During turbulent times like these, markets can be melting down one day… and zooming higher the next. Gold may serve as a fantastic safe-haven asset one day… but get hammered by futures traders the next.

The news cycle can be just as volatile. One report may show the coronavirus is receding in China, while another may raise alarms about its spread in other parts of the world.

One poll may show a socialist candidate for President on the rise, while another may show Americans overwhelmingly approve of President Donald Trump’s handling of the economy.

We have a record-low unemployment rate (at least officially), but financial markets have become more unstable than at any time since the 2008 financial crisis.

To quote Charles Dickens, “It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair…” (A Tale of Two Cities, 1859).

Long-term investors shouldn’t despair over volatile market conditions. Drawdowns create value opportunities – though not always in the most obvious places.

Liquidation events also trigger reactions from central bankers, which in turn create new market distortions and risks – as well as new opportunities.

Last week’s global stock market mini-crash drew a massive response from concerned central bankers around the world:

- The People’s Bank of China sought to prop up Chinese equities with direct interventions.

- The European Central Bank announced that it “stands ready to adjust all its instruments, as appropriate.”

- The Bank of Japan, said it would “strive to provide ample liquidity.”

- The U.S. Federal Reserve vowed to “use our tools and act as appropriate to support the economy.”

Meanwhile, the World Bank and International Monetary Fund pledged to provide assistance to countries that need it.

Last Tuesday morning, Treasury Secretary Steven Mnuchin and Federal Reserve Chairman Jerome Powell joined finance ministers and central bank heads from G7 countries to hold emergency talks and give carefully crafted reassurances over the coronavirus pandemic.

“The only medicine central bankers know how to administer is interest rate cuts and stimulus injections.”

Tweet This

“There will be coordinated action,” said French Finance Minister Bruno Le Maire.

Of course, these economic central planners know next to nothing about how to fight a virus. The only medicine they know how to administer is interest rate cuts and stimulus injections.

The Dow Jones Industrials surged a record 1,293 points Monday as investors anticipated a globally coordinated plunge protection response. The 10-year Treasury note yield also traded down to a record low – well below the current Fed funds target rate of 1.50%-1.75%. The U.S. Dollar Index also slid on the day.

In effect, financial markets were reacting as if the Fed had already cut its benchmark rate. And then the Fed followed through with an “emergency cut” of 50 basis points the next morning.

Goldman Sachs economists are now forecasting that Jerome Powell and company will slash rates another 50 basis points later this year.

That would effectively reinstate ZIRP (Zero Interest Rate Policy), leaving the Fed with a very limited conventional toolkit to fight the next financial crisis or recession.

Powell would have to face the prospect of pursuing negative interest rates or initiating direct “helicopter drops” of stimulus into the financial system.

When Europe and Japan began pursuing negative interest rate policies, they did little to stimulate moribund economies. Instead, they drove capital into higher-yielding U.S. assets, including Treasuries, and helped boost the U.S. dollar.

When the U.S. goes to zero or negative on interest rates, there will be no place in the world left to go for decent yields – or at least, no place big enough and safe enough to absorb trillions of dollars in global capital flight.

That leaves gold and other hard assets as potentially the prime beneficiaries of a global race to debase. If cash has no yield, then gold looks even better than ever in comparison.

Gold had surged to a 7-year high of $1,680 in late February before getting smashed last Friday. Whether the selling was due to margin calls, forced liquidation carrying over from the stock market, or a “coordinated action” by bankers, it stands in contrast to the strong buying of physical gold and silver seen by bullion dealers in recent days.

Now that fear has returned to financial markets and central bank monetary spigots have been turned open, we would expect investment demand for bullion to continue gaining strength.

A major increase in retail precious metals demand won’t necessarily have an immediate impact on spot prices, which are set by futures traders. But over time an increase in physical buying will put pressure on the very limited global supply of precious metals.

When it’s the worst of times for markets that central bankers are trying to prop up, the best of times may follow in months and years ahead for gold and silver markets.

