- Gold, silver see sharp downside corrections from recent gains Kitco NEWS

- Gold retreats from multi-year peak, but virus fears remain CNBC

- Gold Prices Steady from 3% Covid-19 Swing, Possible Vaccine ’12-18 Months Away’ | Gold News BullionVault

- Gold retreats from seven-year high, but virus fears limit losses Yahoo Finance

- Gold prices today fall ₹1,200 per 10 gram, silver rates plunge Livemint

- View Full Coverage on Google News

A Digital “Fedcoin” May Be Coming…

Cryptocurrencies are based on blockchain technology that allows for de-centralized peer-to-peer transactions to take place outside the government-controlled banking system.

Backers of cryptocurrencies such as Bitcoin tout their privacy advantages and resistance to inflation due to their strictly limited quantities.

But what if this free-market innovation were co-opted to achieve opposite ends – centralized tracking of every transaction with no possibility of escaping digital devaluations?

That’s what some central bankers are ultimately aiming for by replacing paper cash with their own digitized, monopolized currencies.

Federal Reserve Officials Are Eager to Follow China’s Authoritarian Lead

Not surprisingly, authoritarian regimes such as Venezuela and China are leading the way in rolling out their own cryptocurrencies. But the U.S. may not be far behind.

Consider what Federal Reserve Governor Lael Brainard said at a recent conference hosted by Stanford University: “By transforming payments, digitalization has the potential to deliver greater value and convenience at lower cost.”

These are selling points for Bitcoin. But Brainard clearly isn’t a fan of this and other cryptos gaining wider use in the free-market. “Some of the new players are outside the financial system’s regulatory guardrails, and their new currencies could pose challenges in areas such as illicit finance, privacy, financial stability and monetary policy transmission,” she said.

Her solution? Centralization.

Brainard noted that the Federal Reserve is “conducting research and experimentation related to distributed ledger technologies and their potential use case for digital currencies, including the potential for a CBDC (central bank digital currency).”

Fed chairman Jerome Powell has also taken a keen interest in the concept of central bank digital currency – i.e., Fedcoin.

During testimony before Congress earlier this month, Powell noted that “every major central bank is currently taking a deep look” at cryptocurrencies, adding, “I think it’s very much incumbent on us and other central banks to understand the costs and benefits and trade-offs associated with a possible digital currency.”

“Having a single government currency at the heart of the financial system is something that has served us well. It’s a very, very basic thing, it really hasn’t been in question, and I think before we move away from that, we should really understand what we’re doing. Preserving the centrality of a central, widely accepted currency that is accepted and trusted is an enormously important thing.”

Venezuela issued a digital currency called the “petro” in early 2018 – primarily as a way of getting around U.S. sanctions. It is purportedly backed one-for-one by barrels of oil.

But the petro also circulates at a fixed exchange rate with the Venezuelan bolívar, giving officials the ability to devalue it at will.

The Venezuelan regime may ultimately seek to push its citizens out of physical bolívars entirely and into digital petros exclusively.

“The petro makes it much easier to monitor transactions — and punish those conducting transactions inconsistent with the prevailing government’s objectives,” explains William J. Luther of the American Institution for Economic Research. “By requiring petro use, the Maduro regime tightens its grip on power.

China’s central bank, meanwhile, is actively pursuing digital currency as a way of enforcing its “social credit score” system on its populace.

Even as Chinese authorities have banned most cryptocurrency mining and trading, they have invested heavily in centralized cryptocurrency infrastructure. China has reportedly filed 84 patents in pursuit of a new electronic currency payments system.

How to Break Free from the Brave New Digital Currency World

In the event that the decentralized cryptocurrency dream turns into a centralized Fedcoin nightmare, what can individuals do to maintain some measure of financial privacy?

Since all Bitcoin transactions are already recorded on a ledger, it would be technically feasible for the government to track them back to exchanges and demand they release user data.

Worse, if all cryptocurrencies are some day banned, individuals would assume great legal risks by holding wealth in black market cryptos.

Security risks and the proliferation of cryptocurrency scams are also threats to the financial privacy and security of crypto holders.

Last week, a California man pleaded guilty to bilking nearly $150 million out of thousands of people worldwide through a digital currency scheme.

The scheme centered around a phony digital currency called GemCoin. It was pitched as being backed by precious gemstones. But the so-called GemCoins were ultimately backed by nothing but fraudulent promises.

Some digital coins claim to be backed by gold or silver. Even when they are legitimate, these types of vehicles should still be regarded as entailing many of the risks of cryptocurrencies in general.

No digital instrument can replicate the properties of physical coins. Gold and silver coins, bars, and rounds you can actually hold in your hand carry no counter-party risk and no risk of being stolen through cyber attacks.

Moreover, while the number of cryptocurrencies that could be launched into existence is unlimited, the amount of precious metal that can be mined from the earth is finite.

Hard money may lack the convenience of digital currency when it comes to transferring funds over the internet. But most people who hold gold and silver coins do so for long-term offline wealth preservation and true independence from the financial system.

Source: Maurice Jackson for Streetwise Reports 02/24/2020

In this interview with Maurice Jackson of Proven and Probable, Millrock Resources’ CEO describes the company’s prospects in Alaska’s Goodpaster gold district and how a new joint venture improves the value proposition.

