Click here to get this article in PDF

When inflation ramps up in the United States, gold gets a lot of attention for being a hedge against inflation, and rightfully so. Silver, on the other hand, might tend to fly under the radar as investors scramble to get their hands on gold when the market heats up. Yet, when it comes to protecting your assets against rampant inflation and the ever-declining U.S. dollar, silver can’t be ignored. Silver is real money.

Like gold, silver can act as a hedge against inflation, which may make it a great option when it comes to diversifying your portfolio with precious metals. Gold and silver have traditionally been much more resilient over time, holding or increasing in value as the dollar loses its buying power.[1]

How Does Inflation Affect Silver Price?

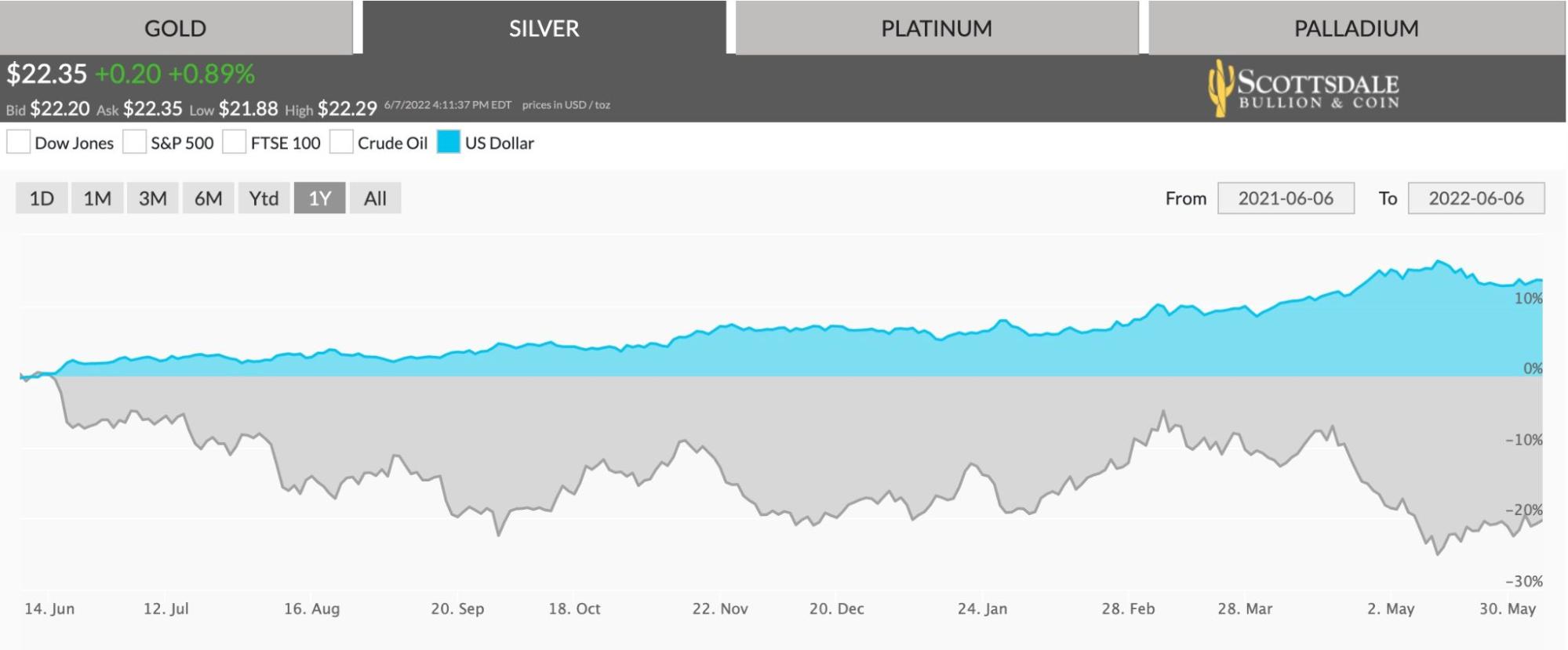

Historically, the value of the dollar and the price of silver have had an inverse relationship. When the value of a dollar is high, the price of silver tends to pull back. When inflation is high and the dollar loses value, the price of silver goes up. Of course there are always market forces at play, which is why you’ll see constant fluctuations in spot price.

