Click here to get this article in PDF

Every year, investors have a brief window of opportunity to contribute to their individual retirement accounts (IRAs) for two consecutive years at once. Meanwhile, interest in diversifying retirement accounts with precious metals has reached unprecedented levels.

With annual thresholds rising, overlapping contribution timelines, and shifting portfolio allocation models, investors who act strategically now can position themselves more effectively for long-term stability.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Sr. Precious Metals Advisor Steve Rand and IRA Liaison Michelle Ellis explain how to leverage the current dual-year contribution window and why diversification into precious metals is becoming a mainstream retirement strategy.

How to Make IRA Contributions for Two Years at the Same Time

Between January 1 and April 15 each year, investors have a short window to make IRA contributions for both the current and previous tax year. Right now, that means you can fund your IRA for the 2025 and 2026 tax years simultaneously.

This opportunity closes on April 15th, when eligibility to contribute for the 2025 tax year officially ends. Contributions for 2026, however, may still be made throughout the remainder of the year and up until April 15, 2027.

Many investors take advantage of this dual-year funding window to reduce taxable income, accelerate retirement savings, and maximize tax-advantaged growth. It can also be especially helpful for those who delayed contributing to their IRA in 2025 and want to catch up while staying within IRS guidelines.

“Right now is a unique window to maximize your contributions across two tax years.”

IRA Contribution Limits for 2025 & 2026

The Internal Revenue Service (IRS) places an annual limit on how much investors can contribute to their IRAs. Because these retirement accounts come with tax advantages, the government sets contribution caps to ensure they’re used for their intended purpose and not as unlimited tax shelters.

Notably, the IRS increased contribution limits between 2025 and 2026 to reflect inflation and cost-of-living pressures, although these adjustments are not automatic and only occur when certain benchmarks are met. Contribution caps also vary by age. Investors age 50 and older qualify for catch-up contributions, which allow them to contribute more than the standard limit and strengthen their retirement positioning in the years leading up to retirement.

Below is a breakdown of the IRA contribution limits for the 2025 and 2026 tax years, separated by age group:

| 2025 IRA Contribution Limits | 2026 IRA Contribution Limits | |

|---|---|---|

| Under age 50 | $7,000 | $7,500 |

| Age 50+ (catch up contribution) | $8,000 | $8,600 |

Until April 15th, investors under age 50 can contribute up to $14,500 combined across the 2025 and 2026 tax years, reducing their taxable income for both years. Those age 50 and older can contribute as much as $16,600 during this window, thanks to catch-up provisions that allow for higher annual limits.

For investors looking to accelerate retirement savings while improving tax efficiency, this dual-year opportunity can be a meaningful move before the filing deadline closes.

Investors Show Unprecedented Interest in Physical Precious Metals

When people think of IRAs, they usually envision traditional assets, such as stocks, bonds, exchange-traded funds, and mutual funds. Although this has been the long-standing default structure for retirement accounts, the IRS has always allowed for more diverse investments, such as physical precious metals, through a self-directed IRA. Recently, investors have shown unprecedented interest in adding physical gold and silver to their retirement plans.

Through a precious metals IRA, investors can put their annual contributions toward eligible coins, bars, and bullion in gold, silver, platinum, and palladium. Over the past few years, this investment channel has seen rapid adoption as precious metals have returned to their role as a cornerstone of the global financial system.

“There’s been unprecedented demand recently for gold and silver in people’s…IRAs.”

Official Demand for Physical Gold

Central bank purchases of physical gold have been at historical highs for the past several years, stretching over 1,000 tonnes between 2022 and 2024. Global gold demand hit a record of 5,000 tonnes in 2025, with governments accounting for 863 tonnes of that demand. Furthermore, gold has overtaken the euro as the second most widely held foreign reserve asset and has even outpaced U.S. Treasuries in terms of value within reserves.

Gold as a Tier One Asset

Under Basel III banking regulations, properly allocated physical gold can be classified as a Tier 1 asset, carrying a 0% risk weighting for qualifying banks. That designation places gold in a category traditionally reserved for cash and high-quality sovereign debt. This regulatory shift reinforces gold’s role as a balance-sheet asset within the global banking framework, thereby strengthening its institutional legitimacy.

Silver’s Critical Minerals Status

Silver’s sharp price surge has been accompanied by growing institutional, investment, and industrial demand worldwide. The United States recently added silver to its critical minerals list, while China imposed strict export controls on the shiny metal. These moves underscore silver’s dual role as both an investment asset and a strategically significant resource tied to national security and economic sovereignty.

