“”silver price”” – Google News

Hecla Mining: Prices Down But Still Attractive Seeking Alpha

The post Hecla Mining: Prices Down But Still Attractive – Seeking Alpha appeared first on WorldSilverNews.

“”silver price”” – Google News

Hecla Mining: Prices Down But Still Attractive Seeking Alpha

The post Hecla Mining: Prices Down But Still Attractive – Seeking Alpha appeared first on WorldSilverNews.

Silver Price – BingNews

Silver Futures—Silver futures in the May contract is currently trading at 14.51 an ounce after settling last Friday in New York at 12.38 up over $2 for the trading week experiencing high volatility …

The post Was That The Bottom In Silver appeared first on WorldSilverNews.

Silver Price – BingNews

Hecla had a strong Q4 and a great start to 2020. Production is ramping, pricing is strong, and Lucky Friday is back. COVID-19 led to panic selling in precious m …

The post Hecla Mining: Prices Down But Still Attractive appeared first on WorldSilverNews.

$AEM $AGI $BTC $CXB.TO $CG.TO $EGO $EDV.TO $EQX $FSM $HL $IAG $HL $LUG.TO $MUX $OGC.TO $PAAS $SSRM

Gold Seeker Report: This Week in Mining Issue #6

BNN Bloomberg/

“But the virus, and the global economic collapse that it’s sparking, have created such extreme price distortions that those easy-exit options disappeared on them. Which means that they suddenly faced the threat of having to deliver actual gold bars to the buyers of the contract upon maturity.”

“But the virus, and the global economic collapse that it’s sparking, have created such extreme price distortions that those easy-exit options disappeared on them. Which means that they suddenly faced the threat of having to deliver actual gold bars to the buyers of the contract upon maturity.”

USAGOLD note: Brother, can you spare a 100-ounce gold bar?

MarketWatch/Ivan Martchev/3-28-2020

“Gold bullion is staying firm, close to a multiyear absolute high. This dynamic has caused bullion to register a relative all-time high compared with the CRB Index. What happened to gold bullion after it registered its previous all-time high relative to the CRB in 2008? It doubled in absolute terms to peak above $1,900 in 2011.”

USAGOLD note: Also …… Is this not a disinflation-deflation signal? If so, the demand for gold will come from investors seeking refuge from a possible systemic meltdown – ala 2008-2009.

Reuters/Peter Hobson/3-27-2020

“The move would be aimed at reducing the risk of disruption if metal cannot reach London, the world’s most important physical gold trading hub, where trades are underpinned by metal held in high-security vaults.”

USAGOLD note: It was only a few days ago that we were told there is plenty of gold in London just in the wrong bar size. This article tells us the physical availability problem goes beyond bar size to one of getting gold in and out of the world’s central physical gold hub because of coronavirus-related problems.

Cartoon courtesy of MichaelPRamirez.com

Source: The Critical Investor for Streetwise Reports 03/27/2020

The Critical Investor takes a look at recent actions taken by this gold explorer.

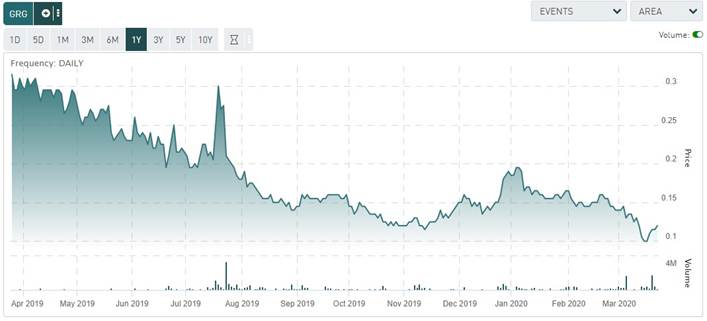

The coronavirus pandemic together with the Saudi Arabia-Russia oil production increase took its toll on the equity markets the last few weeks. The commodity markets in particular got hit too, as main end-user China got hit by a halt in manufacturing plants across the economy. Precious metals like gold rose initially, but after the virus spread globally it got sold off ruthlessly like any other asset class. Golden Arrow Resources Corp. (GRG:TSX.V; GARWF:OTCQB; G6A:FSE), as a gold explorer, didn’t come out completely unharmed either, as the following chart shows:

