctors.