Welcome to this week’s Market Wrap Podcast, I’m Mike Gleason.

Coming up we’ll hear an eye-opening interview with Craig Hemke of the TF Metals Report. Hear from the man who accurately predicted a year ago that 2019 would be the best year for gold and silver since 2010. And we’ll hear his new call for 2020. Craig also takes serious issue with some of the gold naysayers and perma-bears and calls them out for being blinded by their agendas. So, don’t miss my conversation with Craig Hemke, coming up after this week’s market update.

A wild week for markets as the U.S. and Iran come to the brink of war before both sides apparently decided it would be wiser to pull back.

After Iranian missiles hit a U.S. military base Tuesday night, gold prices surged above $1,600 an ounce. As gold headed toward a 7-year high, even the mainstream media had to take note. Jim Cramer and his fellow stock market pumpers on CNBC took time to lament the fear-driven buying of gold.

CNBC Anchor: All right. Jim, what’s caught your attention this morning beyond Citi in terms of the key to this market? Obviously, we see, broadly speaking, a down market.

Jim Cramer: It’s gold, gold, gold, gold. When I see this endless buying of gold, it makes me think, for the first time, maybe people are just saying, “I am really fearful.” It’s not just Treasures. The gold buying has been endlessly, over and over and over. There are only a few growth gold companies. The main one is Agnico Eagle. People want to buy, that’s the one to buy. But it’s relentless and it feels like gold wants to go to $1,700, $1,800. That would be very negative for the market.

CNBC Anchor: Uh, yeah.

Fear buying of gold and other safe havens ended up being short lived. After U.S. officials reported there had been no casualties and Iran stood down, fears of World War III suddenly turned into hopes for a quick end to hostilities. Wall Street celebrated as metals markets sharply reversed mid-week.

As of this Friday recording, gold is now relatively flat overall for the week to trade at $1,560 per ounce. The silver market shows a slight weekly gain of 0.2% to bring spot prices to $18.16 an ounce. Platinum is off 0.4% last Friday’s close to come in at $982.

And finally, palladium pushed through the $2,000 level for the first time ever. It currently trades at $2,129 on the heels of a 6.5% advance this week.

Well, while we can all take comfort in the tamping down of tensions between the U.S. and Iran, it would be naïve to believe that the threat of further conflict in the region is over.

It appears that Iran was in fact responsible for shooting down a Ukrainian passenger jet. If it instead had been an American Airlines jet loaded with U.S. citizens, we’d likely be seeing much more of a reaction from President Donald Trump and perhaps our military forces as well.

Iran or Iranian-backed terrorists could be planning other forms of retaliation as I speak. The assassination of Iran’s top general has stoked extreme new levels of anti-American resentment. It won’t abate anytime soon, especially as the Trump administration is vowing to impose tougher economic sanctions to punish Iran.

America is also struggling to keep Iraq from forging closer relations with Iran. Iraqis increasingly want U.S. forces out of their country.

Democracy in the Middle East never quite works out the way the foreign policy central planners in Washington envision. After so many years since 9/11, after so many trillions of dollars invested and ultimately wasted in Iraq and Afghanistan, President Trump at this point is looking for an honorable way to cut our losses.

But his neo-conservative advisors still cling to grand notions of re-making the region in our own image. And the pull of the Israeli lobby and military-industrial complex is perhaps the most powerful force in Washington. D.C. — as all Presidents come to learn.

Of course, precious metals markets will need more than occasional geopolitical flare ups to drive a long-term bull market advance. The fundamentals are turning in favor of higher gold and silver prices. From fiscally reckless trillion-dollar deficits in Washington, to a Federal Reserve obsessed with generating higher rates of inflation, to mining supplies of gold and silver looking tight, the ingredients for a big bull market are in place.

However, safe haven demand from investors has yet to pick up in a big way. We saw some of it this week, but it will likely be fleeting until the general public sees good reason to pull assets out of the stock market.

As stocks hit record highs last year, gold and silver coin sales at the U.S. Mint plunged to multi-decade lows.

The U.S. Mint sold just 152,000 ounces worth of gold American Eagles in 2019. That marks the lowest total on record going back to 1986. Meanwhile, sales of silver American Eagle coins came in at their lowest level since 2007. Now granted, a robust secondary market as a result of hordes of retail investor selling supplied the market with a cheaper alternative to the newly minted coins, and that explains part of those low numbers for 2019 U.S. minted product.

Australia’s Perth Mint, however, saw an increase in coin demand from its more internationally based buyers. Many sought physical bullion as a refuge from negative interest rates in their home countries.

As U.S. investors realize that they too face the prospect of negative real interest rates on savings and bubble valuations in equity markets, they too will increasingly find a compelling value proposition in gold and silver.

Well now, for some predictions on what 2020 will look like for the metals and the other markets, let’s get right to this week’s exclusive interview.

Mike Gleason: It is my privilege now to welcome in Craig Hemke of the TF Metals Report. Craig is a well-known name in the metals industry and runs one of the most highly respected websites in our space and provides some of the best analysis you will find anywhere on banking schemes, global macroeconomics, and evidence of manipulation in the gold and silver markets.

Happy New Year to you, Craig. Thanks for coming on and welcome, how are you?

Craig Hemke: Mike, it’s always a pleasure. New Year’s started off with a bang, man. I hope it’s not indicative of how crazy this entire year is going to be. We’ll see.

Mike Gleason: Yeah, certainly this week sparking action itself. Lots going on both geopolitically and in the markets, and we’ll get to a lot of that. Well, Craig, here we are entering another new year. The conflict with Iran and the potential for an escalation there spurred some safe haven buying in recent days, but the rally in metals started last month. I’d like to open by getting your thoughts on what you believe will be driving metals prices this year. Yes, we expect the forces of evil to continue doing their best to manage prices, and we’ll get to that topic of price manipulation in a moment, but talk about what you’re seeing in the metals here recently and discuss some of the themes you anticipate people will be talking about this year when it comes to the metals.

Craig Hemke: Well, I think it’s critical that people try to have a longer memory than 48 hours. As we record this today, I’m seeing all kinds of garbage. I saw garbage from some group that is always a perma-bear, always talking about how gold has topped out and going down, has a clear agenda, just like some of the short sellers that are always anonymously pound the mining stocks with fake research reports and stuff like that. And I’m seeing these things today about how, “Oh yeah, gold, look at that. Look how terrible that candle looks on the daily chart, and how come hold’s not going up when all this war stuff,” and it’s like, do you not understand? I mean, gold went up prior to the war starting. Beginning last Thursday, gold closed on the Comex, last Thursday, January the 1st at about $15.30. So, the whole move from $1,530 to $1,580 was war premium, if you will, really short-term war premium. Then the spike to $1,610 was when we seemed to be on the verge of what could even have been a nuclear war in the Middle East.

The fact that it’s pulled back to $1,550 shouldn’t surprise anybody. I mean, we hadn’t even worked out all the war premium yet. Despite what is some pretty cheery economic news this week, service sector PMIs, the ADP jobs report, that kind of thing, so jeez-Louise, I sure hope people keep their perspective. You are correct in pointing out, Mike, that the metals rallied strongly into the year and it had nothing to do with war. That wasn’t on anybody’s mind prior to about six o’clock in the evening on January the 2nd. Gold rallied 3% from December the 20th through that date. Silver rallied 8.5% from December 9th at $16.60 up to $18.40 on January the 2nd. The HUI, the gold bugs index … which everybody’s freaking out because the shares went down yesterday. The HUI is up 15% still since the middle of October. For a while it was up 20, and why is this happening? Because the Fed, whether they want to call it QE or not, began this direct monetization of the debt program in October.

Everything’s going up. Stock market, you name it, and that is going to continue this year. It’s only going to get worse. A lot of people missed last Friday, the 3rd, the minutes for the December Fed meeting were released. First of all, everybody was on vacation still on Friday, January the 3rd, and second of all, those are always released on a Wednesday, three weeks after the Fed meeting. So, no one’s looking for them on a Friday afternoon at two o’clock, but here they came. And buried within the minutes, anybody can pull these up, is admission that what’s very likely to happen in the months ahead is the Fed will start monetizing not just T-bills, but notes, longer term duration notes, two years, three years, five years, seven years, ten years. There’s no other option. They cannot afford the stock market to go down. They cannot afford the money supply to contract, and thus they will constantly be printing all through this year more and more dollars, and everything is going to go up for the reasons that were driving them last year. Please don’t get caught up in what happened and how the chart looks based on these extraordinarily rare events that we saw back on Tuesday.

Mike Gleason: There’s been a bit of a pattern in recent years where the metals start perking up in December and perform well in the first half of the year. Any thoughts about what’s behind that and are you looking for that pattern to repeat this year, Craig?

Craig Hemke: Yeah. We were talking about it on my site all the way through December. It was logical to expect, first in November, you expected the metals to trade lower because the December contract is always the most heavily traded all year long. And the December contracts, both gold and silver, had massive open interest and they were both going off the board at the end of November, which meant all the speculators that were long were going to have to sell, and if they don’t completely roll over their positions into February, then that effect is a selling pressure. The price went down.

I told people all through November, I thought, $1,440, that’d about do it. We’re already so extremely oversold. I couldn’t see a waterfall down. I think we saw $1,445. I thought we’d rally into the end of the year because as you said, Mike, that’s typically been the pattern, especially since the bear market lows were put in back in 2015. The shares performed well, especially in the back half of December, because they’re subject to so much tax loss selling, particularly in Canada, and that usually concludes around 18th, 20th. People want to get that done before they go on Christmas holiday. And so once again, we got that behind us and up with the metals. Let me just point this out to you, Mike, because this is a lot like last year. You remember last year, the stock market crashed. Remember that in December of 2018?

Mike Gleason: Sure. Worst December in decades.

Craig Hemke: Yeah, it was crashing, and basically the stock market was catching down to the contraction of the money supply that the Fed was doing by trying to “normalize”, whatever that means, their balance sheet, and the stock market finally caught on to that disappearance of liquidity. And so, what happened? On Christmas Eve, (Treasury Secretary Steven) Mnuchin… and anybody can look it up, I’m not making this stuff up… Mnuchin called a meeting of what’s called the Plunge Protection Team, the President’s Working Group on Financial Markets. They came up with a strategy to float it back higher. The day after Christmas, after the holiday, the Dow went up a thousand points and never looked back. Now, this was when gold first started to move higher, was in December last year, because interest rates had peaked in November, and this is what all caused me to issue a forecasting saying ’19 was going to be the best year for the metal since 2010. Well, why? Because the Fed was going to be reversing course and they were going to be printing cash because they don’t have any choice but to liquefy and continue to liquefy all these markets.

They can’t have deflation. They can’t have crashing stock markets. They can’t have higher interest rates, none of that stuff. So, in December of 2018, gold starts to rally, and everywhere everybody’s like, “Well, this is just a safe haven deal. Gold’s going to $1,100 in 2019,” and all this crap, Harry Dent stuff. Anyway, that’s not what happened. It wasn’t what was going to happen. It’s not what did happen, and so now here we are, gold rallying again, anticipating what’s going to be happening this year and it’s the same thing. “Well, the only reason gold went up is because of the safe haven stuff,” as if gold rallying in December and the shares railings since October had something to do with the idea that the U.S. was going to whack this Soleimani character on January the 2nd. It didn’t have anything you do with that. Gold is simply looking ahead, looking over the horizon as it always does, sees all this liquidity coming from the central banks around the world because it can’t afford to do anything else and it’s moving higher, and people need to understand that and they need to plan for that as they make their investment allocations for 2020.

Mike Gleason: Now let’s talk about price manipulation. Nobody does a better job than you when it comes to covering what the crooked bankers are up to in the paper markets for gold and silver. They sold a boatload of futures contracts last year in both metals. You observed that open interest in gold was up a whopping 70%. Said another way, the supply of paper gold rose by 70%. Yet the amount of gold in the vaults backing that paper barely budged. It’s quite the racket. So, while gold itself is actually scarce and hard to produce, futures contracts are exactly the opposite. The supply is essentially unlimited. Last year, 33 million new ounces of paper gold were dumped into the market. Despite that, gold prices still managed to rise by 18% or so. So, what do you make of that?

Craig Hemke: Yeah, I mean, how the world, and I guess, I don’t know, too many people get their beaks dipped in this or just simply don’t care, but how the world allows, how the mining companies allow their product to be priced, not off of the exchange of the actual commodity, but off the exchange of these derivative contracts that have nothing to do with anything. It’s like I look at you and I say, “Mike, here. We’ll call this contract between you and I gold, and I promise at some point that I got the gold behind it and if you want it, I’ll deliver it to you,” and then you promise that you’re actually interested in it and you go borrow a bunch of money from your broker-dealer to buy it on margin, and then we just pretend that that contract is actually … there’s going to be some physical exchange between us at some point, but that never happens, and at the end of the day you just say, “Well, I liked my exposure,” and I sell my contract. You sell your contract and I, taking the other side of it, buy it back, and there was never any gold exchange at all. There was just some weird promise that there was a backing to it and it’s a trading of those things that is allowed to determine prices. It’s just ridiculous.

Yeah. Let’s backtrack to that open interest thing that you said, because here’s a great way to look at it. Everybody knows, or at least should know, that 2018 was the largest year of global central bank gold purchases since 1969, the year after the London Gold Pool, 651 metric tons. Projections are, run rates, I haven’t seen the actual final numbers yet, but the projections are the 2019 was even greater, probably about 670 metric tons. So, there is what, 25% of global mine output actually demanded, I guess, as far as we can tell, physically delivered to the central bank – 670 metric tons of physical demand, offset by, as you said, the creation of over 1,000 metric tons of digital pretend paper, gold contracts. It’s like a two headed monster. I mean you’ve got the actual physical product, which as you said, is scarce, being priced by the trading of derivatives, which can be created infinitely because no one ever calls any of these people to the carpet. So it’s ridiculous. It’s outlandish.

Yes, gold managed to rise 18% last year, even while the supply of derivative contracts increased by 73%. Imagine if there was some forced linkage between the ability to create contracts and the amount of actual gold on deposit in the vaults, and you couldn’t have increased it by 73%. What if the supply only increased by 10%? Well then all that money around the planet looking for gold exposure would have had to find it through acquisition of existing contracts. This is how the stock market that allegedly works, but that’s not how it works in the pricing of precious metals. The banks just create more contracts, taking the opposite side, taking the short side, and figuring they can out last the speculators, eventually maybe forced them out and cover their shorts. It’s disgusting, and again, at the end of the day, what’s really astonishing are these dopey rock breaking geologist CEOs of the mining companies that think it’s a valid pricing structure and they fall for it. That’s what’s really mind blowing.

Mike Gleason: I want to ask you about the possibility of whether or not the bullion banks will lose control of prices anytime soon. That 70% jump in open interest is extraordinary. The department of justice is prosecuting several people and they have secured some guilty pleas. It’s interesting that they are using RICO laws. Perhaps they actually see the bank activity for what it truly is, organized crime. Officials in London are asking some pointed questions about the fraudulent use of EFPs, exchange for physical. An optimist would say that some of these developments will lead to reforms, but I think we’ve all learned that you should never overestimate bureaucrats’ ability or willingness to do the right thing. We may have to wait for the market to solve the problem, which will happen right after confidence in the futures markets, the banks, and/or the dollar collapses. What are your thoughts about how much longer this crooked price discovery system will persist, Craig?

Craig Hemke: Well, Mike, you’ve said a mouthful there. Let me pick off a couple of things. You mentioned the regulatory agencies. You got the Rico investigations here in the U.S. It’s pervasive. The fraud is pervasive. The former head of JP Morgan’s precious metals desk, who is also on the board of the London bullion marketing association, the LBMA – why would he be on both? Why would he be a JPM trader and on the board at the LBMA? But anyway, he’s now been indicted. The RICO statutes allow you to not just go after the goon, but allow you to go after the Don. So, we’ll see how far it reaches, however, it does reach across the pond. My friend Andy McGuire has been telling me this now for over a year, that the FCA, which is the English/British equivalent of the SEC, I guess, or Department of Justice, whatever, has been looking into the risks that are being taken by the English banks, and what that might pose the system.

