Source: Bob Moriarty for Streetwise Reports 03/08/2020

Bob Moriarty of 321gold explains why he believes gold needs a correction.

In military aviation pilots are taught about an important concept called being on the Back Side of the Power Curve. For every aircraft and altitude there is a speed and power curve. Until the aircraft gets too slow things work just fine. A lot like the Fed. But when the aircraft flies too slow and drag gets too high, the addition of more power makes the situation worse. The aircraft stalls no matter how much power the pilot applies. A lot like the Fed.

On Tuesday the 3rd of March the Fed surprised the market with a 50 basis point drop in interest rates. The move was intended to reassure the market that the Fed had things under control. The market in turn surprised the Fed by doing the opposite of what those investing using the rear view mirror believed.

The market tanked. Of course it tanked, the economy was on verge of stalling due to the highest debt level in history and just as it hit the stall point, the Fed jammed on the afterburner. Bad idea. But what a wonderful example of why pilots and the Fed should never add power when they are on the backside of the power curve.

Markets don’t trade on fundamentals or because of technicals. At every market top there are a hundred reasons to buy. That’s what makes a top. And at every market bottom there are a hundred reasons to sell, that’s how you know it’s a bottom.

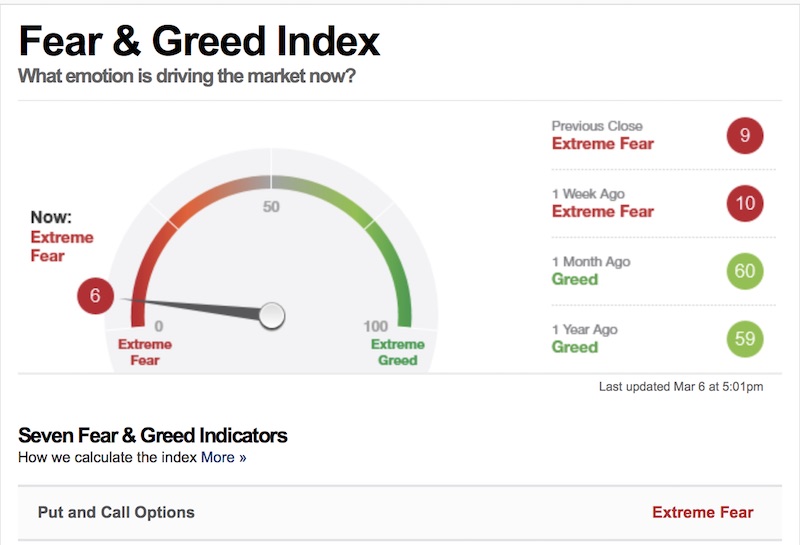

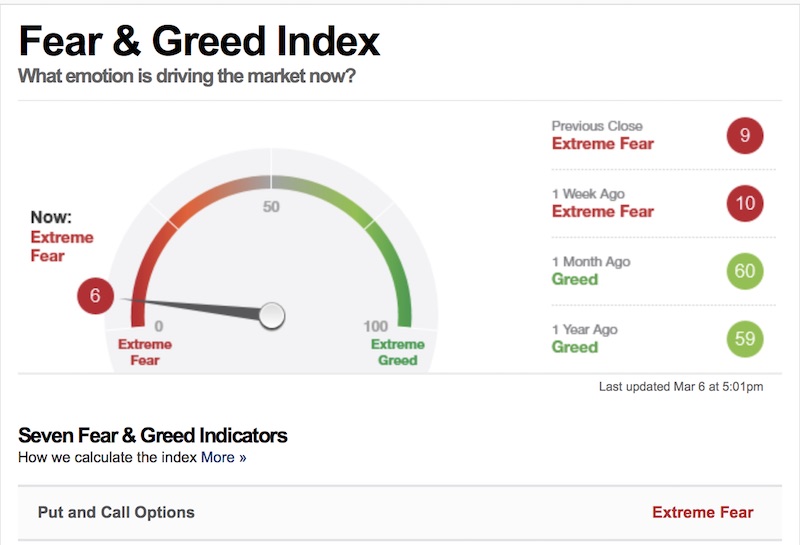

Markets trade on emotion and if you can just measure that emotion with accuracy, you can make a lot of money or in the worst case, avoid losing a lot of money. I wrote about the propensity of the stock market to top based on nothing more complex than the Fear and Greed index on January 1st.

On Friday March 6th the Fear and Greed index became the opposite and then some of the late December reading as it hit a reading of 6. That’s really fearful.

Monday March 9th is going to be an interesting day. The DSI (Daily Sentiment Index) for Treasury Bonds had a near all time high reading of 98 on Friday March 6th. It’s only been higher one time, which was back in December of 2008.

The DSI may bounce around at record highs for two weeks as it did in December of 2008 during the GFC but there is another interesting issue that makes me think we will have a turn almost at once. The 9th of March marks a full moon and according to Tom McClellan his research showed that at full moons, markets tended to either accelerate in the direction they were moving or do an immediate U-turn.

Gold has wanted to correct for a couple of months. Gold shares peaked relative to gold at the start of the year at exactly the same time as I was saying to beware the stock market. I started to lighten my percentage of shares to cash during what was a great time to be selling shares. I have kept my core positions but selling when you have a profit beats the hell out of selling at a loss.

Gold needs a correction. Two weeks ago the DSI on gold hit 96 and that says things are getting frothy. I always get a lot of hate mail when I point out that gold and resource stocks sometimes go down but that just tells me I have nailed it.

We have entered the Greatest Depression. The latest chaos in the stock market is just the beginning. It’s going a lot lower. And likewise, bond prices could go higher with gold. But when everyone is on one side of the boat, that’s not a percentage bet.

Meanwhile the coronavirus spirals out of control. In the U.S. the number of cases went up almost 400% in a week, from 68 on the 29th of February to 378 on the 7th of March. That’s nothing. In France cases exploded higher from 100 cases on the last of February to 653 a week later for a 550% higher reported number cases in a week. Germany showed a 750% increase in coronavirus cases in the same week.

The travel industry is being destroyed. The world faces a critical shortage of medicine starting at once. Airlines may as well fold now and get it over with. The coronavirus will not cause the Greatest Depression. That was on the cards already due to the incredible amount of debt in the world that will never be paid. The virus is little more than a catalyst but it is a black swan of black swans and makes for a handy excuse.

Meanwhile the latest act out of Washington is Donald Trump playing Archie Bunker in a comedy with tragic overtones with Mike Pence cast as Barney Fife. Pence believes you can pray away an outbreak of a deadly virus while Trump believes women only have two important attributes and you can conduct world affairs on Twitter.

Anyone appointing a born again Christian who believes in neither science nor evolution as the leader of the U.S. fight against a deadly virus is an idiot. But it’s a case of the blind leading the blind.

Readers, don’t be tempted to consider writing a novel or a screenplay to be made into a movie using our own Archie Bunker and Barney Fife as characters. If your plot was identical to the facts it would be rejected as being too far fetched to be believed.

The stock market hasn’t finished its crash. The Everything Bubble just blew sky high and the ensuing deflation is going to take everything down.

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. Bob Moriarty is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Bob Moriarty was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.