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free Report

It’s important to note that the spot price isn’t necessarily the best indicator of how silver is performing against inflation and the reason boils down to supply. For instance, the spot price of silver may appear lower than expected compared to the dollar, but you have to keep in mind that silver isn’t actually being traded at spot price. Because supply has been so low in 2022, no one is actually able to buy physical silver at spot – and this includes coin dealers as well.

So, when you look at the physical price of silver, or how much it is actually trading for at the moment, you’ll get a better idea of the value. While the spot price has pulled back, premiums on silver are rising as a result of increased demand, especially for products like American Silver Eagle coins and silver bullion bars The reality is that spot price doesn’t represent the actual physical market value, which is typically higher when you factor in dealer premiums used to cover the cost of overhead and storage.

Is Silver a Long Term or Short Term Investment?

Silver is an excellent long term investment. It’s attractive as a dual purpose investment because it holds value as a precious metal and an industrial metal.[2] Expect demand for silver to increase exponentially in coming years as the world continues moving toward new forms of energy.

Silver is used as a component in certain types of batteries and is essential for the production of solar panels. It is also used in countless applications, from electronics to filtration and so much more.

The growing demand for silver, especially in the green energy technology sector, makes it perfect for long term investing and as a hedge against inflation. Because it is a finite material, the value of silver should increase along with demand, making right now a great time to diversify your portfolio with silver. If you plan on investing in silver, don’t get caught up in the day-to-day fluctuations. Rest assured that many experts believe the future is bright for silver. Buy when you find a great deal and hold onto it.

Suggested Reading: Little-Known Facts About The Importance of Silver in Technology

Suggested Reading: Little-Known Facts About The Importance of Silver in Technology

Did You Know

You Can Add Physical Silver (and Gold) to Your IRA to Protect It Against Inflation

Physical silver (and gold) can be rolled into a precious metals IRA to help diversify your portfolio and protect your retirement from inflation and stock market declines. There are certain requirements when it comes to what types of silver you can use in a precious metals IRA. Most notably, there’s a minimum fineness requirement of .999, so you’ll want to make sure you purchase quality coins or bullion for your investment.

Prior to the Taxpayer Relief Act of 1997, gold and silver could not be held in an IRA account. This major step by Congress broadened the scope and allowed investors to contribute certain precious metals and protect their retirement from the pressures of inflation.

Learn more about adding physical gold and silver to your IRA

Is Silver Still Undervalued?

When you consider the fact that spot silver hit a high of almost $50 per ounce in 2011, it’s safe to say silver is dramatically undervalued today. This is no accident. For years, big bullion banks have worked behind the scenes to manipulate the price of silver to keep the value down.

Now that the world knows of the scheme big bullion banks have been pulling for years, regulators are cracking down and it should be much harder to manipulate silver prices in the future. It’s not a stretch to say the jig is up for the big banks and the era of the silver investor is on the horizon.

When you look at the current and future market demand alongside long term silver price forecasts, it’s easy to see that silver shouldn’t be undervalued for long. In his article published by Seeking Alpha, investor Garrett Duyck notes that demand for silver is going to outpace supply well into the future. He sees silver surpassing $300 per ounce as a long term projection.[3]

It isn’t just the long-term projections that look good for silver. Bank of America is bullish on silver, projecting that it could surpass $30 an ounce by the end of 2022. Analysts with NASDAQ are also looking at a supply crunch as a key indicator of silver prices rising in the short term.[4]

With silver potentially on the verge of historic gains after decades of being undervalued, demand is on the rise. It’s crucial for investors to get in on silver because the market is already experiencing shortages as more people realize that this might just be the perfect window to buy.

How to Invest in Silver to Hedge Against Inflation

Unlock your superior silver investment strategy with this FREE Silver Investor Report published by Scottsdale Bullion & Coin. You’ll find the key information needed to break into the world on silver investing to maximize your potential.

Learn the basics of silver investing with this FREE Silver Investor Report published by Scottsdale Bullion & Coin. The information provide the fundamental knowledge you need to diversify your portfolio with precious metals.