‘Anatomy of the Bear’

John Authers interviews Russell Napier author of the cult classic: Anatomy of the Bear

Bloomberg/John Authers/3-3-2020

“This is where we are headed, and helicopter money must come with financial repression — something I have written a 60-page tome on for clients. I cannot go through all those arguments, but gold is the stand-out asset class in a financial repression. So in the world of finance Covid-19 will be remembered not for the damage it did, but for the new form of cure it unleashed — particularly in Europe but also probably in Japan. Gold benefits from this shift for a very long time indeed.” – Russell Napier

“This is where we are headed, and helicopter money must come with financial repression — something I have written a 60-page tome on for clients. I cannot go through all those arguments, but gold is the stand-out asset class in a financial repression. So in the world of finance Covid-19 will be remembered not for the damage it did, but for the new form of cure it unleashed — particularly in Europe but also probably in Japan. Gold benefits from this shift for a very long time indeed.” – Russell Napier

USAGOLD note: The timing for this interview could not have been better given the present circumstances in global stock markets. We cited it in this morning’s DMR and post the link here for those who may have missed this morning’s report.

Bloomberg/Liz McCormick/3-3-2020

“Treasuries surged as traders bet the Federal Reserve’s emergency rate cut might not be enough to prevent the coronavirus from chilling the U.S. economy. The rally drove yields on benchmark 10-year notes down 14 basis points to a record low of 1.02%.”

“Treasuries surged as traders bet the Federal Reserve’s emergency rate cut might not be enough to prevent the coronavirus from chilling the U.S. economy. The rally drove yields on benchmark 10-year notes down 14 basis points to a record low of 1.02%.”

USAGOLD note: Stocks’ immediate reaction was to view the rate cut as an admission that something was wrong – perhaps very wrong – with the U.S. and global economies.

The Fed injected a record amount of liquidity this morning via its Repo Market Operation to supply dealers in the interbank market. While investors may be reassured by the huge 1293 point rally on the Dow yesterday, the global contagion and its impact are just beginning. Don’t be surprised to see a 40-50% correction in the Dow Jones over the next month.

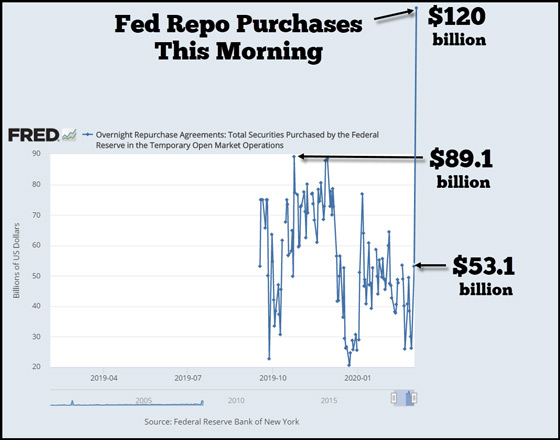

I’ve been keeping an eye on the Fed Repo Operations and was quite surprised this morning to see the Fed has already injected a record $120 billion into the market. Again, this is the largest single-day amount of Fed liquidity, going back to the first Repo Operation on September 17, 2019:

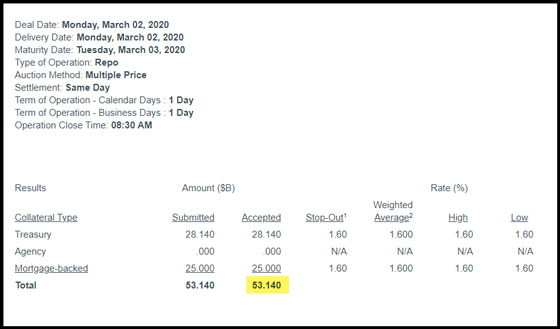

As you can see, I had to enlarge the chart to accommodate the Fed’s newest liquidity injection this morning… and the day isn’t over yet… LOL. The Fed’s largest single-day Repo injection was $89.1 billion on October 24. Yesterday, on Monday, March 2, the Fed accepted $53.1 billion from the dealers:

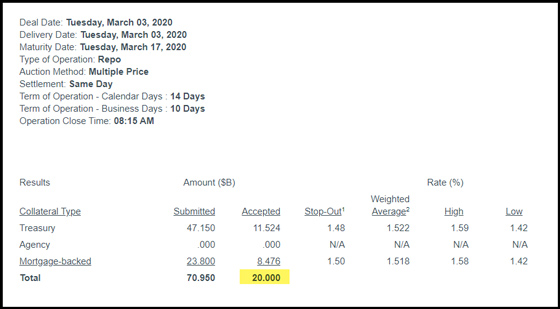

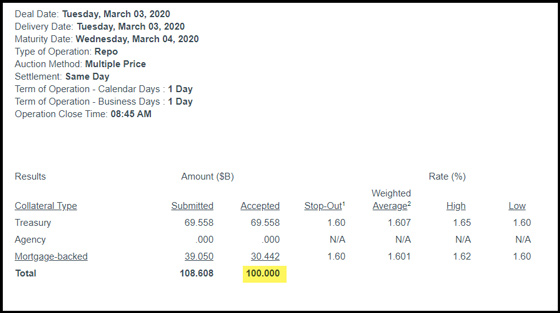

The $53.1 billion is shown in the FRED chart above for yesterday. Now compare that to the record $120 billion so far today, shown in the next two graphics. The first $20 billion was accepted at 8:15 am, and the $100 billion was taken on 8:45 am:

Clearly, there is something SERIOUSLY WRONG in the Financial markets for the Fed to being injected $120 billion, the most since it started its Rep operations last September.

I believe investors and the market have no idea just how bad this Global Contagion will be like over the next 2-4 weeks… and longer. As I stated, don’t be surprised to see the Dow Jones Index lose 40-50% from its peak over the next month. Traders and Wall Street are going to get destroyed, and there is little they can do about it.