Share price Golden Arrow Resources 1 year time frame; Source Tmxmoney.com

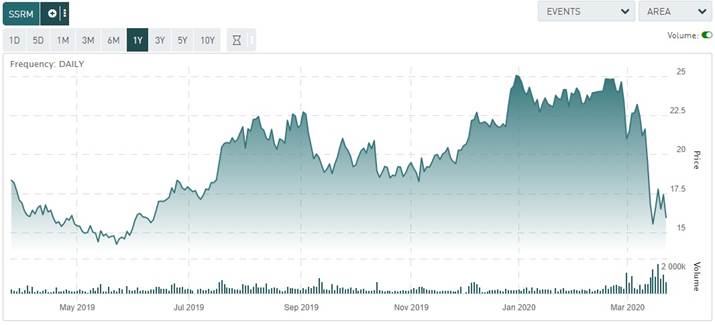

The drop in the share price for Golden Arrow is relatively comparable to that of SSR Mining, the company Golden Arrow holds roughly 1 million shares of (and which are the bulk of tangible assets at the moment):

Share price SSR Mining 1 year time frame; Source Tmxmoney.com

At a current market capitalization of just C$14.3 million, Golden Arrow trades below the value of its SSR Mining holding, which attributes to C$16.2 million. Besides this, Golden Arrow has a modest cash position and its exploration assets among which is the promising Indiana gold project in Chile, so it is safe to say that the company has reached decent support levels technically and fundamentally speaking. Management decided this was the case as well, and came to the conclusion that it was probably easier to buy back shares in order to create accretive value for shareholders instead of trying to create value through the drill bit on its projects.

For that purpose, management announced a normal course issuer bid on March 12, 2020, to purchase up to 10,658,050shares being equal to 10% of the float. This bid commenced on March 17, 2020, and will end on the earlier of March 16, 2021, or when it’s been completed or terminated. The shares will be bought in the open market by PI Financial on behalf of Golden Arrow Resources. Management and the Board clearly think this will be advantageous for shareholders, as they commented as follows:

“The board of directors of the company are of the opinion that the recent market prices of its shares do not reflect the underlying value of its property portfolio and its strong financial position. Accordingly, the purchase of shares through the bid is in the best interests of the company and its shareholders, as it will increase the proportionate share interest of remaining shareholders. The bid will afford an increased degree of liquidity to the company’s shareholders. The directors also believe that there will be long term benefits to the company with fewer shares issued and outstanding.”

This news release was followed a few days later on March 16, 2020, by a statement of the President, Chairman and CEO Joseph Grosso, of which a few highlights are presented here:

“I believe that today’s market sentiment has resulted in a share price that does not reflect the Company’s asset value, or our future potential value. At this time, our asset value includes:

“In addition, our potential value includes:

“I believe that the current market is creating the significant disparity seen between the share price and the combination of our asset value and exploration potential. This has created the opportunity for management to initiate an economical buyback of up to 10% of the public float of our shares, as approved by the TSX Venture Exchange. This will benefit the shareholders by increasing their proportionate share interest, increasing liquidity provide long-term benefits afforded by a tighter structure.”

After reading this, I wasn’t immediately convinced if this was the best possible action for a junior explorer with a lot of current assets to its disposal, in a bear market. I have several reasons for this.

Notwithstanding this, because of the current rout for oil companies, even the likes of Shell have halted their share buy back programs to save cash now, for harsh times to come. So, why Golden Arrow management decided to initiate a buyback program at a point where its SSR Mining shares are valued at about 40% lower compared to the highs of a few weeks ago, whereas Golden Arrow lost just 33% and already recovered towards a 20% loss from the share price right before the outbreak (probably caused partially by the buyback program itself), wasn’t really clear to me. If 10% of the float will be bought at an average price of 13c, this means C$1.38 million of precious cash will be gone. Therefore I asked them for more clarity on the subject.