Maurice Jackson: Today we will focus on a premier project generator that is conducting quite an intriguing exploration program in the prolific Tintina Gold Province of Alaska. Joining us for a conversation is Gregory Beischer, the CEO of Millrock Resources Inc. (MRO:TSX.V; MLRKF:OTCQB).

Gregory, for someone new to Millrock Resources, please introduce the opportunity the company presents to the market.

Gregory Beischer: Millrock Resources is a project generator company. We’re early-stage exploration geologists. Alaska is home base for us and this is the main area of exploration focus for us. We come up with new exploration ideas, concepts; we acquire mineral rights; and then we show the geologic potential to partners, mining companies or junior explorers that are interested in investing in our properties to earn an interest. The project generator model allows us to explore on multiple projects at one time, thereby increasing the chance of mineral deposit discovery—and the concurrent share price increase that comes along on those occasions when early-stage geologists make gold or other metallic mineral discoveries.

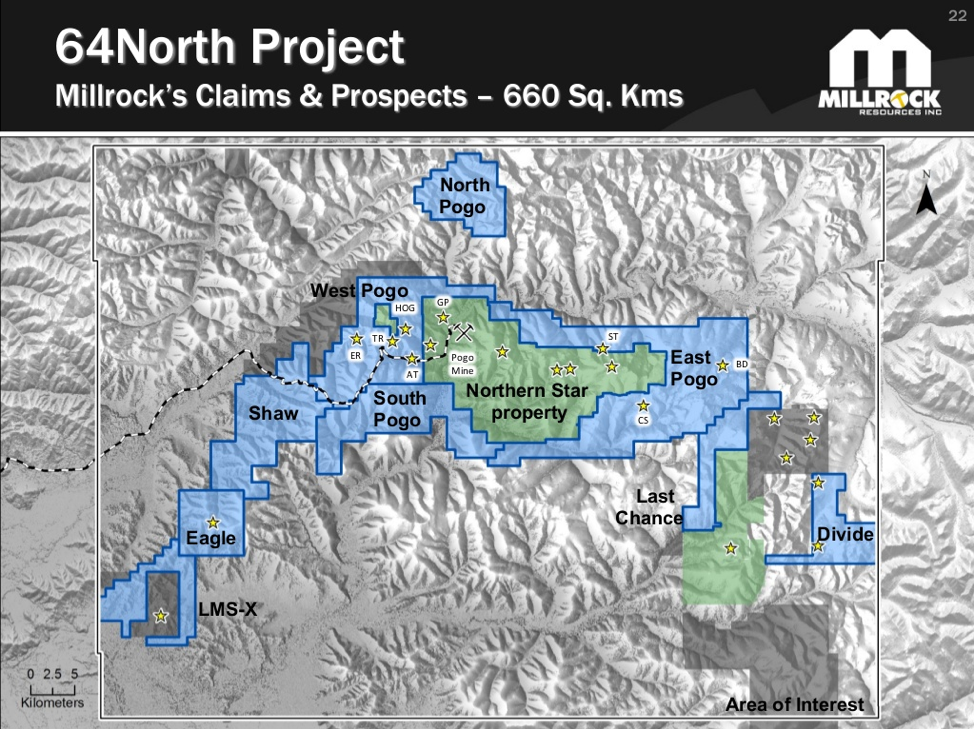

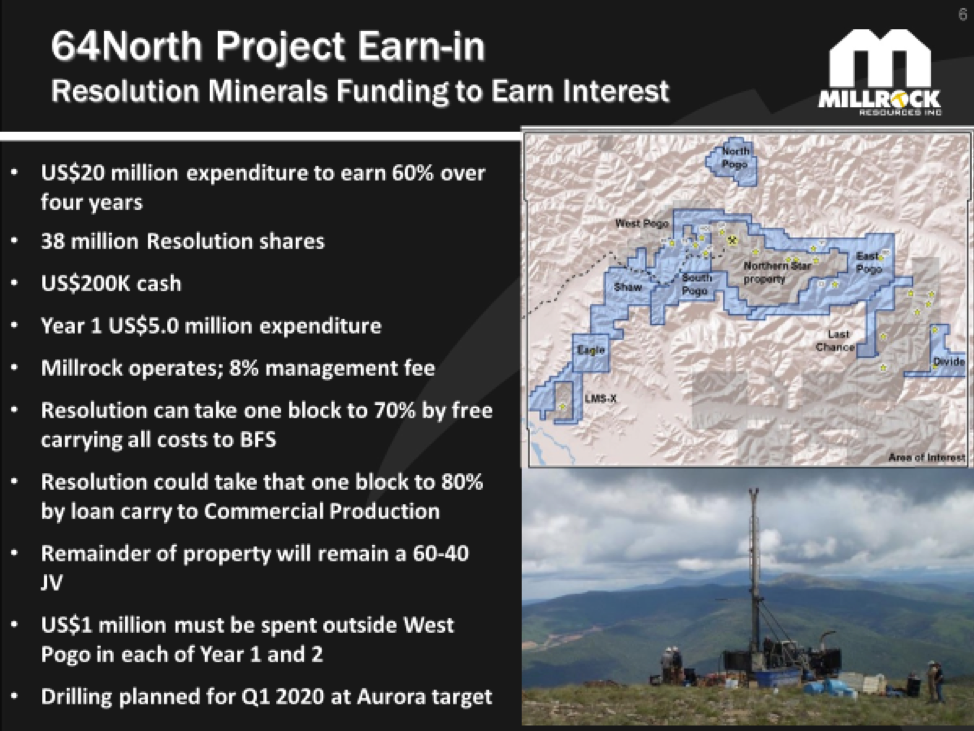

Maurice Jackson: Mr. Beischer, one of the tenets of Millrock Resources is increasing shareholder value through the discovery of world-class deposits. Millrock’s property bank has generative projects throughout North America. Take us to Alaska, to this 64 North project, which is a joint venture with Resolution Minerals Ltd. (RML:ASX) of Australia, and introduce the value proposition before us.

