“All of the projection models were wrong. All of them,” admitted New York Governor Andrew Cuomo in an interview last week with MSNBC.

Governor Cuomo had been issuing frantic demands for tens of thousands of ventilators… that turned out not to be needed as the rate of new hospitalizations for COVID-19 infections in New York plunged with surprising speed.

Governor Cuomo had warned America that New York City was the canary in the coal mine, that other cities would soon suffer similar death rates.

Deeply flawed infection models have led

to economic and societal devastation.

And based on models cited by Dr. Anthony Fauci just a few days ago, the United States was expected to rack up around 200,000 deaths from the virus – or more than 2 million if we failed to socially distance, according to other widely cited models.

Thankfully, all those models were wrong.

The new ones show daily death counts peaking out around now at dramatically lower than projected levels and new cases continuing to plunge, as is the typical seasonal pattern in April for cold and flu-like infections.

A sustained decline in coronavirus cases for the remainder of this month would likely mean the U.S. economy could begin to reopen unless myopic medical experts continue to get their way.

However, a lifting of lockdowns doesn’t mean things will return to normal anytime soon. The pre-virus economy as we knew it will likely never return.

Some businesses and business practices will be gone forever. Many consumer buying, saving, and investing habits will also likely change permanently and in ways nobody at this point can predict.

U.S. monetary policy certainly won’t be able to “normalize” back to pre-virus practices.

The Federal Reserve’s balance sheet is exploding, literally by the trillions every week, with purchases of government and corporate bonds. The Fed’s once-pristine balance sheet now includes junk bonds.

We are in uncharted territory in terms of what assets the Fed can buy, and there are no limits on how much cash it can create to buy them. Maybe next the central bank will buy up restaurants, casinos, cruise ships, farms and shopping malls. Maybe its next policy move will be to slash interest rates below zero.

No conventional economic models are able to account for the simultaneous collapse in economic demand to depression levels and the explosion in fiscal and monetary stimulus to hyperinflationary levels.

We could see GDP contract by 30% in the second quarter with unemployment spiking to 30% – a Great Depression scenario. But the metals markets could jump based on the artificial stimulus being pumped into the financial system that is debasing the dollar.

An inflationary depression would be a terrible environment for most investments in real terms. But it could potentially be a fantastic environment for gold and silver.

During most crisis investing environments – whether inflationary or deflationary – precious metals tend to outperform stocks.

Anyone who proffers a prediction on where the Dow Jones Industrials will be trading at the end of the year is just guessing. None of the so-called “experts” on Wall Street have a clue. The officials at the Fed who are trying to centrally manage a broken economy don’t know what the ultimate consequences of their interventions will be either.

After the initial outbreak of the Wuhan coronavirus, neither the World Health Organization nor our own Surgeon General had any idea of the global threat it posed.

They initially downplayed it, repeated false Chinese propaganda that it wasn’t transmissible from human to human, and then falsely (and selfishly) told us medical masks were ineffective when worn by the general public.

All of their projection models were wrong. And investors should be skeptical of any particular projection models for the economy or financial markets. They will all be wrong to some extent.

But investors can be confident that a portfolio diversified into gold and silver will mitigate downside risk in stocks and other paper assets – while also providing added upside potential, especially as inflationary pressures build.

Now that the Peruvian Government announced an extension of the country’s state of emergency until April 26th, the world’s first and second-largest silver producers have taken 40% of global silver mine supply offline for a month. Actually, Peru first announced its national quarantine on March 15th. So, the country’s mines will be shut down for more than a month when the state of emergency is projected to end on April 26th. But, will it?

According to the Reuters article, Peru’s Vizcarra extends state of emergency to April 26th; the country will remain on lockdown for an additional two weeks:

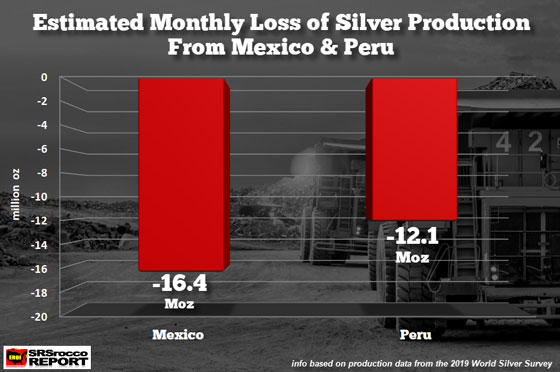

Including Mexico’s state of emergency issued on April 2nd to last until the end of the month, the total estimated silver production lost from these two countries could be 28 million oz (Moz). That is 40% of global mine supply. But, what if additional mines have been shut down in other countries?

As I stated in previous articles and my Youtube video updates, we could see between 100-150 Moz of global silver mine supply lost this year. However, if we just consider the estimated 28 Moz of silver production lost from Mexico and Peru, that would equal 28,000 of the 1,000 oz wholesale silver bars.

With the continued surge in demand for silver bullion pushing availability of products back weeks and for months, it has also impacted the 1,000 oz wholesale silver bar market. How will the reduction of 28,000 wholesale 1,000 oz silver bars impact the market in the next few months?? Good question.

Lastly, if the oil price continues lower, it is possible that the silver price will fall even further. However, this will not be the BUYING OPPORTUNITY that many are hoping for. Why? A further decline in the futures silver price will only exacerbate the already tight physical market. So, don’t expect to be able to find much silver at lower prices.

As with the subject of INSURANCE… you don’t wait until there is a FIRE in the house to purchase fire insurance. It seems like the window of acquiring SILVER INSURANCE is running out, and will only become more difficult if the futures silver price falls lower.

With tens of millions of Americans having gone for so long without income, what will be the consequence to the American economy? by Eric Zuesse via Strategic Culture Foundation America’s […]

The post Why America Will At Least Be in Another Great Depression appeared first on Silver Doctors.

This Monday, President Trump is openly trying to raise taxes on the most vulnerable of the American population, and his very supporters no less! (by Half Dollar) At the start […]

The post Trump Openly Boasts About His Negotiations To Raise Taxes On Americans appeared first on Silver Doctors.

Precious metals are about to enter a phase that has never been experienced in recent history… by Chris Vermeulen of The Technical Traders As we’ve attempted to illustrate the intuitive […]

The post A “Wash-out” To Global Credit & Debt Markets That Will Send Gold & Silver Prices Skyrocketing appeared first on Silver Doctors.

If you are a yield investor it is becoming increasingly difficult to find anywhere to put your money… by Simon Popple of Brookville Capital If you are a yield investor […]

The post Dividends are being slashed, is there anywhere to hide? appeared first on Silver Doctors.

The panic & fear among the people who cannot be bothered to read the actual statistics about this pandemic is concerning. Covid-19 has been so overhyped that… by Mac Slavo […]

The post ARMY’S SEATTLE FIELD HOSPITAL CLOSED AFTER 3 DAYS WITHOUT SEEING ONE PATIENT appeared first on Silver Doctors.