Andy has told me about a meeting he had with a couple of Members of Parliament, and this guy, Andrew Bailey, who at the time was the head of the FCA. This was back in maybe August, and this Bailey had no idea, because the LBMA’s so opaque. I mean, you don’t get these stats every day, all the unallocated gold and all this stuff, and the risk that the bullion banks are taking there. So Andy laid it out for him and he said, this guy’s jaw dropped, and he’s like, “Look, we can’t afford a second financial crisis off of this. I mean the people … we already shafted them once. They’ll never let us get away with it again. We have to put a stop to this somehow,” and Andy told him about the EFPs, and we’ll get to how that continues in a second.

So anyway, this guy Bailey, who according to Andy said we got to somehow put a stop to this, this guy Bailey was just nominated and confirmed to be the head of the bank of England by Boris Johnson. So what’s he going to do? Does the buck stop when he leaves there, leaves the FCA and now he’s got to be a servant to the bank of England and stop paying attention? Or maybe he’s going to call the banks on the carpet. I know what direction I think any cynical or non-cynical person would think that that’s going to go, but I digress. These EFPs that I’ve been writing about for a couple of years, this is an arcane process that’s a part of every futures market, but I just can’t even describe the degrees to which it is abused … I guess that’s the right word … within golden silver.

I’ve kept track of … I don’t even know what it is… over the last two years, something like 14,000 metric tons of gold contracts. Each Comex gold contract is a hundred ounces, allegedly, of gold. Well, enough contracts that are the equivalent of 14,000 metric tons had been moved off the Comex and exchanged for physical (EFP) through London. Andy says they have this process where they swing them into these 13 day little contracts that are off the books and just keep rolling them over and over and over trying to kind of hide it and pretend that it’s not there, but this process continues. Mike, let me lay this on you. It’s just that we’ve had, as we speak, five trading days in the year 2020. In those five trading days, there have already been 67,713 Comex contracts shifted off of the exchange and exchanged for physical, as they say again, in London. 67,000. Mike, again every contract is a hundred ounces. That’s 6.7 million ounces. That’s 210 metric tons of gold.

The whole Comex vaults only holds 8 million ounces and they shifted 210 metric tons, 6.7 billion ounces off exchange in just five days? This is the scam of the greatest order, and like I said, again, the amazing thing is that it still exists… that people in 2020, when the world is all interconnected and everybody knows everything and I can watch missiles take off in Iran five minutes after they’re shot just by following Twitter. It’s amazing that this continues. It’s just mind boggling that this is allowed to continue.

Mike Gleason: Yeah. Well put, you beat your head against the wall trying to figure out when it’s going to finally end and why there’s not more talk about it. Well, Craig, before we wrap up, I’d like to get any final thoughts. I know you’ve got a lot to say here early in the year. If you could give metals investors an idea of what it is that you’re going to be watching most closely, what they should be watching most closely over these first few months of the year, and then maybe a sign that perhaps the powers that be are losing control, or any other comments you want to make here as we wrap up?

Craig Hemke: Yeah, I don’t know, Mike. Since I’ve been doing this, and I have to admit kind of fallen forward a little bit and getting excited about it myself back in 2009 and ’10, that kind of thing. This hyperbole of, “The Comex is going to fail.” Come on. That’ll all happen in a blink of an eye someday or overnight, but to sit there and … these people that say it’s going to fail above $22 silver. I mean, come on. We’ll see. The banks are going to keep it going as long as they possibly can and I don’t think anybody can come up with a time table for it. The only thing it that will end is a run on the banks for physical metal, and this kind of thing gains momentum and it snowballs and finally that realization of what a scam at all is sinks in and people panic to get their hands on actual mental while they can. Again, I can’t stress this enough, ignore the perma-bears with an agenda.

They’re trying to talk down the market. They’re trying to talk down the shares, or trying to talk down the individual shares because they have some massive short position. The Fed is going to continue with the repo crisis. It’s not going away. The U.S. is going to have at least a $1.2 trillion deficit every year this decade. That’s what the Congressional Budget Office says. That money’s got to come from somewhere. The central banks cannot afford a deflationary collapse. They will be printing and printing and printing. Even absent that argument about what that does to the dollar and all this other stuff, that cash goes someplace, and it goes everywhere. Again, it’s not a mistake that the HUI… was up 20% since October 15th… is now up 15%. What happened on October 15th? That’s when this whole new not-QE debt monetization program kicked in.

Everything’s going up. Okay? So everything’s going to continue to go up. The banks are going to throw up roadblocks. We’ve already got 800,000 contracts of open interest Comex gold. So, I don’t know how far gold will go. $1,650? Maybe if it kind of gets rolling, it can go to $1,750 this year. That’d be a pretty good year from where we are. Where I think the real interest should be, for people that want to either have some fun, make some trading fiat currency that then they can buy more physical metal, that kind of thing … I mean start looking into whether or not you have exposure to the mining shares, not just the big companies, but the medium juniors and the explorers, that kind of stuff, because as global asset managers, who have all this cash, and they’re always looking for a place to go. Once the GDX, the DDXJ, the HUI begin to make new highs versus 2016, the floodgates are going to open and money’s going to come pouring into the sector and it all has to pass through a little tiny funnel because there’s only so many places it can go.

It’s just simple economics. You get twice the cash chasing the same handful of stocks, and they’re going to go up in price. So, I think it’s going to be a very good year again for the metal, just like last year was, and I was right when I predicted it last year. But I think the real outsize gains will probably be in the shares more than in the physical metal. I wrote that up. I kind of make an annual forecast every January. I posted it to my site. It’s a free link. Maybe I’ll send it to you, Mike. You can put it on this page. I always try to come up with a catchy name, so this year’s title is 2020 Foresight, instead of 2020 hindsight. Kind of clever, huh?

Anyway, 2020 Foresight is what it’s called. You can go to my site, or like I said, click the link, if you can put it on this page, and it will just explain to you the basis for why I think it’s going to be a good year. If you’ve got time, I think it’s worth a read.

Mike Gleason: Yeah, it would be time well spent for sure. I always say, we spend a lot of time looking at your site here in this office. It’s money well spent for anybody that wants to get on board there with TF Metals Report. And before we let you go here, Craig, tell people a little bit more about your site, how they can get signed up, and maybe some other tidbits they should know.

Craig Hemke: Well really the best thing about my site, I mean I do analysis every day and we try to keep people locked into the big picture, not the tick by tick stuff, but the site is… I mean the people that populate it are from all around the world, all different political views, but we realize we’re all in the same boat, and so instead of bickering at each other and name calling and all that kind of stuff, rule number seven in the community guidelines is treat others the way you want to be treated. Come on, your mother taught you that. Why do you think just because it’s an anonymous website, you can be rude and mean like Twitter, things like that. So anyway, the community itself is what’s worth it.

It’s only 12 bucks a month. So it’s not like I’m getting rich off of it. 40 cents a day to give you access, really keep you on top and grounded of where we’re headed. And again, I just can’t emphasize enough. I mean Mike, the old line is a rising tide lifts all boats, right? Think of the rising tide being all of the cash. It has to be created from nothing. You must understand, this is direct monetization of the debt by the Fed. Primary dealers, they get the Treasury bills, soon to be Treasury notes from the Treasury. The primary dealers are the ones responsible for making that market and getting them filled. They buy them themselves, and anybody can, ZeroHedge has been great about writing this. The Fed then buys these directly from the primary dealers about 72 hours later. Okay, so there’s an intermediary in between, but basically the Fed is buying the Treasury bills, soon to be notes, directly from the Treasury.