Joseph Grosso commented himself as follows: “Golden Arrow has been trading at a discount to not only value, but to its cash (and cash equivalent) ever since the sale of Puna Operations to SSR Mining. Many investors had purchased Golden Arrow’s shares as a production story; even though we were a fairly passive investor in that project. The recent general market sell-off has exacerbated the discount. I believe that by initiating the repurchase of up to 10% of the company’s public float, we can show to the market that we firmly stand behind the value underpinning Golden Arrow. Since the announcement of our buyback program, the company’s shares are up by 20%. By reducing some of the outstanding shares, Golden Arrow is in effect mopping up excess stock held by investors with different investment objectives, and increasing the inherent value held across all remaining shareholders. As the bull market in gold continues to advance this should provide great leverage to all of our investors.”

One could wonder if investors who were in it for the leveraged production play didn’t already leave, and the sell-off wasn’t connected to a higher degree to the broader market sell-off itself, but let’s see what happens. At least they are buying back at an absolute low, and the leverage is optimized.

Exploration

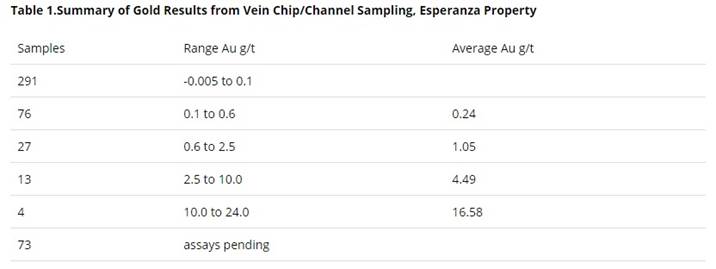

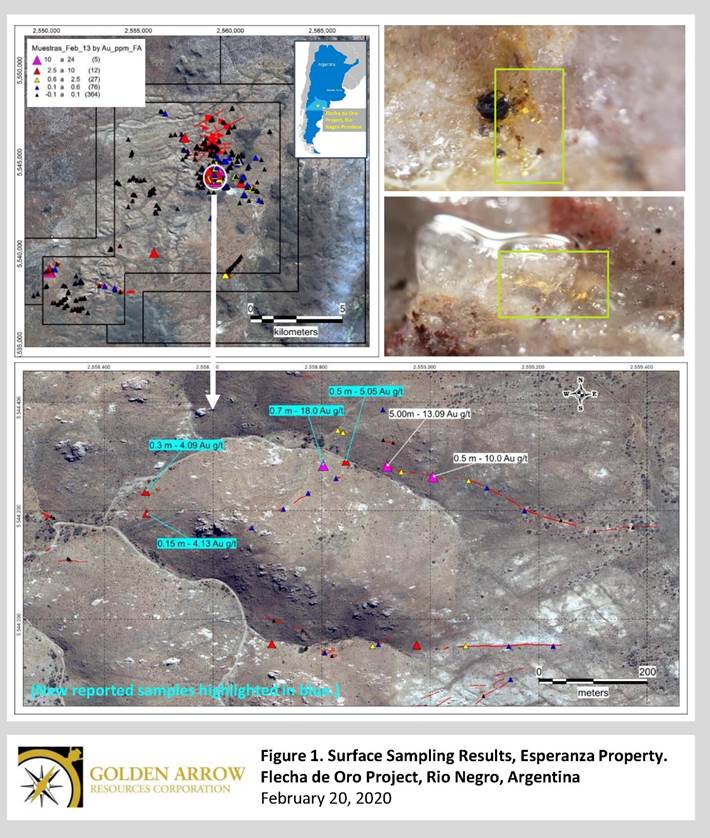

In the meantime, Golden Arrow progressed on its ongoing exploration programs, and the one at the Flecha de Oro project in Argentina delivered the first sampling results at the Esperanza and Puzzle properties. Sampling and mapping continued throughout the month of January at the Esperanza property, identifying high-grade and visible gold hosted in epithermal quartz veins. Especially the results at Esperanza were encouraging in my view, as shown here in this table:

Everything topping 1 g/t Au at surface is showing high potential in my view, so if about 40 of 500 samples show these results, the sampling program was successful in my opinion. Several samples also involved visible gold, as can be seen at these pictures (in green):

At Esperanza, Golden Arrow’s target is to define high-grade mineralized zones within the 16 kilometers of identified quartz and chalcedony veins that display epithermal textures. The mapping program is continuing to gain greater understanding of the structural plumbing system and distribution of classic epithermal vein textures that can provide formation temperature information, which are both important in targeting thicker and higher-grade zones.

The company is using the Cerro Vanguardia district as an exploration model for the Esperanza property. There are geological similarities between the two areas, in particular the presence of swarms of low sulphidation epithermal quartz veins in an area of approximately 100 square kilometers. The Cerro Vanguardia district is located in Santa Cruz province in southern Argentina, and includes over 100 gold and silver-bearing epithermal veins. The district has a cumulative exposed vein strike extent of more than 240 kilometers, and has produced more than 4.5 million ounces of gold over the last 20 years.

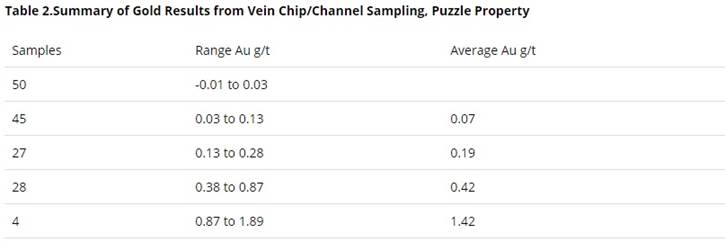

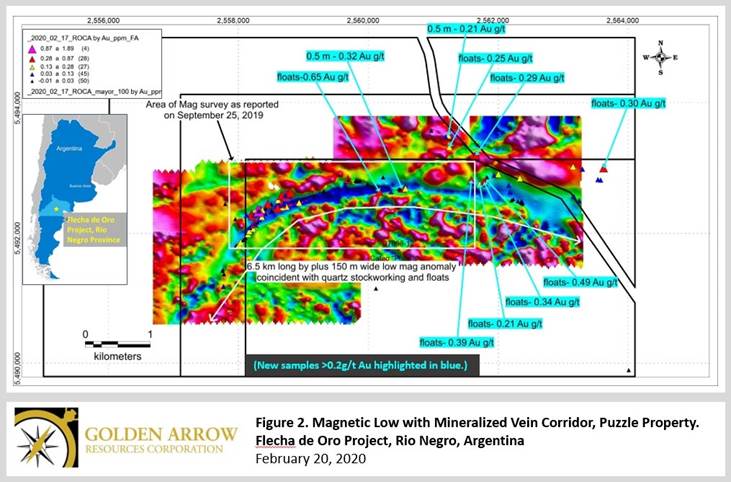

Golden Arrow Resources also received sampling results for the Puzzle property, but these were, despite establishing a trend of 6.5km, of much lower grade, and therefore of lower interest/potential in my view, especially since it is not heap leachable potential:

The trend can be seen here:

Despite these low-grade sampling results at Puzzle, the company made applications for additional concessions around both the Esperanza and Puzzle properties.

I also wondered if the corona pandemic had any influence on the ongoing exploration programs, and VP Exploration and Development Brian McEwen had this to say about this subject: “The Corona pandemic is a global phenomenon. Our first priority is the safety of our staff and personnel. Our organization is abiding by all the local regulations in every jurisdiction to keep our people safe. Although our exploration programs have been placed on a temporary holding pattern, we expect to pick up when this pandemic has passed us. We will provide updates, as appropriate.”

Conclusion

The share buyback program of 10% of the Golden Arrow Resources float came a bit as a surprise for me, as this is unusual for junior mining companies. After contacting Joseph Grosso, the reasoning became more clear, as they figured there were still investors with the objective of holding a (leveraged to silver) production play selling their shares, and they wanted to clean those up. The coronavirus seems to have a delaying impact on operations, according to Brian McEwen, as they paused their exploration programs in order to comply with all pandemic related regulations. It seems investors have to wait out the pandemic and its fallout, but in the meantime these share price levels trading below cash seem an interesting time to entry (or re-entry).