Dolly Varden Silver Is Going to Ride Again

Source: Bob Moriarty for Streetwise Reports 03/02/2020

Bob Moriarty of 321gold makes the case for silver and profiles a company with a storied silver project in British Columbia’s Golden Triangle.

As I write the ratio of silver to gold is about 96-1. It takes 96 ounces of silver to buy one ounce of gold. As the magnificent Steve Saville has just pointed out the ratio is within five percent of the highest it has ever been in history. Once in 1942 and again in 1993 when the ratio touched just over 100-1. I believe it will again.

For those who have read my books, I advocate using the silver/gold ratio to make a relatively safe but highly predictable return. Buy what is cheap (silver) and sell what is dear (gold). The DSI on gold hit 96 about ten days ago on the 21st of February. Like palladium and rhodium gold got frothy. Palladium and rhodium got super frothy with palladium almost touching $2800 an ounce and rhodium going to $12,000 an ounce on the ask. A correction is necessary for a healthy market no matter what the conspiracy people tell you.

Dolly Varden Silver Corp. (DV:TSX.V; DOLLF:OTCBB) is probably the most famous name in silver in Canada. Under the British Empire, the Dolly Varden mine in the world renowned Golden Triangle was the richest mine producing direct shipping ore in excess of 1,100 g/t Ag. The Dolly Varden Silver Corp (DV-V) wants to regain that title under new aggressive management. I don’t fault their timing at all. We are in a market crash dead cat bounce not withstanding. At the end of the day and the Everything Bubble we will have both a debt jubilee and a return to a precious metals financial system. Silver will be far more valuable relative to gold than today. Buy any silver company you can, they are all cheap.

With $4 million in the bank, Dolly Varden is well financed to make it through the storms ahead. The company reports a 44 million ounce 43-101 resource. At lower silver prices back just after the turn of the century silver in the ground was being valued up to $3 an ounce. It will happen again.

The company has just announced a management shift and a new CEO named Shawn Khunkhun and appointed Rob McLeod as a director. I am a giant fan of Rob McLeod. He literally was born with a rock pick in his hands and is a third generation Canadian miner.

Dolly Varden has 100% ownership of the 8,800 square Ha property with four past producing mines and four new exploration targets. The company estimates that only three percent of the project has been explored.

In 1919-1921 Dolly Varden produced 1.3 million ounces of silver at an average grade of 1,103 g/t. Between 1949 and 1959 their Torbrit Mine delivered 18 million ounces of silver at 466.3 g/t and had base metal credits. In the 1960s due to the low price of silver the mine went out of production.

In the past three years Dolly Varden drilled over 55,000 meters in 174 holes. Met testing shows silver recovery of about 86-87% using flotation and cyanide recovery on the tails.

Dolly Varden is an institutional favorite with institutions holding about 60% of the shares, Hecla Canada owns another 11% with Eric Sprott taking down another 13%. Only about 16% of the float is in the hands of individual investors leaving a great potential for the stock price to just take off.

I like the story enough to go out in the open market and buy shares. Dolly Varden has just become a sponsor so I have to be biased. If you like silver, please review their company presentation, it’s very good and comprehensive.

Dolly Varden Silver

DV-V $0.295 (Mar 02, 2020)

DOLLF-OTCBB 83.5 million shares

Dolly Varden website.

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Dolly Varden Silver. My company has a financial relationship with the following companies mentioned in this article: Dolly Varden Silver is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

( Companies Mentioned: DV:TSX.V; DOLLF:OTCBB,

)

Peniaphobia Prevails

Source: Michael Ballanger for Streetwise Reports 03/02/2020

Sector expert Michael Ballanger charts tumbling markets amid the scare of a coronavirus pandemic.

(Peniaphobia: fear of poverty)

This weekend, newsletter writers the world over are scrambling to explain to their paid subscribers why they are now showing losses in portfolios that were supposed to be showing gains, and especially because it was only two weeks ago that the S&P 500 hit all-time highs at 3,393.52. Without going into a long diatribe over the multiple warnings I issued in January, Mother Nature (or a bioweapons lab) has provided the pinprick that has now popped the global equities bubble, triggering a gargantuan rush to the exits and liquidity.