How that isn’t direct monetization of that? I don’t know. Just because there’s a step in between? So, this is happening, Modern Monetary Theory, all that stuff that the politicians daydream about, that’s coming, and whether you are going to want to talk about gold standard and system reset and all that kind of stuff, whatever. Yeah, sure. But all of that cash is going to be sloshing around. Stock market’s going to go up, everything. So, gold and silver are going to go up and the shares are going to be particularly advantageous to own in the next few months. And so, again, I just want to keep everybody grounded and not be thinking about the events of Tuesday, and I mean that was a real, you want to talk about one off, that was a one off. That was hopefully something that you’ll never see again in your lifetime. This on the brink of maybe nuclear war in the Middle East. Ignore the reaction to it, the run up to it and look at the bigger picture and I think you’ll see that physical gold and silver and maybe some mining shares must be a part of a portfolio in 2020 going forward.

Mike Gleason: Yeah, well put. It’s going to be a great time to kind of focus more in on this if you’re not already doing that, and it’s going to be an interesting maybe, tumultuous year. Ignore the blips or don’t pay as much attention to them. We do have a trend in place here and Craig and TF Metals Report is a great way to follow that, hopefully right here on this podcast as well.

Well, very good. Thanks again Craig. Have a great weekend. I wish you a happy and prosperous New year and we look forward to catching up with you again soon. Keep up the good work, my friend.

Craig Hemke: All the best, Mike. Go Chiefs!

Mike Gleason: Yeah, good luck to your Chiefs this weekend. Well, that will do it for this week, thanks again to Craig Hemke. The site is TFMetalsReport.com, definitely a fantastic source for all things precious metals and a whole lot more. We urge everyone to check that out if you haven’t already done so for some of the very best commentary and analysis on the metals markets that you will find anywhere.

And be sure to check back here next Friday for our next Weekly Market Wrap Podcast. Until then, this has been Mike Gleason with Money Metals Exchange. Thanks for listening and have a great weekend, everybody.

Gold Just Broke Through A Key Level

For the first time in more than six years, gold broke through a key level. Gold surged on Friday due to the geopolitical tensions stemming from the Middle East after the U.S. took out Iran’s top military leader.

During early trading in the early Asian markets, the gold price continued even higher, reaching $1,579.

This morning, gold is trading at the $1,575 level. It will be interesting to see if gold closes at the end of the day near its high or a low. The key resistance level is $1,550, which gold surpassed by $25.

Here is gold’s monthly chart below (each candlestick represents one month of trading).

If you look at the “Larger View” insert, I have superimposed the candlestick breaking through the Key level.

The Gold price finally broke through this level, and for it to remain in a bullish trend in the monthly chart below, it will have to close above the $1,550 (actually $1,560) level by the end of January. If we look at the next chart, the gold price surpassed the high of $1,566 in September:

Gold is currently trading at $1,574. And, if we look at the weekly gold chart, we can clearly see gold breaking through the $1,550 level:

Here we can see the three Key Levels for gold. After the big run-up in the summer, I thought gold would retest its breakout level of $1,360 before moving higher. While it’s not a guarantee that gold would retest this $1,360 level before moving higher, traders typically expect it to happen.

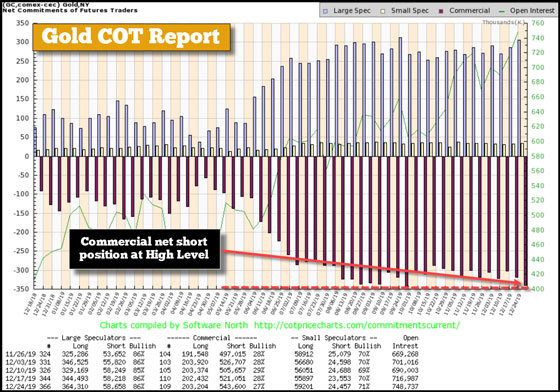

Furthermore, the latest Gold COT Report shows the Commercial Net Short position at the highs from last summer:

This is a very strange situation for gold. Due to the Fed continued Repo Market intervention and the $60 billion a month in U.S. Treasury purchases, it seems that gold just won’t selloff or correct down to that $1,360 breakout level.

However, with the Commercial net short position at a high, logic suggests that gold will likely correct lower before resuming its trend higher in 2020.

Moreover, at some point, the bloated U.S. stock market will need to experience a correction lower, even if it continues higher due to the massive Fed and Central Bank liquidity. Thus, the gold and silver price may correct lower with the broader markets once a correction takes place.

But, again… this is only short-term trading possibilities. The situation for the U.S. Financial and economic system is heading for a BRICK WALL. Only 1% or less of investors have diversified some of their assets into gold (and silver).

‘We Must Get a Winner One Day’

For months, there have been signs of big changes in the gold and silver markets, including indications of exceptional tightness. For example:

— The resolution of most Comex gold and silver futures contracts through the mysterious emergency “exchange for physicals” mechanism.

— The extraordinary increase in open interest in Comex gold and silver futures contracts.

— The Comex’s strange and urgent increase in the out-of-system collateral permitted to be used by the major bullion banks that short gold.

— Increased acquisition of gold by central banks that are not afraid to reveal their admiration for an asset that central banks were generally unloading just a few years ago.

— The reversal of the usual gold flow from London to Switzerland, a flow now going from Switzerland to London, where the shorts largely reside and from where they would need to cover.

— Assertions by Swiss gold fund manager Egon von Greyerz and London metals trader Andrew Maguire that Swiss banks have already imposed “bail-ins” on depositors seeking to withdraw both gold and cash – in effect a gold and cash confiscation.

— The New York Fed’s recent sudden injection of tens of billions of dollars into the financial system through the big New York banks, some of which are bullion dealers, and the dubious explanations given for this.

— The refusal of the Federal Reserve, Treasury Department, and Commodity Futures Trading Commission to answer or even acknowledge a few basic critical questions about the gold market not just for GATA but also for a member of Congress.

— The inability of the usual smashes in the futures market to push gold and silver prices down much for long.

For some musing on these developments from two weeks ago, see this article recently published by Money Metals Exchange.

If the recent developments really signify extreme strain on the physical gold market, and if, as there is still every reason to believe, the ratio of paper claims to real metal ranges from 90 or 100 to 1 – that is, 90 or 100 claims for every ounce – an international crisis like the current one might induce enough physical buying at precisely the wrong moment for the price suppressors, causing delivery defaults and exposing the fraud of the paper gold system.

Besides, if supplies are really tight, it would not take an international crisis to explode the system. Any substantial demand for physical delivery might explode it. Indeed, many governments long have known about the fraud of the system and could have pulled the plug on it any time in the last 10 years or more just by taking enough delivery. The Russians and Chinese long have talked openly about the Western central bank policy of gold price suppression.

With the United States having recently weaponized the dollar to an unprecedented extent, is it so farfetched to imagine adversaries of the United States counterattacking by weaponizing gold, the former world reserve currency?

This is exactly what the U.S. government has feared as long ago as 1974, when U.S. Secretary of State Henry Kissinger was warned about the possibility by his deputy, Thomas O. Enders, in a meeting in Kissinger’s office. The remarkable transcript of this meeting was discovered in 2013 by gold researcher Jan Nieuwenhuis, then writing under his pen name, Koos Jansen, and was analyzed by GATA here.

The transcript remains on the internet site of the State Department’s historian, a wonderful if studiously overlooked explanation of the U.S. policy of gold price suppression:

Gold, Enders told Kissinger, is the international “reserve-creating instrument” and whoever has the most gold can change its price periodically and thereby enrich himself and alter all the world’s financial valuations in his favor. Gold, Enders explained, is the great threat to the dollar and U.S. control of the world financial system and as such it must be pushed out of the system.

In any case, the previous U.S.-instigated gold price-control system, the London Gold Pool, failed in 1968 for geopolitical reasons and the current gold price control system will fail eventually too. As was said by the leader of the doomsday cult first portrayed by some British comedians including Peter Cook and Dudley Moore back in the 1960s: “We must get a winner one day.”

Tomorrow would be as good as any!

Gold and silver investors buy metals because they are scarce. Precious metals are by nature difficult to find, and hard to produce. Consequently, above ground stocks are limited and valuable, particularly when priced in unlimited fiat currencies.