Gregory Beischer: Resolution Minerals is earning into our 64 North Project in Alaska. They issued a press release last week that featured a really interesting map that I’d like to take the time to explain later in our interview, but before we do I would like to set the stage for readers and put everything in context about the project using Millrock’s corporate presentation, which of course is available on our website. That’ll set the stage so that I can explain the contents of this very interesting map in Resolution’s press release.

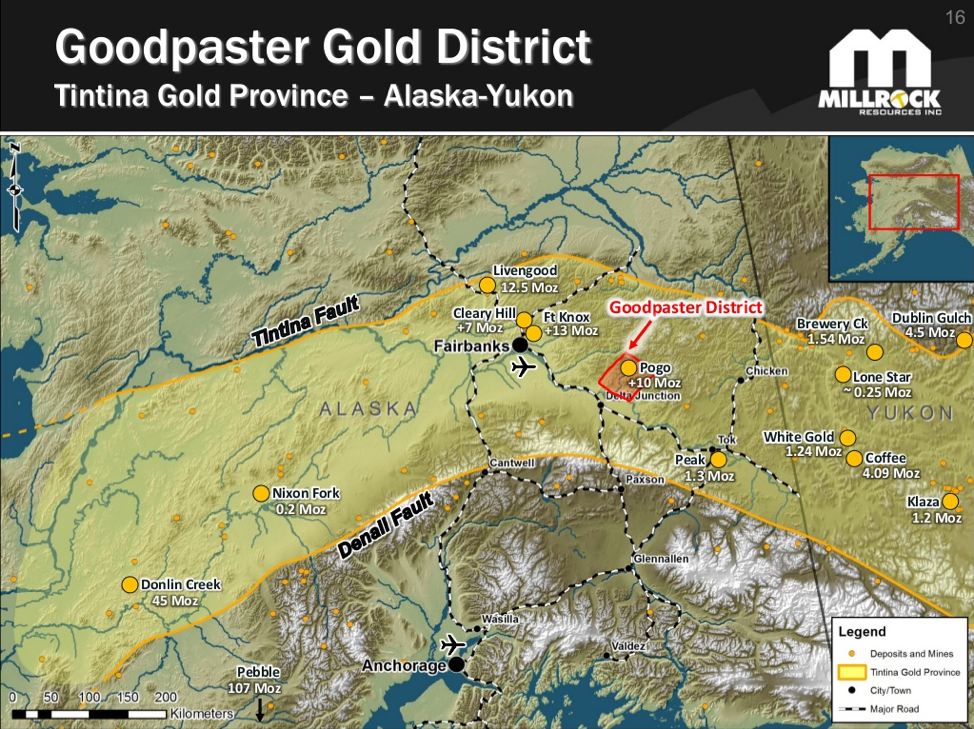

I’m based here in Anchorage. You can see a network of roads throughout the state. Alaska is a pretty big place, on the same par with the provinces of Ontario and Quebec, so it’s a pretty big chunk of real estate, but the project I want to tell you about in particular is 64 North, located just to the southeast of Fairbanks.

Maurice Jackson: Mr. Beischer, please introduce us to the Tintina Gold Province.

Gregory Beischer: Zooming for a closer look. Readers should note the yellow shaded arc are Cretaceous-aged rocks that have produced quite a few gold deposits. To the east is the Yukon-Alaska border. In the Yukon. . .quite a number of explorers have made discoveries and there is a new mine that has recently gone into production. The rocks on the Alaskan side of the border are quite prospective all the way to Fort Knox’s mine, which is over 13 million ounces of gold now, and the Pogo Mine, which is central to our story, now 10 million ounces and growing every day. It’s located in the Goodpaster mining district, which is the area of our 64 North project.