Mind you, the month of February started off like a house on fire, with literally everyone taking victory laps over their ingenious market prognostications and thumbing their noses at COVID-19, because Trump and Kudlow told us that it was a “non-event” and urged everyone to “buy the dip.” The gold newsletters were all collectively refuting any possibility of a 2008-style rout in the precious metals due to a silly virus, forgetting, of course, that the bullion banks did not let their bootheels off the throats of the precious metals for as much as one nanosecond. Even after the $105 crash from last Sunday’s $1,692 peak, by Tuesday, they had only reversed a mere 8,891 shorts.

Same applied for silver, but what was noteworthy was the mass liquidation in both gold and silver by the Large Speculators—yet not exactly a surprise. The weekly gold chart is a great deal healthier today than it was last weekend as the overbought condition is now absent, which is a good thing.

The two charts on the next page were e-mailed to you all in Email Alert 2020-06 (Jan. 12), where I warned of the rapidly eroding momentum in the S&P and initiated a combination of short SPY, long SPY puts and long UVXY. Those were all cashed out last week with excellent profits, albeit too early too really ring the register with the late-week downside extension (“crash”).

Since the turn of the year, I have constantly warned of the possibility of a stock market panic affecting the precious metals stocks adversely, and as it would turn out, that is exactly what we got in the final week of the month. A complete scramble for liquidity in all asset classes, not unlike 2008 and 1987, where the HUI lost 17.3% despite gold still being up 2.86% year to date. Shades of 1987, which I wrote about in January, were exactly what we got and while everything was impacted, my only saving grace was being stopped out of the GDX and GDXJ with modest profits (US$29.90 and US$41.20), after which they both went “no-bid.” We close out the month down 19.71% but sitting on a 41% cash position (and that does not count the profits from the short SPY, long put, and long volatility trades).

It was an ugly week and an ugly month but the GGMA portfolio survived, albeit not without a few bumps and bruises.

You will note that the red down arrow in the second chart pointed to the sub-3,000 level for the SPX ,so the monthly close at 2,988 was particularly prescient.

As for the SPX looking out to this week, the daily relative strength index (RSI) below 20 registers a Buy signal, but the weekly at 38.85 says that any buying next week is to be traded as the inevitable retest of the lows as a virtual shoe-in. For the precious metals exchange-traded funds (ETFs) to recover, I need this pervasive panic to end. Then, and only then, can we even discuss (let alone analyze) the Senior Gold Producers and how incredibly cheap they are.

As for the gold and silver mining stocks, with gold at $1,578 (where it closed two weeks ago), there is only one meaningful gauge upon which to rely, and that is the ratio of the HUI to gold prices. Last July, the HUI:GOLD ratio broke a long downtrend dating back to August 2016, which means that all the terrific technical work put in during the last three quarters has been vaporized by the left-right combo of mysophobia (fear of germs) and peniaphobia (fear of poverty). Just as the hyperbaric levitation of all things “paper” since Christmas Eve 2018, SPX at 2,351, made little sense to many of us, the events of the past two weeks made perfect sense to many of us. The algobots that chased these major markets to extreme valuations, while devoid of emotion, transformed themselves into ruthless sellers of equal intensity and indifference.

One of the symptoms of a troubled financial system is accelerated volatility and increasing crashes. In my early years, the old-timers used to talk about the 1973–1974 bear that nearly turned a generation of stockbrokers into a generation of cab drivers, as volatility faded away and apathy dominated.

The really old veterans would talk about fathers and uncles being wiped out in the ’29 crash but in my career, we only had one actual crash and that was in October 1987, fifty-four years after the “big one” that preceded the Great Depression.