I hope you will find this article interesting and useful, and will have further interest in upcoming articles on mining. To never miss a thing, please subscribe to The Critical Investor’s free newsletter, http://www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclaimer: The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Golden Arrow Resources, a company mentioned in this article.

Charts and graphics provided by the author.

( Companies Mentioned: GRG:TSX.V; GARWF:OTCQB; G6A:FSE,

)

Source: Bob Moriarty for Streetwise Reports 03/27/2020

Bob Moriarty of 321gold comments on where he believes the economy is heading.

Those who never predicted a financial collapse in the first place are now edging closer to the swamp to dip their toes into the water. Now they are suggesting, perhaps we could have a recession.”

Forget that. You cannot have every supply chain in the world chopped in two and have a recession. A depression was baked into the cake before the Corona popped out of the six-pack. The US government dumping a $6 trillion dollar bailout for their buddies that has more pork in it than the butt of a two-ton pig is the proverbial pissing up a rope. We are in a depression. The entire financial system, education system, medical system, political system, hell, the entire artifice needs a total reset.

What do we get? More of the same. Well, if the government created the workspace for the depression by unlimited debt and financial chicanery, you are not going to fix it with more of the same.

Americans are unlike any other people on earth. At heart they want to trust their government. Granted, the Democrats understand that the Republicans are at the heart of all evil. And Republicans know full well that the Democrats caused all of the problems in the country but both agree that if only we elect their pet fools, all would be well with the world.

No other country on earth actually trusts their government. Their people growl and on occasion turn out in the streets to man the barricades but they know deep in their hearts that their “leaders” are fools who can do nothing well. Americans are always shocked to find their elected representatives are idiots. The rest of the world simply assumes stupidity and cupidity on their behalf and find themselves rarely disappointed.

Ignore the virus for a moment. True, it will kill tens of millions of people but everyone alive is going to die someday anyway. All the virus will do is accelerate the process. Some of those who survive will figure out how to cope.

The depression is another story. Already pundits are suggesting that investors should buy the dip. The FDIC actually put out a video saying, your money in the bank is safe. Do not withdraw your money. Are you kidding me, they really said that?

I’m told the FDIC chairman who actually put out the video was confused by the message. She stated in the first take of the video that “we are proud of the fact that since 1933 no American depositor covered by the FDIC ever lost a cent up until now. That’s a 99% success rate for us.” Naturally they had to brief her and rewrite her lines.

The message was clear. Just moments before a bank closes the president of the bank says, “Your money is perfectly safe in our bank.” And then slams the door forever.

Banks are going to close. The financial system may well shut down for a period. Lots of investors will go to bed rich and wake up poor.

Buying the dip is probably a really bad idea. We have had a crash. We have had a dead cat bounce and we are about to go back to the crash mode. Nothing at all has been fixed.

Between now and the end of this year I suspect the total drop will be between 85 and 92%. It could be worse. In the case of resource stocks, when the margin clerk calls, everything gets sold. Everything.

I have a lot of core positions of stocks I love. I will be putting in stink bids 20% lower than the close of shares I like the day before. While drops of 20% are common, drops of 25% are not. The value of these shares has not changed at all, only the price. Actually that’s not totally true, the latest $6 trillion piggy giveaway pretty much guarantees higher prices for real assets in the future. Keep some cash for screaming deals.

Rely on yourself, your family and your friends. The government is not your friend, not now, not ever.

Bob Moriarty

President: 321gold

Archives

321gold

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. Bob Moriarty is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Bob Moriarty was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The public are so misinformed that they are like horses with blinders on and which are being driven by a master to whom they are expendable and replaceable… by Eric […]

The post The Post-Coronavirus World Will Be FAR WORSE Than The Pre-Coronavirus World appeared first on Silver Doctors.