The bankers and government officials behind these fiat currency systems don’t like stable monetary benchmarks such as gold putting their inflation schemes on full display. They absolutely hate that gold works as a refuge.

Inflation is a stealth tax. Instead of overtly raising taxes, politicians simply borrow and print the money needed for more government. They just need people not to notice.

Which brings us to the futures markets for gold and silver. They are the solution to the difficult scarcity problem that metals pose for bankers and bureaucrats. The futures markets are the primary tool for managing prices and discouraging people from turning to metals as a hedge against inflation.

Craig Hemke of the TF Metals Report published a recap of futures market activity in 2019. It perfectly captures how their tool works. They replaced real markets for actual gold and silver with a market for paper gold and silver proxies. Then they severed all connection between the proxies and physical metal.

Hemke writes with regard to gold:

For the year, Comex Digital Gold was up 18.75% from $1,280 to $1,520. An 18.75% gain is certainly impressive, and we’ll take every basis point. However, it’s even more impressive when you pause to consider that the total amount of Comex contracts was increased by 74.2% from 451,460 to 786,166. That’s an increase of 33,480,600 digital, pretend ounces all while the total amount of vaulted gold in the Comex depositories was barely changed.

And for silver:

For the year, price rose 15.1% from $15.55 to $17.90. Total contract open interest rose from 176,159 to 229,680 for a total of 30.4%. Again, that’s a total of 1,150,000,000 ounces of fantasy silver on an exchange when the ENTIRE WORLD produces less than 900,000,000 ounces in a year.

The bullion banks are selling a lot of paper gold and silver.

Imagine the gold price if demand for more than 33 million ounces were actually directed into the physical bullion markets, where supply is scarce and limited, rather than the futures markets where banks supply contracts for all the buyers who show up.

And barely an ounce of actual metal has to be found, mined, refined and moved into bullion bank vaults.

This mechanism works beautifully for those who prefer to keep a lid on prices. Precious metals and the topic of honest money get almost zero attention.

Almost no one is talking about the trillion-dollar federal deficits. In 2019, the Federal Reserve returned to monetizing hundreds of billions in federal debt. Most people now assume that is normal.

Perhaps most important for the central planners trying to maintain the fiat dollar, there is very little discussion about why gold and silver prices are rising.

Bankers and bureaucrats are trying to herd people into the Federal Reserve Note and other preferred asset classes, including bonds. They don’t want people buying, or even talking about inflation and financial turmoil hedges like precious metals.

These people are not good shepherds, and they don’t have the public’s best interest at heart. As such, it is probably not a good idea to follow the herd.

Gold continues to move higher due to trouble in the Fed Repo and U.S. Treasury Market. In the first hour of business today, the Fed has already injected $57 billion in the Repo Market. While the Fed’s Repo Market injections didn’t spike during the last few days of 2019, as many analysts forecasted, there’s still BIG TROUBLE ahead.

Many reasons have been attributed to the break-down in the U.S. Repo Market that started on September 17th when the daily repo rate spiked to 10%. Several readers have sent me very interesting information and youtube videos on the subject matter. I thought it was a good time to sift through all the information and present my analysis on what the hell I believe is going on.

First and foremost, while there are many reasons given for why the Fed Repo rate spiked, forcing the Fed to provide hundreds of billions of dollars of short-term liquidity in the market, these are “ALL SUPERFICIAL” reasons. The major factors causing wide-spread havoc throughout the financial system are the Falling EROI- Energy Returned On Investment of oil and the Thermodynamics of oil depletion. While these are two different energy analyses, they come to the same conclusion. The financial analyst community and market are still ignoring these key energy factors.

Second, the main “SUPERFICIAL” reason that caused the Fed Repo rate to spike is that there weren’t enough buyers for the increasing amount of U.S. Treasury issuance.

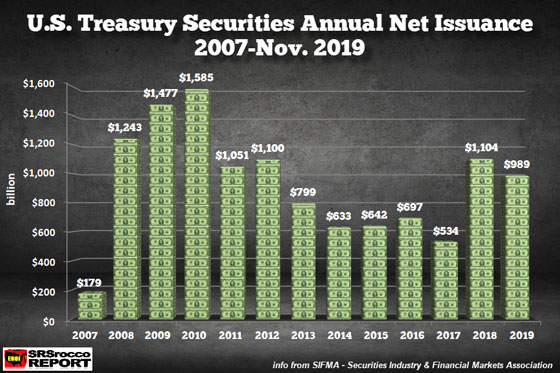

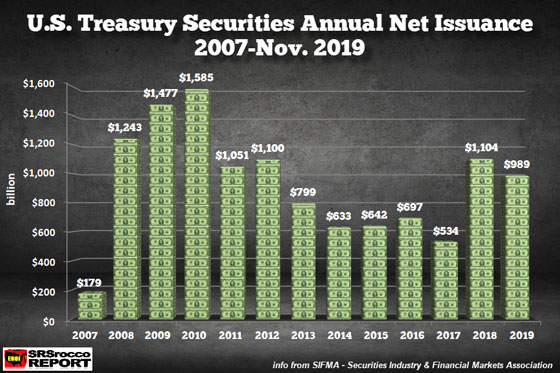

After the 2008-2009 financial crisis, U.S. Government deficits ballooned, forcing the “Net Issuance” of more U.S. Treasuries. In the chart above, the net issuance of U.S. Treasuries spiked to $1,585 billion ($1.58 trillion) in 2010. However, after the economy started to recover, the net issuance of U.S. Treasuries continued to decline to only $534 billion in 2017. But, the very next year, in 2018, something changed as the U.S. Treasury net issuance surged to $1,104 billion. This was bad news… but why?

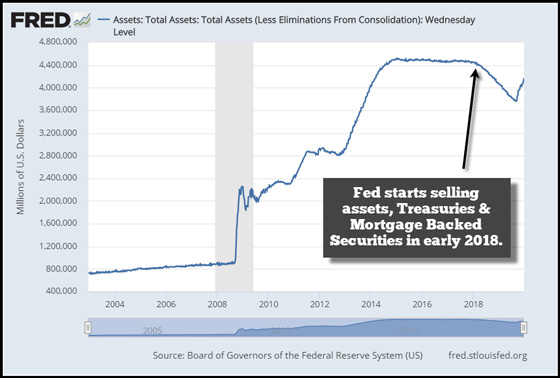

We have to remember that the Fed started reducing its balance sheet by selling U.S. Treasuries and Mortgage-Backed Securities into the market in early 2018:

So, get this… the Fed was a net seller of U.S. Treasuries and Mortgage-Backed Securities in 2018 right at the very same time, the U.S. Government’s net issuance of U.S. Treasuries doubled from $534 billion in 2017 to $1,104 billion in 2018. This had a profound impact on the U.S. Treasury rates, especially the 10 Year/3 Month Spread.