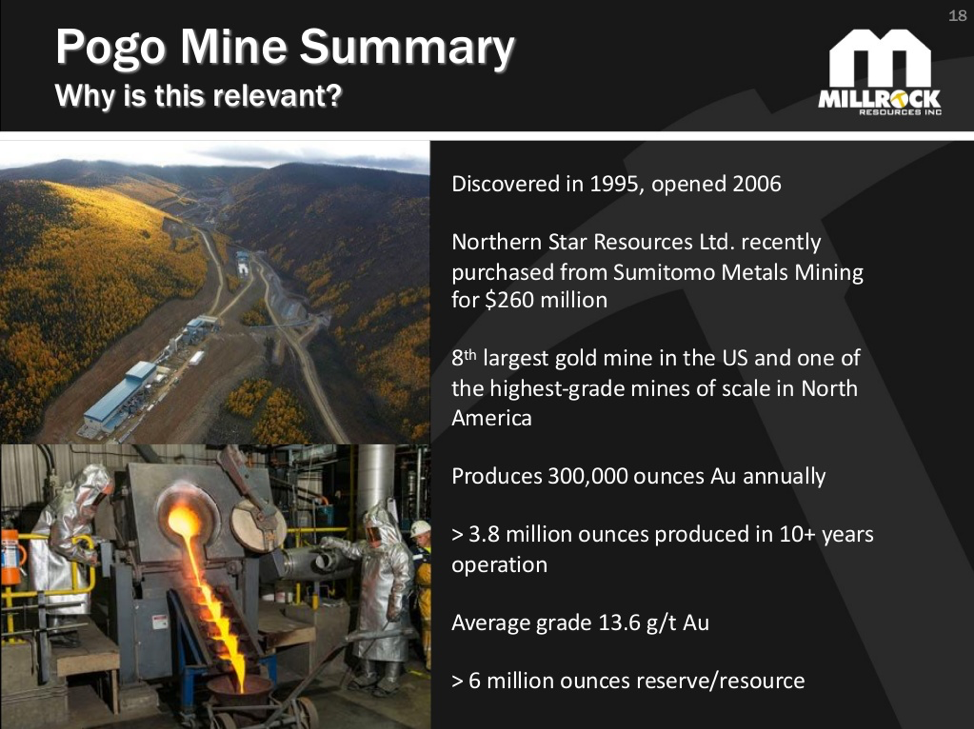

The Pogo is a really great mine. It is not quite high grade. It’s an underground mine, and the new owner, Northern Star Resources Ltd. (NST:ASX), is doing a great job to maximize the value of the mine and they’re making new discoveries. It’s growing day by day.

Looking even closer, on the black and white line, we can see the road coming into a Northern Star’s Pogo mine. Their claims are shown in the green color, and the huge claim block that Millrock staked at this time last year is shown in blue, along with the stars indicating spots where we know there’s signs of gold mineralization in the ground.

The 64 North is an enormous property, but we’ve developed a really compelling target, known as the Aurora Target, right beside the Pogo gold mine. In the background one can see the mine, mill complex, tailings facility, a lay down area and an air strip here, and we can see the Goodpaster River flowing by the mine.

We are standing on our ground, looking east back toward the mine and the mutual claim boundary between Millrock’s claims and Northern Star’s Pogo mine, which is in the foreground. There really is something [to] this old adage about finding a mine near another mine. It is a good place to work. We know the rocks are permissive to produce large gold deposits here. We know that the infrastructure is being developed, there’s a road nearby, there’s power nearby, and it’s permittable. The Pogo line took several years of permitting, but clearly we can permit a mine here. This is a great spot! We’re really excited now because the first drill program is imminent, and that’s what Resolution’s press release was all about.

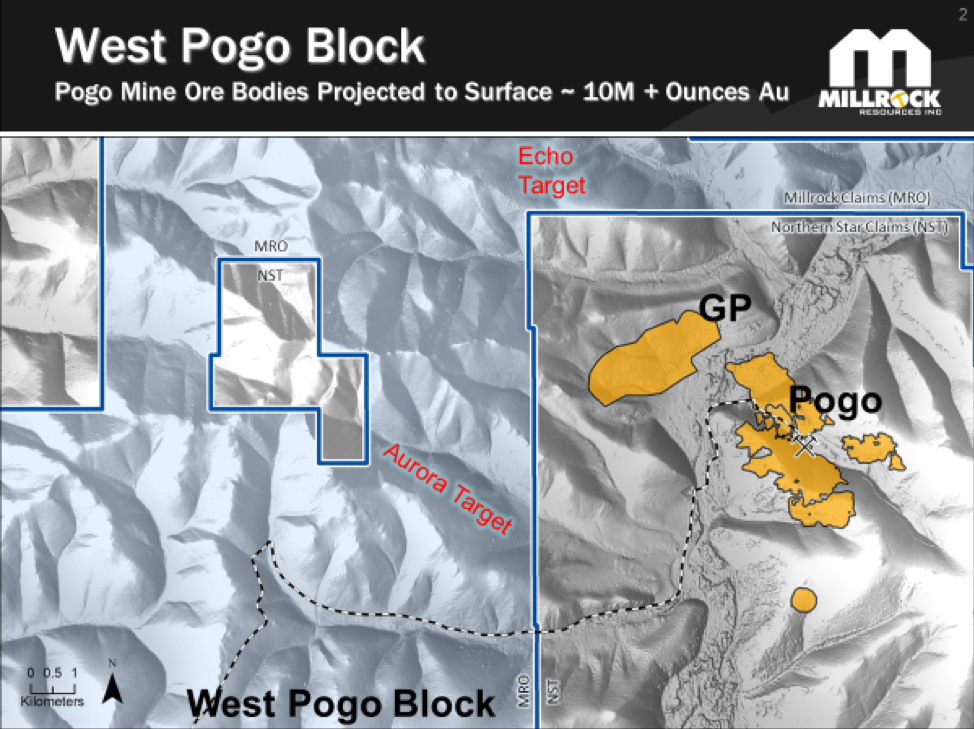

Maurice Jackson: Mr. Beischer, in the background we see the Pogo mine, and you referenced. . .additional discoveries made by Northern Star Resources. Can we see that on the map here?

Gregory Beischer: Yes, if we look on the edge of the picture, down on the floor of the valley of the Goodpaster River, it strikes right toward us, and we have every geologic, geochemical and geophysical reason to believe that new discovery extends right beneath our feet, where our senior project geologist, Chris Ven Treek, is standing.