Since then, we have had crashes in ’98, ’01, ’08, 2018 and now 2020. These cataclysmic selling sprees are occurring with greater frequency and violence than in prior times, and I lay it all at the feet of the central banks and the algobots. Gone forever are the days when retail panicked and instos bought, because here in 2020, a computer program launches a sell program and everyone runs for the diaper bag.

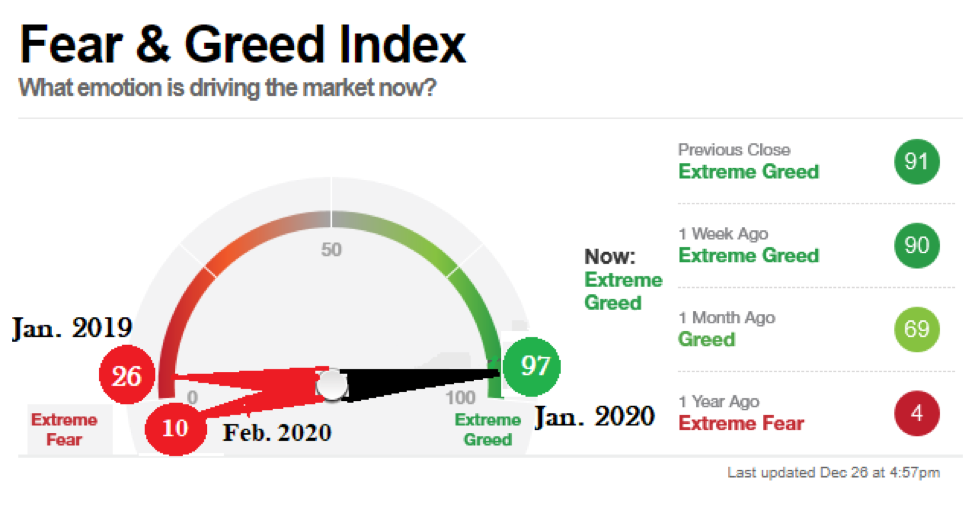

Now, I want you all to take a deep breath and look at this graphic. You have seen a similar one before in mid-January, during the week that I shorted the market, which showed only January 2019 (Extreme Fear at 26) and January 2020 (Extreme Greed at 97). The one below tells you everything. To be sure, it is an imperfect timing tool, but it is a foolproof risk-management tool. It helped me to avoid the 50–60% drawdowns that can torpedo careers.

It is flashing the green light, with a reading of “10” versus a near-impossible “97” three weeks ago. Furthermore, it is now 17 points lower than Christmas Eve 2018, when Trump, Mnuchin, and Powell teamed up to save the bull market in stocks.

Accordingly, I will have a few ideas in the subscriber section that I assure you will include the gold and silver stocks. Important as it is to get aggressive here, be it known that whenever I elect to buy after a crash, I do not make the mistake of going after the speculative juniors. I own a bunch of them and I will not sell any of my “penny dreadfuls,” but I learned over the years that you stay with the senior and intermediate miners for the rebound, and then reassess when the retest occurs. If it is a mild retest, you can venture into the little guys but if it is a deep retest, you stick with the big, liquid names.