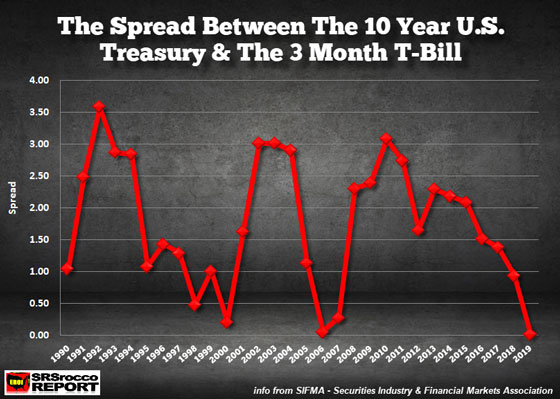

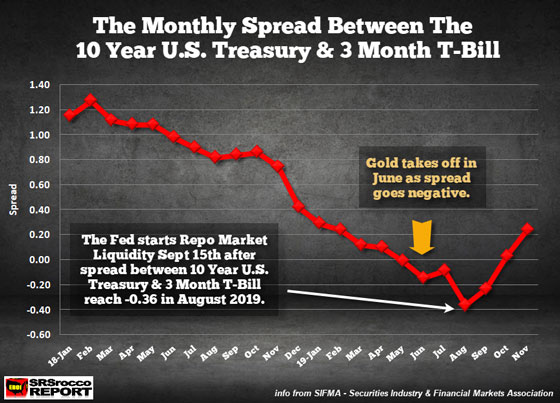

Now, to make this easy to understand, the 10-Year/3 Month Treasury rate spread shows how much more demand there is for either the shorter-term Treasuries or the longer-dated ones. If the 10-Year/3 Month spread falls, then there is more demand for the 10 year Treasury, which suggests investors are worried about an upcoming recession. The 10-Year/3 Month U.S. Treasury spread has been steadily falling since 2010 and is now only 0.02 compared to 3.08 in 2010:

According to SIMFA, the Securities Industry & Financial Markets Association, the average rate for the 10 Year U.S. Treasury (Jan-Nov) was 2.17 versus 2.15 for the 3 Month Treasury Bill. Thus, there is a positive 0.02 Spread. However, there were some real problems starting in June when the 10-Year/3 Month Treasury spread went NEGATIVE:

There is no coincidence that the Gold Price began to take off in June 2019 when the 10-Year/3 Month Treasury spread went negative… for the first time since the 2007 financial crisis began. As the 10-Year/3 Month, Treasury spread went further negative until August, the gold price continued higher to reach a peak of $1,560 at the end of the month. Then what happened in September and October?? You got it, the Fed came in and started the Repo Operations in mid-September and then announced the $60 billion a month in U.S. Treasury purchases in mid-October:

The GREEN arrow shows where the 10-Year/3 Month Treasury spread started to go negative, and over the next three months, as the spread reached a low of -0.36 in August, the gold price increased $300. The RED arrows show that when the Fed came in to save the day in September with its Repo Market operations, providing short-term liquidity, and then again in October to buy $60 billion a month, the 10-Year/3 Month spread moved higher.

If we look at the U.S. Treasury Net Issuance chart again, we can see that the U.S. Government is in trouble as it has to finance a lot more of its annual deficits:

With the global economy stalling and some regions heading into a recession, there are fewer surpluses available to be able to buy the increasing amount of U.S. Treasuries, not including the amount that is continuously rolled over.

Even though there may be a BIG PROBLEMS with individual banks that caused the Fed Repo rate to spike on September 17th, the main issue is that the U.S. Government is issuing more Treasuries than the market can absorb. Thus, the Fed had to start buying U.S. Treasuries, which helped push the 10-Year/3 Month spread back into positive territory. However, the problem isn’t over as the market mistaken assumes… IT’S JUST BEGINNING.

I believe the September 17th Fedo Repo rate spike to 10% was the CRISIS and will only get worse as time goes by.

Source: Bill Powers for Streetwise Reports 01/08/2020

Bill Powers of Mining Stock Education sits down with Kevin Drover, CEO of Aurcana, to talk about the company’s production plans for its high-grade project in Colorado.

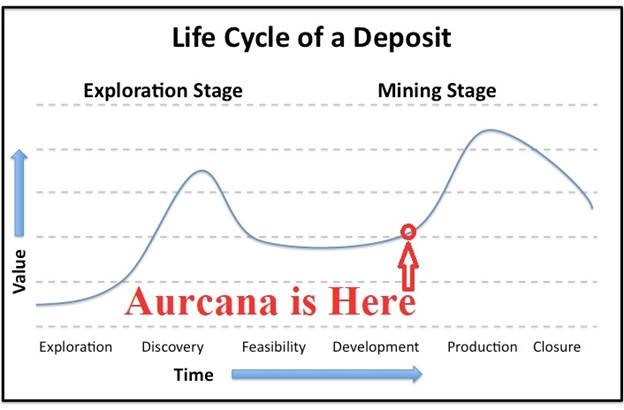

Aurcana Corporation (AUN:TSX.V; AUNFF:OTCQX) has 100% ownership of the world’s highest-grade silver mine (P&P): the Revenue-Virginius mine in Ouray, Colorado, USA. This fully permitted mine will also be one of the lowest-cost silver producers in the world at only US$8/oz Ag (AISC) after byproduct credits. Aurcana is currently (Q1 2020) securing the final capex needed to commence production, which it expects to accomplish in Q4 2020. In this interview, Aurcana CEO Kevin Drover provides an overview of the Revenue-Virginius mine and Aurcana’s investment value proposition.

Kevin Drover has over 40 years of both domestic and international experience. He was previously VP Worldwide Operations at Kinross Gold and possesses experience in all aspects of mining industry operations, process re-engineering, project development and corporate management.

Bill Powers: I would like to welcome Aurcana Corporation president and CEO, Kevin Drover. I’ve met Kevin at the last two Beaver Creek Precious Metals Summits and have been following the company and getting updates annually at the Precious Metals Summit. So, Kevin, it’s your first time on Mining Stock Education, welcome. Please begin provide an overview of this mine that I’ve referenced with the highest grade proven and probable silver reserves in the world?

Kevin Drover: Well, thank you, Bill. Yes, this mine, it’s located in Colorado in the San Juan Mountains near the town of Ouray, and it’s up at about 10,000 feet, in that range, and it is extremely high grade. Our Proven and Probable reserves are 21 million ounces at 37 ounces of silver equivalent per ton. And I don’t know of any other mine in the world, at least that I’m aware of, with a Proven and Probable reserve of that grade. And the exploration potential of this property is quite significant as well for the future.

Bill: And you own this project 100% outright?

Kevin: We own the project 100%. We own this one, and this mine is essentially fully built. It is fully permitted. There’s a feasibility study completed and it’s ready to go. Technically, there’s nothing left to do with this mine but to put it into production and we, of course, are seeking funding to do that now.

We also have a fully-permitted, fully-built mill in place, 1,500 ton a day mill, located at the Shafter Mine in Texas and that’s near the town of Marfa, Texas. It’s currently on care and maintenance, but at some point we will need to revisit that one as well. It needs some additional technical work and that’s not our focus right now. Our primary focus is to get the Revenue-Virginius mine back into production as soon as possible.

Bill: What are some of the highlights of the Revenue-Virginius mine? The feasibility study that you referenced?

Kevin: Well, first, maybe I can just step back a second and just talk about the resources and reserves. We have a Measured and Indicated resource of 30 million ounces at 30 ounces per ton. An Inferred resource, of course, which you cannot include in your feasibility study, but it’s still an Inferred resource of 13.2 million ounces at 40 ounces per ton and ,of course, our Proven and Probable reserves are 21 million ounces at 37 ounces per ton. Currently, it’s at six and a half year mine life, an average production rate of 3.1 million ounces per year. Our all-in sustaining cost of production after byproduct credits is $8 an ounce. If you look at byproducts and convert them to silver equivalent, our all-in sustaining cost is $10.71 per ounce, which is one of the lowest cost silver producers in the world by far.

Our pre-production capital needs are $37 million. We’ve recently raised approximately $7 million in August and September, so our needs are somewhat less than that $37 million on a go-forward basis. The NPV on this project at 5% using an $18.50/ounce silver price, which is not far from where we are today, is $75 million and the IRR is 71%. Time to production from full funding is seven months.

Bill: And of your total resource, what percentage of that is actually silver?

Kevin: Probably the best way to look at that would be from a revenue perspective and silver generates 71% of the revenue. Gold will produce 8% of the revenue, lead 15% and zinc 6%. There is some copper here, but it’s not a high enough grade to make sense for us to start up our copper circuit. We do have a copper circuit in the mill, but on some of the other veins that we have, we may look at producing a copper concentrate, but right now we won’t do that.

Bill: So you’re in Colorado, you have your permit, so there’s nothing on the environmental front or the permitting front that you have to worry about. The main hurdle here is just securing the funding in order to bring the mine into production?

