When investors become increasingly concerned about the financial system, they rush into physical precious metals. And, this is precisely what we see taking place at the U.S. Mint as sales of Silver Eagles surged in the first three days of March versus the entire month of February. The U.S. Mint hasn’t seen this type of buying for several years.

For the past three years, annual Silver Eagle sales fell below 20 million, reaching a low in 2019. However, that may all change this year as the global contagion spreads, motivating investors to shed paper assets and move into physical precious metals.

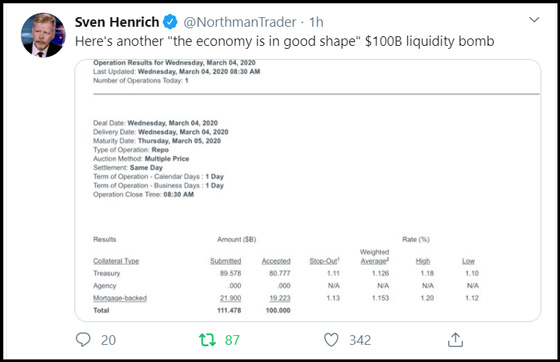

For sure, investors should be worried when the Fed starts to do “LIQUIDITY BOMBS” via its Repo Operations as stated by Sven Heinrich, the Northman Trader:

While the Primary Dealers submitted requests for $111.478 billion this morning, the Fed accepted $100 billion. Add that to the single-day Repo of another $100 billion yesterday, which I wrote about in my article; FED REPO INJECTIONS HIT RECORD LEVEL: Global Contagion Negatively Impacting Financial Markets. The Fed Repo Operations yesterday purchased $100 billion (overnight) and a $20 billion (two-week period) for a total of $120 billion.

On top of the record Fed Repo Operations, then there was the “EMERGENCY” 50 basis point rate cut yesterday that should have pushed the markets up considerably.

However, the Dow Jones Index fell nearly 800 points by the end of trading… a very bad sign indeed. While the Dow has recovered this morning, I believe this is only a temporary situation as the global contagion continues to spread negatively impacting the world’s supply chain. Let’s face it; the worst is yet to come.

With precious metals sales surging over the past few weeks due to the risk of the global contagion, the U.S. Mint website reported that 675,000 Silver Eagles were sold in just the first three days of March.

Now, compare that to the total 650,000 sold during the entire month of February:

Again, it has been quite a while since the U.S. Mint has experienced this type of buying. It will be interesting to see if this trend continues throughout the rest of the month.

Total U.S. Mint Silver Eagle sales for 2020 are currently 5,171,000, with 3,846,000 just for January. Each year, the primary dealers purchase a lot of Silver Eagles in January to meet the increased demand for the new yearly product. Last year, Silver Eagle sales in January were 4,017,500.

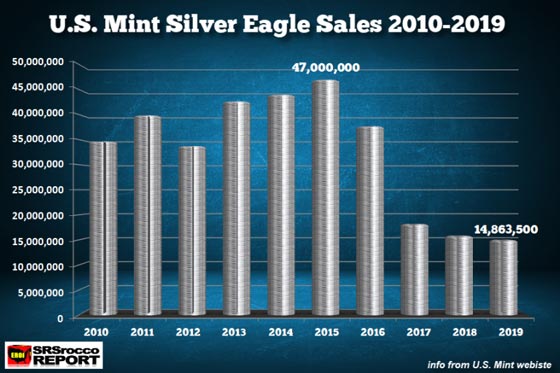

Here are the annual Silver Eagle sales from 2010-2019:

As we can see, the U.S. Mint Silver Eagle sales peaked at 47 million in 2015 and fell to a low of 14.86 million in 2019.

However, as I stated, this all can change in 2020 as this global contagion spreads, forcing investors to move into physical precious metals to protect wealth.

IMPORTANT FACTORS to consider about U.S. Mint Silver Eagle Sales in 2020:

- The U.S. Mint is not set up to do large monthly mint runs of Silver Eagles like it was before 2016. Thus, there is likely less staff, and it will take a while to ramp up production.

- If the global contagion continues to spread in the U.S., then acquiring silver rounds to make Silver Eagles may become increasingly difficult.

- What happens if the U.S. Government decides to shut down some “Non-critical” facilities to protect against the spread of the virus? This could impact the production of Silver Eagles.

I believe precious metals investors should be aware that it may be challenging to get available supplies of physical gold and silver bullion in the future… only at much higher prices.

A US official illegally crossed into Syria to announce a hundred million dollars in US aid. These weapons will end up in the hands of al-Qaeda… by Ron Paul via […]

The post Ron Paul: Another Trump Flip-Flop – US To Send Money And Weapons To Syria Rebels appeared first on Silver Doctors.

The number US Forces Korea cases is increasing along with the number of cases in South Korea as a whole. Here are the details… (Silver Doctors Editors) South Korea continues to […]

The post Military Penetration: US Forces Korea Now Reports 6 Confirmed Coronavirus Cases appeared first on Silver Doctors.

Governments are not going to disguise the real economic impact of the epidemic, rather the opposite. Aggressive shutdown measures will… by Daniel Lacalle via Mises The Johns Hopkins University Coronavirus Global […]

The post Governments Are Using The Coronavirus To Distract From Their Own Failures appeared first on Silver Doctors.

This virus is weaponized, on accident or on purpose… by Sean from SGTreport This virus is weaponized, on accident or on purpose…

The post SGTreport: PANIC BUYING BEGINS & MY RESPONSE TO THE WSJ HIT PIECE appeared first on Silver Doctors.

Pence said we are able to provide testing for those who are believed to be exposed and showing symptoms. Trump’s silent on the matter… (Silver Doctors Editors) On Sunday, March […]

The post On Sunday Pence Said 15,000 Coronavirus Test Kits Have Been Released, Today He Says It’s 1,500 appeared first on Silver Doctors.