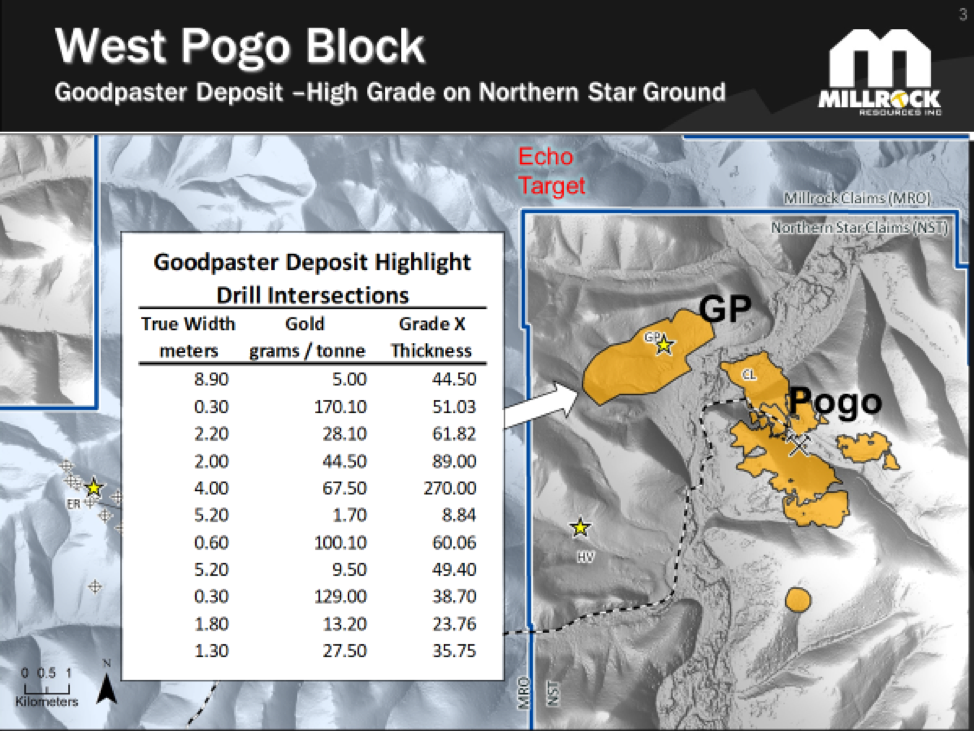

The black-and-white line indicates a road on the map, which is coming into the mine across Millrock’s claim blocks, which are shown in blue. The new deposit discovery, the Goodpaster deposit (GP), which Northern Star announced, sits right along the valley floor. The previous picture, with our lead geologist Chris Van Treek, was taken roughly from a distance of about two and a half kilometers.

Within these shapes are 10 million ounces of gold. That’s the flat-lying quartz veins that are being projected back up to surface that are presently being mined and developed by Northern Star. They haven’t told us how many ounces of gold are contained in this shape, but from an announcement they made last December, it appears there’s a great number of very strong drill intersections—four meters of 67.5 grams per ton gold. That’s more than two ounces of gold in every ton of rock indicated by that drill hole. Noteworthy of mention, there are additional high-grade results that have been published by Northern Star. So one can imagine what Millrock’s share price could do if we were to pull an intersection similar to the aforementioned on our own ground in our upcoming drill program.

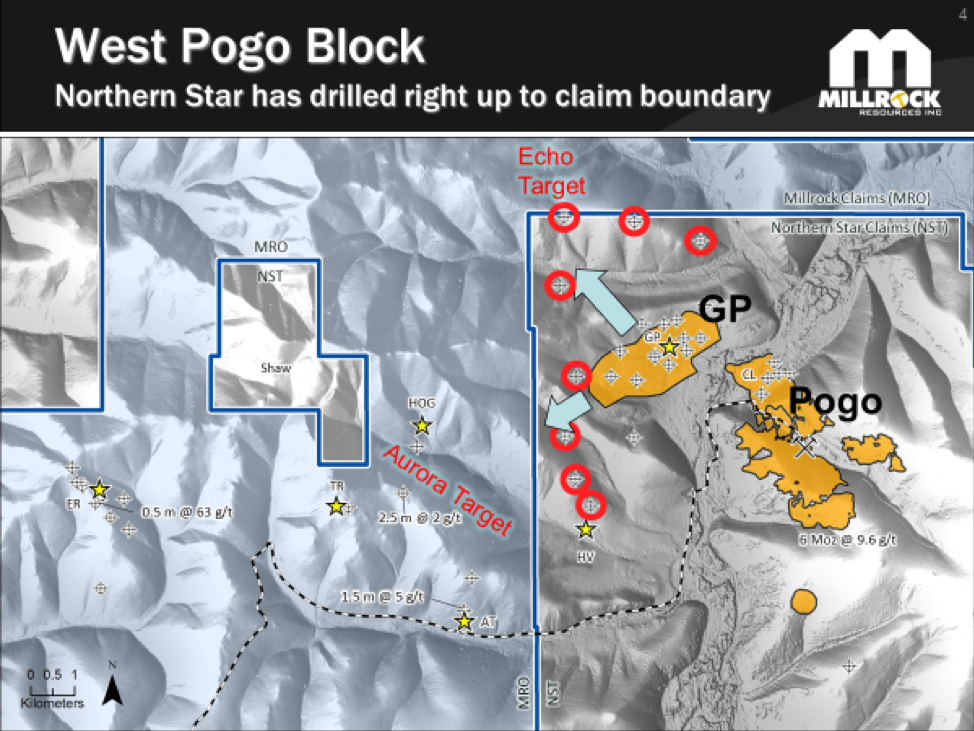

The red circles are holes that have been drilled by Northern Star over the course of the summer and fall of 2019. We have no indication of the results of those holes yet, but you can see that they’re drilling quite close to our mutual claim boundary and getting increasingly closer.