Kevin: That’s correct. Yes. There’s no permits required whatsoever to go into production. Our environmental, social and government relations are excellent. Our guys down there have done a fantastic job with our environmental folks in that area and of course, we’re not far from Telluride, Colorado, and it’s a primary ski area, but the guys on the ground down there have done a fantastic job. We’ve had environmental groups to the site. We’ve had most of the senators, local county commissioners, mayor and such visit our site. We enjoy a good relationship with them.

We won the Colorado environmental stewardship award last year and we continue to pay a lot of attention to our health, safety, environmental, government and community relations. The community has been extremely supportive of us down there and so we continue to enjoy that and we want to make sure that that continues on into the future as we get up and running.

Bill: Kevin, is there anything more of pertinence regarding your treasury and how you might obtain this CAPEX money that you could share with investors?

Kevin: We’re looking for a debt facility at the moment and we’ve been somewhat successful. We’re going down the road on a couple of a different routes in terms of raising that. Gary Lindsey (Investor Relations) and I were recently through Europe and we have talked to a number of entities that appear to be interested in taking a deep look at this operation here.

So, we’re rather hopeful that we’re going to be able to find the funds, certainly within the next quarter, which is what we are targeting. And there will be a debt facility. We will do some more equity as well in the next little bit here, and between those two we think we’ll have sufficient funding to be able to fully restart the project.

Bill: What about expansion potential? Do you own the full strike length and are there other veins that you could potentially target to increase your resources?

Kevin: There are significant vein systems in this particular area. This is a very prolific area of the San Juan Mountains. Over the course of the last century and a half, there’s probably been thousands of mines in this region here. We are currently the only one with a mill that’s fully permitted and ready to go into operation.

The Virginius vein that we have is rather prolific. It’s the highest-grade vein, relatively cleanest and easiest to mine. It’s rather vertical. There was one area on the Virginius vein and basically one claim that we didn’t own that interrupted our ownership of the Virginius vein. We’ve recently acquired that vein and signed an agreement. The closing of that should be relatively soon, within the next month or thereabouts. And that is contiguous to our operation where we’re actually going to be first restarting the mining.

We intend this coming spring to do a drill program on that. This is one area up there that you can drill from surface, for the most part. There are no other areas that you can really drill from surface in this particular area. So, we’re pretty excited that we’ve been able to acquire that claim and that we will start a drill program. The goal of this drill program will be to add another couple of years of mine life to the operation along with the target that we already have as we develop the underground mine up toward the Monongahela, which is the area where we will be mining first.

Bill: And typically, with these underground mines in Colorado in the mountains, you kind of have that six to eight-year runway and then you keep that six to eight-year runway often, don’t you, as you just drill and expand?

Kevin: That’s absolutely correct. These narrow vein mines, I mean they’re narrow vein, but they’re very high grade of course and almost impossible to drill from surface and in order to drill them from underground, you actually have to do a significant amount of development in order to get yourself in a position where you can access the vein so you can point your drill in the right direction. And it’s very, very costly. Not just this mine, but any narrow vein mine in the world.

For instance, I used to work for Dome Mines in Timmins, Canada. And Dome Mines was a mine that ran for 120 years and it had only about two years of reserves for those 120 years. So, nobody spends that huge amount of money upfront to put all of these reserves out in front of you when you know all you’re going to do is you follow the vein. Right now we have six and a half years. We believe within the next year to year and a half, we’ll have closer to 10 years. We’ll add a couple of years from this Blue Grass claim. We think we will convert some of our Inferred that’s underground and if you look on page 17 of our presentation (see chart below), you’ll see there the green area that’s outlined by the red. We believe we’ll convert that into Measured and Indicated within the next year and that as well will add about two years of reserve. So, we’re looking at close to 10 years of reserves by the time we really get into operation and that’s quite a long time in the narrow vein environment.

Bill: Kevin, we’ve mentioned some of the unique factors and highlights of the Revenue-Virginius Mine, but are there any other market comparables that you could point out for investors?

Kevin: Yes. As a matter of fact, there are. If you were to go in our presentation to page 20 (see chart below), probably the best one to look at is the comparable valuations of enterprise value to M and I resource, silver equivalent ounces. And if you look there, you’ve got Excellon, Great Panther, Alexco, Endeavour and Aurcana. And if you look at that, we’re at 45 cents per enterprise value per silver equivalent ounce. You look at Endeavor, they’re at $1.17, Alexco, which probably is more comparable to us, they’re not operating at this stage of the game. I believe they’re still waiting on one permit and they’re at $1.34. I think what this chart tells you is that you can you buy a dollar stock here for about 30 cents as of today.

Bill: Are there any other monetization opportunities within the company? Assets that you could sell to self-fund?

Kevin: Yes, there are. And we have some options in that regard. As I said at the outset, the Shafter project is certainly not core to us. We’ve had some offers to purchase. We’ve had some offers to purchase just the milling facility itself. The mill is designed for 1,500 tons a day. We see Shafter more as a 500-600 ton a day operation in the future. So, the mill is probably not the right mill to start with and I certainly believe we could monetize the mill. We may or may not do that, but it is one of our options that we do have here.

Bill: Please share a little bit about your background and what makes you qualified to advance this project?

Kevin: I’ve been doing this for close to 45 years, I guess. At this stage, I’ve worked in most places around the world. My background is in operations. I work with Kinross as Vice President of Operations. Ran six of their mines in the Northern Hemisphere around the world for a number of years. Spent a lot of time in Russia. Built mines, restarted mines in countries like Nicaragua, Costa Rica, Peru, Russia, United States, Canada, and I’ve been doing this a very long time and I guess if there’s one claim to fame from my perspective, is that what I’ve typically done most of my life has gone into operations. I restarted them and get the production going, get the cost down, and those things are the focus that we have here, is we get ourselves funded, we will get this thing restarted, we will control our costs. We don’t have any control over the price of the metal that we sell. What we do have control over is how we operate and how we spend our money and we’re going to spend it very, very wisely going forward.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Aurcana Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Aurcana Corp. is a Mining Stock Education advertiser.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.

( Companies Mentioned: AUN:TSX.V; AUNFF:OTCQX,

)

Source: Maurice Jackson for Streetwise Reports 01/08/2020

In this interview with Maurice Jackson of Proven and Probable, Exploration Insights’ Brent Cook discusses the value of site visits to determining the potential of a prospect, and offers insights into various metals markets.

Maurice Jackson: Joining us for conversation is Brent Cook. He’s the founder of the highly regarded Exploration Insights. Mr. Cook, you’re one of the most trusted, highly regarded names in the natural resource space, so it’s a real pleasure to be speaking with you today sir.

Today we will address the positives and negatives for the mining sector in 2020. Sir, from a macro perspective, please share with us what is your view on the current state of the mining sector?

Brent Cook: For my colleague Joe Mazumdar and me, the overriding issue that the mining sector faces is they’re just not finding enough economic metal deposits to replace what’s been mined. To put that into terms that might make sense, we are producing on a global scale, 90 million ounces a year, which is about what’s come out of the Carlin Trend in Nevada since 1980. We’re not finding 90 million ounces a year. Ditto for copper. We’re burning through one Bingham Canyon deposit just outside of Salt Lake a year. We’re not putting in production one of those a year. So that’s the real issue they face. It’s real positive for those of us in the exploration sector.

Maurice Jackson: Speaking of positives, are there any catalysts that you see that will enhance the value propositions of companies in 2020?

Brent Cook: Well, certainly metal prices. We expect gold to do well, platinum, palladium, nickel—but the lack of production we really see as the catalyst for the metal prices.

Maurice Jackson: And where do you see the best value propositions in 2020? Is it the precious metals or is it the base metals?

Brent Cook: We’re going with precious metals for a lot of reasons, from a shortage of deposits, to global geopolitical risks that keep increasing with every threat, to global debt. There’s just so much going on that I think gold is going to act as a safe haven more and more.

Maurice Jackson: And regarding base metals, which base metals have your attention and why?

Brent Cook: Copper for the future is certainly something that’s going to be in deficit—the demand for copper with the increase with electric vehicles, electrification, green energy, etc. So copper, further down the road. Right now, probably the one base metal we’re most interested in is nickel. Fortunately or unfortunately, there’re not many decent nickel plays out there, so nickel is a good one. Palladium, I think, is also going to do well again this year. So those are the base metals we’re sticking with. Zinc, lithium, lead; sort of so-so on those.

