Click here to get this article in PDF

“You can’t print more Bitcoin. You can’t create gold out of nothing. This scarcity is what people are looking for right now to protect themselves, so they’re referring to Bitcoin as digital gold.”— Todd Graf, Scottsdale Bullion & Coin precious metals advisor

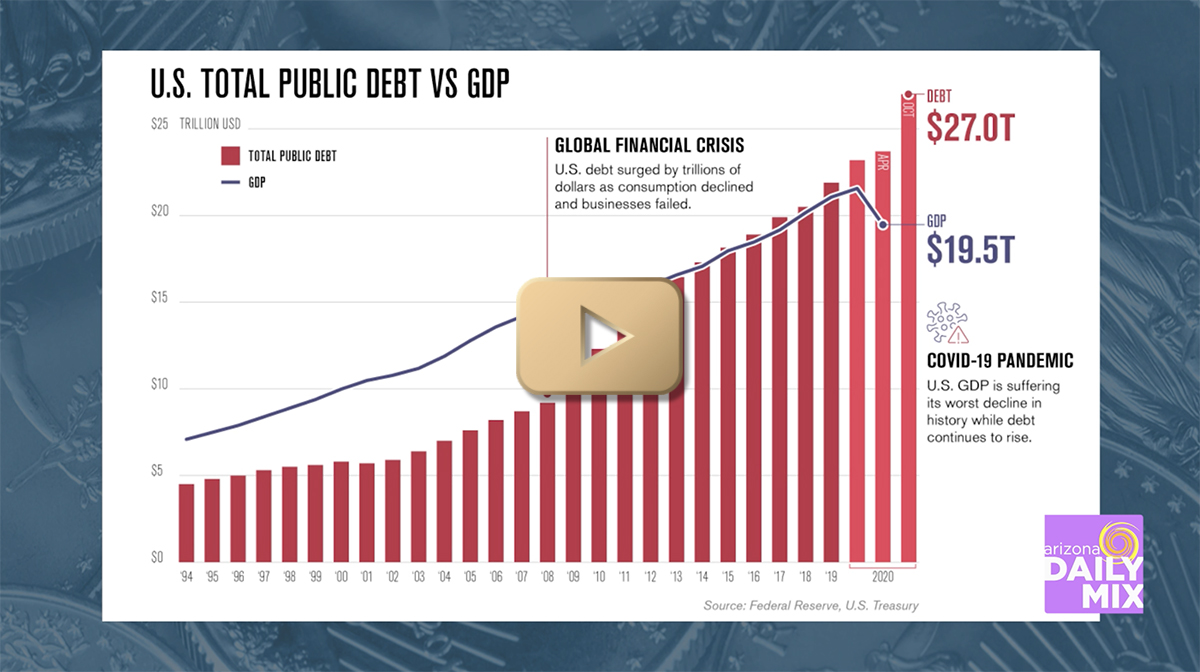

The more money the Fed prints, the greater the fervor around alternative assets: gold and silver and cryptocurrencies, namely Bitcoin.

It’s true. Unlike fiat currencies, gold and Bitcoin are scarce, but the similarities stop there, explain precious metals advisors Todd Graf and Damian White in the above video:

- Gold’s been valuable for thousands of years. Bitcoin’s existed for ten.

- Gold’s stored in secure depositories. Bitcoin lives in the digital ethers: one day it’s in your account and the next? Poof. Hacked. Your savings gone. It’s a real risk with the cryptocurrency.

- You’ll always know where your gold is, but you might forget the password to your digital fortune.

Smart money investors like Warren Buffet buy gold. “‘Real money’— as JP Morgan calls it—hasn’t bought a single Bitcoin yet.”1

Where’re you putting your savings? In defensive assets you understand. Assets you can hold in your hand and give to your grandchildren, or the latest tech craze Main Street’s betting its mortgages on?

Diversification is no get-rich-quick scheme. It’s a long-term investing approach for wealth preservation. See how to protect your financial future with gold. Request your Free Gold IRA Guide now.