Within Millrock’s claim boundary is the Aurora target area. We have every reason to believe that this deposit, if extended along strike, exists in this area on our property, and if you followed it down dip—remember, these are stacked shallow dipping quartz veins—then it should appear out here, underneath the surface on our claim block.

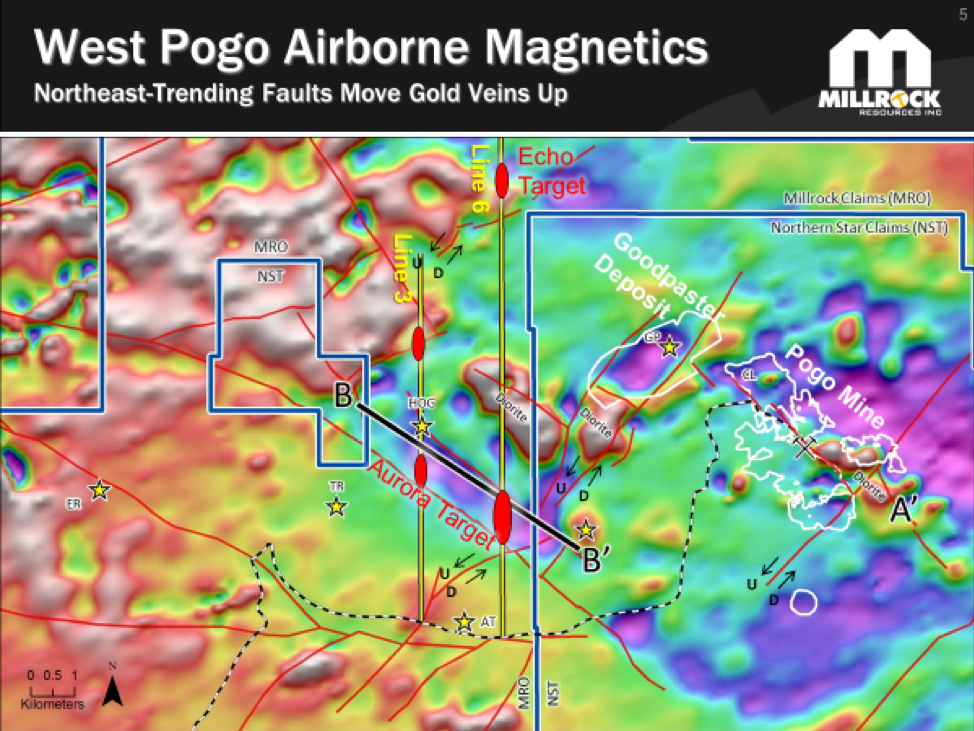

Looking at the same map area, but a different base underneath—non-geologists or geophysicists at first don’t understand what they’re looking at—but I’d like to take a minute to explain this. The base map is created by an airborne magnetometer. A helicopter has dragged a magnetometer back and forth all over this ground to detect the natural magnetic susceptibility of the rocks that are hidden beneath the soil. The red shades are rocks that are strongly magnetic, have a higher natural magnetic susceptibility, grading down to the bluish shades, which are rocks with very low magnetic susceptibility.

These can be rocks that are just naturally low in magnetism, but it can also indicate that gold mineralizing fluids have passed through formerly magnetic rocks, destroying the mineral magnetite and rendering the rocks as low magnetism, as shown in blue. You’ll note that there’s magnetic highs. These are diorites, light magmatic intrusions, but it should also be noted that the gold deposits, which are outlined in white shapes, occur right in the bluish areas, where magnetite has been destroyed.

These gold deposits being mined are on the flanks of these magnetic highs. The new discovery made by Northern Star is right on a very pronounced magnetic low—beside this magnetic high, which is a diorite—and thus making all the blue magnetic low area adjacent to this diorite very good hunting grounds for gold deposits. This is where we’re going to focus our drilling efforts in the coming month.

Maurice Jackson: What an exciting time for Millrock shareholders. Resolution Minerals just announced a press release on the 64 North project outlining a road-based program focused on the eastern Aurora targets, which are located near the claim boundary of Northern Star Resources, stating that drilling is expected to commence in March. Take us onsite and share the details with us.

Gregory Beischer: These really are exciting times for us here at Millrock. It was just a year ago that we really initiated this program. We were very pleased to make this agreement with the Resolution Minerals, and now it’s resulted in a robust budget on a really compelling drill target. In a joint effort, we are collaborating with their team. Our geologists are working with their geologists as we work to operate the project on their behalf. They are the manager of the project, but it’s a great team we put together with the two companies, and we’re off to the races.

Remember right on that magnetic low, beside the magnetic high, there’s the claim boundary between Millrock and Resolution and Northern Star on the east side. The yellow stars are our known prospects and there’s some of those here on our ground at Half Ounce Gulch and Tourmaline Ridge. All these lines on the map are faults—breaks in the rock—and that’s where the gold is typically going to occur. The vertical faults are feeders to the flat line or shallow dipping quartz veins that host the ore bodies at the mine, and at this new deposit. So you can imagine this plane sitting in space, dipping gently off in the northwestward direction. But if you bring it along strike, it should show up right around. . .this nice a magnetic low area.