Maurice Jackson: I’d be remiss if I didn’t ask you about uranium.

Brent Cook: Not keen on the uranium price, per se. I started off the business in the uranium industry, working in the Colorado Plateau, and I’ve done work in Australia and Africa as well. There is no shortage of uranium out there. It’s just waiting on an increase in the price. So I don’t see uranium as a good investment.

Although, having said that, we recently purchased Energy Fuels (NYSE: UUUU), just based on the potential for the U.S. to start stockpiling uranium bought from U.S. uranium producers, which requires about a $50–60 a pound price for them to even break even or make money. So there’s that play, but that’s not really a play on uranium. It’s more a play on a political event.

Maurice Jackson: Speaking of that political event—Section 232? Do you think it will pass?

Brent Cook: I honestly, give it a 50/50 chance. I think it’s a dumb idea. There’s no shortage of uranium in the world, and it doesn’t make sense for the U.S. government to subsidize industries like that. Having said that, anything could happen.

Maurice Jackson: Moving on to physical precious metals: You alluded to gold earlier, and palladium. What are your thoughts on platinum, and silver, and rhodium?

Brent Cook: Platinum is not used as much as palladium, so I don’t think it’s got that much of an upside to it. Rhodium is such a small market, we don’t even consider it. I think the price is great, but there’s no rhodium deposits. It all comes with the platinum group metal mining anyway. I mean, there’s no way to play, in my mind, rhodium.

Maurice Jackson: And if you don’t mind me asking, because readers like to follow your work. . .what are you buying at the moment, as far as physical precious metals? Or are you buying anything at all?

Brent Cook: I’ve got some physical gold—coins, basically, I store in a safe deposit box in two countries, just in case. And I don’t own a lot of precious metals, personally.

Maurice Jackson: Moving onto Exploration Insights. Sir, you run one of the most successful newsletters in the space. For someone not familiar with your work, please introduce us to Exploration Insights.

Brent Cook: Love to. I bought Exploration Insights from Paul Van Eaton back in early 2009, as everything was collapsing, and I switched over. His was more of a macro picture sort of thing. And I did the geology forum, so I rebranded it Exploration Insights. The letter’s basically about what. . .I was buying and selling and seeing in the metals exploration market.

Recently, I brought on Joe Mazumdar, who is an extremely smart economic geologist who worked and studied in Australia, Argentina—basically all over the world, including Canada and the U.S. It’s now his letter, and so he writes almost all of the letter. He and I communicate back and forth. I’m sort of a senior advisor there. The letter is about what he is buying, selling and seeing in the exploration industry.

We make no money from companies. Everything we make is based on subscriptions and how we do in terms of our purchases. And it’s pretty technical. That’s a positive and a negative, because sometimes we get pretty far in the weeds explaining what exactly is happening in terms of the geology, the metallurgy, the geopolitics, all that sort of thing. We get pretty heavy into the weeds, but it’s our money, so we don’t want to make any mistakes, or as few as possible.

Maurice Jackson: Prior to this interview, you shared with me that if you’re going to be in the space, the importance of attending site visits, specifically on early-stage exploration and development projects. Please share why access to site visits are paramount for speculators in the natural resource space.

Brent Cook: You go to the shows or you sit down with a company’s investor relations person, and you go through the, “It all looks great. Here’s the geology. This looks just like this deposit over here, which is a $1 billion company. We’ve got this project that looks the same, it just hasn’t been drilled. We’re going to drill it and we’re going to find a billion-dollar deposit,” or something like that. But the reality is only maybe 1 in 10,000 prospects turns into an economic mine.

It’s important to realize that an economic deposit is a unique geological event, and to go there and see it with knowledgeable eyes. I’ve been doing this for almost 35, 40 years, and Joe has been doing it for 30, all over the world. To go and look at these projects with your eyes and experience that you’ve gotten from previous work you’ve done, you see things that you might not see in those flip books.

For instance, I remember one project in Mexico—great trench, I think it was like, 40 meters of six grams. Looked fantastic on paper. You get there and the things sits in the bottom of a canyon, and there’s no way it’ll ever be a mine.

I can think of a lot of examples like that, where you get there and go, “Wait a minute, this isn’t going to work.” We were in Colombia, another project; sounded really good. Got there, and there was this beautiful, little, white church sitting on top of the hill that they want to mine. Well, that isn’t going to happen.

On site visits you are able to see things like that. I’ll give you one more. I was in Peru—again, a high-sulphidation epithermal discovery. The theory was that a later, volcanic rock had covered up the deposit, and all what we were seeing was a small window into what was below. Sounded great. Went and looked at it—actually, what happened was that they had misinterpreted, and the small window was in fact a small crack, and the rest of the rock was the same rock that hadn’t been altered. It’s about just those things you see on the ground that you don’t necessarily get on the website or out of the flipbook.

Maurice Jackson: On average, how many site visits do you attend?

Brent Cook: I think last year Joe and I visited 33 projects. So quite a few. We’re trying to slow down, but you know how it goes.

Maurice Jackson: So if I, as a speculator, don’t have access to site visits, I can gain access through Exploration Insights?

Brent Cook: Most definitely. I mean, again, I think if mining and exploration is not your expertise, it really is critical, especially in the early-stage exploration stuff, to have someone that you trust and can give you insights into the companies. Now, this could be a broker that you trust, or a relative who’s in the industry, that sort of thing—or a newsletter. I personally think ours is one of the best in terms of technical detail and that—I mean, you’ve got two economic geologists writing it. So I really think it’s a big help to have expert advice if this isn’t your area of expertise.

But the rewards are huge. I mean, as you know, you can take a $0.20 stock to two bucks within a couple of weeks with a discovery, or vice versa. You can take a $2 stock to $0.20 if something goes wrong. And that’s the key. We spend a lot of time looking for that fatal flaw ahead of the market.

Maurice Jackson: And you have a proven pedigree of success. In closing, sir, what keeps you up at night that we don’t know about?

Brent Cook: Someone’s tweets (laughter).

Maurice Jackson: Someone, huh? No particular name there (laughter).

Brent Cook: It’s pretty crazy out there. And I guess in terms of the mineral industry and mining, that is it. I mean, one geopolitical event can just trash the market—the larger markets or the smaller markets—or make them go up. I mean, just this week we’ve seen gold jump $50–60 bucks? And who would’ve thought that was going to happen last week?

So it’s those sorts of things. . .It’s the unforeseeables, the black swans that hit you that you really can’t know. And I think the best way to avoid that—what we try and do—is if we’re into a project or a company that has a legitimate play, a legitimate deposit that we think will make money, at least we’ve got some founding, some basis for owning it, as opposed to just betting on the metal price or betting on what’s the greater fool theory. We prefer to sell to someone smarter than us than someone dumber than us. I guess that’s our game plan, which means we try and get into projects that a major mining company will buy.

Maurice Jackson: Last question, sir. What did I forget to ask?

Brent Cook: You’ve covered everything pretty well. . .our website is explorationinsights.com.

One more thing, Maurice. Joe just finished our year-in New Year review, and he’s putting together an article, I guess, if you will, that would be free to any of the readers. Just go to our website, www.explorationinsights.com, and contact us and we’ll send that along for free.

Maurice Jackson: Before you make your next bullion purchase, make sure you call me. I’m a licensed representative for Miles Franklin Precious Metals Investments, where we provide a number of options to expand your precious metals portfolio, from physical delivery, offshore depositories, precious metal IRAs, and private blockchain-distributed ledger technology. Call me directly at (855) 505-1900, or you may e-mail maurice@milesfranklin.com. Last but not least, please subscribe to www.provenandprobable.com for mining insights and bullion sales.

Brent Cook of Exploration Insights, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Statements and opinions expressed are the opinions of Maurice Jackson and not of Streetwise Reports or its officers. Maurice Jackson is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Maurice Jackson was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.