Narayana Kocherlakota, the former President of the Federal Reserve bank of Minneapolis wants you to know the Federal Government can never borrow too much money.

Our government already borrowed $23 trillion and deficits are expected to exceed $1 trillion per year. He knows many Americans feel anxious about the federal government going bankrupt, and he has a simple solution.

He just wrote the following in an editorial published by Bloomberg:

Policy makers and voters often express concern about the level of the federal deficit, which topped $1 trillion last year, and the national debt, now more than $23 trillion. But, unlike a household that owes money to a bank, the U.S. government has the ability to tax its creditors. This power means that the federal government can afford any level of debt that is owed to American taxpayers.

There you have it. Government can tax Americans for whatever is needed.

The solution is so simple any dim-wit could have come up with it. As a matter of fact, one did…

Federal Reserve bankers have always received unnatural reverence for their wisdom and piety. It’s refreshing when one of them puts their patently stupid, indeed evil, ideas on public display.

The people running our central bank come from the same stock as the liars, schemers, and sociopaths who run the Federal Government and Wall Street. The sooner Americans figure that out, the better.

Toward that end, we have some follow up questions for Kocherlakota:

Have you considered the track record of nations that borrowed and spent without restraint? We can find lots of examples of nations that collapsed when leaders like you arrogantly assumed they could get away with borrowing, spending – and taxing – in confidence destroying amounts.

What do you expect will happen to the Treasury market when your tax is imposed on creditors? Do you expect them to continue lining up after they discover they must both lend money and then bear the cost of its repayment too?

What if creditors – the people who buy Treasuries – tend to be better politically connected than people who don’t buy treasuries? Will politicians really impose a massive tax on these people? Or is it possible they will stick it to the poor and middle class instead when they get cornered and have to raise taxes?

Of course, Kocherlakota is well aware his cabal of central bankers and politicians is already taxing Americans heavily and lying about it. The tax is called inflation, and it is severely underreported.

The Federal Reserve is printing money to buy federal debt. Officials there pushed interest rates to epic lows and kept them near there for most of a decade. As a consequence, the Federal Reserve Notes Americans saved are worth a lot less.

The purchasing power was transferred to Washington and Wall Street, the recipients of all the monetary stimulus. The effect is exactly like income tax and the myriad other federal taxes people pay.

All that borrowed currency is fueling the massive expansion in government. Financial services gobble up an ever larger chunk of the nation’s GDP and wealth inequality just keeps getting bigger.

Kocherlakota published his “solution” for unlimited government borrowing in a misguided attempt to put people at ease. But have a look at the comment section below the editorial. Those who gave it a serious read were aghast, thank goodness.

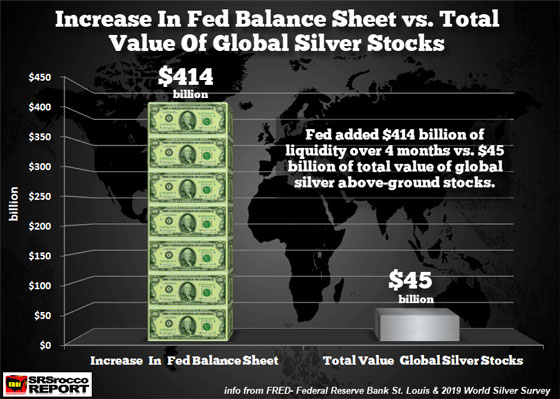

By looking at the symptoms taking place in the financial system, we can see just how bad the situation is becoming. The chart below shows the amount of asset purchases the Federal Reserve has added to its balance sheet over the past four months versus the total value of all global above-ground silver stocks:

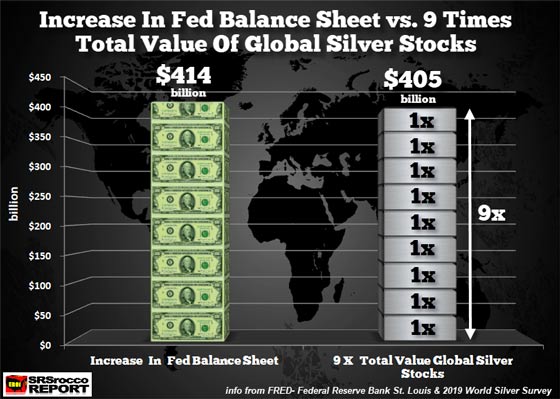

I decided to compare the Fed’s balance sheet to silver rather than gold because I believe silver will be the GO TO ASSET once investors get PRECIOUS METALS RELIGION. Silver’s future price action or value will make Palladium’s current bubble look tame indeed. Unfortunately, Palladium’s value will crash once the global economy heads into a depression. Even though Palladium and Platinum are precious metals, the overwhelming majority of investment demand is in silver and gold. Palladium and Platinum’s value is based more on industrial demand rather than investment demand. KISS – Keep It Simple Stupid. Acquire the 2,000+ year history of money… gold and silver.