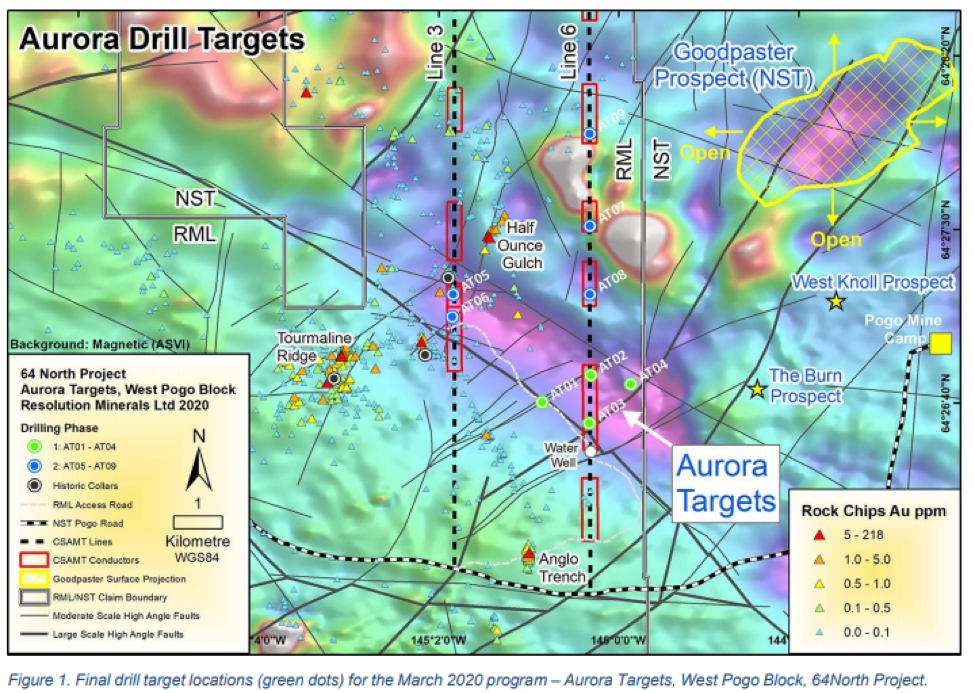

We’ve completed what is called a CSAMT geophysical survey along the two vertical lines in the diagram above. The CSAMT is the exact same type of survey that Northern Star used a couple of years ago to make their most recent discoveries. If we look on the two vertical lines on our claim block, the red boxes along the line are places where the geophysical instrument discovered anomalous conditions. We were very encouraged when it discovered conductive rocks that are thought to represent the flatline shear zone that hosts this deposit and the mine. We’re going to drill the four holes circled in green to test the magnetic anomaly with the CSAMT conductor, just 150 meters below surface. We plan to drill these holes fairly deep so that we get some idea about the geology in all three dimensions.

And on the second round of drilling, we will focus on with blue circles, on the vertical lines further up the Aurora valley, which got some interesting gold mineralization but were not drilled deep enough. We plan to get to the depth where we believe the flatline shallow dipping quartz veins—thicker veins—will exist. So we’ve got a great program laid out in front of us here to execute over the spring.

Maurice Jackson: Mr. Beischer, what can you tell us about the agreement that we have with Resolution Minerals to earn into the interest of the 64 North project?

Gregory Beischer: The summary of the agreement terms [is in the chart]. Resolution can earn up to a 60% interest by spending US$20 million over the next four years. What I like most about it is that the first $5 million is coming this year, so this gives us a really robust budget with which to do the initial test at 64 North, but will also allow us to advance all the way across the property. There are multiple prospects over this enormous claim holding, and we’ve got other prospects to advance through to drill readiness.

In addition, Millrock received quite a few Resolution shares as a result of this agreement, and they’ll end up paying us 38 million of their shares over the course of those four years, along with a little bit of cash. We are the operator working collaboratively with Resolution as the manager, and we get a modest cash management fee out of that.

That helps reduce Millrock’s overhead. We’ve got a good base of operations here in Anchorage and in Fairbanks, and so we recover part of those costs from Resolution. Now Resolution could actually take one of the blocks that I’ve shown in the map further, all the way through to 70% interest if they solo-fund a bankable feasibility study, or even to 80% ownership if they carry Millrock all the way through to a producing mine.

So that would really be something, if Millrock ended up being a 20% owner of a mine without having had to pay anything further out of its treasury. But if one block gets nominated to go that far, the remainder of the property remains a 60/40 joint venture, and I’ll tell you, we’ve been having some fun doing geologic analysis on the other prospects across the block

But the compelling thing right now is playing at the Aurora target, just to the west of the Pogo mine. We’re onto it now and we’re off to the races, Maurice. We’ll be starting in a couple of weeks.