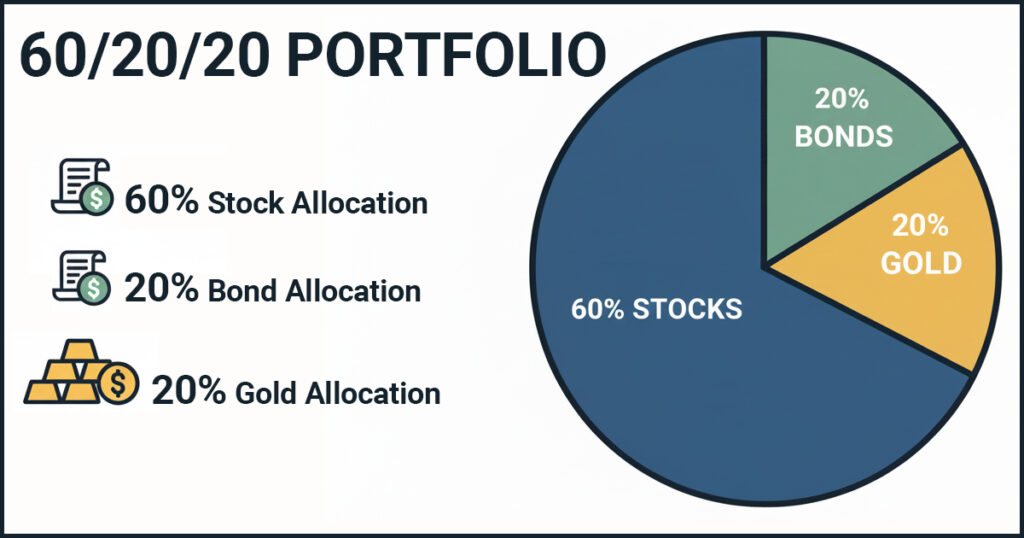

A Momentous Shift Away From the 60/40 Model

For decades, investment portfolio diversification centered on the traditional 60/40 framework, wherein 60% of funds were allocated to equities and 40% to bonds. As U.S. fiscal credibility has diminished and Treasuries see reduced demand, that investment model has come under renewed scrutiny. Now, many banks and investment firms reference a 60/20/20 investment portfolio rule, consisting of 60% equities, 20% bonds, and 20% gold.

Diversifying Into Physical Metals Through a Gold IRA

Contrary to popular belief, you can invest in physical precious metals through an IRA. While standard retirement accounts only allow investors to hold paper gold alternatives, such as ETFs or mining stocks, a self-directed precious metals IRA permits investment in tangible bullion products. This includes some of the most popular precious metals investments, including American Gold Eagle coins, American Silver Eagle coins, and other IRA-eligible precious metals.

Many individuals fund these accounts by simply rolling over assets from an existing 401(k) or traditional IRA, reallocating a portion of their retirement savings into physical precious metals. You can open a precious metals IRA from scratch, too, but many find the rollover method the most straightforward.

Don’t Miss The Opportunity!

The current window to contribute to your IRA for both the 2025 and 2026 tax years is closing quickly. That means the opportunity to maximize retirement savings, diversify your investments, and potentially reduce your tax burden is narrowing.

By the end of this tax season, the national debt is projected to reach approximately $39 trillion — a reflection of the country’s dire fiscal situation, the aversion of foreign countries to the U.S. dollar, and the risk investors face in tying up their retirement funds with dollar-backed assets.

“By the time tax day rolls around, we’ll have a $39 trillion debt, so it’s really important to make sure you diversify and have yourself in a position…to…hedge against uncertainty and the devaluation of the U.S. dollar.”

If you’re interested in learning how you can optimize your nest egg with precious metals with tax-advantaged dollars, watch our in-depth Precious Metal IRA video.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

CommentMichelle Ellis Celebrates 10 Years at Scottsdale Bullion & Coin

We’d like to take the opportunity to recognize and celebrate Michelle Ellis on her 10th anniversary with Scottsdale Bullion & Coin. From starting as a receptionist while working two jobs to becoming our trusted IRA Liaison and back-of-house leader, Michelle has made herself truly irreplaceable. Her work ethic, leadership, and dedication to both our clients and our team embody what makes Scottsdale Bullion & Coin a family business. We are incredibly grateful for her decade of commitment and excellence.

We’d like to take the opportunity to recognize and celebrate Michelle Ellis on her 10th anniversary with Scottsdale Bullion & Coin. From starting as a receptionist while working two jobs to becoming our trusted IRA Liaison and back-of-house leader, Michelle has made herself truly irreplaceable. Her work ethic, leadership, and dedication to both our clients and our team embody what makes Scottsdale Bullion & Coin a family business. We are incredibly grateful for her decade of commitment and excellence.

Powered by WPeMatico

Questions or Comments?

“*” indicates required fields