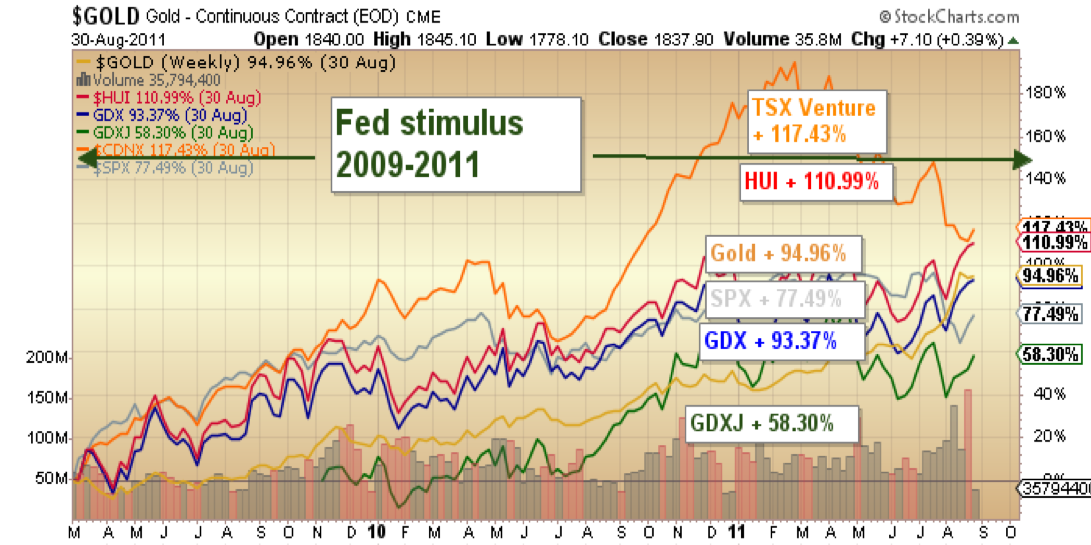

Before I sign off after a really interesting week, I thought I would take a glance at the best performers in the two years after the 2007–2008 Great Financial Bailout Crisis, and wouldn’t I be the most shocked person in the room to see the TSX Venture Exchange leading the pack in terms of pure performance?

I happen to believe that it was the degree to which the TSX.V got absolutely obliterated during the late 2008 meltdown that skewed the result, but I was there in 2008, when one of our underwritings went from CA$0.90 to CA$0.085 (all in 2008), but then bolted the 2008 lows to over CA$1.50 by January 2010. Point being: Get ready to write a check.

Not to get maudlin on you all but, despite my age and ornery, unsympathetic and unyielding disposition, I feel the pain of those who are getting slammed by this correction in a big way. If you are not grizzled with the scar tissue of prior crashes, you have little or no emotional defense against peniaphobia.

In my early days, where I was speaking to investors 24/7 about their savings, I used to give them the same advice my Jesuit math teacher used to give me when I was at his door the night before a final exam: “Why don’t you have faith in the work you have done in my class and go home and sleep on it?” That was always great advice, and I wound up with eight As in the math requisite thanks to him.

More importantly, my customers used to thank me for calming their fears, which resonated in a very big way and has become a life-long mission that I take very seriously.

As indicated earlier, I am ticked off that I wasn’t more aggressively short the S&P in light of all the warning signs that I posted since the beginning of the year, but I am pleased that we head into March able to allocate the 41% cash into record declines and ridiculous valuations. It is precisely at times like this, with fear running high, that I have to fight the urge to vegetate and muster up the intestinal fortitude to start buying.

The portfolio I have constructed is perfectly suited for a world floating on an ocean of false promises and unmanageable debt, and when this current excuse for profit-taking has ended, the steps taken to rectify the markets’ problems will be the same ones that will annihilate currencies across the planet, leaving gold and silver as the only mediums of exchange offering generational security.

Buy ’em.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Department of Defense experts are expecting the coronavirus to reach pandemic levels in 30 days… by Mac Slavo of SHTFplan Department of Defense experts are expecting the coronavirus to reach […]

The post WITHIN 30 DAYS, THE CORONAVIRUS OUTBREAK WILL LIKELY BECOME A PANDEMIC appeared first on Silver Doctors.

Today came the rate cut, soon comes the fiscal stimulus, and then comes financial ruin… Mike Manwell and Half Dollar on Rethinking the Dollar Today came the rate cut, soon […]

The post Financial Ruin Ahead Because of Human Malware appeared first on Silver Doctors.

Do they want to stop the spread of Covid-19 coronavirus, or do they want millions and millions of dead Americans? It’s rather sickening. CNN is blaming prudent Americans for the […]

The post OPINION: If Washington Says “Don’t Wear Masks”, Then Close Down All Public Schools And Government Buildings In Outbreak Areas Immediately appeared first on Silver Doctors.