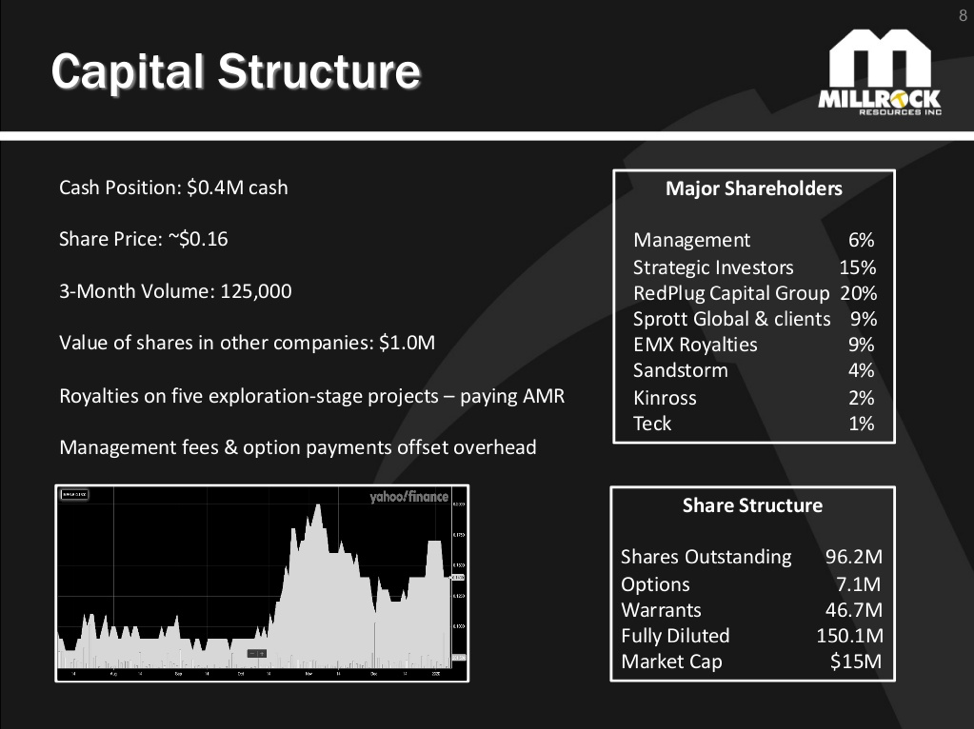

Maurice Jackson: Switching gears, Mr. Beischer, please provide us with an update on the capital structure of Millrock Resources.

Gregory Beischer: We now have 108 million issued and outstanding shares, having recently raised capital of CA$1.5 million. We intend to use those funds to generate yet more projects in the Tintina gold province in Alaska.

We feel now is the time. We see gold rising in price and we know that projects are going to be of great interest to explorers and mining companies alike. We’ve established relationships with the Australian companies and brokerage firms that we believe will invest in Alaska projects. Australians have recognized the great mineral potential of our state and they’re investing heavily in it. Almost 70% of the exploration expenditures in Alaska came from Australia last year, so we’re happy to keep building those relationships—building our portfolio of gold projects—going into what looks like a strong gold bull market.

Maurice Jackson: Speaking of financing, Millrock just completed their financing and they had to increase it due to investor demand. What would you like to say to current and prospective shareholders?

Gregory Beischer: I think we have a really good chance of rewarding our shareholders in the coming months and years, and I’m glad they’ve invested. I’m glad they’ve stuck with us with what’s been seven really tough years.

But Millrock’s managed to take advantage of those seven years. Because of the bad times we were able to stake up this entire Goodpaster District, where the 64 North project is situated. It’s so rare to be able to stake an entire gold camp like this, and I believe it will be a gold cap on the level of Val D’Or, Quebec, or Red Lake, Ontario, or Coolgardie, Western Australia, for that matter. We were able to strike a good deal with Resolution Minerals, but they too got a really good deal. It’s so rare for a junior company like that to be able to access what will be an entire gold camp one day.

Maurice Jackson: Mr. Beischer, what is the next unanswered question for Millrock Resources? When should we expect an answer, and what will determine success?

Gregory Beischer: Well, if we pull an ore grade intersection or two in our upcoming drill program, that would spell success for sure. I think that would result in a strong share price increase for Millrock shareholders, and it would be great to reward them for their investment.

Maurice Jackson: Sir, before we close, what did I forget to ask?

Gregory Beischer: We always like to talk about the price of gold. It’s been great to see its resilience, staying above $1,560 an ounce over the last 40 days. It’s tested that support level a couple of times but bounced right back, and then went up over $1,600, and seems to be holding there. I think that sort of a psychological barrier—where the generalist investors will start to surge into the gold space, start to invest more into producing gold companies, the majors, then the mid-tiers—[will finally] trickle down to the junior explorers.

We see it starting to come now. We’ve seen an uptick, just a clear change in the mood and the tone among brokers, fund managers, investors interested in what’s going on and looking for opportunities. I think we’re at the early stages now of a good strong gold bull market.

Maurice Jackson: Mr. Beischer, for someone listening that wants to get more information on Millrock Resources, please share the contact details.

Gregory Beischer: www.millrockresources.com.

Maurice Jackson: Millrock Resources trades on the (TSX.V: MRO | OTCQB: MLRKF). Millrock Resources is a sponsor of Proven and Probable and we are proud shareholders for the virtues conveyed in today’s message.

And as a reminder I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs and private blockchain distributed ledger technology. Call me directly at (855) 505-1900, or you may e-mail maurice@milesfranklin.com. Finally, please subscribe to www.provenandprobable.com, where we provide mining insights and bullion sales. Subscription is free.

Gregory Beischer of Millrock Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Millrock Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Millrock Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: MRO:TSX.V; MLRKF:OTCQB,

NST:ASX,

RML:ASX,

)