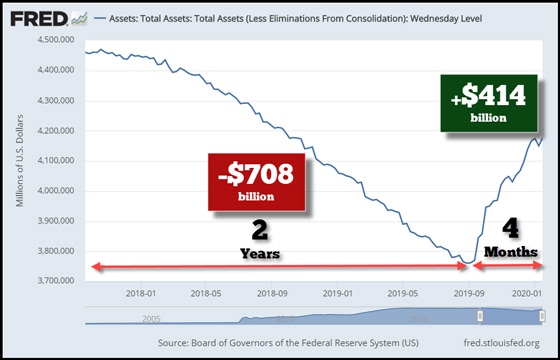

In the last four months, the Federal Reserve added $414 billion to its balance sheet. What a change compared to the $708 billion in assets the Fed sold back to the market (primary dealers) over a two-year period.

The Fed was selling an average of $118 billion of its assets every four months over the 2-year period. However, it purchased more than three times that rate of $414 billion in the past 4-month period.

Now, think about this. The Fed announced on October 15th that it would start purchasing $60 billion a month of U.S. Treasuries. The Fed has purchased at most, $240 billion in U.S. Treasuries in the 4-month period. But, the total increase in the Fed’s balance sheet is $414 billion, or $174 billion higher. So, it also has been slowly adding assets (liabilities) via its Repo Market operations. I call them liabilities because there is no real market for them. And, as time goes by, the world is going to watch as the majority of so-called ASSETS turn into LIABILITIES.

As I mentioned in previous articles, I believe the “FINANCIAL CRISIS” started on September 15th, when the Fed had to step in with emergency Repo Market Operations and has continued to do so. While the markets believe the Fed has fixed the problem, it’s only going to get worse. Why? Because the Thermodynamics of oil depletion doesn’t stop and the quality of oil (or net energy) that makes it to the market continues to decline.

Thus, The Federal Reserve increased the value of its balance sheet over the past 4-month period by nearly 10 times the value of all the global above-ground silver stocks:

Based on a global value of available silver stocks (2.5 billion oz X $18 = $45 billion), the Fed’s balance sheet purchases of $414 billion are 9.2 times all the investment silver held in the world.

Investors do not understand this CRITICAL comparison… YET. But, they will in time.

Peter Schiff has been saying the Federal Reserve is going to let the inflation monster loose and this is going to be good for gold. Some people in the mainstream are starting to pick up on this theme. During a recent interview with the Financial Times, Bridgewater Associates co-chief investment officer Greg Jensen said gold […]

The post Bridgewater: Gold Could Push Above $2,000 as Fed Ignores Inflation appeared first on SchiffGold.com.

Are consumers getting close to the end of their road of debt? There are some indications that they might be and that’s not good news for an economy built on consumers spending money they don’t have. Total consumer debt grew and set yet another new record in November, according to the most recent data released […]

The post Are Consumers Nearing the End of Their Road of Debt? appeared first on SchiffGold.com.

As economic data releases and reports offer more evidence of where we are in the business cycle, gold, silver and the miners are set-up to push a lot higher… Tavi […]

The post Gold’s The One Performer To Act As A TRUE SAFE HAVEN Asset In Downturn Of Business Cycle appeared first on Silver Doctors.

Perhaps the most ominous sign is that despite the “end” of the trade war, global trade volume forecasts were cut again… from Zero Hedge After the IMF cut its global […]

The post IMF Slashes Global GDP For 6th Consecutive Time, Warns “Climate Change” Will Hit Economy appeared first on Silver Doctors.

Trader: Expect A Silver Price Decline

Silver could drop to support in the $16 area without doing any significant technical damage… by Clive Maund via Streetwise Technical analyst Clive Maund charts silver and predicts a small […]

The post Trader: Expect A Silver Price Decline appeared first on Silver Doctors.